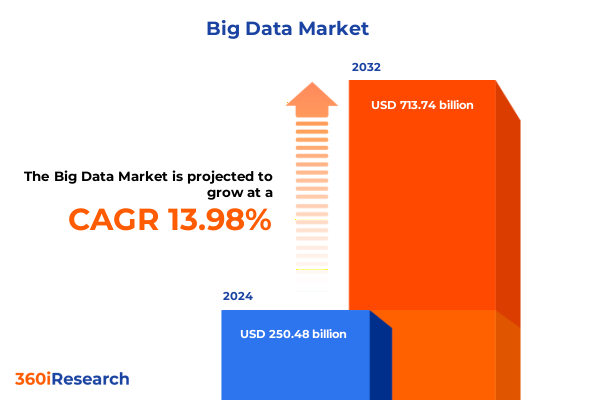

The Big Data Market size was estimated at USD 284.91 billion in 2025 and expected to reach USD 321.05 billion in 2026, at a CAGR of 14.01% to reach USD 713.74 billion by 2032.

Unlocking the Power of Big Data: A Comprehensive Overview of Its Evolution, Strategic Significance, and Implications for Modern Enterprises

In today’s data-rich environment, organizations are inundated with vast streams of information emanating from internal systems, customer interactions, and external data providers. Understanding how to harness this continuous influx is no longer a luxury; it is a strategic imperative for driving sustainable growth and competitive differentiation. The convergence of advanced analytics, cloud technologies, and increasingly sophisticated data governance frameworks has shifted big data from an experimental initiative to a core enterprise capability. Consequently, businesses across sectors are intensifying investments in data infrastructure, talent acquisition, and analytics platforms to convert raw data into actionable intelligence.

As the volume, velocity, and variety of data continue to expand, this introduction sets the stage for an insightful exploration of the factors reshaping the big data landscape. We will begin by examining the transformative shifts that have redefined data management and analytics, followed by an analysis of external policy impacts, including the 2025 United States tariffs. Further sections delve into nuanced segmentation insights, regional dynamics, and the profiles of leading companies that are driving innovation. To guide decision makers in translating insights into action, this executive summary culminates with strategic recommendations and a transparent description of the rigorous research methodology that underpins our findings. Ultimately, this overview aims to equip enterprise leaders and data professionals with the knowledge they need to navigate the evolving big data ecosystem with clarity and confidence.

Navigating the Transformative Shifts in Big Data Landscape Driven by Advanced Analytics, AI Integration, and Evolving Data Governance Frameworks

Over the past decade, the big data landscape has undergone seismic changes propelled by the integration of artificial intelligence, the proliferation of edge computing, and a growing emphasis on data privacy. Initially, organizations focused on building basic data lakes and warehouses to store burgeoning datasets. However, as artificial intelligence and machine learning matured, enterprises migrated toward advanced analytics platforms capable of real-time processing and predictive modeling. At the same time, edge computing has emerged as a critical enabler, delivering on-premises data processing and reduced latency for time-sensitive applications in manufacturing, healthcare, and telecommunications.

In tandem with technological progress, regulatory developments and evolving data governance best practices have driven organizations to adopt more rigorous frameworks. From enhanced data protection regulations like the European Union’s General Data Protection Regulation to sector-specific guidelines for financial services and healthcare, companies have had to bolster compliance measures while still deriving strategic value from their data assets. As a result, data quality management and metadata strategies have become core disciplines, ensuring that insights are both reliable and traceable. These transformative shifts underscore a fundamental truth: success in a data-driven world depends on harmonizing innovation, operational rigor, and regulatory adherence.

Assessing the Cumulative Impact of 2025 United States Tariffs on Data Infrastructure Costs, Supply Chains, and Technology Adoption Across Industries

In 2025, the United States introduced a new tranche of tariffs on imported hardware components, software packages, and related services critical to big data infrastructures. These policy measures have reverberated across supply chains, increasing procurement costs for networking infrastructure, servers, and storage devices. Consequently, enterprises have had to reassess sourcing strategies, explore alternate suppliers in tariff-exempt jurisdictions, and engage in more nuanced total cost of ownership analyses. The ripple effects are particularly pronounced for organizations deploying on-premises solutions, where hardware cost increases directly translate into elevated capital expenditures.

Moreover, the cumulative impact extends beyond hardware to encompass services, software licenses, and cloud service fees. Tariffs on professional services fees have driven integration and deployment costs upward, prompting companies to strengthen internal capabilities and streamline vendor engagements. In parallel, managed services such as support, maintenance, and training have become focal points for cost containment. Despite these headwinds, many enterprises are accelerating their shift to cloud-hosted data management and analytics platforms, drawn by the agility and scale these environments offer. By mitigating upfront hardware investments and accessing flexible consumption models, businesses are finding ways to counterbalance tariff-induced cost pressures.

Uncovering Key Segmentation Insights Across Components, Data Types, Deployments, Applications, Industries, and Organization Sizes to Drive Strategic Decision Making

A nuanced understanding of market segmentation reveals the diverse pathways through which organizations derive value from big data investments. When viewed through the lens of components, the ecosystem spans hardware, services, and software. Hardware inquiries focus on networking infrastructure, servers, and storage devices, each driven by the need for greater speed, capacity, and resiliency. In contrast, services encompass managed offerings-ranging from support and maintenance to training and education-and professional services such as consulting and integration, reflecting a maturation of in-house skill sets.

Software segmentation highlights a broad spectrum of functionality: business intelligence tools that facilitate reporting, advanced analytics platforms that power predictive modeling, data management suites that ensure governance and integration, and visualization tools that translate insights into intuitive dashboards. Likewise, data type classification underscores how semi-structured, structured, and unstructured datasets each present unique challenges and opportunities for ingestion, processing, and analysis.

Deployment models further diversify strategic options, whether through the scalability of cloud environments or the control afforded by on-premises architectures. Application segmentation illustrates the range of use cases, from risk analytics and master data management to descriptive analytics and prescriptive optimization. Industry verticals-from BFSI and healthcare to media and retail-adopt big data according to sector-specific imperatives, supported by tailored solutions for diagnostics, IT services, and e-commerce platforms. Finally, organizational size influences resource allocation: large enterprises leverage expansive infrastructures and cross-functional data teams, while SMEs prioritize modular, cost-effective offerings that accelerate time to value.

This comprehensive research report categorizes the Big Data market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Data Type

- Deployment

- Application

- Industry

- Organization Size

Examining Regional Dynamics in Big Data Adoption and Innovation Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping big data adoption, with each geography exhibiting distinct drivers and constraints. In the Americas, mature markets lead in cloud migration and advanced analytics implementations, underpinned by robust digital transformation initiatives and a competitive vendor landscape that fosters innovation. Similarly, Latin American emerging economies are embracing data analytics to optimize supply chains, drive financial inclusion, and enhance customer experiences, albeit within the context of varying regulatory frameworks and infrastructure readiness.

In Europe, Middle East, and Africa, stringent data protection laws and a growing emphasis on sovereign data strategies have catalyzed investments in hybrid architectures and on-premises deployments. Organizations in this region prioritize data privacy and resiliency, resulting in sophisticated data governance programs and cross-border data flow agreements. Meanwhile, the Asia-Pacific region is characterized by rapid digital adoption, with governments and enterprises partnering on smart city initiatives, IoT-driven manufacturing, and fintech innovations. Affordability considerations and disparate infrastructure maturity levels drive a mix of cloud and edge computing models that cater to both advanced tech hubs and nascent markets.

These regional insights underscore the need for tailored strategies that account for local regulatory environments, cultural norms, and infrastructure landscapes. By aligning data initiatives to regional priorities and resource capacities, enterprises can unlock the full potential of big data across global operations.

This comprehensive research report examines key regions that drive the evolution of the Big Data market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Big Data Innovators and Enterprise Vendors Driving Market Progress Through Strategic Partnerships and Technological Advancements

At the forefront of market innovation are companies that seamlessly integrate technology development with consultative services and strategic partnerships. Tier-one technology providers continuously enhance their big data platforms by embedding machine learning frameworks, optimizing storage efficiencies, and expanding native visualization capabilities. Concurrently, specialized solution integrators and consulting firms differentiate themselves by offering industry-aligned accelerators, vertical solution packages, and outcome-based engagement models.

Partnership ecosystems have also become a critical success factor, with alliances between cloud hyperscalers, hardware vendors, and software developers enabling more cohesive end-to-end offerings. Strategic mergers and acquisitions further accelerate capabilities, allowing organizations to bridge gaps in data science talent, expand global footprints, and integrate complementary analytics modules. Ultimately, the most influential companies balance product innovation with service excellence, delivering holistic solutions that address the full spectrum of customer needs-from initial data ingestion through advanced prescriptive analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Big Data market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alteryx, Inc.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Cloudera, Inc.

- Databricks, Inc.

- Dell Technologies Inc.

- Google LLC

- Hewlett Packard Enterprise Company

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- MongoDB, Inc.

- Oracle Corporation

- Palantir Technologies Inc.

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Snowflake Inc.

- Splunk Inc.

- Teradata Corporation

Implementing Actionable Strategies to Harness Big Data Potential Through Operational Excellence and Scalable Technology Investments

To fully exploit big data’s transformative potential, industry leaders must adopt a multifaceted approach that blends technology optimization with organizational agility. First, executives should champion cross-functional collaboration by establishing federated data governance councils that ensure alignment among IT, operations, and business units. This integrated governance framework fosters shared accountability for data quality, security, and compliance while accelerating decision-making cycles.

Next, leaders should prioritize scalable architecture strategies, such as adopting microservices-based analytics platforms and containerized deployments. These approaches not only enhance system resilience and modularity but also reduce time to market for new analytics capabilities. Simultaneously, organizations should invest in upskilling initiatives that equip data engineers, scientists, and analysts with the latest tools and methodologies. By cultivating a culture of continuous learning and experimentation, enterprises safeguard against talent shortages and maintain a competitive edge.

Finally, it is essential to adopt a use-case-driven mindset, starting pilot initiatives in high-impact areas-such as customer analytics, supply chain optimization, and fraud detection-and progressively scaling successes. Through iterative development cycles and measurable performance metrics, companies can demonstrate return on analytics investment and build momentum for broader big data transformation.

Explaining the Rigorous Research Methodology Employed to Gather, Analyze, and Validate Big Data Market Insights and Trends

This research leverages a rigorous methodology designed to deliver comprehensive, reliable insights into the big data ecosystem. Primary research components include in-depth interviews with C-level executives, data architects, and analytics practitioners across multiple industries and geographies. These firsthand perspectives illuminate real-world challenges, solution adoption drivers, and evolving organizational priorities. Secondary research encompasses an extensive review of publicly available white papers, industry journals, government publications, and peer-reviewed academic studies to triangulate findings and ensure contextual accuracy.

Quantitative analysis is conducted through data aggregation from proprietary databases, validated by cross-referencing with publicly disclosed financial reports, procurement records, and regulatory filings. Qualitative synthesis involves thematic coding of interview transcripts, enabling the identification of emergent trends, risk factors, and innovation hotspots. Throughout the process, stringent data validation protocols-such as consistency checks, source credibility assessments, and expert panel reviews-safeguard the integrity and reliability of our conclusions. This multifaceted approach ensures that our insights are both actionable and grounded in robust empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Big Data market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Big Data Market, by Component

- Big Data Market, by Data Type

- Big Data Market, by Deployment

- Big Data Market, by Application

- Big Data Market, by Industry

- Big Data Market, by Organization Size

- Big Data Market, by Region

- Big Data Market, by Group

- Big Data Market, by Country

- United States Big Data Market

- China Big Data Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Concluding Insights Synthesizing Key Findings and Strategic Implications for Navigating the Evolving Big Data Ecosystem with Confidence

As the big data landscape continues its rapid evolution, enterprises must adapt to shifting technological paradigms, regulatory complexities, and dynamic competitive environments. Key findings underscore the critical importance of integrating advanced analytics with strong governance frameworks, diversifying deployment models, and responding proactively to policy changes such as the 2025 tariffs. Moreover, segmentation analysis reveals that success hinges on aligning tools and services to specific organizational needs-whether that entails leveraging managed services for SMEs or building bespoke integration solutions for large enterprises.

Regional variations further emphasize the value of localized strategies, while profiles of leading companies illustrate the power of partnership ecosystems in driving innovation. By implementing the actionable recommendations outlined above-spanning governance, architecture, talent development, and use-case prioritization-industry leaders can steer their organizations toward resilient, data-driven futures. In closing, this executive summary provides a blueprint for navigating an increasingly complex data environment, equipping decision makers with the insights required to capitalize on emerging opportunities and mitigate evolving risks.

Connect with Ketan Rohom to Secure Your In-Depth Big Data Market Research Report and Stay Ahead in a Rapidly Evolving Digital Landscape

To embark on a transformative journey with the most comprehensive big data market research available, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Your organization can leverage this authoritative research to refine strategic plans, accelerate innovation roadmaps, and enhance competitive positioning. Through a tailored consultation, Ketan will help you pinpoint the most critical insights relevant to your objectives and ensure seamless delivery of actionable intelligence. Connect with Ketan today to secure exclusive access to proprietary data, expert analysis, and thought-leadership that will empower your leadership teams to make confident, data-driven decisions. Propel your enterprise forward by partnering with a dedicated research specialist committed to unlocking the full potential of big data in your organization.

- How big is the Big Data Market?

- What is the Big Data Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?