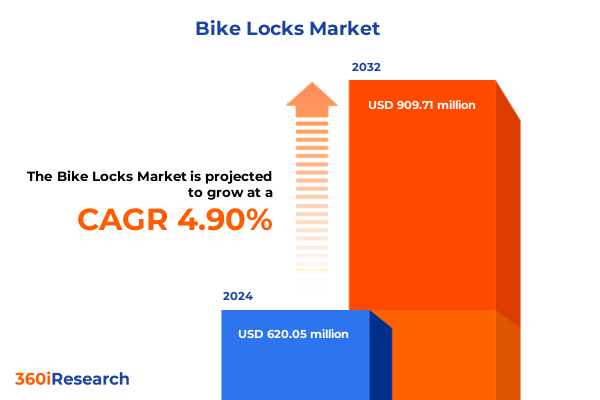

The Bike Locks Market size was estimated at USD 649.25 million in 2025 and expected to reach USD 680.16 million in 2026, at a CAGR of 4.93% to reach USD 909.71 million by 2032.

A concise orientation to the shifting bicycle security environment that frames theft dynamics, rider behavior, and supply-side pressures for strategic decision-making

The contemporary bicycle security landscape is witnessing a convergence of longstanding hardware conventions and rapid technological innovation against a backdrop of evolving criminal behavior, shifting consumer preferences, and intensifying trade-policy volatility. Rising urban cycling rates and the mainstreaming of electric bicycles have reframed lock selection from a simple tool of deterrence into a strategic asset for individual riders, fleet operators, and municipalities alike. In parallel, theft dynamics have become more organized and opportunistic, prompting purchasers to seek solutions that combine physical resilience with digital detection and recovery capabilities. This executive summary synthesizes the principal structural forces reshaping the industry so decision-makers can prioritize product, channel, and sourcing strategies with clarity.

As we begin, it is important to recognize a sharper urgency around theft prevention: independent registries and research partners documented a meaningful year-over-year increase in reported bicycle theft incidents, highlighting recovery challenges and the social costs of insecure cycles. This pressure point amplifies demand for robust security products that are practical to carry and simple to deploy, while also increasing the willingness of higher-value-bike owners to invest in premium and technology-enabled locks. Taken together, these drivers create both near-term operational stress for suppliers and a broader strategic opportunity for firms that can deliver demonstrable improvements in deterrence, detection, and post-theft recovery.

How convergence of mechanical resilience and embedded digital detection is redefining product expectations, channels, and competitive certification standards

Fundamental shifts are reframing what a bike lock must deliver: mechanical robustness is now routinely coupled with electronic awareness and recovery capability. Traditional paradigms that emphasized raw mass and shackle thickness are being supplemented - and sometimes supplanted - by integrated systems that combine high-strength materials with alarms, Bluetooth or cellular connectivity, and GPS-enabled tracking. This hybridization responds directly to two converging realities: criminals are employing more portable cutting tools and organized methods to remove bikes and components, and owners increasingly value real-time signals that aid rapid recovery.

Concurrent with product-level innovation, distribution is fragmenting. E-commerce and direct-to-consumer channels have accelerated the diffusion of specialty devices, while independent bike dealers retain a critical role for high-touch customers who demand installation, warranty support, and demonstrations. Original equipment manufacturers and fleet operators are also influencing upstream design choices by specifying integrated locks and mounting solutions as standard items on commuter and e-bike platforms. The result is a market where modular product architectures, digital service layers, and channel-specific packaging are decisive for adoption.

Finally, the competitive frontier is being redefined by testing protocols and visible certifications. Independent reviews and third-party security ratings have grown in influence, creating a higher bar for claims about angle-grinder resistance, shackle hardness, and alarm performance. Brands that pair independently verified security credentials with clear, user-focused narratives are gaining preferential consideration among risk-averse buyers, insurance partners, and large-scale fleet customers.

An assessment of how layered 2025 tariff actions and ongoing trade volatility are reshaping sourcing economics, procurement strategy, and product cost structures across the lock value chain

Policy and tariff decisions enacted during 2025 have materially changed the economics of steel- and aluminum-intensive segments of the bike lock supply chain and heightened sourcing risk for import-dependent manufacturers and distributors. A renewed application of Section 232 steel tariffs, coupled with new executive orders targeting imports from specific trading partners, produced layered duty exposures on chains, cables, and discrete steel components used in many high-security locks. These measures have translated into immediate cost pressure for products that rely on imported hardened steel linkages and forged components, with importers facing multiple stacked duties that are variable by country of origin and harmonized tariff code.

The practical implications are threefold. First, manufacturers and importers are confronting higher landed costs for chain- and cable-based products in particular, forcing re-evaluation of bill-of-materials choices and prompting accelerated conversations about domestic sourcing or geographic diversification of manufacturing. Second, distributors are witnessing margin compression on entry-level and mid-tier mechanical locks where price sensitivity is acute; channel partners may shift inventories toward premium, differentiated products that preserve per-unit margin. Third, policy volatility has increased working capital and inventory risks across the value chain, as firms balance the desire to hedge against tariff movements with the costs of carrying larger inventories.

Amid these disruptions, there are signs of pragmatic adaptation. Some suppliers are accelerating engineering work to substitute nonferrous or advanced composite components where feasible and to deepen supplier relationships in tariff-exempt jurisdictions. At the same time, short-term relief in the form of administrative extensions, temporary truce arrangements, or targeted exemptions has periodically reduced headline risk but not eliminated the fundamental incentive to redesign supply chains for resilience. These dynamics mean that procurement and pricing strategies must now be managed as core strategic levers rather than back-office functions.

Data-driven segmentation insights identifying product architectures, mechanisms, distribution pathways, and user needs that determine competitive positioning and R&D prioritization

Segmentation analysis reveals where product design choices and go-to-market tactics should concentrate to capture differentiated value. By lock type, the landscape spans Cable Lock variants such as Multi-Strand Braided Cable and Single Strand Cable, Chain configurations across Up To 8 Mm, 8 Mm To 12 Mm, and Above 12 Mm, Folding Lock formats including Compact Folding and Hinge Segment Steel, Frame Lock designs like the Ring Frame Lock, Integrated Lock approaches typified by Integrated Frame Lock, U-Lock options with Extra Thick Shackle, Shackle With Protective Coating and Standard Shackle, and Wheel And Disc Lock solutions; each sub-type aligns with unique trade-offs among portability, perceived deterrence, and manufacturability. Regarding locking mechanisms, the field extends from mechanical systems-Combination variants such as Multi Dial Combination and Single Dial Combination and Keyed Cylinder families including Disc Detainer, Pin Tumbler, and Tubular-to evolving smart architectures spanning Bluetooth, NFC, and Wi‑Fi-enabled Smart Keyless systems. Distribution channels include Direct Manufacturer Sales, E-Commerce platforms, Mass Retail And DIY outlets, Original Equipment Manufacturer partnerships, and Specialty Bike Retail, and each channel imposes distinct requirements for packaging, warranty, and point-of-sale education. End-user segmentation differentiates Commercial Fleet And Shared Mobility requirements from Commuter And Urban needs, E-Bike Owner expectations, Kids And Youth safety priorities, Mountain Biking performance constraints, and Road Cycling portability and weight preferences. Price tiering is stratified across Budget, Midrange, and Premium segments, driving variation in materials and lifetime-value assumptions. Materials choices encompass Alloy Steel, Braided Steel, Composite And Plastic Components, Hardened Steel, and Titanium And Specialty Alloys, while security classifications span High Security, Medium Security, and Low Security designations. Application contexts range from Commercial Fleet Security to Daily Commuting, Residential Storage, and Sport And Recreation, each demanding different mounting and durability features. Mounting system options include Bag And Accessory Mounted, Frame Mounted, Integrated Mount, and Portable solutions, and technology architectures subdivide into Electronic Only, Hybrid Mechanical-Electronic, and Mechanical Only approaches. Taken together, this segmentation map highlights where product architecture, certification focus, and channel packaging must be tailored: premium users and fleet customers prioritize hardened materials and integrated tracking; urban commuters and mid-tier buyers require lightweight, affordable options that are simple to use; and OEM channels increasingly prefer integrated frame-locking systems or mounts that ship as part of the bike specification.

This comprehensive research report categorizes the Bike Locks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Lock Type

- Material

- Technology

- Distribution Channel

- End-User

Region-specific dynamics that reconcile demand drivers, manufacturing footprints, and regulatory or tariff exposures to guide portfolio and channel stratification

Regional dynamics shape demand patterns, supply-side risk, and product feature priorities in distinctive ways across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, persistent urban theft pressure and rapid e-bike adoption create strong demand for high-security solutions that pair mechanical resistance with electronic recovery tools; supply-chain exposure to tariff actions and reliance on Asian manufacturing hubs are also more consequential here, leading many North American firms to accelerate supplier diversification and inventory hedging. In Europe, dense urban centers and regulatory frameworks that promote cycling infrastructure tend to favor compact, certified products and integrated systems that meet both commuter and insurance-driven requirements; European buyers are also responsive to sustainability messages and lighter-weight solutions for mixed-mode commuting. In the Middle East & Africa, heterogeneous infrastructure and rapidly modernizing urban centers present opportunities for robust, weather-tolerant hardware and simple-to-use locking mechanisms that require minimal digital dependencies. The Asia-Pacific region remains both a major manufacturing base and a fast-growing consumer market; local OEM partnerships and price-sensitive distribution channels coexist with pockets of high-end demand in major metropolitan areas where e-bike adoption and mobility-as-a-service initiatives are accelerating.

Across these regions, two shared patterns are evident: more sophisticated theft techniques are raising the minimum acceptable security standard for urban customers, and e-bike prevalence is pushing buyers toward higher-margin hybrid or high-security products. Policymakers and trade developments can amplify or mitigate these trends, so manufacturers that align regional product portfolios with tariff exposure, logistics realities, and local certification expectations will gain tangible competitive advantage.

This comprehensive research report examines key regions that drive the evolution of the Bike Locks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive mappings that explain how legacy mechanical expertise, materials innovation, and embedded tracking solutions determine procurement outcomes and product roadmaps

Competitive dynamics are shaped by a mix of legacy hardware specialists, rapid innovators in composite and materials science, and technology-driven entrants offering smart locking and recovery services. Established lock manufacturers continue to lead in demonstrable mechanical performance, with multiple products in independent testing programs achieving top-tier security ratings that influence fleet procurement and insurance underwriting. Simultaneously, challenger brands and niche specialists are differentiating with angle-grinder-resistant architectures, graphene- or composite-reinforced shields, and wearable or integrated form factors that improve day-to-day usability for commuters and e-bike riders. Technology-focused firms that embed GPS or cellular tracking - or partner with third-party tracker providers - are expanding value propositions by shifting the conversation from pure theft resistance to an integrated theft mitigation lifecycle that includes detection, notification, and recovery.

In practice, market-winning plays have combined rigorous third-party security validation with clear narratives around rider convenience and recovery assurance. Retail and distribution partners reward products that reduce support friction - for example, frame-mountable solutions or modular kits for different bike classes - and fleet customers give preference to vendor partners that can demonstrate scalable deployment, warranty handling, and service-level commitments. For incumbent manufacturers, strategic responses include selective licensing of technology modules, co-development with OEMs to ship locks as factory-fitted options, and targeted investment in materials and electronics engineering to sustain relevance against nimble challengers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bike Locks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Enterprises

- Allegion plc

- Allegion plc

- Alone Enterprises

- ASSA ABLOY AB

- Decathlon Sports India Private Limited

- Europa Locks Ltd

- Giant Manufacturing Co., Ltd.

- Gryphon Lock

- Henry Squire & Sons Ltd

- Kailash Works

- Kohlburg GmbH

- Link Locks Private Limited

- LITELOK CORP

- Magnum Locks

- Master Lock Company LLC

- Mitsico

- Naren International

- Otto Designs

- Plus 8 Industries Ltd

- Seatylock Ltd

- Stageline Security

- Strider Industries

- Universe Industries

- Via Velo Bike

A pragmatic set of strategic moves-spanning product modularity, supplier diversification, verified certification, and service innovation-that drive resilience and profitable growth

Leaders should treat the current moment as an inflection where product, sourcing, and service models need simultaneous modernization. First, prioritize modular product platforms that allow rapid swaps between purely mechanical offerings and hybrid electronic variants so retail, fleet, and OEM channels can be served from a single engineering foundation. Second, accelerate supply‑chain resilience by qualifying additional suppliers in tariff‑advantaged jurisdictions, negotiating long‑term commitments for critical hardened‑steel inputs, and exploring partnerships with domestic foundries when scale economics permit. Third, invest selectively in verified security testing and transparent certification communication - these assets drive purchasing decisions and reduce post-sale support friction.

Beyond product and procurement, adopt service-oriented monetization models that align manufacturer incentives with owner outcomes: warranty-linked insurance, subscription trackers with rapid-recovery concierge, and fleet-focused device management platforms. Complement these offerings with channel-specific packaging that simplifies purchase and installation at specialty retailers while preserving a premium direct-to-consumer experience. Finally, engage proactively with industry trade groups and policymakers to clarify tariff impacts on safety-critical products and explore carve-outs or phased implementation for components central to theft prevention. Firms that implement these measures will improve gross margins, reduce inventory risk, and strengthen brand trust among the highest-value buyer cohorts.

Transparent explanation of the mixed-method research approach that combines primary interviews, independent testing review, registry analysis, and tariff mapping to validate insights

This analysis synthesizes primary interviews with industry executives, structured reviews of independent product testing and certification outcomes, and a mapping of tariff and trade policy changes affecting relevant harmonized tariff schedules. Product and materials insights were validated through technical literature and third‑party testing reviews, while channel and end‑user observations were triangulated using industry association updates and registry-based theft reporting. The segmentation framework was developed by cross-referencing product specifications, locking-mechanism taxonomy, and distribution models to ensure each axis meaningfully differentiates buyer behavior and supplier economics.

Quantitative signals used to inform directional insights included registry-based theft incidence trends, independent media product testing, and documented tariff announcements. Qualitative inputs included interviews with OEM procurement teams, specialty retailers, and fleet operators to capture practical constraints and adoption decision rules. Wherever possible, claims about tariffs, testing, or theft dynamics are referenced to primary public sources and industry reporting so readers can follow the original material and reconcile local nuances. The intention is to provide a reproducible, transparent methodology for executives considering commercial, engineering, or policy responses to the structural shifts described above.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bike Locks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bike Locks Market, by Lock Type

- Bike Locks Market, by Material

- Bike Locks Market, by Technology

- Bike Locks Market, by Distribution Channel

- Bike Locks Market, by End-User

- Bike Locks Market, by Region

- Bike Locks Market, by Group

- Bike Locks Market, by Country

- United States Bike Locks Market

- China Bike Locks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concise synthesis of why integrated mechanical strength, digital recovery capabilities, and resilient sourcing determine winners in the evolving bicycle security landscape

The bike lock industry stands at a strategic crossroads where traditional mechanical prowess must be recombined with digital detection and resilient sourcing to address rising theft risk and trade-policy disruption. Buyers now expect products that not only resist attack but also enable rapid detection and recovery; organizations that deliver both will command stronger pricing power and channel advocacy. Tariff volatility and supply-chain exposure turn procurement strategy into a competitive lever, while regional demand patterns require finely tuned product portfolios that respect local certification expectations and infrastructure realities. In this environment, the most successful firms will be those that integrate engineering, supply-chain, and service innovations into coherent offerings that reduce customer friction and demonstrably raise the odds of theft prevention and recovery.

In closing, the industry must balance near-term operational adjustments with longer-term investments in modular architectures and service ecosystems. Doing so will protect customers’ goods, preserve brand reputation, and create durable commercial advantage as cycling-conventional and electric-continues to consolidate as a central pillar of urban mobility.

Secure your executive briefing and custom licensing package with our sales lead today for tailored access to the comprehensive bike lock market research suite

Engage directly with our sales lead to obtain the full market research report, tailored briefings, and licensing options that unlock precise competitive intelligence and go-to-market support. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to request a confidential executive briefing, custom data extracts, or a demonstration of our interactive market dashboards. Ketan can coordinate a purchasing pathway that aligns the research deliverables with procurement timelines, corporate compliance requirements, and any embargoed distribution needs. For procurement-ready documentation, sample chapter access, and enterprise licensing terms, ask Ketan for a formal proposal and a schedule for stakeholder workshops and implementation support.

- How big is the Bike Locks Market?

- What is the Bike Locks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?