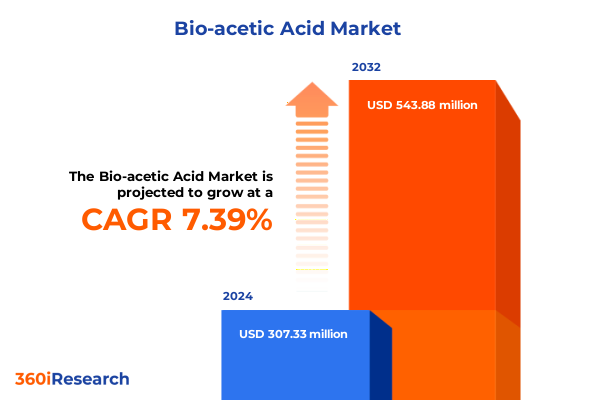

The Bio-acetic Acid Market size was estimated at USD 328.44 million in 2025 and expected to reach USD 351.47 million in 2026, at a CAGR of 7.47% to reach USD 543.88 million by 2032.

Unveiling the Bio-acetic Revolution Driving Tomorrow’s Industry Innovations Through Sustainable Acetic Acid Production That Redefines Global Supply Chains

The journey of bio-acetic acid from niche innovation to a cornerstone of modern industry reflects a broader transformation toward sustainable chemistry. As organizations worldwide strive to decouple growth from fossil resources, bio-acetic acid has emerged as an exemplary building block derived from renewable biomass. This shift not only leverages agricultural and lignocellulosic feedstocks but also aligns with corporate commitments to carbon neutrality and circular economy principles.

Stakeholders across research, manufacturing, and end-user sectors are increasingly recognizing the strategic advantages of bio-acetic acid beyond its historical role in vinegar production and chemical synthesis. Rapid advances in bioconversion and fermentation technologies have enhanced process efficiencies and reduced environmental footprints, establishing bio-acetic acid as a competitive alternative to its petrochemical counterpart. In parallel, regulatory frameworks and consumer preferences are exerting pressure on conventional supply chains, compelling enterprises to explore biobased pathways that promise both performance and ecological integrity.

In this dynamic context, decision-makers must grasp the critical drivers shaping supply, demand, and value creation. By understanding emerging technological innovations, evolving policy landscapes, and shifting market priorities, industry leaders can position themselves to seize new growth avenues, foster resilience against volatility, and engineer sustainable product portfolios that resonate with tomorrow’s market imperatives.

Decoding the Paradigm Shifts Reshaping Bio-based Acetic Acid Market Dynamics Amid Technological Breakthroughs and Sustainability Pressures

Recent years have witnessed a convergence of technological breakthroughs and sustainability mandates that have upended traditional acetic acid production paradigms. Innovations in genetic engineering and process intensification now enable customized microbial strains to convert a diverse array of feedstocks-ranging from agricultural residues to sugar-rich crops-into acetic acid with unprecedented yield and purity. These scientific strides have accelerated the transition toward decentralized production models, reducing reliance on large-scale petrochemical complexes and lowering logistical burdens.

Concurrently, corporate and regulatory commitment to greenhouse gas reduction has elevated lifecycle assessment and carbon accounting to boardroom priorities. Companies are increasingly implementing internal carbon pricing mechanisms and supplier scorecards, compelling chemical and consumer goods manufacturers to source feedstocks and intermediates that demonstrate verifiable emission reductions. This paradigm shift has elevated bio-acetic acid from a sustainable alternative to a strategic imperative for brands seeking to differentiate on environmental performance.

Moreover, collaborations between biotechnology start-ups and established chemical producers have created an ecosystem that balances agility and scale, enabling rapid commercialization of novel bio-based pathways. These partnerships, coupled with government incentives such as low-interest green loans and tax credits for renewable chemical production, are reshaping investment flows and risk profiles. As a result, the bio-acetic acid landscape is evolving at an accelerating pace, with transformative impact on value chains and competitive positioning.

Assessing the Cumulative Effects of 2025 United States Tariffs on Bio-acetic Acid Supply Chains and Market Accessibility

In 2025, the United States implemented a revised tariff framework on imported bio-acetic acid, designed to safeguard domestic capacity and stimulate local investment. While protective measures can catalyze growth within home markets, they also introduce complexity for global supply chains that historically relied on cost-effective imports. These tariffs have created a dual effect: they offer domestic producers a more predictable pricing environment while compelling downstream consumers to reassess sourcing strategies.

End users in sectors such as food and beverage, pharmaceuticals, and polymers experienced immediate cost adjustments as import duties were applied at the border. In response, procurement teams have accelerated qualification of alternative suppliers and evaluated in-house fermentation capabilities. Some multinational players have shifted a portion of their purchasing to allied nations under preferential trade agreements, while others have fast-tracked capacity expansions in U.S. facilities to mitigate exposure to tariff volatility.

Beyond short-term supply reallocations, the tariff regime has spurred renewed collaboration among feedstock suppliers, technology licensors, and energy providers to achieve cost efficiencies. By fostering integration between agricultural cooperatives and bioprocessing units, stakeholders aim to streamline logistics, optimize feedstock availability, and secure feedstock prices-insulating the industry from future policy fluctuations. Ultimately, the 2025 tariff adjustments have underscored the necessity of agile supply chain design and reinforced the strategic value of domestic production for national competitiveness.

Unraveling Core Segmentation Insights to Illuminate Feedstock, Production Processes, Product Grades, and End-user Verticals Impacting Bio-acetic Evolution

The bio-acetic acid landscape can be illuminated by examining fundamental segmentation dimensions that reveal distinct market characteristics and strategic opportunities. When exploring feedstock type, recent research has scrutinized how biogas, corn, lignocellulosic biomass, and sugar cane each contribute unique advantages and constraints. Biogas-based routes offer continuous feed availability and integration with anaerobic digestion facilities, while corn-derived processes benefit from established agricultural infrastructure and feedstock liquidity. Alternatively, lignocellulosic biomass presents the promise of utilizing non-food residues, addressing land-use concerns, and enhancing circularity. Sugar cane remains a compelling option in regions with favorable agroclimatic conditions and established sugar industries.

Production process segmentation highlights the dichotomy between bioconversion and fermentation pathways. Bioconversion technologies, often reliant on engineered enzymes or microbial consortia, excel in high-throughput continuous operations that minimize downstream separation challenges. Fermentation processes, in contrast, leverage time-tested microbial systems capable of converting carbohydrates into acetic acid under anaerobic conditions. Both approaches are advancing through improved catalysts, process control systems, and integration with waste-heat recovery units to enhance energy efficiency.

Grade differentiation underscores the tailored demands across food grade, industrial grade, and medical grade applications. The food industry seeks acetic acid that meets stringent purity and sensory standards, whereas industrial applications may tolerate broader impurity profiles in exchange for cost advantages. Medical grade acetic acid commands the highest level of pharmaceutical-grade compliance, necessitating clean-room production environments and exhaustive quality testing.

End-user profiling further refines market perspectives. Agricultural applications harness bio-based acetic acid as a component in biopesticides and soil conditioners; chemical synthesis segments utilize it as a key intermediate for esters and solvents; food and beverage manufacturers exploit its tang and preserving qualities; pharmaceutical and cosmetics producers integrate acetic acid in formulation pipelines; and polymer and plastics producers valorize it as a monomer precursor for bio-based polyvinyl acetate and cellulose acetate products. Understanding these interwoven segmentation dimensions enables stakeholders to align technology investments, supply strategies, and product development roadmaps with evolving market expectations.

This comprehensive research report categorizes the Bio-acetic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock Type

- Production Process

- Grade

- End-User

Navigating Regional Variations to Uncover Strategic Opportunities in the Americas, Europe Middle East Africa, and Asia-Pacific Bio-acetic Markets

Regional dynamics play a pivotal role in shaping the trajectory of bio-acetic acid adoption and investment strategies. In the Americas, mature agricultural infrastructure, combined with robust R&D ecosystems, has fostered a surge in pilot-scale demonstration plants and integrated biorefineries. The prevalence of corn subsidies and green chemistry incentives in North America has incentivized producers to scale fermentation-based operations, while in South America, sugar cane agri-clusters have explored conversion pathways that optimize both sugar and acetic acid co-production.

Europe, the Middle East, and Africa exhibit diverse market drivers. European policy frameworks, such as the European Green Deal and carbon border adjustment mechanisms, have elevated bio-acetic acid to a strategic priority for reducing dependence on fossil feedstocks. Collaborative funding schemes and public-private partnerships have seeded multi-faceted innovation hubs, accelerating enzyme engineering and process intensification. Meanwhile, Middle Eastern economies are validating pilot projects that integrate bio-acetic production with solar energy assets, leveraging abundant land and renewable power to decarbonize chemical processes. In Africa, emerging ventures are harnessing agricultural residues for low-cost feedstock sourcing, demonstrating scalable pathways for rural job creation.

Asia-Pacific continues to emerge as a dynamic growth axis, driven by both government-led clean chemical mandates and surging consumer demand for natural ingredients. China’s strategic roadmap for bio-economy expansion has catalyzed capacity expansions in fermentation and bioconversion platforms, supported by low-interest green financing and land allocation for bio-refinery parks. Southeast Asian nations, with their sugarcane and palm oil byproducts, are forging consortia aimed at valorizing waste streams into value-added chemicals, positioning the region as an influential player in the global bio-acetic acid arena.

This comprehensive research report examines key regions that drive the evolution of the Bio-acetic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Pioneers and Powerhouses Steering the Bio-acetic Acid Industry Through Innovation, Sustainability, and Strategic Collaborations

A handful of pioneering companies stand at the forefront of bio-acetic acid commercialization, combining deep chemical expertise with biotechnological innovation. Global chemical leaders have leveraged their extensive process engineering capabilities and distribution networks to pilot bio-based production lines, securing off-take agreements with leading consumer goods and pharmaceutical firms. Biotechnology specialists, from agile start-ups to medium-sized enterprises, have brought forth proprietary microbial strains and tailored enzyme platforms designed to maximize yield and minimize energy input.

Partnerships between venture-backed innovators and established chemical conglomerates have accelerated scale-up timelines, blending nimble R&D agility with capital-intensive manufacturing prowess. Collaborative ventures have also extended into feedstock supply chains, enabling agricultural cooperatives to co-invest in processing facilities and guarantee long-term offtake, thereby stabilizing raw material prices and enhancing regional economic development.

In parallel, technology licensors and engineering contractors have expanded their portfolios to include turnkey biorefinery solutions, offering integrated design and automation services that lower entry barriers for new market entrants. These strategic alliances underscore a shared objective: to build resilient, end-to-end value chains that can adapt swiftly to policy shifts, sustainability benchmarks, and evolving consumer preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-acetic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AFYREN SAS

- Aurochemicals

- Bio-Corn Products EPZ Ltd.

- Biosimo Chemicals

- Celanese Corporation

- EZ-Gro Inc.

- GJ Chemical

- Godavari Biorifineries Limited

- Jubilant Ingrevia Limited

- Lenzing AG

- Maha Automations

- Merck KGaA

- Sekab Biofuels & Chemicals AB

- Spectrum Laboratory Products, Inc

- Sucroal S.A.

- Super Bio Tech Marketing Company

- Symrise AG

- Vigon International, LLC

Implementing Data-driven Strategies for Industry Leaders to Accelerate Bio-acetic Adoption, Enhance Competitiveness, and Drive Sustainable Growth

Industry leaders seeking to accelerate bio-acetic acid adoption must prioritize data-driven decision frameworks that integrate sustainability metrics, cost analysis, and risk assessments. Establishing cross-functional teams that bridge procurement, R&D, and sustainability divisions will enable organizations to holistically evaluate feedstock selection, process pathways, and end-product positioning. Scenario planning exercises can help anticipate regulatory changes-such as future carbon pricing or waste-valorization mandates-enabling proactive supply chain adjustments and capital deployment.

Engagement with upstream partners, including agricultural associations and waste management firms, will be critical to secure feedstock security and foster co-development opportunities. By formalizing long-term contracts or equity partnerships, organizations can mitigate raw material price volatility and ensure consistent quality parameters. Similarly, collaboration with technology licensors for licensing or joint development agreements can accelerate access to cutting-edge bioconversion or fermentation platforms without necessitating full in-house R&D investment.

Lastly, embedding sustainability criteria into product marketing strategies will resonate with environmentally conscious end users and differentiate offerings in crowded markets. Transparent lifecycle disclosures, coupled with third-party certifications, bolster brand credibility and facilitate premium pricing. By weaving action plans around these strategic pillars, industry leaders can not only navigate immediate tariff and supply chain challenges but also secure enduring competitive advantage in a rapidly evolving bio-acetic acid landscape.

Unfolding a Comprehensive Research Methodology Blending Primary and Secondary Data to Ensure Reliability, Accuracy, and Market Relevance

This research undertook a structured approach combining primary and secondary methodologies to deliver a comprehensive understanding of the bio-acetic acid market. A rigorous review of technical literature, patent filings, and regulatory publications provided foundational insights into feedstock properties, process innovations, and policy frameworks. Industry association reports and academic white papers were cross-verified to ensure data integrity and contextual relevance.

To complement desk research, in-depth interviews were conducted with senior executives, process engineers, and R&D leaders across feedstock suppliers, biotechnology firms, and end-user organizations. These qualitative discussions shed light on real-world operational constraints, investment drivers, and technology adoption timelines. Insights gleaned from these conversations were triangulated with publicly disclosed project announcements and financial statements to validate strategic trends.

Throughout the study, a stringent data-validation protocol was upheld, including peer review by subject matter experts and consistency checks against multiple independent sources. This multi-layered methodology ensures that the findings not only reflect the current state of technology and policy but also anticipate emerging developments, thereby equipping decision-makers with robust, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-acetic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-acetic Acid Market, by Feedstock Type

- Bio-acetic Acid Market, by Production Process

- Bio-acetic Acid Market, by Grade

- Bio-acetic Acid Market, by End-User

- Bio-acetic Acid Market, by Region

- Bio-acetic Acid Market, by Group

- Bio-acetic Acid Market, by Country

- United States Bio-acetic Acid Market

- China Bio-acetic Acid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Insights Emphasizing the Critical Role of Bio-acetic Acid for Future Industry Resilience and Sustainable Progress Across Key Sectors

The collective landscape of bio-acetic acid underscores a transformative juncture for sustainable chemistry, where technological ingenuity and environmental stewardship converge. The interplay of advanced bioconversion techniques, diversified feedstock strategies, and evolving regulatory imperatives has established bio-acetic acid as a keystone in the transition toward low-carbon industrial ecosystems. Regional variances offer tailored pathways-each presenting unique advantages and challenges, from North America’s fermentation scale-up to the Asia-Pacific’s agro-residue valorization.

Crucially, the 2025 tariff adjustments in the United States have reinforced the indispensable value of agile supply chain design and domestic production capabilities. Simultaneously, segmentation insights highlight the multifaceted applications across food, pharmaceutical, chemical synthesis, and materials sectors, revealing expansive avenues for product differentiation and value creation.

As leading companies and innovators deepen collaborations, the market trajectory points toward integrated biorefinery models, strategic feedstock alliances, and sustainability-anchored product portfolios. These developments signal robust potential for bio-acetic acid to not only displace petrochemical incumbents but also to serve as a blueprint for the wider bio-economy. Ultimately, stakeholders who align strategic investments with this evolving paradigm will fortify their competitive positioning and contribute to a more resilient, circular industrial future.

Take the Next Step Toward Strategic Mastery of Bio-acetic Acid Markets and Connect with Ketan Rohom to Elevate Your Business Decisions Today

Elevate your strategic perspective on the global bio-acetic acid market by reaching out directly to Ketan Rohom, the Associate Director of Sales & Marketing, who can provide tailored insights, pricing options, and customized consultation to ensure your organization captures emerging opportunities. Engaging with an expert of his caliber will enable you to align your product portfolios with evolving sustainability mandates, navigate tariff complexities effectively, and unlock collaborative ventures designed to accelerate your time-to-market. Don’t let the competitive landscape outpace your ambitions-connect with Ketan today to explore how this comprehensive market research report can serve as a catalyst for your next phase of growth and operational excellence

- How big is the Bio-acetic Acid Market?

- What is the Bio-acetic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?