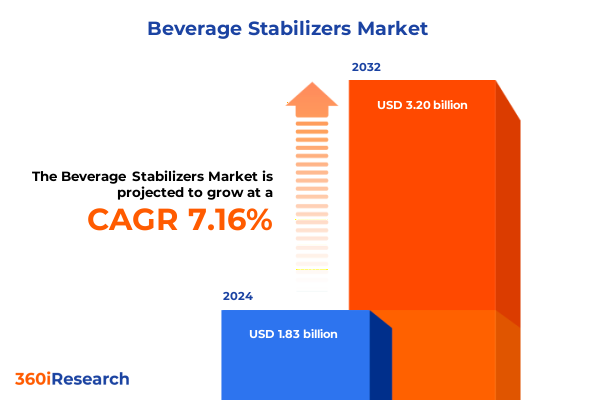

The Beverage Stabilizers Market size was estimated at USD 1.97 billion in 2025 and expected to reach USD 2.10 billion in 2026, at a CAGR of 7.16% to reach USD 3.20 billion by 2032.

Understanding the Essential Role of Beverage Stabilizers in Ensuring Product Quality and Consistency Across Diverse Drink Categories

The beverage stabilizer industry stands at the intersection of science and consumer experience, playing a vital role in maintaining drink quality, texture, and shelf life across a myriad of beverage formats. Innovations in hydrocolloids, proteins, and multifunctional additives have transformed product development approaches, enabling manufacturers to meet rising consumer expectations for clarity, mouthfeel, and natural ingredient credentials. As trends evolve toward cleaner labels and plant-based formulations, the need for advanced stabilizing solutions has never been greater.

With the beverage landscape expanding to include premium wellness shots, plant-based milks, and sparkling functional waters, formulators rely on stabilizers to prevent phase separation, control viscosity, and deliver consistent performance. These essential ingredients not only protect sensory attributes but also support nutrient fortification efforts and broadening flavor profiles. Consequently, understanding the current state and future trajectory of stabilizer technologies is fundamental for ingredient developers, beverage brands, and supply-chain stakeholders alike.

Identifying Key Transformative Shifts Reshaping the Beverage Stabilizer Landscape Through Innovation and Evolving Consumer Preferences

Over the past decade, the beverage stabilizer sector has undergone transformative shifts driven by consumer demand, regulatory reforms, and rapid innovation. Initially dominated by synthetic hydrocolloids and emulsifiers, the market has transitioned toward natural gums, proteins, and bio-based extracts that align with clean-label imperatives. Moreover, the introduction of precision-extracted biopolymers and tailored enzyme treatments has expanded functional capabilities, enabling formulators to engineer texture, clarity, and stability with unprecedented control.

Concurrently, novel processing techniques such as high-pressure homogenization and microfluidization have enhanced stabilizer dispersion and performance, facilitating the development of low-viscosity applications that previously posed formulation challenges. In addition, digital formulation platforms and predictive modeling tools are accelerating innovation cycles, reducing trial-and-error while delivering cost efficiencies. These collective shifts underscore a market in which science, sustainability, and consumer perception converge to redefine expectations for beverage stability.

Examining the Cumulative Effects of 2025 United States Tariff Measures on Ingredient Sourcing and Cost Structures in the Beverage Stabilizer Sector

In 2025, cumulative tariff adjustments imposed by the United States government have significantly influenced raw material sourcing and cost structures for the beverage stabilizer industry. Import levies on certain hydrocolloid grades and specialty nutrient carriers have prompted formulators to reassess supply networks, weighing domestic capacity expansions against higher landed costs for offshore ingredients. This rebalancing has accelerated investment in localized extraction facilities and spurred joint ventures aimed at mitigating trade-related price volatility.

These tariff impacts have also elevated the strategic importance of multi-functional stabilizers that consolidate performance attributes while reducing reliance on multiple imported inputs. In response, ingredient developers have intensified R&D efforts to produce hybrid polymers and composite systems that deliver both emulsification and texture control, thereby minimizing exposure to specific tariff lines. Consequently, supply-chain resilience and formulation agility have become cornerstone priorities for manufacturers navigating this evolving trade environment.

Deriving Actionable Insights from Product Formulations Types End Uses and Channels in the Beverage Stabilizer Market Segmentation Framework

Insightful segmentation based on form unlocks a nuanced view of the stabilizer market, where gel forms cater to confectionery and gel-based beverages seeking ribbon stability, liquid systems integrate seamlessly into low-pH solutions such as carbonated soft drinks, and powder variants serve as versatile ingredients across dry blends and on-the-go functional mixes. Delving into type categories reveals that acidulants not only modulate taste profiles but also contribute to microbial stability, while antioxidants extend shelf integrity by preventing oxidative degradation. Emulsifiers enhance lipid dispersion in fortified waters, gums and hydrocolloids provide structural frameworks in dairy alternatives, and proteins deliver dual functionality as both nutritional and stabilizing agents. Preservatives further safeguard against spoilage, stabilizing agents prevent phase separation in complex formulations, and thickeners refine mouthfeel across the spectrum of beverage styles.

Considering end-users, stabilizers are tailored for alcoholic beverages requiring haze control in craft beers, dairy industries prioritizing silky textures in fermented milks, the food sector integrating beverage ingredients into sauces and dressings, health and wellness drinks needing suspension of active botanicals, and non-alcoholic beverages seeking consistency in flavored waters. Finally, distribution channel analysis underscores a growing share of e-commerce platforms driven by digital sampling programs, while established offline networks continue to dominate for bulk ingredient procurement and technical service support.

This comprehensive research report categorizes the Beverage Stabilizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- Distribution Channel

- End-user

Uncovering Regional Dynamics and Growth Drivers for Beverage Stabilizers Across the Americas EMEA and Asia-Pacific Markets

In the Americas, demand for beverage stabilizers is propelled by robust activity in the U.S. juice and functional drink segments, where consumer emphasis on clean-label and plant-derived ingredients has stimulated growth in pectin and plant-protein stabilizer supplies. Canada demonstrates steady uptake in natural emulsifiers within fortified beverages designed for active lifestyles, while Latin American markets exhibit rising interest in cost-effective gum systems for traditional fruit-based preparations.

Across Europe, Middle East & Africa, stringent regulatory landscapes surrounding clean-label definitions have driven formulators toward transparent ingredient sourcing and eco-friendly processing methods. The European Union’s emphasis on plant-sourced emulsifiers and thickening agents has led to broader adoption of seaweed-derived hydrocolloids, whereas Middle Eastern beverage cultures increasingly incorporate native stabilizing botanicals to enhance traditional drink formulations. In the Asia-Pacific region, rapid urbanization and growing middle-class consumption boost demand for ready-to-drink teas, functional waters, and fortified coconut-based beverages, elevating the need for high-performance stabilizers that ensure flavor retention under diverse climatic conditions.

This comprehensive research report examines key regions that drive the evolution of the Beverage Stabilizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Competitive Positioning and Strategic Initiatives of Leading Beverage Stabilizer Manufacturers and Ingredient Innovators

The competitive landscape of beverage stabilizers features key multinational and specialty players strategically expanding their portfolios through acquisitions, partnerships, and targeted R&D initiatives. Large ingredient suppliers leverage broad formulation expertise and global distribution networks to introduce next-generation hydrocolloid systems with enhanced thermal and pH tolerance. Simultaneously, nimble innovators focus on proprietary extraction technologies and unique biopolymer chemistries, securing intellectual property assets that differentiate their offerings in natural stabilizer segments.

Market leaders are also building collaborative platforms with beverage brands to co-develop tailor-made solutions that address specific sensory and shelf-life challenges. This co-innovation model not only accelerates commercial rollout but also fortifies customer relationships through ongoing technical support. Furthermore, strategic alliances between specialty ingredient firms and contract manufacturers are increasingly prevalent, optimizing scale-up processes for novel stabilizer complexes and streamlining regulatory approvals across multiple jurisdictions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Beverage Stabilizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- BASF SE

- Caldic Ingredients Benelux B.V.

- CARAGUM International

- Cargill, Incorporated

- CEAMSA

- Chemelco International Bv

- Chr. Hansen Holding A/S

- Corbion N.V.

- CP Kelco U.S. Inc.

- DSM-Firmenich

- DuPont de Nemours, Inc.

- Givaudan SA

- Glanbia plc

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Jungbunzlauer

- Kerry Group plc

- Nexira

- Palsgaard A/S

- Silvateam S.p.A.

- Taiyo Kagaku Co.,Ltd.

- Tate & Lyle PLC

Formulating Strategic Recommendations to Drive Innovation Efficiency and Market Differentiation for Beverage Stabilizer Industry Leaders

To thrive amid intensifying competition and evolving consumer demands, industry leaders should concentrate on accelerating innovation pipelines by integrating digital formulation tools, artificial intelligence modeling, and advanced high-throughput screening platforms. By doing so, R&D teams can rapidly iterate and validate multifunctional stabilizer blends that meet specific performance criteria while aligning with clean-label aspirations. Additionally, fortifying supply-chain resilience through diversified sourcing strategies and localized production investments will help mitigate the impacts of trade policy fluctuations and logistics constraints.

Leaders are also advised to strengthen customer partnerships by offering modular service models encompassing end-to-end formulation support, sensory evaluation programs, and regulatory consulting. Such holistic collaborations not only drive product differentiation but also establish ingredient suppliers as trusted advisors. Finally, continuing education initiatives for beverage formulators-such as webinars, workshops, and white papers-will foster deeper understanding of stabilizer technologies, ultimately accelerating adoption and facilitating co-innovation.

Detailing a Rigorous Research Methodology Integrating Primary Expert Engagement Secondary Data Analysis and Qualitative Validation Techniques

This research integrates a comprehensive methodology combining primary interviews with formulators, ingredient developers, and technical service experts, alongside in-depth secondary data analysis of industry reports, peer-reviewed journals, and regulatory publications. Qualitative insights were validated through structured discussions with beverage manufacturers specializing in dairy-alternative, alcohol-based, and functional drinks, ensuring a balanced perspective across end-use categories.

Moreover, trend mapping leveraged a triangulated approach, cross-referencing global trade data, patent filings, and attendance records from leading ingredient conferences to identify emerging formulation technologies and tariff-driven supply-chain shifts. Analytical frameworks were then applied to segment the market by form, type, end-user, and distribution channel, providing a strategic blueprint for stakeholders to navigate the complex beverage stabilizer ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Beverage Stabilizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Beverage Stabilizers Market, by Form

- Beverage Stabilizers Market, by Type

- Beverage Stabilizers Market, by Distribution Channel

- Beverage Stabilizers Market, by End-user

- Beverage Stabilizers Market, by Region

- Beverage Stabilizers Market, by Group

- Beverage Stabilizers Market, by Country

- United States Beverage Stabilizers Market

- China Beverage Stabilizers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Perspectives on the Future Trajectory of Beverage Stabilizers Amid Industry Trends and Evolving Regulatory Landscapes

The beverage stabilizer market is poised for continued evolution as consumer preferences, regulatory environments, and trade policies intersect to redefine formulation strategies. Ingredient developers are advancing multi-functional polymers and natural extract systems that resonate with clean-label trends, while digital tools streamline innovation cycles and reduce time-to-market. Regional dynamics will further shape supply-chain priorities, with companies focusing on localized extraction capacity in high-growth markets and strategic alliances to navigate tariff complexities effectively.

In conclusion, stakeholders equipped with a deep understanding of segmentation nuances, regional drivers, and competitive landscape are best positioned to capitalize on the opportunities presented by this dynamic market. By embracing collaborative models, investing in technology-enabled R&D, and reinforcing resilient supply networks, industry players can secure long-term growth and deliver the differentiated beverage experiences that modern consumers demand.

Engage Directly with Associate Director Ketan Rohom to Access In-Depth Beverage Stabilizer Market Intelligence and Customized Advisory Solutions

For organizations seeking to deepen their understanding of beverage stabilizer dynamics and capitalize on emerging opportunities within this evolving market landscape, direct engagement with Ketan Rohom presents a compelling pathway. As Associate Director of Sales and Marketing, Ketan brings a wealth of expertise and a nuanced perspective on ingredient innovation, regulatory developments, and competitive intelligence specific to regulatory, formulation, and distribution considerations within the beverage stabilizer domain. By reaching out, decision-makers will gain access to comprehensive research deliverables, including tailored data insights, custom advisory sessions, and ongoing market updates that inform strategic initiatives.

Partnering with Ketan ensures that stakeholders, from R&D scientists to C-level executives, receive personalized guidance on ingredient sourcing, pricing dynamics, and emerging formulation techniques. This engagement offers an unparalleled opportunity to align new product development roadmaps with industry best practices and capitalize on incremental shelf-stability advancements. To initiate this collaboration and secure your copy of the full market research report, interested parties are encouraged to contact Ketan directly and explore exclusive options for enterprise licensing and ongoing subscription support.

- How big is the Beverage Stabilizers Market?

- What is the Beverage Stabilizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?