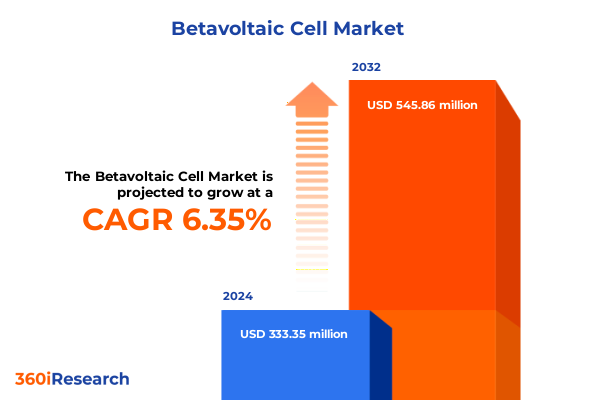

The Betavoltaic Cell Market size was estimated at USD 353.92 million in 2025 and expected to reach USD 380.68 million in 2026, at a CAGR of 6.38% to reach USD 545.86 million by 2032.

Unveiling the Unparalleled Potential of Betavoltaic Cells as a Revolutionary Long-Life Energy Source Transforming Critical Industries Worldwide

Betavoltaic cells represent a paradigm shift in energy generation, harnessing the decay of radioactive isotopes to provide continuous, long-life power for devices across critical sectors. Unlike conventional batteries, betavoltaic technology offers lifespans measured in years or even decades, addressing the growing demand for maintenance-free, reliable power in remote, inaccessible, or highly sensitive applications. As industries push boundaries in aerospace, medical implants, and remote sensing, the unique advantages of betavoltaic cells-ultra-long duration, stable output, and compact form-position them as a transformative solution in the pursuit of energy autonomy.

Recent advancements in material science and semiconductor engineering have propelled betavoltaic cells from laboratory curiosities to viable commercial products. Enhanced designs now deliver higher conversion efficiencies and broader operating temperature ranges, overcoming early limitations related to power density and material degradation. In this introductory overview, we explore the foundational principles underpinning betavoltaic operation and highlight the critical technological milestones achieved to date. By establishing a clear context for current capabilities and emerging prospects, stakeholders gain a unified understanding of why betavoltaic cells are poised to redefine power solutions for applications demanding extreme reliability and longevity.

Identifying the Pivotal Technological, Regulatory, and Market Dynamics Driving Unprecedented Evolution in Betavoltaic Cell Development and Adoption

The betavoltaic cell landscape has undergone transformative shifts driven by converging forces in technology, regulation, and market demand. On the technological front, the integration of advanced semiconductor materials such as gallium arsenide and silicon carbide has significantly improved conversion performance, enabling devices to operate efficiently at lower power thresholds. Meanwhile, refinements in radioactive source material purification and encapsulation have enhanced safety profiles, facilitating broader acceptance in sectors subject to stringent regulatory scrutiny.

Regulatory developments have also reshaped the competitive environment. Updated guidelines on radioactive isotopes, coupled with incentives for low-carbon energy technologies, have created both opportunities and challenges. Policymakers increasingly recognize the strategic value of domestic supply chains for critical materials, prompting initiatives that support local production of nickel-63 and tritium sources while maintaining rigorous safety standards. This regulatory convergence accelerates research collaborations between national laboratories, academic institutions, and private enterprises, fostering a dynamic ecosystem geared toward rapid innovation.

Market dynamics further underscore the momentum behind betavoltaic adoption. Demand from defense agencies for power solutions in remote sensors and unmanned platforms has increased, while the medical device sector seeks implants capable of multi-year operation without battery replacement. In parallel, the rise of the Internet of Things amplifies the need for ultra-low-power, long-life power sources in distributed sensor networks. As these diverse end-use requirements coalesce, manufacturers and developers are recalibrating strategies to capture emerging niches and scale production effectively.

Evaluating the Far-Reaching Consequences of Recent United States Tariff Measures on the Betavoltaic Cell Supply Chain and Cost Structures in 2025

The introduction of new United States tariffs in 2025 has markedly influenced the betavoltaic cell supply chain, particularly for components reliant on imported materials. Increased duties on semiconductor wafers including gallium arsenide and silicon carbide have elevated input costs for manufacturers that had previously depended on cost-competitive imports. This has spurred a strategic pivot toward localized production and vertically integrated supply models, as companies seek to protect margins and ensure material security in a volatile trade environment.

Similarly, tariffs on specialized radioactive isotopes such as nickel-63 and tritium have impacted sourcing strategies for core energy materials. Firms that once imported high-purity isotopes from overseas facilities are now exploring domestic isotope generation and refining capabilities. This shift not only mitigates tariff-related expenses but also aligns with national security objectives, given the strategic importance of isotope control. Consequently, collaborations between isotope producers and semiconductor foundries have intensified, with joint investments aimed at establishing dual-use infrastructure that serves both civilian markets and defense requirements.

While these measures have introduced short-term cost pressures, they are catalyzing a broader reconfiguration of global supply chains. Manufacturers are reassessing logistics frameworks to minimize tariff exposure, including relocating assembly operations and forging new partnerships with regional distributors. In turn, this creates opportunities for equipment suppliers, processing facilities, and service providers positioned to support on-shore production and certification.

Decoding the Multifaceted Segmentation Landscape to Deliver Targeted Insights on Materials, Capacities, Forms, Technologies, and Applications in Betavoltaic Cell Markets

Insights drawn from material segmentation reveal a bifurcated market focus on radioactive source materials and semiconductor materials, where performance, safety, and regulatory compliance drive research priorities. Within radioactive sources, nickel-63 offers stable beta emission over extended periods, making it ideal for implantable medical devices, while tritium’s higher energy output suits applications requiring greater power density such as remote sensing platforms. On the semiconductor side, gallium arsenide demonstrates superior conversion efficiency at low temperatures, propelling its use in aerospace cell designs, whereas silicon carbide excels under harsh environmental conditions, earning favor in geothermal and deep-sea sensor applications.

Power capacity segmentation underscores differentiated development pathways. High power configurations are emerging to meet the demands of autonomous vehicles and mobile telematics, where rapid energy delivery and durability are paramount. Medium power designs balance output with longevity, finding niches in grid-adjacent energy storage and remote utility monitoring systems. Meanwhile, low power cells are optimized for wearable health trackers and smart home sensors, where ultra-low maintenance and minimal form factors trump raw power capability.

The form factor of betavoltaic cells further influences adoption strategies. Hybrid cells, which integrate both direct and indirect conversion pathways, offer customizable performance profiles tailored to application-specific voltage and current requirements. Solid-state cells, with their monolithic structure, provide robustness and miniaturization essential for implantable devices. Thin-film cells, distinguished by their lightweight and conformable architecture, are rapidly gaining traction for integration into flexible electronics and lightweight unmanned aerial vehicle systems.

Conversion methods delineate two primary approaches. Direct conversion cells convert beta particles into electricity through semiconductor junctions, maximizing efficiency for high-performance uses. Indirect conversion relies on phosphor-based systems that translate radiation into light before electrical conversion, proving advantageous where lower efficiencies are acceptable in exchange for simplified manufacturing and enhanced radiation shielding.

Technology segmentation highlights the evolution of junction architectures. Conventional P-N junction cells have matured into heterojunction designs that leverage bandgap engineering for improved carrier separation and extended temperature resilience. Schottky barrier cells, split between metal-semiconductor and semiconductor-semiconductor implementations, enable faster response times and reduced leakage currents, positioning them as attractive options for dynamic sensing applications.

Application-driven segmentation spans aerospace and defense, automotive and transportation, consumer electronics, energy and utility, medical devices and healthcare, and telecommunications. In aerospace and defense, betavoltaic power sources have been integrated into satellite systems and unmanned platforms to deliver uninterrupted energy in extreme environments. Automotive implementations focus on battery management systems and vehicle telemetry, harnessing betavoltaic cells to provide auxiliary power that enhances system reliability. In consumer electronics, portable gadgets and wearable devices increasingly adopt low power cells to eliminate frequent recharging. The energy and utility sector utilizes grid storage supplements and remote energy systems powered by medium power betavoltaic modules to ensure continuity during outages. Implantable devices and patient monitoring systems are reshaping healthcare delivery by offering long-term power for sensors and drug delivery mechanisms. Telecommunications equipment benefits from stable, self-sustaining power for data transmission nodes and signal processing hubs in remote locations.

Distribution channels, split between direct sales and distributors and resellers, reflect strategic go-to-market considerations. Direct sales relationships enable close collaboration on customization and compliance, particularly for defense and medical clients. Meanwhile, distributors and resellers expand market reach by providing local support networks and inventory agility, critical for fast-moving consumer and industrial segments.

This comprehensive research report categorizes the Betavoltaic Cell market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Power Capacity

- Form

- Conversion Method

- Technology

- Application

- Distribution

Unraveling Regional Competitive Advantages and Collaborative Ecosystems Spanning the Americas, EMEA, and Asia-Pacific Betavoltaic Cell Landscapes

Regional variations in betavoltaic cell development underscore the importance of localized strategies and collaborations. In the Americas, a robust ecosystem of research institutions, government laboratories, and private innovators drives steady progress in both material supply and device iteration. The United States leads in isotope generation infrastructure and offers key funding mechanisms for defense-oriented applications, while Canada’s strengths in semiconductor fabrication contribute to regional resilience against global supply disruptions.

In the Europe, Middle East & Africa region, stringent regulatory frameworks challenge market entrants to achieve compliance but also foster high safety and quality standards that facilitate global acceptance. Collaborative consortia comprising aerospace agencies, medical research centers, and energy companies are pioneering betavoltaic use cases that leverage the region’s advanced manufacturing clusters and specialized testing facilities.

The Asia-Pacific region presents a dynamic blend of high-volume manufacturing capabilities and aggressive R&D investments. Countries such as South Korea and Japan are expanding capacity for gallium arsenide and silicon carbide production, targeting both domestic consumption and export markets. China’s growing focus on isotope production centers and semiconductor processing technologies underscores its ambition to become a key global supplier, while partnerships with local distributors ensure rapid deployment across telecommunications networks and IoT ecosystems across the region.

This comprehensive research report examines key regions that drive the evolution of the Betavoltaic Cell market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Innovative Betavoltaic Cell Market Leaders and Strategic Partnerships Shaping the Future of Long-Duration Energy Solutions

Leading companies are capitalizing on differentiated strategies to secure strategic positions in the betavoltaic market. QorTek Corp has emphasized end-to-end integration, investing in proprietary isotope generation capabilities alongside advanced semiconductor fabrication to deliver turnkey power modules for defense and satellite applications. UltraCell Technologies has pursued strategic partnerships with medical device manufacturers, customizing cell form factors and output profiles for next-generation implantable sensors.

Betacel Inc focuses on modular manufacturing lines that enable rapid scaling of thin-film cell production for consumer electronics and wearable applications. RadioVolt Systems, by contrast, targets high-power solutions, optimizing gallium arsenide junctions to achieve breakthrough conversion efficiencies for unmanned aerial vehicle power systems. Radiant Power Solutions leverages its network of distributors to penetrate emerging markets in energy and utility monitoring, combining medium power modules with remote system integration services to ensure uninterrupted grid support.

These players complement a growing roster of specialized suppliers and contract manufacturers that provide critical components ranging from tritium encapsulation assemblies to custom heat-dissipation substrates. As competition intensifies, strategic alliances and mergers are likely, driven by the need to consolidate technological expertise, expand geographic footprints, and enhance vertical integration across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Betavoltaic Cell market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkenlight Limited

- Beijing Betavolt New Energy Technology Co., Ltd.

- BetaBatt, Inc.

- City Labs, Inc.

- Direct Kinetic Solutions

- entX Limited

- Infinity Power

- Kronos Advanced Technologies

- NDB, Inc.

- Qynergy Corporation

- RTX Corporation

- Ultratech Inc

- Widetronix, Inc.

Driving Competitive Advantage through Strategic R&D Investments, Supply Chain Resilience, and Collaborative Partnerships to Maximize Betavoltaic Market Potential

Industry leaders should embark on a series of targeted initiatives to solidify their competitive edge. First, expanding research and development investments in next-generation semiconductor materials and heterojunction architectures will be crucial for achieving higher conversion efficiencies and broader thermal tolerance. Concurrently, forging alliances with domestic isotope production facilities can mitigate tariff impacts and reinforce material security, while collaborative ventures with defense agencies will accelerate qualification cycles for mission-critical applications.

Next, establishing flexible manufacturing platforms capable of scaling hybrid, solid-state, and thin-film cell production will enable rapid responsiveness to diverse power capacity requirements across consumer, automotive, and industrial segments. By integrating digital twins and advanced analytics into production workflows, companies can optimize yield, reduce time to market, and maintain stringent quality standards.

Moreover, designing application-specific packages that streamline regulatory approval-particularly in the medical and aerospace sectors-will reduce deployment timelines and enhance customer confidence. Engaging in thought leadership and standards-setting bodies will further position organizations as trusted innovators and advisors. Finally, investing in after-sales support structures and regional service networks will ensure long-term customer satisfaction and foster the sustainable adoption of betavoltaic solutions across varied end markets.

Combining Primary Interviews, Secondary Data Sources, and Robust Triangulation Processes to Guarantee Precision and Depth in Betavoltaic Market Analysis

This report is underpinned by a rigorous research methodology that blends primary and secondary data collection to deliver comprehensive market intelligence. Primary research comprised in-depth interviews with key executives, R&D leaders, and procurement specialists across semiconductor fabs, isotope manufacturers, and end-user organizations. These insights were supplemented by detailed surveys of system integrators and regulatory bodies to capture evolving compliance requirements and customer preferences.

Secondary research involved an exhaustive review of public filings, technical white papers, industry periodicals, and patent databases to map technology trajectories and intellectual property landscapes. Data triangulation techniques were employed to validate findings and reconcile discrepancies, ensuring the highest level of accuracy. Furthermore, the segmentation framework was developed through iterative refinements, integrating feedback from expert panels to align with prevailing operational realities.

The analysis was subjected to multiple quality assurance reviews, including cross-functional validation by domain experts in materials science, power electronics, and regulatory affairs. Statistical analyses of historical performance metrics and component cost trends provided additional context, enabling a nuanced understanding of market drivers and barriers. The resulting insights offer decision-makers a robust foundation for strategic planning and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Betavoltaic Cell market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Betavoltaic Cell Market, by Material

- Betavoltaic Cell Market, by Power Capacity

- Betavoltaic Cell Market, by Form

- Betavoltaic Cell Market, by Conversion Method

- Betavoltaic Cell Market, by Technology

- Betavoltaic Cell Market, by Application

- Betavoltaic Cell Market, by Distribution

- Betavoltaic Cell Market, by Region

- Betavoltaic Cell Market, by Group

- Betavoltaic Cell Market, by Country

- United States Betavoltaic Cell Market

- China Betavoltaic Cell Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Synthesizing Technological Maturity, Regulatory Evolution, and Market Demand to Chart the Future Course of Betavoltaic Cell Adoption

As the betavoltaic cell market advances beyond conceptual stages into practical deployment, stakeholders face a window of opportunity to shape its trajectory. The convergence of technological maturation, supportive regulatory climates, and diversified application demand creates a fertile environment for innovation and commercialization. By aligning strategies with identified segmentation insights, regional dynamics, and competitive landscapes, industry participants can navigate complexities and drive sustained growth.

Ultimately, success will hinge on the ability to anticipate evolving customer needs, secure resilient supply chains, and continuously refine technological capabilities. Organizations that marry scientific expertise with agile market strategies are poised to lead the transition toward self-sustaining, long-life power solutions. The insights presented herein serve as a roadmap for those prepared to invest, collaborate, and innovate at the forefront of the betavoltaic revolution.

Empower Decision-Makers with Actionable Insights and Connect Directly with Ketan Rohom to Secure Your Comprehensive Betavoltaic Cell Market Intelligence Report

For organizations seeking a strategic advantage through deep insights into the betavoltaic cell landscape, this comprehensive report offers an unparalleled view of material technologies, power capacities, forms, conversion methods, and regional dynamics. By leveraging detailed segmentation, regulatory analysis, and competitive intelligence, industry leaders can accelerate product development, optimize supply chains, and navigate tariff impacts effectively. Take decisive steps toward securing your position at the forefront of this emerging power generation domain by engaging with tailored data and expert recommendations.

- How big is the Betavoltaic Cell Market?

- What is the Betavoltaic Cell Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?