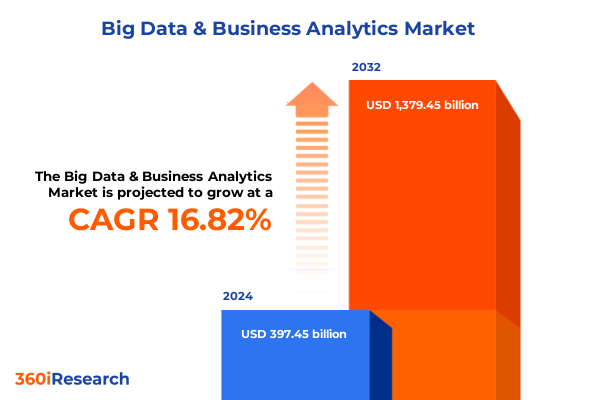

The Big Data & Business Analytics Market size was estimated at USD 460.16 billion in 2025 and expected to reach USD 532.76 billion in 2026, at a CAGR of 16.98% to reach USD 1,379.45 billion by 2032.

Exploring the critical role of data-driven decision-making in a rapidly evolving analytics landscape to empower strategic business growth

Data has become the linchpin of modern organizations, driving strategic decision-making and operational efficiency across industries. Organizations grapple with vast volumes of information generated from sensors, transaction systems, and digital interactions, necessitating comprehensive frameworks to ingest, process, and analyze data at unprecedented scale. In this context, an integrated approach to big data and business analytics emerges as an essential catalyst for competitive differentiation and sustained growth.

Recent advancements in streaming analytics and event processing now enable enterprises to ingest and analyze data in motion, transforming operational response times and allowing for proactive interventions. Leveraging these real-time capabilities, organizations can optimize supply chains by detecting logistical anomalies before they escalate, enhance predictive maintenance in high-value assets, and deliver personalized customer experiences at every touchpoint.

As businesses adopt machine learning, predictive modeling, and automated insight generation, there is an increasing focus on democratizing access to analytics through augmented tools that empower citizen data scientists. Natural language querying, low-code interfaces, and automated data preparation functionalities are breaking down traditional barriers, enabling business users to derive valuable insights with minimal reliance on centralized IT teams.

The following sections delve into the transformative shifts reshaping the analytics landscape, the implications of newly enacted trade policies, and the nuanced segmentation dynamics that define market behavior. By establishing this foundational understanding, readers will be prepared to explore regional trends, competitive landscapes, targeted recommendations, and the methodological rigor underpinning these findings.

Unveiling the seismic shifts in data analytics driven by AI integration, cloud scalability, and real-time insights reshaping competitive dynamics

The analytics landscape is undergoing seismic changes as emerging technologies redefine traditional paradigms. Artificial intelligence and machine learning are now embedded within core analytics platforms, enabling organizations to transition from descriptive insights toward prescriptive and autonomous decision-making. In tandem, the exponential growth of cloud computing has introduced unprecedented scalability, allowing enterprises to dynamically adjust their analytical workloads without incurring prohibitive infrastructure costs.

Moreover, the rise of edge computing has facilitated real-time data processing at the source, opening new possibilities for time-sensitive applications in manufacturing, healthcare, and logistics. This decentralization has fostered a shift from batch-oriented workflows to continuous intelligence, where actionable insights are generated on the fly. Concurrently, the advent of data fabric architectures has simplified data integration across disparate repositories, reducing friction and accelerating analysis cycles.

In addition to technological advances, governance and privacy regulations are playing an increasingly influential role in shaping analytics strategies. Organizations are adopting robust frameworks that balance data utility with compliance, leveraging techniques such as synthetic data and differential privacy to navigate complex legislative landscapes.

Additionally, the emergence of augmented analytics tools empowers business users and citizen data scientists to interact with data intuitively, leveraging natural language queries and automated insight generation without deep technical expertise. Together, these transformative shifts underscore the evolution of analytics from a support function into a strategic enabler of enterprise innovation.

Assessing the comprehensive repercussions of 2025 US tariffs on analytical operations, supply chain continuity, and cross-border data exchange strategies

The imposition of new tariffs by the United States in early 2025 has introduced a complex set of challenges for analytics operations that rely on cross-border data ecosystems and hardware imports. Analytics platforms often depend on high-performance servers, storage arrays, and networking equipment sourced from international suppliers. With tariffs applying to key components, organizations are experiencing increased capital expenditures and extended lead times for critical infrastructure deployments.

Beyond hardware, software licensing and professional services engagements have also been affected. Providers that export on-premises software solutions now face additional duties, prompting many enterprises to reconsider deployment models and favor cloud-based alternatives where duty impacts are less pronounced. However, cloud service providers themselves may pass through increased operational costs, leading to higher subscription fees over time.

In response to these pressures, businesses are recalibrating their supply chains, securing local partnerships and exploring nearshore managed services to mitigate tariff exposure. Strategic stockpiling of hardware and long-term service agreements are being negotiated to lock in pricing and ensure continuity. Ultimately, the tariffs are driving a reevaluation of analytics investments, with organizations prioritizing flexibility, cost predictability, and resilience in their data infrastructure strategies.

Concurrent digital services tax proposals and anticipated changes in data sovereignty policies are further complicating cross-border analytics strategies. Organizations are monitoring legislative developments closely to anticipate additional cost layers and to ensure compliance with evolving digital taxation frameworks.

Revealing nuanced market segmentation across components, deployment models, organizational scales, applications, industries, and data typologies

A fundamental dimension of market analysis involves the differentiation between services and software offerings. Within the services domain, managed services encompass both hosted and outsourced delivery models, while professional services span consulting, support, and system integration engagements. On the software side, organizations are leveraging analytics platforms to drive advanced modeling, deploying data management tools for optimized data governance, and employing visualization tools to translate complex datasets into intuitive, interactive dashboards. The interplay between these offerings underscores the importance of cohesive solutions that blend technical capabilities with expert guidance.

Examining deployment architectures reveals a bifurcation between cloud and on-premises models. Cloud deployments, whether hybrid, private, or public, are prized for their elastic scalability and rapid provisioning, whereas on-premises implementations, managed either internally or by external vendors, remain prevalent for entities with stringent data sovereignty requirements or specialized performance needs. This dichotomy highlights how compliance and latency considerations continue to influence infrastructure decisions across industries.

Organizational scale further defines analytics adoption patterns, as large enterprises invest in expansive, enterprise-grade solutions with extensive customization capabilities, while smaller organizations, including medium and small enterprises, favor streamlined offerings that balance affordability with essential functionality. These distinctions manifest in varied resource allocations, skill requirements, and integration complexities.

From an application standpoint, analytics use cases are equally diverse. Customer analytics initiatives, such as churn prediction, segmentation analysis, and lifetime value optimization, coexist alongside financial analytics, operational process monitoring, risk analytics, and supply chain performance enhancement projects. Industry-specific verticals including banking, capital markets, and insurance; healthcare and life sciences; information technology and telecommunications; manufacturing; and retail and e-commerce each impose unique requirements on these applications. Finally, the type of data-whether structured, semi-structured, or unstructured-governs the selection of storage architectures and analytical methodologies, reinforcing the need for adaptable platforms that can ingest and process heterogeneous data landscapes.

This comprehensive research report categorizes the Big Data & Business Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Data Type

- Deployment Model

- Organization Size

- Application

- Industry Vertical

Highlighting distinctive regional dynamics in the Americas, Europe Middle East and Africa, and Asia-Pacific driving localized analytics adoption

Regional dynamics are shaping the adoption and evolution of analytics in distinctive ways. In the Americas, robust investments in digital transformation are complemented by stringent data privacy regulations in key markets, driving organizations to implement comprehensive governance frameworks while harnessing cloud-native architectures for scalability. The competitive landscape here is characterized by a strong emphasis on customer-centric analytics and operational efficiency.

Moving to Europe, the Middle East, and Africa, collective regulatory environments such as the General Data Protection Regulation have established a high bar for data protection, influencing analytics strategies and cross-border data transfers. Meanwhile, markets in the Middle East and Africa are experiencing rapid cloud adoption as organizations seek to leapfrog legacy infrastructures, often partnering with global and regional service providers to accelerate deployment of advanced analytics use cases.

In the Asia-Pacific region, high-growth economies are fueling demand for edge analytics and real-time intelligence, particularly in manufacturing hubs and smart city initiatives. The diversity of maturity levels across APAC markets underscores the importance of flexible deployment options, with some organizations embracing public cloud at scale, while others favor private cloud or hybrid models to address specific regulatory or connectivity challenges.

Collectively, these regional nuances underscore the necessity for analytics strategies that are tailored to local market conditions while maintaining global interoperability and resilience.

This comprehensive research report examines key regions that drive the evolution of the Big Data & Business Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering competitive strategies of leading analytics and big data solution providers shaping innovation, strategic partnerships, and market positioning

Leading analytics and big data providers are differentiating themselves through a combination of technology innovation, strategic alliances, and targeted acquisitions. Cloud-native platforms are extending their capabilities with embedded artificial intelligence modules, enabling customers to deploy automated machine learning workflows without extensive coding expertise. Concurrently, established enterprise software vendors are deepening their cloud offerings and expanding professional services portfolios to encompass end-to-end implementation, integration, and managed support services.

Partnership ecosystems are increasingly pivotal, as providers join forces with specialized consulting firms and data engineering specialists to deliver verticalized solutions for industries like financial services and healthcare. These collaborations often yield tailored analytics accelerators and preconfigured data models that can significantly reduce time to value. Furthermore, acquisitions of niche technology startups are fueling the development of proprietary algorithms for use cases such as anomaly detection, graph analytics, and natural language processing.

As competitive pressures intensify, organizations are also heightening their focus on interoperability and open standards. Open source contributions and community-driven projects are gaining traction, enabling enterprises to avoid vendor lock-in and customize solutions to their unique requirements. This trend is reinforcing a shift toward modular architectures that support plug-and-play integration of disparate analytics components.

In addition to product and partnership strategies, leading vendors are prioritizing sustainability and responsible data practices in their roadmaps. By incorporating energy-efficient processing, green data center initiatives, and ethical AI frameworks, these companies are aligning analytics innovation with broader organizational commitments to social responsibility and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Big Data & Business Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Acuvate

- Adobe Inc.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Cloudera, Inc.

- Dell Technologies Inc.

- Elinext IT Solutions Ltd.

- Fair Isaac Corporation

- Fujitsu Limited

- Google LLC by Alphabet Inc.

- Hewlett Packard Enterprise Company

- Hitachi, Ltd.

- International Business Machines Corporation

- LTIMindtree Limited by Larsen & Toubro Ltd.

- Micro Focus International PLC by OpenText Corporation

- Microsoft Corporation

- MicroStrategy Incorporated

- Oracle Corporation

- Salesforce.com, Inc.

- SAP SE

- SAS Institute Inc.

- Snowflake Inc.

- Teradata Corporation

- ThoughtSpot Inc.

- VMware, Inc.

- Wipro Limited

Implementing targeted strategies and partnerships to accelerate analytics maturity, optimize cost structures, and strengthen resilient data ecosystems

Industry leaders seeking to capitalize on the evolving analytics landscape should begin by establishing a clear roadmap that aligns data initiatives with overarching business goals. Defining measurable objectives and success metrics ensures that investments in analytics technologies and services drive tangible returns. In parallel, organizations should cultivate strategic partnerships with cloud service providers and managed service firms to secure flexible infrastructure arrangements that can adapt to evolving tariff environments and regulatory demands.

A second priority involves strengthening data governance and security frameworks through the implementation of robust policies, role-based access controls, and privacy-enhancing techniques such as data anonymization and tokenization. This foundation not only supports compliance with global regulations but also instills confidence among stakeholders and customers regarding data integrity. Simultaneously, enterprises must invest in talent development, blending data science expertise with domain knowledge and establishing cross-functional teams to foster collaboration between business units and IT.

Furthermore, adopting hybrid and multi-cloud architectures can optimize cost structures while delivering high performance and resiliency. Organizations should conduct regular supply chain assessments to identify tariff exposure points and negotiate long-term procurement agreements, mitigating the impact of import duties on analytics hardware. Finally, embracing emerging technologies such as edge analytics, AI-driven automation, and self-service visualization platforms will position companies to stay ahead of market shifts and deliver real-time insights at scale.

Detailing rigorous primary and secondary research methods, data validation protocols, and triangulation techniques ensuring robust analytics insights

This study integrates a systematic blend of primary and secondary research to ensure comprehensive and accurate insights. Primary research efforts encompass in-depth interviews with industry executives, surveys of analytics practitioners, and consultations with domain experts across technology, finance, manufacturing, and retail sectors. These dialogues furnish qualitative perspectives on emerging trends, use case priorities, and implementation challenges.

Secondary research activities involve an extensive review of publicly available materials, including industry white papers, regulatory frameworks, technical journals, and corporate disclosures. This literature review is complemented by analysis of proprietary databases to validate company profiles, solution portfolios, and partnership ecosystems. Throughout the process, multiple data points are cross-verified to uphold consistency and reliability.

Quantitative data triangulation techniques are employed to reconcile divergent estimates, ensuring that insights reflect a balanced view of market realities. Additionally, the research team applies rigorous data validation protocols and employs a customized segmentation framework to categorize information by component, deployment model, organization size, application, industry vertical, and data type. This methodological rigor underpins the robustness and credibility of the report’s findings.

Finally, the research methodology incorporates iterative feedback loops with advisory boards comprising senior analytics leaders. This collaborative approach ensures that the analysis remains grounded in practical experience and that the final deliverables address the most pressing decision-making needs of stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Big Data & Business Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Big Data & Business Analytics Market, by Component

- Big Data & Business Analytics Market, by Data Type

- Big Data & Business Analytics Market, by Deployment Model

- Big Data & Business Analytics Market, by Organization Size

- Big Data & Business Analytics Market, by Application

- Big Data & Business Analytics Market, by Industry Vertical

- Big Data & Business Analytics Market, by Region

- Big Data & Business Analytics Market, by Group

- Big Data & Business Analytics Market, by Country

- United States Big Data & Business Analytics Market

- China Big Data & Business Analytics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesizing critical findings to chart the future of data analytics amidst evolving market forces and geopolitical considerations

The convergence of advanced analytics technologies, shifting regulatory landscapes, and evolving trade policies underscores the strategic imperative for organizations to adopt a holistic approach to data-driven transformation. The insights presented here illuminate the critical inflection points where investments in infrastructure, governance, and talent intersect to enable sustained competitive advantage.

By synthesizing key findings across technological, segmentation, and regional dimensions, decision-makers are equipped to chart a course that balances innovation with risk management. The nuanced understanding of service and software offerings, deployment preferences, and application use cases provides a roadmap for tailoring analytics strategies to specific organizational contexts.

Ultimately, the accelerating pace of change in the analytics ecosystem demands agility, foresight, and a commitment to continuous improvement. Stakeholders who embrace these principles will be well positioned to navigate emerging challenges, capitalize on new opportunities, and drive transformative business outcomes through data-driven excellence.

As enterprises look forward, fostering a culture of experimentation and cross-functional collaboration will be key to unlocking the full potential of analytics investments and sustaining a trajectory of inclusive growth.

Drive strategic advantage by partnering with Ketan Rohom to unlock premium insights and propel decision-making through specialized analytics research

Unlock deeper market intelligence and actionable analytics guidance by connecting with Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to explore tailored research deliverables that align with your organization’s strategic priorities and gain early access to exclusive insights designed to drive performance and resilience in today’s dynamic environment. Reach out today to secure your comprehensive analytics report and accelerate your path to data-driven decision-making.

- How big is the Big Data & Business Analytics Market?

- What is the Big Data & Business Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?