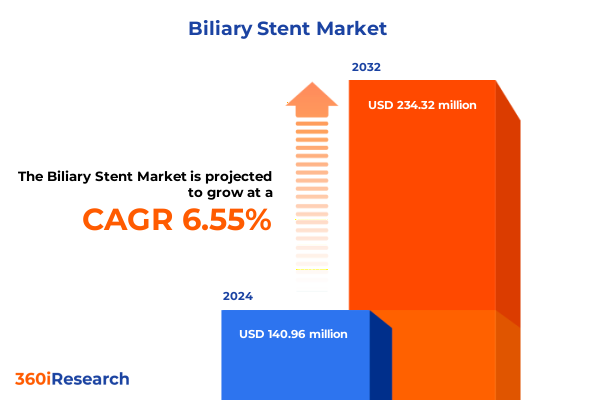

The Biliary Stent Market size was estimated at USD 148.43 million in 2025 and expected to reach USD 157.71 million in 2026, at a CAGR of 6.73% to reach USD 234.32 million by 2032.

Setting the Stage for Innovation in Biliary Drainage Therapeutics Amidst Growing Prevalence and Evolving Clinical Practices

Biliary stents have emerged as indispensable medical devices for maintaining biliary tract patency in patients facing obstructive conditions of the hepatobiliary system. The introduction of these stents has fundamentally transformed the management of biliary obstruction by enabling minimally invasive approaches that not only alleviate jaundice and related symptoms but also reduce hospital stays and post-procedure complications. Over the past decade, clinicians have recognized the pivotal role of stent design and material composition in determining long-term outcomes, prompting manufacturers to prioritize innovation in product development. Simultaneously, the growing burden of gallstone disease, cholangiocarcinoma, and pancreatic cancer has intensified demand for advanced biliary drainage solutions, compelling industry stakeholders to refine procedural techniques and explore novel stent architectures.

Navigating Paradigm Altering Advances in Biliary Stent Technology Shaping Patient Outcomes and Shifting the Standard of Care in Hepatobiliary Medicine

In recent years, the landscape of biliary stenting has experienced a profound transformation driven by technological breakthroughs and evolving clinical paradigms. Self-expanding metal stents incorporating nitinol alloys have gained prominence for their superior radial force, conformability, and extended patency relative to traditional plastic counterparts. Moreover, the advent of drug-eluting stents coated with anti-proliferative agents has introduced a new frontier in restenosis prevention, heralding a shift toward combination therapies that integrate mechanical support with pharmacological control of tissue hyperplasia. Alongside these material innovations, refinements in endoscopic imaging-such as digital single-operator cholangioscopy-have enhanced procedural precision, enabling real-time visualization of bile duct pathology and facilitating targeted stent placement.

Assessing the Far Reaching Consequences of 2025 United States Tariff Policies on Biliary Stent Imports Supply Chains and Domestic Manufacturing Competitiveness

The implementation of new United States tariff policies in 2025 has exerted a significant influence on the global supply chain for biliary stents, particularly given the concentration of manufacturing facilities in regions with established medical device production clusters. As import duties on key components and finished devices rose, market participants encountered upward pressure on landed costs, prompting procurement teams to revisit sourcing strategies and long-term contractual commitments. In response, several device makers accelerated efforts to qualify domestic subcontractors and to establish joint ventures within the United States, thereby reducing exposure to tariff-driven cost volatility and enhancing supply chain resilience. Meanwhile, healthcare providers have sought to mitigate budgetary impacts by negotiating value-based purchasing agreements that tie reimbursement to clinical outcomes of stent procedures.

Uncovering Critical Segment Dynamics Across Stent Materials Indications Procedures End Users and Distribution Channels Driving Market Differentiation

A granular examination of market segmentation reveals the nuanced dynamics shaping competitive positioning and product adoption. When considering product type, the landscape bifurcates between metal stent and plastic stent categories; the former further divides into covered metal stent and uncovered metal stent variants. Among covered options, fully covered metal stents aim to minimize tissue ingrowth while partially covered designs strike a balance between migration risk and embedding in the ductal mucosa. In contrast, uncovered metal stents span balloon expanding metal stent and self expanding metal stent subtypes, each optimized for procedural ease and radial strength. Transitioning to clinical indication, market participants must account for divergent requirements in benign obstruction versus malignant obstruction settings, as device selection criteria encompass factors such as expected patient survival, risk of tumor ingrowth, and ease of removal.

This comprehensive research report categorizes the Biliary Stent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Procedure Type

- End User

- Distribution Channel

Examining Regional Market Dynamics in the Americas Europe Middle East Africa and Asia Pacific Revealing Growth Drivers and Adoption Patterns

Geographically, the market for biliary stents manifests distinct trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, advanced endoscopy centers have driven early adoption of novel stent designs, supported by consolidated reimbursement frameworks that recognize the cost efficiencies of minimally invasive interventions. Conversely, in Europe, Middle East & Africa, heterogeneous regulatory pathways and varying levels of healthcare infrastructure result in a patchwork of adoption rates, with leading metropolitan areas embracing self expanding metal stents while rural facilities often rely on conventional plastic options. Meanwhile, Asia-Pacific markets exhibit rapid growth underpinned by substantial investments in healthcare modernization, rising incidence of hepatobiliary malignancies, and expanding networks of ambulatory surgical centers.

This comprehensive research report examines key regions that drive the evolution of the Biliary Stent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Pioneering Product Innovation Strategic Partnerships and Competitive Differentiation in the Global Biliary Stent Market

The competitive landscape is defined by key companies that have cemented their positions through targeted investments in research and development, strategic alliances, and global distribution networks. Leading multinational medical device manufacturers continue to introduce iterative improvements in stent coatings, delivery systems, and conformable polymer composites. Several emerging technology firms have carved out niches with proprietary biodegradable stent platforms designed to eliminate removal procedures, while midsize players focus on cost-effective solutions for ambulatory surgical centers and specialty clinics. Partnerships between endoscopy device makers and pharmaceutical corporations have further blurred traditional boundaries, as combination products leverage drug elution to address restenosis and biofilm formation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biliary Stent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical LLC

- Leufen Medical GmbH

- Medtronic plc

- Merit Medical Systems, Inc.

- Nipro Corporation

- Olympus Corporation

- Taewoong Medical Co., Ltd.

Strategic Imperatives for Industry Leadership to Capitalize on Emerging Trends Mitigate Regulatory Risks and Drive Sustainable Growth in Biliary Care Solutions

To thrive in this evolving environment, industry leaders must adopt a multi-pronged strategy centered on product innovation, supply chain diversification, and stakeholder engagement. Prioritizing the development of next-generation stent architectures-such as bioresorbable polymers and integrated sensor technologies-will be critical in differentiating portfolios and meeting the demand for personalized therapeutic solutions. Simultaneously, forging agreements with regional manufacturing partners can mitigate tariff exposure and strengthen logistical agility. Engaging payers and regulatory bodies early in the product lifecycle, particularly to demonstrate real-world clinical value and long-term cost benefits, can facilitate favorable reimbursement pathways. Finally, fostering collaborative clinical studies with leading academic centers will generate the robust outcomes data necessary to support adoption in both benign and malignant indications.

Demystifying the Rigorous Research Methodology Employed to Ensure Comprehensive Data Collection Analysis and Unbiased Insights in Biliary Stent Intelligence

The insights presented herein derive from a comprehensive research methodology that integrates secondary research, expert interviews, and rigorous data validation. Secondary sources encompassed peer-reviewed clinical journals, regulatory filings, and publicly available procedural registries to establish a foundational understanding of device performance benchmarks and clinical best practices. Complementing this, in-depth interviews with key opinion leaders-including interventional gastroenterologists, hepatobiliary surgeons, and procurement specialists-provided qualitative context on adoption barriers and emerging clinical preferences. All findings underwent systematic triangulation and quality checks to ensure consistency and minimize bias, with final synthesis structured around the core segmentation framework of product type, clinical indication, procedural approach, end user, and distribution channel.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biliary Stent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biliary Stent Market, by Product Type

- Biliary Stent Market, by Indication

- Biliary Stent Market, by Procedure Type

- Biliary Stent Market, by End User

- Biliary Stent Market, by Distribution Channel

- Biliary Stent Market, by Region

- Biliary Stent Market, by Group

- Biliary Stent Market, by Country

- United States Biliary Stent Market

- China Biliary Stent Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Strategic Conclusions from Market Trends Technological Innovations and Regulatory Developments to Guide Future Decision Making in Biliary Stent Applications

In conclusion, the biliary stent landscape stands at the intersection of material science breakthroughs, regulatory evolution, and shifting economic imperatives. Technological advances-from self-expanding nitinol alloys to drug-eluting and biodegradable platforms-have redefined procedural efficacy and patient quality of life. Concurrently, tariff adjustments and supply chain recalibrations underscore the importance of resilient sourcing strategies. Regional markets display varied adoption curves shaped by infrastructure maturity and reimbursement models, while a diverse competitive arena rewards both incumbent scale and disruptive innovation. Moving forward, stakeholders who embrace integrated product development, strategic partnerships, and data-driven value propositions will be best positioned to navigate the complex trajectory of biliary drainage solutions.

Connect with Ketan Rohom to Unlock Actionable Insights Secure Your Comprehensive Biliary Stent Market Report and Empower Data Driven Strategic Decisions

Unlock actionable insights and empower your team’s strategic decision making by securing your comprehensive market intelligence report on biliary stents. Our team, led by Associate Director of Sales & Marketing Ketan Rohom, stands ready to guide you through the depths of data and analysis that underpin tomorrow’s innovations. By engaging directly with our experts, you’ll gain privileged access to in-depth findings, granular segmentation insights, and regional analyses tailored to your organization’s objectives. Reach out to Ketan Rohom today to discuss how this indispensable resource can be customized to support your strategic initiatives, mitigate market uncertainties, and illuminate new pathways for growth within the dynamic biliary stent landscape

- How big is the Biliary Stent Market?

- What is the Biliary Stent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?