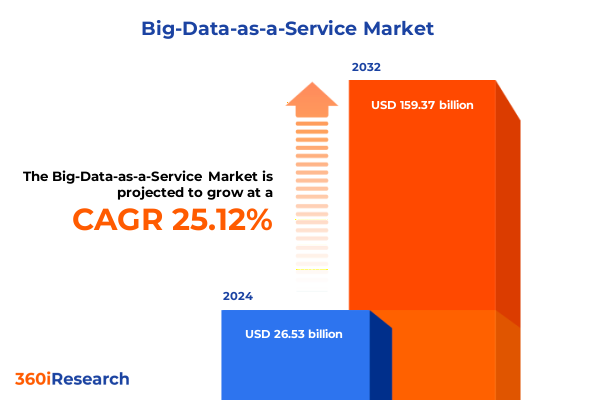

The Big-Data-as-a-Service Market size was estimated at USD 32.78 billion in 2025 and expected to reach USD 40.51 billion in 2026, at a CAGR of 25.34% to reach USD 159.37 billion by 2032.

Unlocking the Promise of Big Data as a Service: Setting the Stage for Unprecedented Insights and Operational Excellence

The proliferation of data across every facet of modern business has underscored the critical importance of scalable, flexible, and cost-effective analytics platforms. As enterprises accumulate unprecedented volumes of structured and unstructured information, the paradigm of Big Data as a Service (BDaaS) has emerged as a compelling alternative to traditional on-premises deployments. By leveraging cloud-native architectures, organizations can now harness advanced analytics, machine learning, and real-time insights without the upfront capital investments and maintenance burdens historically associated with large-scale data environments. This shift has democratized access to powerful data capabilities, enabling companies of all sizes to accelerate innovation and gain competitive advantage.

In this executive summary, readers will find an in-depth exploration of the BDaaS landscape, examining the technological drivers and business imperatives that are reshaping how data is collected, processed, and monetized. Through a comprehensive analysis of transformative industry shifts, regulatory influences, and evolving customer demands, we set the stage for understanding both the opportunities and challenges that lie ahead. This introduction establishes the foundational context for the subsequent sections, ensuring decision-makers can appreciate the strategic relevance of Big Data as a Service in today’s digital-first economy.

Navigating Revolutionary Shifts in Big Data Delivery Models Driving Smarter Decisions in a Rapidly Evolving Digital Ecosystem

The BDaaS ecosystem has undergone a profound evolution, catalyzed by the convergence of cloud computing, artificial intelligence, and edge analytics. Beyond the traditional batch processing model, organizations are now adopting real-time streaming architectures that enable immediate decision-making and proactive responses to dynamic market conditions. As data ingestion and processing pipelines have become more sophisticated, self-service analytics platforms have empowered business users to derive actionable insights without reliance on IT teams. This democratization of analytics has elevated the role of data in strategic planning and operational execution.

Moreover, serverless computing and microservices have disrupted legacy infrastructure, reducing the time and complexity associated with deploying scalable data solutions. In parallel, data fabric frameworks have emerged to unify disparate data sources, ensuring governance and security remain at the forefront. These transformative shifts are further amplified by the integration of prebuilt machine learning models, which accelerate the development of predictive solutions across industries. Consequently, enterprises can respond to emerging trends with agility, harnessing data-driven innovation as a core driver of growth.

Assessing the Far-Reaching Cumulative Effects of 2025 United States Tariffs on the Economics and Accessibility of Big Data Infrastructure

The introduction of heightened tariffs on imported servers, storage components, and semiconductor chips in 2025 has sent ripples through the BDaaS marketplace. As cloud providers recalibrate their supply chains to offset increased duties, the cost base for data infrastructure has risen, compelling enterprises to reevaluate total cost of ownership. Tariffs levied on hardware from major manufacturing hubs have translated into longer lead times and elevated procurement expenses, particularly impacting the deployment of on-demand compute and storage services.

In response, leading platform providers have sought alternative sourcing strategies, investing in domestic manufacturing partnerships and diversifying supplier portfolios. These measures aim to stabilize pricing pressures and mitigate the risk of further policy shifts. Nevertheless, some organizations are encountering higher subscription fees or revised usage tier structures as providers seek to maintain margin targets. Despite these headwinds, the resilience of cloud-native architectures and the inherent scalability of BDaaS offerings have helped enterprises absorb these changes while continuing to focus on their data-driven objectives.

Uncovering Strategic Insights Across Service Types, Deployment Models, Organization Sizes, and Industry Verticals Shaping Big Data Adoption

Insight into service type segmentation reveals that Infrastructure as a Service remains the foundational layer supporting elastic compute and storage, while Platform as a Service is increasingly favored for its ability to streamline application development with integrated middleware and analytics tools. In parallel, Software as a Service solutions specialized in data visualization and advanced analytics have gained traction among end users seeking turnkey capabilities without exposing their teams to infrastructure complexity.

Examining deployment models, hybrid cloud environments have become the dominant choice for organizations balancing regulatory compliance and operational flexibility, with private cloud architectures securing sensitive workloads and public cloud resources delivering rapid scalability. This hybrid approach facilitates seamless data movement across environments and ensures consistent governance practices.

From an organizational size perspective, large enterprises are investing heavily in centralized data lakes to consolidate multi-terabyte data streams, whereas small and midsize entities are adopting subscription-based analytics packages that offer predictable cost structures. These approaches reflect divergent priorities, with larger firms optimizing for scale and SMEs focusing on rapid time to insight.

Across industry verticals, the financial services sector has accelerated adoption of real-time fraud detection and risk analytics in both corporate and retail banking, while capital markets firms leverage high-frequency data analysis to optimize trading strategies. Defense agencies and educational institutions within the public sector are applying analytics for threat assessment and student performance insights, respectively. Healthcare providers are using cloud-based platforms to integrate patient records and accelerate pharmaceutical research, whereas IT services firms deliver managed analytics offerings and telecom service providers optimize network operations. Manufacturing enterprises employ predictive maintenance and quality control models across automotive, electronics, and industrial machinery segments. Media and entertainment companies harness personalized content recommendations in broadcasting, user engagement analytics in gaming, and digital rights management in publishing. In retail, brick-and-mortar operators combine point-of-sale data with online shopper behavior to refine inventory strategies, and e-commerce platforms leverage recommendation engines to boost conversion rates.

This comprehensive research report categorizes the Big-Data-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Organization Size

- Industry Vertical

Revealing Regional Dynamics and Emerging Trends Driving Big Data as a Service Growth Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the BDaaS narrative. In the Americas, the United States leads with a mature ecosystem of cloud infrastructure and innovation hubs, while Canada demonstrates growing interest among small and midsize firms adopting subscription analytics to drive competitive differentiation. Latin American markets are emerging, with government initiatives and digital transformation grants spurring demand for scalable data solutions.

Across Europe, Middle East, and Africa, stringent data protection regulations have elevated the importance of localized private cloud deployments, and regional data centers in Germany, France, and the United Kingdom have flourished. Public sector modernization programs across Gulf Cooperation Council member states are catalyzing investments in cloud-based analytics for urban planning and smart city initiatives.

Moving to Asia-Pacific, rapid digital adoption in China, India, and Southeast Asian nations is fueling demand for real-time analytics, while Japan’s focus on Industry 4.0 drives investments in predictive maintenance and quality optimization. Government-driven cloud alliances and regional trade agreements are reducing barriers to entry, enabling enterprises to exploit cross-border data insights with greater agility.

This comprehensive research report examines key regions that drive the evolution of the Big-Data-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Postures and Innovative Offerings of Leading Big Data as a Service Providers Driving Competitive Advantage

Leading platform providers continue to differentiate through strategic acquisitions, native AI integration, and expanded partner ecosystems. Amazon’s data lakehouse initiatives leverage its existing cloud portfolio, while Microsoft enriches its analytics suite with deep integrations into productivity tools. Google has focused on purpose-built data warehouses and open source distribution models to attract developer communities.

In parallel, established enterprise software firms have adapted their offerings, with one innovator emphasizing secure data fabric architectures and the other advancing autonomous database capabilities. At the same time, Snowflake and Databricks have solidified their positions as independent disruptors, driving rapid customer growth through scalable, consumption-based pricing and collaborative notebook environments. These competitive maneuvers underscore a broader market push toward modular, interoperable solutions that empower organizations to tailor analytics stacks to evolving requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Big-Data-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Alteryx, Inc.

- Amazon Web Services, Inc.

- Capgemini SE

- Databricks, Inc.

- Dell Technologies Inc.

- GoodData Corporation

- Google LLC

- Hewlett Packard Enterprise Company

- Hitachi Vantara Corporation

- IBM Corporation

- Informatica LLC

- Micro Focus International plc

- Microsoft Corporation

- QlikTech International AB

- SAP SE

- SAS Institute Inc.

- Snowflake Inc.

- Splunk Inc.

- Talend S.A.

- Teradata Corporation

- ThoughtSpot, Inc.

- TIBCO Software Inc.

Outlining Actionable Strategic Recommendations to Propel Big Data as a Service Adoption and Unlock Sustainable Value Creation for Industry Leaders

To capitalize on the BDaaS opportunity, industry leaders should prioritize the adoption of hybrid deployment strategies that blend on-premises governance with public cloud agility. This approach safeguards sensitive workloads while enabling rapid scaling for variable analytics requirements. It is equally important to strengthen data governance frameworks and implement robust privacy controls to maintain stakeholder trust and comply with evolving regulatory mandates.

Furthermore, organizations are advised to cultivate advanced analytics talent, ensuring cross-functional teams can translate complex data sets into strategic insights. By forging alliances with specialized cloud partners and exploring joint innovation initiatives, companies can accelerate the development of domain-specific solutions. Simultaneously, proactive monitoring of supply chain and tariff developments will help to mitigate cost pressures and maintain continuity of service operations.

Detailing a Rigorous, Multi-Source Research Methodology Ensuring Data Integrity and Comprehensive Analysis of the Big Data as a Service Market

The research methodology underpinning this analysis integrates multiple data sources to deliver comprehensive insights. Secondary research comprised an extensive review of industry white papers, regulatory filings, and thought leadership publications to establish the foundational context. This phase was followed by primary engagements, including interviews with senior executives at enterprise adopters, solution providers, and industry experts to capture firsthand perspectives on evolving use cases and investment priorities.

Quantitative surveys were deployed to a representative cross-section of organizations across segments and regions, enabling statistical validation of adoption trends and satisfaction metrics. Data triangulation techniques were applied to synthesize findings, and a rigorous vendor evaluation framework assessed platform capabilities, deployment flexibility, and go-to-market strategies. Throughout the research process, stringent quality controls and peer reviews were conducted to ensure data integrity and analytical objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Big-Data-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Big-Data-as-a-Service Market, by Service Type

- Big-Data-as-a-Service Market, by Deployment Model

- Big-Data-as-a-Service Market, by Organization Size

- Big-Data-as-a-Service Market, by Industry Vertical

- Big-Data-as-a-Service Market, by Region

- Big-Data-as-a-Service Market, by Group

- Big-Data-as-a-Service Market, by Country

- United States Big-Data-as-a-Service Market

- China Big-Data-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings to Illuminate the Strategic Imperatives Guiding Future Investments in Big Data as a Service Initiatives

The core findings of this study illuminate a clear imperative: organizations that embrace a modern, cloud-native approach to big data will unlock significant competitive advantage. Transformative shifts in analytics architectures, coupled with the integration of AI and real-time data streams, have redefined the benchmarks for operational efficiency and customer engagement. The impact of 2025 tariff measures underscores the need for adaptive procurement strategies and diversified supply chains to maintain cost-effective access to essential infrastructure.

Segmentation insights reveal that while foundational compute and storage services remain critical, demand for sophisticated analytics applications is surging across industries and organization sizes. Regional dynamics further illustrate that localized cloud deployments and regulatory compliance considerations are key determinants of BDaaS adoption. Ultimately, the strategic postures adopted by leading providers and the actionable recommendations outlined herein offer a roadmap for enterprises to navigate this complex landscape and drive sustained growth.

Engage Directly with Ketan Rohom to Secure Your Access to Cutting-Edge Big Data as a Service Insights and Drive Immediate Organizational Impact

We invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions that align seamlessly with your organizational goals. By discussing your unique requirements, data infrastructures, and strategic priorities, you can secure access to the comprehensive Big Data as a Service market research report designed to inform your critical business decisions.

Connect with Ketan to gain firsthand guidance on how to leverage the latest insights, strategic frameworks, and actionable intelligence contained within the report. This personal interaction will empower your team to accelerate data-driven initiatives and capture immediate value from evolving market opportunities.

- How big is the Big-Data-as-a-Service Market?

- What is the Big-Data-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?