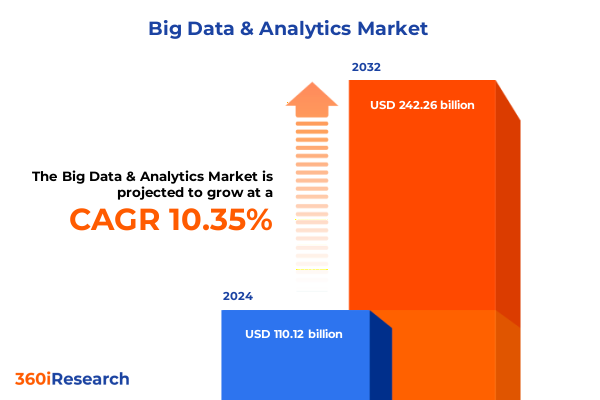

The Big Data & Analytics Market size was estimated at USD 121.44 billion in 2025 and expected to reach USD 133.93 billion in 2026, at a CAGR of 10.36% to reach USD 242.26 billion by 2032.

Driving Strategic Business Value by Integrating Big Data Ecosystems and Cutting-Edge Analytics Amid Evolving Industry Demands

In an era defined by exponential data growth and digital disruption, organizations are compelled to rethink their approaches to information management and decision-making. The proliferation of connected devices, social platforms, and cloud services has generated an unprecedented volume of structured, semi-structured, and unstructured data. Consequently, businesses recognize that harnessing this data through cohesive analytics strategies has become a fundamental catalyst for achieving operational efficiency, customer engagement, and strategic differentiation.

As industries evolve against a backdrop of intensifying competitive pressures, the imperative for a unified Big Data ecosystem has never been stronger. Enterprises are transitioning from siloed reporting functions toward integrated analytics platforms that align with overarching digital transformation initiatives. This convergence not only empowers data-driven decision-making across organizational hierarchies but also accelerates time-to-insight, ultimately enabling adaptive business models that respond in real time to market fluctuations.

Moreover, the rapid maturation of technologies such as machine learning, edge computing, and cloud-native analytics has shifted the paradigm of traditional business intelligence. Forward-thinking organizations are investing in end-to-end data pipelines that blend analytical sophistication with scalable infrastructure. As a result, stakeholders gain not only retrospective clarity via descriptive and diagnostic analytics but also foresight through predictive and prescriptive models. This introduction sets the stage for a comprehensive examination of the forces reshaping the Big Data and Analytics landscape in 2025.

Navigating Paradigm Shifts Triggered by Artificial Intelligence, Cloud Innovation, and Evolving Data Privacy Regulations in Analytics

The Big Data and Analytics landscape in 2025 is characterized by profound shifts driven by next-generation technologies, evolving regulatory frameworks, and shifting business paradigms. Artificial intelligence has emerged as a cornerstone, expanding beyond classical machine learning to encompass deep learning, natural language processing, and autonomous decision-making systems. This technological leap has enabled organizations to automate complex processes, optimize resource allocation, and personalize customer experiences at scale.

Concurrently, cloud innovation has accelerated, with hybrid and multi-cloud architectures becoming the norm rather than the exception. These environments facilitate elastic compute and storage resources, allowing enterprises to spin up advanced analytics workloads on demand while maintaining strict control over sensitive data. Edge computing, in tandem, has gained momentum, particularly in sectors such as manufacturing and telecommunications, where ultra-low latency and bandwidth constraints necessitate distributed processing closer to data sources.

At the same time, heightened attention to data privacy and protection has introduced new complexities. The continued global harmonization of rules-driven by frameworks like GDPR and emerging U.S. data privacy legislation-requires integrated governance models that balance compliance with innovation. This convergence of AI, cloud, edge, and regulatory imperatives is catalyzing a transformation in how organizations architect their data estates and extract value from analytics.

Assessing the Ramifications of Recent United States Tariff Policies on Big Data Infrastructure and Service Delivery Dynamics

In response to shifting trade policies, the United States implemented a series of targeted tariffs in early 2025 that directly impact hardware imports and advanced semiconductor components critical to Big Data infrastructure. Data center operators and cloud service providers are experiencing elevated capital expenditures as tariffs elevate the cost basis for servers, storage arrays, and specialized AI accelerators. This cost increase has triggered a wave of renegotiations with hardware vendors and intensified efforts to optimize total cost of ownership through lifecycle management and predictive maintenance protocols.

Moreover, the tariffs have influenced supply chain strategies, prompting some organizations to diversify procurement across alternative global suppliers and explore local manufacturing partnerships. While these adjustments mitigate exposure to trade duties, they also introduce new logistical complexities, longer lead times, and variability in component quality. As a result, businesses are both strengthening their risk management frameworks and reevaluating inventory buffering strategies to safeguard analytics continuity.

On the service delivery front, higher infrastructure costs have amplified interest in managed services and professional consulting offerings. Enterprises are increasingly outsourcing core functions such as cloud migration, data pipeline orchestration, and model deployment to third-party specialists capable of delivering cost-efficient, scalable solutions. This trend underscores the cumulative impact of tariffs: driving demand for value-added services, accelerating collaboration between service providers and end users, and reshaping the economics of Big Data deployments.

Uncovering Strategic Segmentation Layers to Deliver Tailored Insights Across Components, Analytics Types, Data Forms, Deployment Models, and Applications

An examination of market segmentation layers reveals critical insights into how demand for Big Data solutions is evolving. When analyzing components, it becomes clear that services dominate current investment trends, with managed services offering end-to-end lifecycle support and professional services delivering specialized expertise in data strategy and governance. Software platforms, meanwhile, play a complementary role by embedding core analytics engines, data visualization capabilities, and model development environments.

Delving into analytics types highlights a shifting emphasis from descriptive overviews and diagnostic root-cause analyses toward predictive forecasting and prescriptive optimization. Organizations are increasingly leveraging advanced algorithms to anticipate market movements, automate decision criteria, and prescribe optimal courses of action. This transition underscores the maturation of analytics maturity models across industries.

Data type segmentation further underscores the importance of handling diverse information streams. Semi-structured logs and clickstream records are becoming indispensable for customer journey mapping, while structured transactional data remains a cornerstone for financial reporting. Unstructured content-text, images, and social media feeds-has surged in strategic importance, driving demand for natural language processing and image recognition capabilities.

The deployment model segmentation draws a clear distinction between cloud-hosted services, which afford scalability and rapid provisioning, and on-premises solutions, which continue to appeal to sectors with stringent data sovereignty or latency requirements. Application-centric segmentation highlights the proliferation of use cases ranging from customer analytics that fuel personalized marketing to fraud and risk analytics that fortify security and compliance. Operational analytics is now integral to process optimization, predictive maintenance, and real-time performance monitoring.

Examining enterprise size uncovers divergent adoption patterns: large conglomerates are investing heavily in integrated analytics ecosystems to streamline global operations and foster innovation hubs, whereas small and medium enterprises are prioritizing modular, cost-effective, pay-as-you-go solutions that enable incremental capabilities without significant capital outlays. Industry vertical segmentation reveals that banking, financial services, and insurance continue to be early adopters, leveraging analytics for risk management and customer insights. Healthcare organizations follow closely, deploying data platforms for patient analytics and clinical decision support. Manufacturing enterprises emphasize operational efficiency and predictive maintenance, while retail and telecommunications focus on omnichannel engagement and network optimization.

This comprehensive research report categorizes the Big Data & Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Analytics Type

- Data Type

- Deployment Model

- Application

- Enterprise Size

- Industry Vertical

Evaluating Regional Dynamics Shaping Big Data Adoption Trends in the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional variations in Big Data adoption reflect diverse economic drivers, regulatory landscapes, and technological infrastructures. In the Americas, mature markets such as the United States and Canada are leading investment in cloud-native analytics and AI-powered process automation, underpinned by established data privacy frameworks and advanced telecommunications networks. Latin American markets are following suit with growing interest in remote data management and the democratization of analytics through low-code platforms.

Within Europe, the Middle East, and Africa, stringent data protection regimes, including the European Union’s General Data Protection Regulation, are shaping governance priorities and platform architectures. Enterprises in Western Europe continue to integrate analytics solutions that ensure compliance while extracting customer insights, whereas emerging markets in the Middle East and Africa are rapidly adopting cloud-based platforms to leapfrog legacy infrastructure and accelerate digital services rollout.

The Asia-Pacific region exhibits the fastest growth trajectory, fueled by expansive digitization initiatives in China, India, and Southeast Asian economies. These markets are embracing hybrid cloud deployments to balance cost efficiency with local data residency mandates. The Asia-Pacific appetite for mobile-first analytics, social media-driven insights, and IoT-enabled smart city projects underscores the region’s role as an innovation epicenter. Ultimately, these regional dynamics underscore the importance of localized strategies and ecosystem partnerships tailored to distinct regulatory and commercial landscapes.

This comprehensive research report examines key regions that drive the evolution of the Big Data & Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Driving Innovation, Ecosystem Expansion, and Competitive Differentiation in the Big Data and Analytics Sector

The competitive arena of Big Data and Analytics is populated by industry stalwarts and emergent challengers, each pursuing distinctive growth trajectories. Leading global technology providers have harnessed their expansive R&D budgets and partner ecosystems to develop comprehensive analytics platforms. These offerings integrate data ingestion, processing, model training, deployment, and collaboration capabilities, facilitating end-to-end workflows.

Strategic acquisitions have also reshaped the competitive landscape. Market leaders have bolstered their portfolios by acquiring niche analytics startups specializing in AI-driven anomaly detection, real-time streaming analytics, or domain-specific solutions for healthcare and financial services. Such M&A activity has accelerated feature innovation, enabling seamless integration of specialized algorithms into broader analytics suites.

Open source communities continue to exert a meaningful influence on product roadmaps and go-to-market strategies. Providers are increasingly contributing to and commercializing open source frameworks for distributed data processing, machine learning libraries, and container orchestration, thereby fostering ecosystem interoperability and reducing vendor lock-in concerns.

Meanwhile, pure-play analytics vendors are capitalizing on their domain expertise, focusing on vertical-tailored solutions that address the nuanced requirements of industries such as telecommunications and manufacturing. Partnerships between hyperscale cloud providers and analytics specialists are proliferating, combining scalable infrastructure with deep algorithmic expertise.

These dynamics underscore a competitive environment where differentiation hinges on agility, platform extensibility, industry-specific IP, and the ability to deliver integrated services across the analytics life cycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Big Data & Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Acuvate

- Adobe Inc.

- Alphabet Inc.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Cloudera, Inc.

- Dell Technologies Inc.

- Elinext IT Solutions Ltd.

- Fair Isaac Corporation

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- Hitachi, Ltd.

- International Business Machines Corporation

- LTIMindtree Limited by Larsen & Toubro Ltd.

- Micro Focus International PLC by OpenText Corporation

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Teradata Corporation

Implementing Actionable Strategies to Enhance Data Governance, Foster Analytics Maturity, and Accelerate Digital Transformation in Enterprise Environments

Industry leaders poised to excel in the evolving Big Data and Analytics realm must adopt a strategic posture that aligns technology investments with organizational objectives. First, it is essential to establish robust data governance frameworks that encompass security, compliance, and ethical AI considerations. By defining clear policies and accountability structures, organizations can confidently scale analytics initiatives while mitigating regulatory risk.

Next, fostering analytics maturity requires targeted upskilling programs that empower cross-functional teams. Data scientists, business analysts, and operational stakeholders must collaborate to translate insights into actionable strategies. Comprehensive training curricula, including certifications and hands-on workshops, can accelerate adoption and ensure that analytics capabilities permeate the organization.

To maximize technology ROI, enterprises should pursue hybrid architectures that leverage both on-premises and cloud environments. This approach balances performance requirements for latency-sensitive workloads with the flexibility of elastic cloud resources. Selecting modular, API-driven platforms facilitates incremental deployment, enabling organizations to adapt rapidly to evolving business demands.

Furthermore, cultivating strategic partnerships with managed service providers and specialized consultancies can augment internal capabilities and expedite time-to-value. These alliances offer tailored expertise in advanced analytics use cases, from customer segmentation to anomaly detection. By leveraging third-party knowledge, enterprises can bypass common pitfalls and scale solutions more efficiently.

Finally, prioritizing continuous innovation through agile methodologies-such as DevOps and MLOps-ensures the iterative refinement of models, data pipelines, and user interfaces. This mindset fosters rapid experimentation and resilience in the face of shifting market conditions, positioning organizations to lead in the competitive Big Data and Analytics landscape.

Outlining Rigorous Research Methodologies Combining Quantitative Analysis, Qualitative Insights, and Multi-Channel Data Collection Techniques

Our research methodology combines rigorous quantitative analysis with qualitative insights to deliver a holistic market perspective. The quantitative component involves the analysis of anonymized survey data and structured interviews with key decision-makers across industry verticals, ensuring statistical relevance and sector coverage. Concurrently, secondary research leverages publicly available financial reports, regulatory filings, and reputable trade publications to triangulate findings and validate emerging trends.

Complementing these efforts, in-depth interviews with domain experts and technology practitioners provide nuanced understanding of implementation challenges, best practices, and adoption roadmaps. By synthesizing empirical data with anecdotal evidence, we capture both macro-level market dynamics and micro-level operational nuances.

Data collection is further enriched through multi-channel sources, including global conference proceedings, patent filings, and open source community contributions. Cross-referencing these datasets enables the identification of innovation hotspots and partnership ecosystems driving analytics breakthroughs.

Finally, an iterative validation process engages an expert advisory panel to review preliminary findings, challenge assumptions, and refine analytical models. This collaborative approach ensures that the final deliverables reflect the most current market intelligence and actionable recommendations, thereby delivering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Big Data & Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Big Data & Analytics Market, by Component

- Big Data & Analytics Market, by Analytics Type

- Big Data & Analytics Market, by Data Type

- Big Data & Analytics Market, by Deployment Model

- Big Data & Analytics Market, by Application

- Big Data & Analytics Market, by Enterprise Size

- Big Data & Analytics Market, by Industry Vertical

- Big Data & Analytics Market, by Region

- Big Data & Analytics Market, by Group

- Big Data & Analytics Market, by Country

- United States Big Data & Analytics Market

- China Big Data & Analytics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Offer a Cohesive Perspective on the Future of Big Data Growth, Operational Efficiency, and Competitive Advantage

This executive summary has illuminated the defining forces reshaping the Big Data and Analytics market in 2025, from the integration of advanced AI capabilities to the ramifications of evolving trade policies. It underscores the necessity of adaptive data architectures that reconcile cloud-native innovations with on-premises requirements, enabling organizations to optimize cost structures while preserving performance and security.

Through strategic segmentation analysis, businesses can align their investments with the nuanced demands of different analytics types, data formats, deployment models, and application use cases. Regional perspectives highlight the importance of tailoring approaches to localized regulatory and infrastructure landscapes, whether in the Americas, EMEA, or Asia-Pacific.

Competitive insights reveal a dynamic arena where platform extensibility, strategic partnerships, and open source contributions drive differentiation. Meanwhile, actionable recommendations emphasize the critical role of governance frameworks, targeted upskilling, and agile methodologies in scaling analytics maturity and sustaining innovation.

Looking ahead, industry leaders that embrace a holistic, data-centric mindset-underpinned by iterative experimentation and cross-functional collaboration-will unlock new levels of operational efficiency, customer intimacy, and market resilience. This coherent perspective offers a roadmap for leveraging Big Data as a strategic asset and forging a competitive advantage in an increasingly complex business environment.

Unlock Comprehensive Market Intelligence Today by Connecting with Ketan Rohom to Secure Your Exclusive Access to Strategic Big Data and Analytics Insights

Ready to elevate your strategic initiatives and gain unparalleled competitive intelligence in the Big Data and Analytics arena? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to tailor a solution that meets your organization’s unique needs and budget. By connecting with Ketan, you’ll unlock privileged insights into advanced analytics methodologies, emerging technology roadmaps, and region-specific market dynamics that are crucial for maintaining an innovative edge.

Don’t miss this opportunity to secure exclusive access to the comprehensive market intelligence report that has guided leading enterprises through complex digital transformations. Reach out today to explore your options, understand customized deliverables, and negotiate a package designed to drive sustained growth. Transform data into your organization’s most powerful asset and lead your industry with confidence by partnering with Ketan Rohom to acquire the definitive Big Data and Analytics resource.

- How big is the Big Data & Analytics Market?

- What is the Big Data & Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?