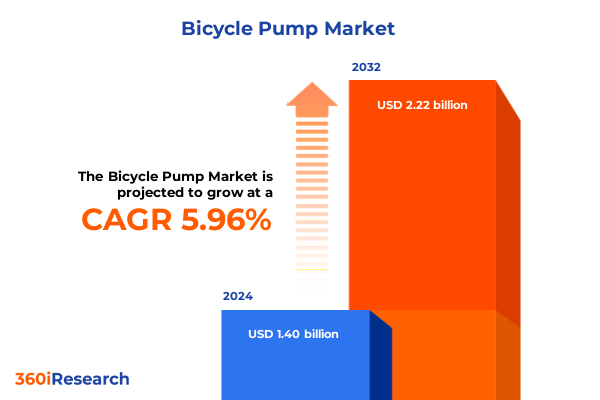

The Bicycle Pump Market size was estimated at USD 1.47 billion in 2025 and expected to reach USD 1.54 billion in 2026, at a CAGR of 6.11% to reach USD 2.22 billion by 2032.

Unveiling Core Dynamics of the Bicycle Pump Market Amid Rapid Shifts in Consumer Mobility Preferences and Technological Innovation

The bicycle pump market sits at a pivotal juncture as global mobility trends converge with consumer demands for convenience, reliability, and performance. Over the past decade, the proliferation of cycling as both a recreational pastime and a sustainable transportation solution has driven heightened awareness of component quality, fueling innovation among pump manufacturers. Shifts in demographic preferences, notably among urban commuters seeking compact and portable solutions, have sparked growth in lightweight manual options. Concurrently, professional and recreational cyclists continue to demand high-pressure floor and electric pumps that promise rapid inflation and precision control.

Against this backdrop, the market has evolved to balance traditional mechanical designs with cutting-edge advancements in materials, ergonomics, and digital integration. The rise of e-bikes and hybrid bicycles has created new performance benchmarks, driving the adoption of electric pumps equipped to meet higher pressure requirements while maintaining energy efficiency. In parallel, CO2 inflators are carving out a niche among racers and touring cyclists who prioritize speed and portability. As the landscape becomes increasingly complex, understanding the interplay between consumer demands, technological capability, and distribution dynamics will be essential for industry stakeholders aiming to navigate future growth trajectories.

Examining Pivotal Transformations Reshaping the Bicycle Pump Industry from Technological Advances to Shifting Consumer Expectations

The bicycle pump industry has undergone profound transformation driven by several converging forces. First, modern material science breakthroughs have enabled the production of ultra-lightweight alloys and composites, reducing overall weight without compromising structural integrity. This shift has elevated consumer expectations, particularly in high-performance applications where every gram matters. Second, digitization has paved the way for smart pumps featuring integrated pressure sensors and Bluetooth connectivity, allowing riders to monitor inflation levels via mobile apps and ensuring precise tire pressure maintenance.

Moreover, evolving retail landscapes have redefined distribution strategies. Online direct-to-consumer platforms have gained prominence, challenging traditional specialty shops and sporting goods retailers to enhance their value proposition through experiential services and education. At the same time, strategic partnerships between pump manufacturers and bicycle OEMs have emerged as a potent channel for embedding branded pumps with new bike models, reinforcing brand loyalty from the first ride. These transformative shifts underscore a broader industry pivot towards consumer-centric innovation, necessitating agile business models capable of responding to rapidly evolving market demands.

Assessing the Cumulative Economic and Supply Chain Impacts of United States Tariffs on Bicycle Pump Imports through 2025

Over the course of 2025, United States tariff policies have exerted mounting pressure on bicycle pump import economics, reshaping cost structures and supply chain dynamics. Initial levies under Section 301 and expanded duties on industrial components have increased landed costs for pumps and key raw materials, prompting manufacturers to revisit sourcing strategies and renegotiate supplier contracts. Rising steel and aluminum duties have translated into upstream cost escalations, which in turn have narrowed profit margins for both domestic producers and importers reliant on offshore manufacturing hubs.

Cumulatively, these measures have driven a recalibration of pricing across consumer segments, with higher-end electric and CO2 inflator models absorbing the brunt of added duties due to their more complex componentry. Some leading players have responded by accelerating investments in North American assembly facilities, seeking to mitigate duty exposure and shorten lead times. Meanwhile, smaller original equipment manufacturers and boutique brands face difficult trade-offs, as relocating production closer to end markets involves significant capital outlay. As the US government signals sustained protectionist stances through year-end 2025, stakeholders must weigh the balance between cost pressures and market competitiveness when charting their strategic roadmaps.

Revealing Critical Segmentation Insights across Product Types Pressure Capacities Distribution Channels and Target Applications

Analyses of market segmentation reveal nuanced insights into product performance, consumer preferences, and distribution effectiveness. Within the type dimension, the automatic segment-encompassing CO2 inflators and electric pumps-has witnessed accelerated adoption among commuters and endurance athletes seeking rapid, on-demand inflation without manual exertion. Conversely, the manual category, which includes floor pumps, foot pumps, and hand pumps, retains broad appeal across recreational riders who value simplicity, reliability, and cost efficiency.

When viewed through the lens of pressure capacity, the division between high-pressure (over 80 psi), medium-pressure (30-80 psi), and low-pressure (below 30 psi) offerings delineates clear application boundaries. High-pressure units cater predominantly to road cyclists and professional racers where precision is paramount, while medium-pressure options serve a diverse rider base on hybrid and mountain trails. Low-pressure pumps remain essential for e-bikes and comfort-oriented models, where larger volume inflation at lower pressures ensures ride stability and comfort. Distribution channel analysis highlights the ascendancy of online retailers, yet department stores and specialty bicycle shops continue to drive brand discovery through in-store demonstrations and expert guidance. Sporting goods chains maintain relevance by bundling pumps with accessory packages during seasonal promotions.

Application-based insights underscore the interdependence of pump innovation and bicycle category growth. The electric bike segment’s booming popularity requires pumps calibrated for battery-powered inflation cycles and enhanced durability, whereas mountain bicycles demand robust construction and high-volume displacements to accommodate wider tires. Hybrid bicycles tap into a middle ground where modular pump designs that traverse multiple terrain types are particularly valued. Road bicycles, with their slender tire profiles, emphasize precision pressure control, cementing the floor pump’s role as an indispensable tool. Finally, end user evaluation across amateur riders, professional competitors, recreational enthusiasts, and repair shops illustrates a spectrum of requirements-from portable emergency inflation to heavy-duty workshop applications-driving varied product features and pricing models.

This comprehensive research report categorizes the Bicycle Pump market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Pressure Capacity

- Distribution Channel

- Application

- End User

Unearthing Strategic Regional Trends and Growth Drivers Influencing Bicycle Pump Demand across Americas EMEA and Asia-Pacific

Regional market dynamics exhibit pronounced heterogeneity as growth drivers diverge across major territories. In the Americas, robust cycling cultures in North America and parts of South America support sustained demand for mid- to high-end pump solutions, particularly electric pumps tailored for the expanding e-bike market. Consumer expectations in this region are shaped by environmental concerns and an appetite for premium, feature-rich products that align with urban mobility initiatives.

By contrast, Europe, Middle East, and Africa present a mosaic of market maturity levels. Western Europe’s well-established cycling infrastructure fuels strong uptake of manual and electric pumps alike, while emerging markets in Eastern Europe, the Middle East, and North Africa showcase latent potential driven by infrastructure investments and growing leisure cycling participation. The cultural significance attached to premium European pump brands also elevates the perceived value of domestic manufacturers.

In the Asia-Pacific region, burgeoning urban populations and government programs promoting cycling as an antidote to congestion and pollution have catalyzed rapid market growth. Here, affordability remains a critical determinant, positioning low-pressure hand and foot pumps as volume drivers, even as interest in higher-specification electric and CO2 inflators begins to take hold. Manufacturers that tailor product portfolios to address regional price sensitivities while maintaining performance standards stand to capture significant market share amid intensifying competition.

This comprehensive research report examines key regions that drive the evolution of the Bicycle Pump market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Market Leaders and Innovative Player Strategies Defining the Competitive Bicycle Pump Landscape Globally

Leading companies in the global bicycle pump arena have adopted differentiated strategies to maintain market leadership and accelerate innovation. Market incumbents with deep OEM relationships have leveraged co-development agreements to integrate proprietary pump designs with new bicycle models, ensuring early adoption and brand visibility. Others have pursued targeted acquisitions to bolster technical capabilities in electric pumping systems and digital integration, thereby expanding their product portfolios and service offerings.

Several innovative players have carved competitive niches by focusing on sustainable manufacturing processes, using recycled metals and bio-based polymers to reduce environmental impact. This commitment to sustainability resonates with consumers prioritizing eco-friendly credentials and has catalyzed partnerships with bicycle share programs and municipal initiatives. In addition, direct-to-consumer subscription models for pump maintenance and accessory upgrades are emerging as a novel approach to foster ongoing engagement and generate recurring revenue streams.

Smaller specialized companies continue to influence market dynamics through boutique offerings, delivering handcrafted pumps with premium materials and artisanal finishes. While their volume remains limited, these brands drive aspirational appeal and set design benchmarks that often are scaled by larger manufacturers. Overall, the competitive landscape is defined by a delicate balance between scale-driven efficiency and nimble innovation, with successful players harmonizing both to capture diverse consumer segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bicycle Pump market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIRACE Co.,Ltd.

- Axiom Cycling Gear

- BBB Cycling by Pon Holdings B.V.

- BETO ENG. & MKTG., CO., LTD.

- Birzman Corp.

- Chengdu Chendian Intelligent Technology Co., Ltd.

- CO-LUCK ENTERPRISE CO., LTD

- Crankbrothers by Selle Royal Group S.p.A.

- Decathlon Sports India Pvt Ltd.

- Dial4Trade

- Eastman Industries Ltd.

- Illinois Tool Works Inc.

- Lezyne USA, Inc.

- Pacific Cycle, Inc. by Dorel Industries Ltd.

- Park Tool Co.

- Planet Bike PRIVATE LIMITED

- Raj Cycles (india) Private Limited

- SCOTT Sports SA.

- SKS metaplast Scheffer-Klute GmbH

- Solmark International, Inc.

- Specialized Bicycle Components, Inc.

- SRAM Corporation

- TOPEAK INC

- Trek Bicycle Corporation

- Vibrelli Outdoors Pty Ltd

- Zéfal SA

Formulating High-Impact Strategic Recommendations for Industry Leaders to Navigate Evolving Market Complexities and Accelerate Growth

To thrive in an increasingly complex environment, industry leaders should prioritize strategic initiatives that drive both efficiency and differentiation. First, diversifying supply chains by blending regional assembly hubs with contractual partnerships can mitigate tariff exposure and curtail lead times. Investing in near-shoring for critical components will bolster resilience against future trade policy shifts and logistical disruptions. Second, enhancing direct-to-consumer digital capabilities-through robust e-commerce platforms and integrated mobile applications-will deepen customer insights and foster long-term brand loyalty.

Simultaneously, product innovation must remain at the forefront. Expanding electric pump offerings with modular battery configurations and advanced pressure sensing will address growing e-bike segment requirements. Embracing circular economy principles by incorporating recyclable components and offering pump refurbishment services will resonate with environmentally conscious consumers and differentiate brands in crowded marketplaces. Finally, cultivating strategic alliances with bicycle OEMs, shared mobility operators, and municipal planners can unlock new revenue channels and amplify brand credibility. By pursuing these high-impact actions, companies can balance cost optimization with value creation, setting the stage for sustained growth amid dynamic market forces.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Data and Statistical Validation Techniques

This analysis is underpinned by a rigorous, multi-method research framework designed to ensure the reliability and relevance of insights. Primary data collection involved structured interviews with senior executives from leading pump manufacturers, distribution channel partners, and procurement specialists at bicycle brands, yielding qualitative perspectives on market drivers and challenges. Parallel to this, extensive surveys of end users-including amateur riders, professional cyclists, and repair shop managers-provided quantitative validation of product preferences, usage patterns, and price elasticity.

Secondary research encompassed a comprehensive review of industry publications, trade association reports, and import-export databases to triangulate market trends and tariff data. In addition, component cost analyses leveraged publicly available commodity pricing indices for aluminum and steel, enabling an assessment of input cost fluctuations and their pass-through effects. Advanced statistical techniques, including regression modeling and sensitivity analysis, were applied to evaluate correlations between tariff levels, distribution channel performance, and regional demand variations. Finally, all findings were subjected to peer review by an external advisory panel of market analysts and technical experts to ensure objectivity and eliminate bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bicycle Pump market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bicycle Pump Market, by Type

- Bicycle Pump Market, by Pressure Capacity

- Bicycle Pump Market, by Distribution Channel

- Bicycle Pump Market, by Application

- Bicycle Pump Market, by End User

- Bicycle Pump Market, by Region

- Bicycle Pump Market, by Group

- Bicycle Pump Market, by Country

- United States Bicycle Pump Market

- China Bicycle Pump Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Empower Strategic Decision Making in the Bicycle Pump Sector

The evolving bicycle pump market presents both challenges and opportunities for stakeholders across the value chain. Driven by transformative technological advances, shifting consumer preferences, and policy-induced cost pressures, the industry landscape demands strategic agility and forward-looking innovation. Key insights underscore the importance of targeted segmentation strategies, regional customization, and partnerships that span OEMs, retailers, and end users.

Looking ahead, the continued rise of e-bikes and growing emphasis on sustainability will redefine performance criteria and product development roadmaps. By integrating durable materials, intelligent connectivity, and circular economy principles, manufacturers can align with consumer values and regulatory expectations. Simultaneously, proactive management of geopolitical and tariff risks through diversified sourcing and near-shored production will be critical to safeguarding margins and market access. Ultimately, the companies that harmonize operational resilience with customer-centric innovation will be best positioned to shape the next chapter of growth in this dynamic sector.

Connect with Ketan Rohom to Unlock Comprehensive and Actionable Bicycle Pump Market Insights and Elevate Your Strategic Advantage

Elevate your strategic positioning by accessing the complete market intelligence report tailored specifically for decision-makers seeking a comprehensive understanding of the bicycle pump industry. Engage directly with Ketan Rohom (Associate Director, Sales & Marketing) to explore in-depth analyses, competitive assessments, and actionable recommendations designed to help your organization capitalize on emerging opportunities and mitigate risks. Immediate access ensures you stay ahead of market shifts and regulatory developments, unlocking the data-driven insights you need to inform product development, supply chain strategies, and go-to-market plans. Connect today to secure your competitive edge and drive profitable growth in an evolving market landscape.

- How big is the Bicycle Pump Market?

- What is the Bicycle Pump Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?