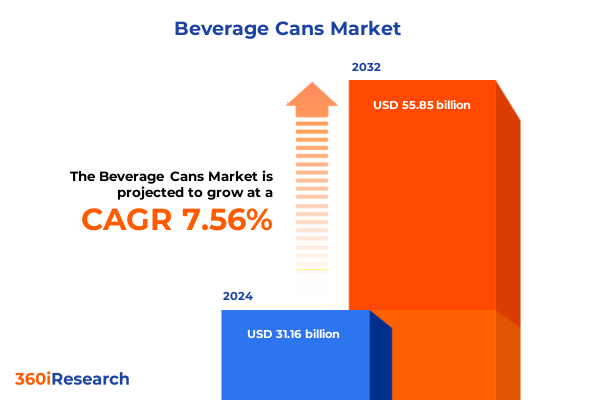

The Beverage Cans Market size was estimated at USD 40.91 billion in 2025 and expected to reach USD 42.69 billion in 2026, at a CAGR of 5.08% to reach USD 57.91 billion by 2032.

Uncovering the Strategic Significance of Beverage Cans as a Versatile Packaging Solution Amidst Shifting Consumer Behaviors and Sustainability Imperatives

Beverage cans have transcended their traditional role as simple containers to become pivotal enablers in a highly competitive packaging arena. As consumer demand evolves, driven by sustainability imperatives and a quest for premium experiences, the can has emerged as a versatile medium capable of fulfilling diverse beverage applications while aligning with environmental goals. This introduction establishes the context for a comprehensive exploration of the factors redefining the beverage can ecosystem, from shifts in raw material preferences to technological breakthroughs in production and post-consumer management.

Against the backdrop of rising global environmental scrutiny and heightened consumer awareness, aluminum and steel cans have garnered renewed attention for their recyclability, light weight, and capacity to preserve beverage integrity. Simultaneously, manufacturers and brand owners are experimenting with innovative can sizes and embellishments to satisfy consumer desires for convenience, portability, and on-the-go consumption. This dynamic interplay of forces underlines the importance of understanding not only current market conditions but also the emergent trends poised to shape the future of beverage packaging.

By framing the significance of beverage cans within broader industry imperatives-sustainability, brand differentiation, and operational efficiency-this section lays the foundation for subsequent analyses. It underscores why stakeholders must view cans not merely as passive vessels, but as strategic assets capable of influencing consumer perception, driving brand loyalty, and contributing to circular economy objectives.

Examining the Revolutionary Technological, Regulatory, and Consumer-Driven Transformations Reshaping the Beverage Can Industry Landscape

The beverage can industry is undergoing a series of transformative shifts propelled by technological innovation, evolving regulations, and changing consumer priorities. In recent years, advancements in high-speed conversion lines and precision coating technologies have dramatically enhanced production flexibility, enabling manufacturers to respond rapidly to custom design requests while maintaining stringent quality and performance standards. At the same time, digital printing capabilities are opening new avenues for on-demand personalization and limited-edition runs, fostering closer engagement between brands and their audiences.

Regulatory landscapes are also in flux, as environmental policy frameworks increasingly target single-use packaging and incentivize closed-loop recycling systems. Extended producer responsibility mandates in key markets are compelling stakeholders to invest in collection and reprocessing infrastructure, which is in turn driving collaboration across the supply chain. Meanwhile, consumer sentiment is tilting decisively toward sustainability credentials, with demand surging for packaging that boasts both minimal carbon footprint and a demonstrable recycling pathway. Consequently, brands are redirecting their packaging strategies to emphasize circularity, notably by adopting higher recycled content levels and communicating these credentials through eco-labeling and certification schemes.

Furthermore, the rapid rise of e-commerce has reshaped distribution dynamics, prompting can suppliers and brand owners to re-evaluate packaging specifications for direct-to-consumer shipping. Lightweighting efforts, package integrity assessments, and pack design optimizations are now integral to ensuring that cans withstand the rigors of transit while delivering a premium unboxing experience. These converging forces underscore that the beverage can landscape is not merely evolving but being fundamentally redefined, heralding an era of innovation, collaboration, and heightened sustainability focus.

Assessing the Aggregate Effects of Updated United States Tariffs on Aluminum and Steel Cans and Their Ripple Impact on the Beverage Packaging Sector

Over the past several years, the United States has applied Section 232 tariffs on steel and aluminum imports, and these measures continue to produce a cumulative impact on the beverage can sector. Although originally introduced to bolster domestic production, these duties have inadvertently altered global supply dynamics and elevated raw material costs for can manufacturers. As tariffs remain in effect through 2025, producers have been compelled to re-assess sourcing strategies, pivoting between domestic suppliers and qualified international partners to manage cost pressures and maintain production continuity.

Notably, the sustained tariff environment has spurred investment in domestic capacity expansion, including new rolling mill projects and can conversion facilities. While such developments promise long-term resilience and stability, in the short term they have translated into supply chain bottlenecks as capacity comes online and domestic logistics must scale. Additionally, fluctuations in spot metal prices-driven by tariff-driven market distortions-have contributed to volatility, complicating procurement planning and contract negotiations for both can makers and beverage brand owners.

Moreover, the ripple effect of higher packaging costs has encouraged downstream stakeholders to explore alternative packaging formats and lightweighting options. Some beverage producers have intensified trials of lightweight can walls and hybrid packaging hybrids to offset the tariff burden, even as regulators impose stricter standards on beverage safety and material supply traceability. Taken together, this tariff-driven landscape underscores the strategic importance of adaptive sourcing, supply chain diversification, and proactive engagement with policy developments to navigate the complex interplay of cost, capacity, and compliance.

Highlighting Nuanced Insights Derived from Diverse Beverage Can Market Segmentation Across Applications, Materials, Sizes, Processes, and Channels

The beverage can market exhibits a rich tapestry of segmentation, each providing unique insights into how packaging must adapt to diverse applications, materials, sizes, processes, and sales channels. From the classic beer segment subdivided into ale, lager, and stout to the dynamic ready-to-drink tea and coffee arenas, the product portfolio demands packaging solutions that cater to distinct flavor profiles, shelf-life requirements, and brand positioning needs. In the energy drink and soft drink spaces, further differentiation between carbonated and noncarbonated variants underscores how carbonation levels and carbonation-sensitive shelf stability influence can wall thickness, coating chemistry, and seam design.

Material choice between aluminum and steel similarly underscores divergent priorities. Aluminum’s high recyclability and lightweight nature make it the preferred option for beverage brands prioritizing sustainability narratives, whereas steel’s robustness and magnetic separation ease render it a cost-effective choice in regions with less developed recycling infrastructures. Can size segmentation-from compact 250 mL formats ideal for premium spirits samples to the more ubiquitous 330 mL that serves as the standard reference size-further illustrates how consumption occasions dictate ergonomics, branding visibility, and logistics optimization.

Production processes, whether draw and iron or draw redraw, each confer distinct benefits in terms of metal utilization, dimensional precision, and finish quality, offering converters a toolkit to meet evolving design and performance specifications. Finally, sales channels bifurcate into off-trade environments such as convenience stores, online retail, and supermarkets & hypermarkets, and on-trade venues including bars, pubs, hotels, and restaurants. Each channel carries its own expectations for package presentation, shelf appeal, and supply chain agility, shaping how can manufacturers and brands orchestrate packaging strategies across the consumer journey.

This comprehensive research report categorizes the Beverage Cans market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Can Size

- Production Process

- Application

- Sales Channel

Delving into Regional Dynamics Shaping Beverage Can Adoption Trends Across the Americas, Europe Middle East and Africa and Asia-Pacific Zones

Regional nuances play a pivotal role in shaping how beverage cans are produced, marketed, and consumed around the globe. In the Americas, strong recycling infrastructures in North America contrast with emerging collection systems throughout Latin America, driving differential demand for lightweight aluminum cans versus steel alternatives. Beverage brands in this region often leverage eco-friendly attributes to strengthen brand equity, spotlighting recycled content and reclamation partnerships in marketing campaigns while navigating a patchwork of state and provincial regulations.

Across Europe, Middle East, and Africa, regulatory stringency around extended producer responsibility and single-use packaging is among the world’s most rigorous, encouraging can suppliers to invest heavily in closed-loop recycling initiatives. At the same time, evolving consumer tastes-ranging from craft beer aficionados in Western Europe to rapidly growing ready-to-drink tea consumption in the Gulf states-necessitate flexible packaging runs and localized design capabilities. In regions where recycling facilities are still developing, steel cans have gained traction due to their compatibility with magnetic separation collection systems.

In the Asia-Pacific arena, rapid urbanization, burgeoning middle-class demographics, and a thriving on-trade hospitality sector are fueling explosive beverage consumption growth. Here, can converters are balancing the need for high-speed, large-volume production with the imperative to offer smaller, premiumized can sizes that align with evolving premium beverage segments. Additionally, collaborative efforts between governments and industry consortia to expand recycling capacity signal significant future momentum for aluminum can adoption, as policymakers and brands work in tandem to reduce packaging waste and improve resource efficiency.

This comprehensive research report examines key regions that drive the evolution of the Beverage Cans market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves and Competitive Positioning of Leading Beverage Can Manufacturers Driving Innovation and Market Leadership

The competitive landscape of the beverage can industry is defined by a handful of global leaders and a dynamic array of regional players, each leveraging unique capabilities to capture market share and drive innovation. Major aluminum and steel producers have strategically expanded into can conversion, marrying upstream metal production with downstream can fabrication to enhance operational synergies and capture value across the supply chain. This vertically integrated model has empowered these companies to streamline logistics, manage raw material price volatility, and offer end-to-end packaging solutions under single-source agreements.

Meanwhile, specialist converters with laser-focus on high-value segments, such as craft beer or premium ready-to-drink cocktails, are carving out niches by providing agile shorter-run capabilities and rapid turnaround times. Their investments in digital labeling and on-demand decoration enable beverage brands to execute limited-edition campaigns, limited release seasonal flavors, and market tests with minimal inventory risk. Moreover, several players have established strategic joint ventures with beverage brand owners to co-develop proprietary can designs that optimize fill integrity, chill rate characteristics, and shelf standout.

Across both global and regional tiers, sustainability leadership has become a point of competitive differentiation. Leading companies are publicizing commitments to increase recycled content ratios, achieve net-zero operations, and support community recycling initiatives. Those with the most advanced circularity programs are collaborating directly with municipal authorities and packaging consortiums to close the loop on used cans, thereby reinforcing the business case for aluminum-based solutions and elevating brand value propositions in sustainability-conscious markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beverage Cans market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ardagh Group S.A.

- Ball Corporation

- Baosteel Metal Co., Ltd.

- CANPACK S.A.

- CPMC Holdings Limited

- Crown Holdings, Inc.

- Envases Group

- GZ Industries

- Mahmood Saeed Beverage Cans & Ends Industry Company Limited

- Nampak Ltd.

- Orora Limited

- Silgan Holdings Inc.

- Techpack Solutions

- Toyo Seikan Group Holdings, Ltd.

- Universal Can Corporation

Offering Targeted Strategic Recommendations to Empower Industry Stakeholders in Optimizing Beverage Can Operations, Sustainability, and Market Expansion Efforts

Industry leaders seeking to capitalize on evolving market dynamics should prioritize a series of strategic actions that align operational excellence with sustainability and customer-centricity. Foremost, proactive engagement with regulatory developments-particularly those affecting extended producer responsibility and recycling mandates-will be essential to mitigate compliance risks and optimize packaging portfolios for circular economy criteria. Interdepartmental task forces that incorporate legal, procurement, and sustainability teams can ensure that emerging regulations are anticipated and translated into actionable packaging strategies.

Simultaneously, investment in production process flexibility will yield significant competitive advantage. Upgrading conversion lines to accommodate both draw and iron and draw redraw techniques, while integrating digital printing systems for agile design changes, positions converters to address diverse brand requirements without disruption. Parallel efforts to trial wall gauge optimization and lightweighting will not only improve material efficiency but also resonate with environmentally conscious consumers seeking lower-carbon packaging options.

Finally, strengthening collaboration across the supply chain-from raw material suppliers to recycling partners-will be critical in securing resilient, cost-effective sourcing and achieving closed-loop objectives. Joint ventures or strategic partnerships that facilitate raw material traceability and bolster recycling collection networks can unlock shared value and enhance brand trust. By orchestrating these recommendations with a cohesive sustainability narrative and robust stakeholder alignment, industry players can navigate market complexity while reinforcing leadership in the beverage can domain.

Detailing the Rigorous Research Methodology Employed to Ensure Comprehensive and Reliable Insights Into the Beverage Can Market Analysis Practices

This market research leverages a multi-pronged approach combining primary data collection, secondary research, and rigorous data validation protocols to ensure robust and reliable findings. Primary engagement includes in-depth interviews with can manufacturers, beverage brand strategists, packaging engineers, and regulatory experts, providing direct insights into operational challenges, emerging trends, and strategic priorities. These discussions are complemented by on-site observations at key production facilities to assess technology deployment and process efficiencies firsthand.

Secondary research encompasses a thorough review of industry publications, trade association reports, regulatory filings, and academic studies to map broader market dynamics, legislative developments, and sustainability benchmarks. Data triangulation is conducted by cross-referencing multiple sources, thereby minimizing potential biases and validating emerging themes. The research team also employs advanced text analytics tools to synthesize large volumes of unstructured data, enabling the identification of subtle market signals and innovation hotspots.

To further ensure analytical rigor, all qualitative inputs are subjected to structured coding frameworks, and quantitative observations-such as production throughput performance and material usage metrics-are examined through statistical analysis where available. The methodology culminates in a comprehensive quality review process, involving peer evaluation and stakeholder feedback loops, to refine conclusions and ensure the report delivers actionable, trustworthy intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beverage Cans market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beverage Cans Market, by Material Type

- Beverage Cans Market, by Can Size

- Beverage Cans Market, by Production Process

- Beverage Cans Market, by Application

- Beverage Cans Market, by Sales Channel

- Beverage Cans Market, by Region

- Beverage Cans Market, by Group

- Beverage Cans Market, by Country

- United States Beverage Cans Market

- China Beverage Cans Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Illuminate Future Directions in Beverage Can Packaging and Empower Stakeholders With Strategic Clarity

The executive summary has synthesized the essential facets of the beverage can ecosystem, delineating the strategic importance of cans as adaptive packaging vehicles that respond to consumer, environmental, and operational imperatives. Through an exploration of transformative industry shifts, it has highlighted how technological advancements and regulatory pressures are jointly steering the market toward enhanced sustainability, production flexibility, and consumer engagement.

By examining the cumulative impact of United States tariffs on aluminum and steel inputs, stakeholders are apprised of the need for agile sourcing strategies and capacity planning to mitigate cost volatility. The segmentation overview offers a nuanced perspective on how application categories, material types, size formats, production processes, and sales channels collectively shape demand and design preferences. Regional insights have illuminated divergent regional trajectories-from mature recycling frameworks in North America and EMEA to rapid consumption growth and infrastructure development in Asia-Pacific.

Competitive intelligence underscores the strategic maneuvers of both global and specialist converters, emphasizing the role of vertical integration, digital personalization, and sustainability leadership in defining market positioning. Finally, actionable recommendations and a transparent methodology round out the summary, equipping decision-makers with a roadmap for navigating the complex beverage can landscape. Collectively, these insights empower stakeholders to refine packaging strategies, fortify supply chain resilience, and seize emergent growth opportunities.

Encouraging Decision-Makers to Connect With Ketan Rohom for Exclusive Access and Personalized Guidance on Securing In-Depth Beverage Can Market Research Reports

To secure comprehensive, actionable insights tailored to your strategic priorities in the beverage packaging sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan Rohom brings deep industry expertise and can provide personalized guidance to help you understand which aspects of the report will most effectively support your organizational goals. Establishing a direct dialogue will ensure you access the full suite of in-depth analysis covering market dynamics, regulatory impacts, segmentation nuances, regional differentiators, and competitive landscapes. By partnering with Ketan Rohom, you gain a dedicated advisor to navigate the complexities of procurement and application of this critical research resource. Connect now to discuss pricing options, customization possibilities, and delivery timelines, and to unlock the strategic intelligence that will empower your decision-making and drive sustained growth in the evolving beverage can market.

- How big is the Beverage Cans Market?

- What is the Beverage Cans Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?