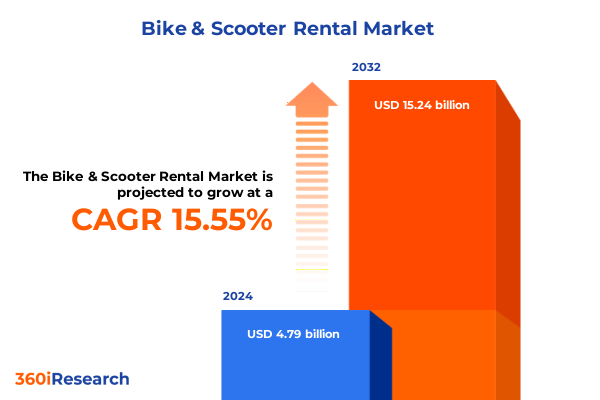

The Bike & Scooter Rental Market size was estimated at USD 5.53 billion in 2025 and expected to reach USD 6.29 billion in 2026, at a CAGR of 15.57% to reach USD 15.24 billion by 2032.

Unveiling the Evolution and Value Proposition of Bike and Scooter Rentals in Today's Fast-Moving Urban Mobility Ecosystem

Shared micro-mobility solutions have evolved from novel city-center experiments into essential components of modern transportation ecosystems. Once dominated by dock-based bike-sharing schemes, the bike and scooter rental industry now spans a diverse array of digital platforms, electric vehicles, and integrated mobility services. Urban planners and private operators alike recognize that these services can reduce congestion, complement public transit, and deliver flexible, on-demand options for commuters and leisure users. Companies are investing heavily in app development and battery-management systems, while municipalities collaborate through pilot programs to calibrate regulations that balance safety with growth. Concurrently, consumer preferences are shifting toward greener, more personalized travel choices; riders now expect seamless digital experiences complemented by vehicles that cater to both short trips and longer journeys. This introduction sets the stage for a deep dive into the forces reshaping micro-mobility, positioning bike and scooter rental service providers as pivotal players in urban resilience and sustainable development.

How Technological Innovation and Consumer Behavior Are Catalyzing Transformative Shifts in Last-Mile Mobility and Shared Transportation

A surge of technological advancements and changing lifestyles has propelled bike and scooter rentals into a period of rapid transformation. Real-time telematics and IoT sensors now enable dynamic fleet management, improving vehicle utilization rates and maintenance scheduling. Artificial intelligence algorithms predict demand hotspots and preposition assets, creating more reliable availability precisely when and where riders need them. Meanwhile, mobile apps integrate seamlessly with transit-oriented journeys, offering unified payment systems that bridge buses, trains, and micro-mobility modes. Beyond technology, the rise of contactless payments and health-focused commuting has reinforced consumer appetite for these services. Pandemic-driven behavioral shifts accelerated trial among demographics previously hesitant to adopt shared mobility, and loyalty programs have since cemented lasting usage habits. As cities embrace smart infrastructure investments and regulatory sandboxes proliferate, the stage is set for micro-mobility to transition from an experimental convenience to a core element of the urban transportation tapestry.

Examining the Multifaceted Impact of 2025 United States Tariff Policies on the Supply Chain Dynamics of Two-Wheel Mobility Rental Operations

In 2025, the United States introduced a series of tariff adjustments targeting imported folding bikes, electric scooters, and related components, a continuation of broader trade policy aimed at bolstering domestic manufacturing. The immediate effect has been an uptick in landed costs for fleets dependent on overseas production, prompting operators to reexamine procurement strategies and contract terms. Some providers have accelerated partnerships with local assemblers to mitigate exposure, while others are negotiating long-term supply agreements to secure price stability. These tariff shifts have also spurred investment in domestic R&D, with start-ups focusing on modular designs that adapt to evolving rate schedules. At the same time, the regulatory landscape has incentivized repatriation of certain manufacturing processes, from battery module fabrication to frame welding. Although end-users have thus far experienced minimal fare increases due to competitive pressures, operators are mindful that sustained tariffs may reshape fleet compositions and alter vehicle lifecycles. As the policy environment continues to evolve, successful service providers will be those that navigate these headwinds through supply chain diversification and close collaboration with policymakers.

Unlocking Strategic Perspectives Through Comprehensive Segmentation Insights Across Usage, Vehicle, Booking, Pricing, and End User Dimensions

A nuanced understanding of customer needs emerges when examining usage patterns delineated by rental durations, product typologies, booking modalities, pricing schemes, and end-user segments. Short-term trips, whether hourly or daily, cater to spontaneous travelers seeking quick, flexible mobility solutions for errands or leisure outings. Conversely, long-term arrangements-spanning monthly to yearly commitments-appeal to habitual commuters desiring cost predictability and reduced operational friction. Within product categories, demand is bifurcated between conventional bicycles and electric variants, the latter gaining traction among riders prioritizing effortless ascents and longer range, while kick scooters and their electric counterparts address the need for ultra-compact last-mile connectivity. Offline booking channels, though still relevant for corporate programs and campus integrations, are ceding ground to online platforms valued for instant availability and digital wallets. Pricing models split between pay-per-use convenience and subscription plans that foster user loyalty; each approach carries implications for revenue stability and customer lifetime value. Moreover, different end-user groups-from daily commuters to leisure tourists-express distinct preferences, with business travelers seeking hassle-free trips and students gravitating to budget-friendly hourly rentals. Recognizing these multifaceted segmentation vectors enables operators to tailor service propositions, optimize fleet makeup, and design marketing campaigns that resonate with targeted cohorts.

This comprehensive research report categorizes the Bike & Scooter Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Rental Duration

- Product Type

- Booking Mode

- Pricing Model

- End User

Gaining a Panoramic View of Regional Variations and Growth Drivers Across Americas, Europe Middle East Africa, and Asia Pacific Territories

Regional dynamics in the bike and scooter rental market reflect diverse urban fabrics and regulatory environments across the globe. In the Americas, dense city centers in North America have laid fertile ground for robust micro-mobility ecosystems, supported by substantial venture capital and progressive municipal partnerships. Latin American metropolises, meanwhile, present high growth potential amid increasing traffic congestion and rising consumer interest in affordable shared options, though adoption curves vary significantly between countries. Across Europe, the Middle East, and Africa, established multimodal networks provide a supportive backdrop for integrated ride-share solutions, with southern European cities leading in bike-friendly infrastructure and northern capitals experimenting with subsidy programs for e-scooter pilots. In contrast, Middle Eastern initiatives often emphasize futuristic smart-city frameworks, while African urban areas are beginning to leverage micro-mobility as a complement to congested minibuses and informal transit. Asia-Pacific exhibits a mosaic of maturity levels: high-density East Asian markets combine advanced digital ecosystems with stringent safety regulations, Southeast Asian hubs witness surging demand fueled by smartphone penetration, and Oceanic cities deploy micro-mobility to reduce carbon footprints. Understanding these regional nuances is critical for service providers plotting targeted expansions, forging governmental collaborations, and adapting operational models to local preferences and regulatory mandates.

This comprehensive research report examines key regions that drive the evolution of the Bike & Scooter Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape with Key Player Strategies Collaborations and Differentiation Tactics in Micro Mobility Rental Services

The competitive arena is populated by global pioneers, national challengers, and localized disruptors, each leveraging distinctive strategies to capture rider loyalty and market share. Leading multinational operators differentiate through extensive fleet footprints, proprietary telematics platforms, and strategic alliances with transit agencies that embed micro-mobility into broader travel networks. National and regional players often compete on agile deployment and community engagement, rapidly iterating service offerings to match local topographies and regulatory requirements. Innovative entrants are introducing peer-to-peer rental schemes and subscription bundles that incorporate corporate mobility programs, while some have ventured into vertical integration by manufacturing in-house vehicles optimized for rental durability and low maintenance. In addition, partnerships with automotive manufacturers and energy providers signal a growing convergence of micro-mobility with broader mobility-as-a-service ecosystems. To thrive amid intensifying rivalry, companies must harness data analytics for precise fleet sizing, differentiate through value-added services such as guided route planning or loyalty rewards, and build resilient supply chains capable of responding to evolving tariff structures and component shortages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bike & Scooter Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bikxie Services Private Limited

- Bird Rides, Inc.

- Boongg.com Private Limited

- Bounce

- Exa Mobility Private Limited

- Gearz Vehicle Rentals Private Limited

- Manscooter Rental Service

- Metrobikes

- Neutron Holdings, Inc.

- ONN Bikes

- Rent Me Ride Private Limited

- RentoMojo

- Rentrip Services Private Limited

- Royal Brothers

- Snapbikes Private Limited

- Sukuto Bike Rental Private Limited

- Ve Go Bike Private Limited

- Vogo Automotive Private Limited

- Wheelstreet

- Wickedride Adventure Services Private Limited

Formulating Actionable Recommendations to Enhance Operational Efficiency Regulatory Engagement and Customer Experience for Industry Stakeholders

Industry leaders can enhance operational excellence by investing in predictive maintenance systems that minimize downtime and optimize vehicle lifespans. Engaging proactively with regulators through data-driven safety reports and pilot programs will reinforce social license to operate and unlock opportunities for infrastructure co-development. Embracing a hybrid pricing approach that blends subscription tiers with dynamic per-use rates enables flexibility to match diverse rider budgets and usage patterns. Cultivating partnerships with public transit operators and corporate mobility offices will integrate bike and scooter rental as a recognized component of first- and last-mile journeys. From a technological standpoint, operators should prioritize open APIs to enable third-party integrations and foster broader ecosystem synergies. Marketing efforts tailored to specific end users-such as bespoke commuter bundles or tourist sightseeing passes-will drive adoption while preserving margins. Finally, companies should navigate tariff complexities through scenario planning and supplier diversification, positioning themselves to absorb short-term cost fluctuations without passing excessive fees onto riders.

Outlining Rigorous Research Methodology Incorporating Primary Interviews Secondary Sources and Statistical Validation for Informed Decision Making

This analysis draws on a multi-tiered research framework combining primary and secondary methodologies. Primary insights were gathered through in-depth interviews with executives at leading micro-mobility operators, municipal planners, and component manufacturers, supplemented by surveys of end-users across key urban markets. Secondary research leveraged industry journals, regulatory filings, and academic studies on urban mobility trends, safety standards, and consumer behavior. Fleet telematics data provided quantitative inputs into utilization rates, downtime metrics, and maintenance intervals, while tariff schedules and international trade reports informed our assessment of supply chain impacts. Data validation employed triangulation across sources to ensure consistency and reliability. Statistical techniques, including cluster analysis for segmentation profiling and regression analysis to identify demand drivers, underpinned our strategic insights. This rigorous approach ensures that findings reflect real-world market dynamics and offer actionable intelligence for decision-makers seeking to deepen their understanding of the global bike and scooter rental arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bike & Scooter Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bike & Scooter Rental Market, by Rental Duration

- Bike & Scooter Rental Market, by Product Type

- Bike & Scooter Rental Market, by Booking Mode

- Bike & Scooter Rental Market, by Pricing Model

- Bike & Scooter Rental Market, by End User

- Bike & Scooter Rental Market, by Region

- Bike & Scooter Rental Market, by Group

- Bike & Scooter Rental Market, by Country

- United States Bike & Scooter Rental Market

- China Bike & Scooter Rental Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings to Cement a Holistic Understanding and Strategic Foresight of the Bike and Scooter Rental Ecosystem

The bike and scooter rental sector stands at the intersection of urban innovation, consumer empowerment, and regulatory evolution. Across this report, we have examined how technology and infrastructure investments coalesce to create seamless rider experiences, how tariff policies redefine supply chain imperatives, and how nuanced segmentation analysis reveals tailored opportunities for different user cohorts. Regional insights underscore the importance of adapting strategies to local regulatory frameworks and consumer preferences, while competitive analysis highlights the vital role of differentiation through digital capabilities and strategic alliances. By synthesizing these elements, industry stakeholders are equipped with a holistic perspective on emerging challenges and untapped potential. As micro-mobility continues its trajectory toward mainstream transportation status, providers that leverage data-driven decision-making, foster collaborative partnerships, and remain agile in the face of policy shifts will secure lasting leadership.

Take the Next Step With Expert Guidance From Associate Director Ketan Rohom to Secure Comprehensive Insights and Propel Your Mobility Strategies

As you consider the depth and breadth of insights contained within this report, remember that expert guidance can transform data into decisive action. By partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, you gain privileged access to tailored briefings, customized data visualizations, and strategic advisory sessions designed to align this research with your unique objectives. Whether you seek to refine your service portfolio, optimize supply chain resilience in light of evolving tariffs, or pioneer new offerings for specific end users, Ketan will work with you to translate intelligence into implementation. Don’t wait to embed these findings into your strategic roadmap-reach out today to secure your copy of the full bike and scooter rental market research report and accelerate your journey toward market leadership.

- How big is the Bike & Scooter Rental Market?

- What is the Bike & Scooter Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?