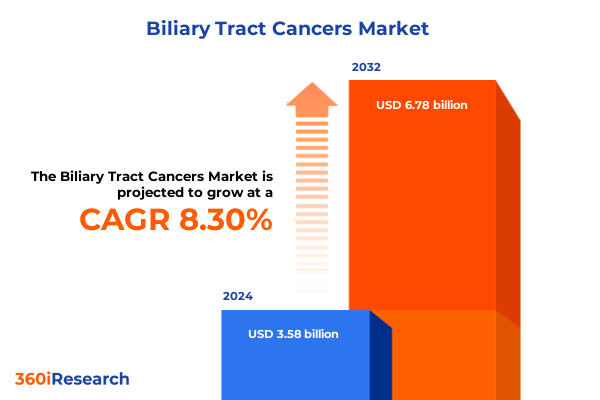

The Biliary Tract Cancers Market size was estimated at USD 3.65 billion in 2025 and expected to reach USD 4.03 billion in 2026, at a CAGR of 9.78% to reach USD 7.03 billion by 2032.

Setting the Stage for Breakthrough Solutions in Biliary Tract Cancer Management Amidst Evolving Clinical and Research Landscapes

In recent years, biliary tract cancers have emerged as a significant global health concern, marked by a substantial disease burden and persistent unmet need. In 2021, the Global Burden of Disease study reported 216,768 new cases and 171,961 deaths attributable to gallbladder and biliary tract cancers, corresponding to age-standardized incidence and mortality rates of 2.6 and 2.0 per 100,000, respectively, underscoring the aggressive nature of these malignancies and their disproportionate impact in high-income Asia-Pacific and Latin American regions where infrastructure and early detection strategies remain limited. Despite modest declines in age-standardized rates over the past three decades, low and middle-SDI countries continue to experience rising burdens, highlighting enduring disparities in risk factor mitigation, healthcare access, and treatment availability.

The clinical management of biliary tract cancers is challenged by late-stage diagnosis, complex anatomical heterogeneity, and historically limited therapeutic options. With conventional chemotherapy yielding median survival under 12 months in advanced disease, the imperative for novel modalities has driven an expansion in translational research, molecular profiling initiatives, and collaborative consortia aimed at identifying actionable targets and optimizing patient selection. As risk factors such as high body-mass index and chronic liver disease persist globally, the epidemiologic profile of these cancers underscores the urgency for both precision interventions and public health measures to arrest momentum in incidence and mortality trends.

Against this backdrop of mounting clinical need and evolving etiologic insights, stakeholders across academia, industry, and healthcare systems are coalescing to accelerate innovation. The convergence of genomic medicine, immuno-oncology, and advanced surgical techniques has begun to redefine treatment paradigms, while regulatory agencies are responding with expedited pathways and orphan drug designations. Building upon this momentum, the following sections delve into the transformative forces, market dynamics, and strategic imperatives shaping the future of biliary tract cancer care.

Unprecedented Advances in Novel Immunotherapies Targeted Agents and Diagnostic Technologies Are Reshaping the Future of Biliary Tract Cancer Care Worldwide

Over the last three years, the therapeutic landscape for biliary tract cancers has undergone a striking transformation driven by breakthroughs in immunotherapy, targeted agents, and precision diagnostics. The TOPAZ-1 trial marked a watershed moment when the addition of the PD-L1 inhibitor durvalumab to the gemcitabine-cisplatin backbone demonstrated a statistically significant 20% reduction in risk of death and extended progression-free survival, establishing immunotherapy as a new cornerstone in first-line treatment of advanced disease. Subsequent follow-up confirmed durable three-year survival benefits and a manageable safety profile, reinforcing the critical role of checkpoint inhibition in reshaping outcomes for patients with unresectable or metastatic biliary tract cancer.

Concurrently, the advent of precision oncology has spawned the first targeted options tailored to molecular aberrations in cholangiocarcinoma. Incyte’s pemigatinib gained accelerated approval as the first FGFR2 inhibitor for patients with previously treated, FGFR2-rearranged cholangiocarcinoma, achieving a 36% overall response rate and a median duration of response of 9.1 months in the pivotal FIGHT-202 study. Taiho Oncology’s futibatinib followed suit, securing accelerated approval based on a 42% objective response rate in FGFR2-positive intrahepatic disease, underscoring the potential of irreversible FGFR inhibition in refractory settings.

Diagnostic innovation has kept pace with therapeutic advances, as next-generation sequencing panels and liquid biopsy platforms enable comprehensive molecular profiling at diagnosis and during disease progression. These technologies facilitate identification of actionable fusions, mutations, and immune biomarkers, guiding enrollment in biomarker-driven trials and informing real-world application of novel regimens. As multidisciplinary teams adopt integrated diagnostic workflows, the alignment of targeted treatments with underlying tumor biology is poised to elevate response rates, extend survival, and catalyze further investment in translational research.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Regime on Pharmaceutical Supply Chains and Treatment Access

The introduction of comprehensive 2025 tariffs in the United States has imposed significant headwinds on pharmaceutical supply chains, with cumulative duties of 20–25% on active pharmaceutical ingredients (APIs) sourced from China and India, 15% on sterile packaging and laboratory equipment, and 25% on key manufacturing machinery, in addition to a blanket 10% global tariff on imported goods. These levies have driven immediate inflationary pressures on drug production costs, compelling biopharmaceutical companies to reassess sourcing strategies and inventory management to mitigate exposure.

Beyond direct cost increases, the tariffs have disrupted downstream manufacturing timelines and prompted reconsideration of long-standing supplier relationships. Generic drug makers, heavily reliant on Chinese APIs for approximately 40% of U.S. generic volume, face the prospect of elevated input costs translating into higher prices for essential therapies, potentially exacerbating patient access challenges while straining on-global production partnerships. Similarly, tariffs on packaging materials and equipment have lengthened regulatory timelines and complicated logistics for temperature-sensitive biologics seeking U.S. market entry.

In response to these pressures, companies are accelerating reshoring initiatives and forging public-private partnerships to expand domestic API and drug product manufacturing capabilities. While onshoring promises long-term supply chain resilience, industry experts caution that rebuild of specialized infrastructure may require years of investment and regulatory approvals. In the interim, strategic diversification of vendor networks across tariff-exempt markets, coupled with active engagement in tariff exemption petitions, will be critical to preserving continuity of care and safeguarding affordability in the evolving trade environment.

Illuminating Critical Market Segments Across Cancer Types Treatments End-User Channels and Distribution Pathways in Biliary Tract Cancer

The biliary tract cancer market exhibits multifaceted segmentation that informs competitive positioning and development strategies. When evaluated by cancer type, the landscape is primarily divided between cholangiocarcinoma, which encompasses intrahepatic and extrahepatic presentations, and gallbladder cancer, each with distinct molecular profiles and clinical outcomes. Therapeutic modalities further segment the market, as conventional chemotherapy remains a backbone for first-line regimens, while expanding roles for immunotherapy, radiation therapy, surgical interventions, and precision-targeted agents create differentiated value propositions for specialized subpopulations.

End-user channels likewise reflect diverse stakeholder needs. Leading academic institutions drive early-phase research and protocol development, while dedicated cancer research institutes specialize in molecular and translational investigations. Hospitals and clinics represent the primary delivery points for standard-of-care treatments and emerging regimens, requiring seamless coordination across multidisciplinary teams and infrastructure to support complex infusion protocols and biomarker testing. Distribution networks are equally dynamic, encompassing traditional offline channels for hospital procurement alongside burgeoning online platforms that streamline access to specialty pharmaceuticals and companion diagnostics, thus enabling patient-centric service models and telehealth integration.

Understanding the interplay of these segmentation dimensions is essential for tailoring clinical trial design, optimizing go-to-market strategies, and aligning stakeholder incentives. By mapping therapeutic investments against end-user preferences and distribution efficiencies, emerging and established players can prioritize resource allocation, accelerate market entry, and enhance patient access across the continuum of biliary tract cancer care.

This comprehensive research report categorizes the Biliary Tract Cancers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cancer Type

- Treatment Type

- End-User

- Distribution Channel

Divergent Regional Dynamics Highlight Growth Opportunities and Challenges Across Americas EMEA and Asia-Pacific Biliary Tract Cancer Markets

Regional heterogeneity in incidence, infrastructure, and regulatory environments shapes the outlook for biliary tract cancer across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust R&D ecosystems and established reimbursement frameworks support rapid uptake of novel immunotherapies and targeted agents; collaborative networks among U.S. academic centers and leading cancer institutes have accelerated translational studies and patient enrollment in registrational trials. Meanwhile, Latin American countries grapple with resource constraints that necessitate innovative public-private partnerships to expand molecular testing and address disparities in treatment access.

The Europe, Middle East & Africa region presents a complex mosaic of regulatory pathways and healthcare funding mechanisms. The European Medicines Agency’s centralized review process streamlines approval for breakthrough therapies, yet national health technology assessments and budget impact analyses govern reimbursements, influencing uptake. In Middle Eastern and African markets, emerging oncology infrastructures are complemented by government initiatives focused on building diagnostic capabilities and local manufacturing, although variable regulatory maturity and distribution challenges persist.

Asia-Pacific stands out for its dual dynamics of high incidence and rapidly evolving healthcare markets. Countries such as Japan and South Korea have pioneered early detection programs and invested in precision medicine consortia, while China’s biotech sector continues to scale through domestic innovation and global partnerships. Across Southeast Asia and Australia, increasing clinical trial participation and expanding payer coverage for targeted therapies reflect growing commitment to combat biliary tract malignancies, even as access inequities remain a concern in less developed territories.

This comprehensive research report examines key regions that drive the evolution of the Biliary Tract Cancers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Biopharmaceutical Innovators Driving Transformational Progress in Biliary Tract Cancer through Strategic Collaborations and Pipeline Development

Several leading biopharmaceutical companies are at the forefront of driving change in biliary tract cancer through strategic collaborations, robust pipelines, and regulatory milestones. AstraZeneca’s partnership between immuno-oncology and chemotherapy, exemplified by the durvalumab plus gemcitabine-cisplatin combination, has established a new standard of care in first-line advanced disease and underscored the value of checkpoint inhibitors in this historically refractory indication. The company’s global clinical program continues to explore synergistic combinations with novel agents and biomarker-driven cohorts.

Incyte Corporation’s accelerated approval of pemigatinib marked the first targeted therapy for FGFR2-rearranged cholangiocarcinoma, setting a precedent for molecularly guided interventions and companion diagnostic utilization. Taiho Oncology’s futibatinib approval further validated FGFR inhibition as a viable strategy, with Phase 2 data demonstrating a 42% overall response rate and median duration of response nearing 10 months, driving confidence in irreversible kinase blockade.

Emerging players such as Agios Pharmaceuticals and Zymeworks are expanding the horizon with IDH1 inhibitors and bispecific antibodies, respectively, targeting distinct molecular subsets and tumor microenvironment vulnerabilities. These efforts are bolstered by collaborations with regulatory authorities to expedite development under breakthrough and orphan drug designations, ensuring that innovative treatments reach patients with speed and efficiency. Across the competitive landscape, partnerships with academic consortia and contract research organizations are fostering translational studies and real-world evidence generation, cementing a collaborative ethos in the pursuit of enhanced patient outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biliary Tract Cancers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agios Pharmaceuticals, Inc.

- Amgen Inc.

- AstraZeneca PLC

- Basilea Pharmaceutica AG

- BeiGene, Ltd.

- Bristol-Myers Squibb Company

- Delcath Systems, Inc.

- Eisai Co., Ltd.

- Eli Lilly and Company

- Exelixis, Inc.

- F. Hoffmann-La Roche Ltd

- Incyte Corporation

- LES LABORATOIRES SERVIER

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- TAIHO PHARMACEUTICAL CO., LTD.

- TransThera Sciences (Nanjing), Inc.

- Zymeworks Inc.

Actionable Strategies for Industry Leaders to Enhance Resilience Innovation and Patient Outcomes in the Biliary Tract Cancer Ecosystem

Industry leaders must proactively adapt to the evolving biliary tract cancer ecosystem by implementing strategies that balance innovation with resilience. First, diversifying supply chains to include multiple API and manufacturing vendors across tariff-exempt geographies will help mitigate the exposure to trade disruptions, while onshoring key production capabilities can reinforce long-term security. Simultaneously, forging partnerships with government agencies and academic institutions can accelerate the development of domestic infrastructure under public-private investment models.

To leverage therapeutic advances, biopharmaceutical companies should invest in scalable molecular testing platforms and liquid biopsy workflows, ensuring that patients undergo comprehensive profiling at diagnosis and during disease progression. Collaborative frameworks with payers and health technology assessment bodies can facilitate access by demonstrating the clinical and economic value of biomarker-driven therapies. Aligning clinical trial design with real-world practice settings will enhance generalizability and support evidence generation for differentiated regimens.

Finally, stakeholder engagement through patient advocacy groups and digital health initiatives can strengthen the continuum of care, improve treatment adherence, and facilitate early detection programs. By integrating telemedicine, remote monitoring, and outcome tracking, industry leaders can drive patient-centric innovation and sustain momentum in capturing the full therapeutic potential of emerging modalities.

Methodological Rigor and Multidisciplinary Approaches Underpinning Comprehensive Biliary Tract Cancer Market Research and Analysis

This research leverages a comprehensive, mixed-methodology approach to ensure rigor and relevance. Secondary data were collated from authoritative sources, including peer-reviewed clinical trial publications, regulatory agency approvals, trade and tariff databases, and global disease burden studies, to form a solid quantitative foundation. Primary insights were obtained through interviews with oncologists, supply chain experts, and patient advocacy representatives, providing qualitative context on market dynamics and clinical priorities.

Subsequently, market triangulation methods were applied to cross-validate findings across multiple data streams, encompassing epidemiology, treatment utilization trends, regulatory landscapes, and competitive intelligence. Validation workshops with key opinion leaders and industry veterans were conducted to refine assumptions, assess emerging signals, and ensure alignment with real-world practice. All data collection and analysis adhered to strict confidentiality protocols and data integrity standards, with outcomes synthesized into actionable recommendations tailored to stakeholder needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biliary Tract Cancers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biliary Tract Cancers Market, by Cancer Type

- Biliary Tract Cancers Market, by Treatment Type

- Biliary Tract Cancers Market, by End-User

- Biliary Tract Cancers Market, by Distribution Channel

- Biliary Tract Cancers Market, by Region

- Biliary Tract Cancers Market, by Group

- Biliary Tract Cancers Market, by Country

- United States Biliary Tract Cancers Market

- China Biliary Tract Cancers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Consolidating Insights and Charting a Path Forward for Next-Generation Biliary Tract Cancer Solutions and Collaborative Endeavors

Biliary tract cancers stand at the cusp of a new era defined by precision medicine, immuno-oncology integration, and supply chain innovation. The convergence of durable immunotherapeutic regimens, molecularly targeted agents for FGFR2 and IDH1 alterations, and sophisticated diagnostic platforms has begun to shift the prognosis for patient subgroups historically underserved by standard chemotherapy. Concurrently, trade policy dynamics have underscored the strategic importance of resilient manufacturing and diversified sourcing strategies to ensure continuous access to life-saving therapies.

Market segmentation across cancer type, treatment modality, end-user adoption, and distribution channels provides a granular view of unmet needs and growth opportunities. Regional analyses highlight the interdependence of incidence trends, regulatory maturity, and healthcare infrastructure in shaping access and expansion strategies. Leading biopharma entities demonstrate the power of strategic alliances, expedited regulatory pathways, and robust clinical pipelines in bringing novel therapies to market.

By synthesizing these insights, stakeholders can chart a path toward enhanced patient outcomes through collaborative innovation, evidence-based policymaking, and targeted investment. As the landscape continues to evolve, agility, foresight, and a commitment to patient-centered care will be paramount for realizing the full potential of next-generation biliary tract cancer solutions.

Engage with Ketan Rohom to Unlock Comprehensive Intelligence and Strategic Guidance for Biliary Tract Cancer Market Opportunities

Are you seeking tailored insights, expert support, and strategic intelligence to navigate the complexities of the biliary tract cancer market? Ketan Rohom, Associate Director of Sales & Marketing, can guide you through the latest findings and customized analyses to meet your organization’s needs. Reach out to Ketan Rohom to explore how this comprehensive report can inform your decision making, identify growth opportunities, and position your team for success in this dynamic landscape.

- How big is the Biliary Tract Cancers Market?

- What is the Biliary Tract Cancers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?