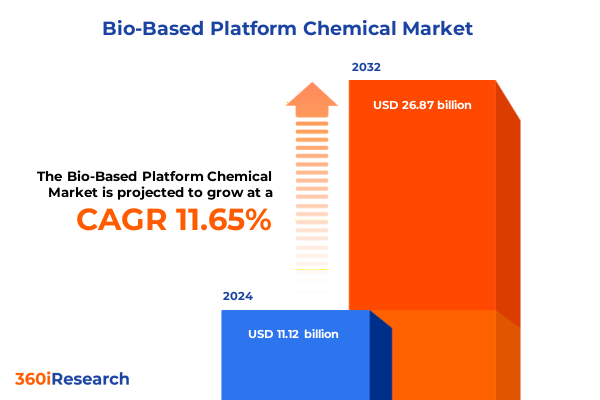

The Bio-Based Platform Chemical Market size was estimated at USD 12.23 billion in 2025 and expected to reach USD 13.45 billion in 2026, at a CAGR of 11.89% to reach USD 26.87 billion by 2032.

Unveiling the Rise of Sustainable Bio-Based Platform Chemicals Driving Innovation and Offering Resilient Solutions Across Multiple End-Use Industries

The shift toward bio-based platform chemicals represents a pivotal moment in the transition to sustainable industrial practices. As global stakeholders grapple with the challenges of carbon footprint reduction, resource scarcity, and volatile petrochemical prices, bio-derived alternatives are gaining unprecedented traction. These precursors serve as versatile building blocks for a wide array of downstream products, enabling manufacturers to meet stringent environmental objectives without compromising performance standards.

An intricate network of technological innovations, policy incentives, and evolving consumer preferences underpins the momentum driving this sector. Breakthroughs in enzymatic catalysis and fermentation processes have significantly enhanced the yield and cost-competitiveness of products such as acrylic acid, bio-based ethylene, and bio-based propylene. Simultaneously, stricter regulations aimed at curbing greenhouse gas emissions and plastic waste are reinforcing the imperative for circular economy solutions.

Against this backdrop, industry participants-from established chemical majors to nimble biotechnology start-ups-are forging strategic collaborations to scale up production capacities and accelerate commercialization pathways. This executive summary provides a high-level overview of the transformative dynamics at play, equipping decision-makers with the context needed to navigate a market defined by rapid innovation, complex regulatory environments, and shifting global trade patterns.

Charting the Evolution of Production Pathways and Regulatory Landscapes Shaping the Future of Bio-Based Chemicals Industry Dynamics Globally

The landscape of bio-based platform chemicals is undergoing a profound evolution, driven by advances across production methodologies and a more favorable regulatory environment. Traditional chemical catalysis routes have been progressively augmented by biocatalysis techniques, where enzymes fine‐tune reaction specificity, minimize byproduct generation, and lower energy consumption. In parallel, integrated biorefinery concepts are emerging, leveraging lignocellulosic residues and glycerol streams to produce platform chemicals with improved feedstock economics.

Furthermore, policy frameworks across major economies are converging around incentives that bolster sustainable manufacturing. Subsidies for green hydrogen and carbon capture, combined with tax credits for renewable feedstock utilization, are reducing the total cost of ownership for bio‐derived monomers. This convergence is catalyzing investment in fermentation-based production plants, where robust microbial strains transform sugars and vegetable oil derivatives into key chemicals at scale.

Meanwhile, market dynamics have been reshaped by heightened investor focus on Environmental, Social, and Governance criteria. Companies that can demonstrate verifiable life-cycle emission reductions and circularity credentials are securing premium partnerships and long-term offtake agreements. Taken together, these transformative shifts are not only expanding the commercial viability of bio-based platform chemicals, but also setting new benchmarks for performance, transparency, and resilience in the chemicals sector.

Evaluating the Comprehensive Economic and Supply Chain Implications of New United States Tariffs on Bio-Based Platform Chemicals in 2025

In 2025, the introduction of new United States tariffs on select bio-based platform chemicals has generated a complex set of economic ripple effects across supply chains. Import duties applied to certain intermediate monomers have led global producers to reassess sourcing strategies, spurring a trend toward on-shore production and back-integrated operations. While localized facilities incur higher capital expenditures, they gain insulation from cross-border tariff volatility and enjoy proximity to key end-use markets.

These measures have also shifted competitive dynamics among regions. Suppliers in the Americas are now more aggressively investing in capacity expansions to capture displaced volumes from overseas producers facing higher landed costs. At the same time, customers in the food & beverage, pharmaceuticals, and coatings segments are entering into longer-term contracts to lock in stable pricing and guarantee supply security. Notwithstanding short-term disruptions in feedstock logistics and shipping schedules, the net effect has been to accelerate innovation in process intensification and waste valorization to offset margin pressures.

Moreover, the tariffs have underscored the importance of flexible feedstock sourcing strategies. End users are diversifying their input portfolios to include lignocellulosic biomass and waste glycerol streams, thereby mitigating exposure to single-feedstock price swings. This adaptive response highlights the sector’s resilience and its capacity to evolve in the face of shifting trade policy landscapes.

Delving into Diverse Market Dimensions Revealing Application, Industry, Feedstock, Product Type, and Process Technology Segmentation Trends

A nuanced understanding of market segmentation reveals distinct value propositions across five core dimensions. In terms of application, the exterior coatings and interior components of automotive manufacturing demand high-performance polymers that can deliver durability and aesthetic appeal, while construction projects prioritize materials with enhanced thermal insulation and reduced environmental impact. In packaging, both flexible films for pouches and rigid containers require bio-derived monomers that offer barrier properties and recyclability, whereas personal care formulations and textile finishes benefit from specialty acrylates and propylene derivatives tailored for skin compatibility and dye affinity.

Shifting to end-use industries, agriculture leverages bio-based ethylene derivatives for controlled-release agrochemicals, while cosmetic brands are integrating platform chemicals into bio-based emollients and biodegradable polymeric beads. The food & beverage sector utilizes modified acrylic acids in processing aids and preservative matrices, and paints & coatings manufacturers adopt propylene-derived resins to enhance gloss and adhesion. Pharmaceutical producers, for their part, exploit bio-based butadiene intermediates in active pharmaceutical ingredient synthesis, underscoring the versatility of these platform chemicals.

Feedstock origins further delineate market threads: refined glycerol, lignocellulosic biomass, fermentable sugars, and vegetable oils each confer unique cost and sustainability profiles. For instance, glycerol co-products from biodiesel supply chains can be valorized through fermentation routes, whereas cellulosic residues offer a non-food competing pathway. From a product lens, acrylic acid stands out for its wide utility in superabsorbents and coatings, while bio-based butadiene, ethylene, and propylene are pivotal for elastomers and high-performance plastics. Finally, the choice of process technology-whether chemical catalysis, enzymatic catalysis, or fermentation-shapes operating metrics, carbon intensity, and capital requirements, illustrating that no single approach dominates across every market segment.

This comprehensive research report categorizes the Bio-Based Platform Chemical market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Feedstock

- Process Technology

- Application

- End Use Industry

Analyzing Regional Demand Drivers and Growth Potential Across Americas, EMEA, and Asia-Pacific in the Bio-Based Platform Chemicals Sector

Regional demand profiles exhibit marked divergence in buyer preferences, infrastructure maturity, and regulatory incentives. In the Americas, a combination of abundant agricultural feedstocks and supportive state-level mandates has galvanized the scale‐up of fermentation plants, particularly in Brazil and the United States. This environment fosters close collaboration between research institutions and industrial producers, resulting in pilot-to-commercial translation of advanced biocatalytic pathways.

In Europe, the Middle East, and Africa, stringent circular economy directives and plastic reduction targets compel multinational corporations to integrate bio-based platform chemicals into their supply chains. The European Green Deal’s emphasis on renewable content is accelerating the deployment of lignocellulosic and waste glycerol feedstocks, while Gulf region investments in industrial biotechnology are positioning the Middle East as an emerging hub for large-scale production of propylene and ethylene from non‐petrochemical sources.

Across the Asia-Pacific, dynamic economic growth and rising consumer awareness about environmental footprint are pivotal. Major Asian economies are infusing stimulus funds into research grants for enzymatic catalysis, and local chemical producers are forging international joint ventures to adopt best-in-class process technologies. Collectively, these regional trends highlight that while each geography faces unique constraints, all are aligned in pursuing more sustainable and resilient chemical value chains.

This comprehensive research report examines key regions that drive the evolution of the Bio-Based Platform Chemical market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Innovators, Strategic Partnerships, and Competitive Approaches Driving Advancement in the Bio-Based Platform Chemicals Landscape

Leading enterprises are showcasing diverse strategies to capture the burgeoning opportunities within this market. Chemical incumbents are augmenting their traditional petrochemical portfolios with bio-based product lines, often through strategic acquisitions of specialty biotechnology firms. Collaborative alliances between enzyme developers and manufacturing champions are also proliferating, pooling resources to optimize catalyst performance and streamline scale-up timelines.

Meanwhile, agile start-ups are carving out niches by focusing on high-purity monomers and tailor-made polymer precursors that address specific end-use challenges. These innovators leverage modular bioreactors and continuous processing technologies to achieve rapid product iteration and cost reductions. Strategic partnerships with global end users facilitate early validation of performance attributes, creating pathways toward long-term supply agreements.

Investment consortia encompassing venture capital, government grants, and corporate backers are de-risking the capital-intensive rollout of new production facilities. By sharing both technical design and market insight, these frameworks are expediting the transition from laboratory breakthroughs to commercial viability. Collectively, the competitive landscape underscores a convergence of traditional chemical know-how with frontier biotechnology, heralding a new era of integrated value chains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-Based Platform Chemical market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aktin Chemicals, Inc.

- Archer Daniels Midland Company

- BASF SE

- Braskem S.A.

- Cargill, Incorporated

- Corbion N.V.

- Corbion N.V.

- Dow Inc.

- DSM-Firmenich

- DuPont de Nemours, Inc.

- Evonik Industries AG

- GENOMATICA, Inc.

- GFBiochemicals Ltd.

- LyondellBasell Industries Holdings B.V.

- Nippon Shokubai Co., Ltd.

- Novozymes A/S

- Novozymes A/S

- PTT Global Chemical Public Company Limited

- Roquette Frères S.A.

- Royal DSM N.V.

- Tate & Lyle PLC

- Tokyo Chemical Industry Co., Ltd.

Providing Strategic Roadmaps and Practical Initiatives for Industry Leaders to Capitalize on Emerging Trends in Bio-Based Platform Chemicals Market

To harness the full potential of bio-based platform chemicals, industry leaders should prioritize end-to-end supply chain integration, fostering collaborations across feedstock suppliers, technology providers, and end users. This holistic approach mitigates risks associated with feedstock volatility and regulatory shifts, while facilitating rapid scale-up of new production technologies.

Leaders must also invest in advanced digital platforms that enable real-time tracking of feedstock sources, production yields, and sustainability metrics. Deploying such systems enhances transparency and supports certification processes critical for securing premium pricing in environmentally conscious markets. Further, allocating resources to joint research initiatives with academic and government institutions can unlock novel biocatalytic pathways, accelerating cost reductions and performance enhancements.

Finally, decision-makers should adopt a flexible portfolio strategy that balances high-volume commodity monomers with specialty derivatives differentiated by functionality. By diversifying product offerings, companies can optimize asset utilization and capture value across multiple end-use sectors, from automotive components to pharmaceutical intermediates. This strategic agility will be essential for navigating shifting policy landscapes and evolving customer demands.

Outlining Rigorous Research Frameworks, Data Collection Methods, and Validation Techniques Underpinning the Analysis of Bio-Based Platform Chemicals Market

The analysis underpinning this report integrates extensive primary research, including interviews with C-level executives, technical directors, and procurement specialists across key regions. Quantitative data collected through surveys and direct consultations was triangulated with secondary information from peer-reviewed publications, patent filings, and regulatory disclosures.

A multi-stage validation process ensured the robustness of insights: initial hypotheses were tested through expert workshops, followed by sensitivity analyses to assess the impact of varying feedstock costs and process efficiencies. Geographic scope was defined to capture diverse regulatory regimes and infrastructure conditions, while segmentation frameworks were applied consistently to enable comparative cross-segment evaluation.

Throughout the research, stringent quality controls were maintained, encompassing data integrity checks, consistency reviews, and alignment with recognized standards for market intelligence. This methodological rigor guarantees that the findings reflect real-world industry dynamics and provide a reliable foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-Based Platform Chemical market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-Based Platform Chemical Market, by Product Type

- Bio-Based Platform Chemical Market, by Feedstock

- Bio-Based Platform Chemical Market, by Process Technology

- Bio-Based Platform Chemical Market, by Application

- Bio-Based Platform Chemical Market, by End Use Industry

- Bio-Based Platform Chemical Market, by Region

- Bio-Based Platform Chemical Market, by Group

- Bio-Based Platform Chemical Market, by Country

- United States Bio-Based Platform Chemical Market

- China Bio-Based Platform Chemical Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Comprehensive Conclusions on the Future Trajectory and Strategic Imperatives for Stakeholders in the Bio-Based Platform Chemicals Arena

The trajectory of the bio-based platform chemicals sector is marked by sustained innovation, strategic collaboration, and evolving regulatory support. As environmental imperatives intensify, the shift from petrochemical to bio-derived feedstocks will accelerate, unlocking new pathways for reducing greenhouse gas emissions and fostering circularity.

Companies that successfully integrate robust research partnerships, adaptive production platforms, and diversified product portfolios will emerge as leaders, securing long-term offtake agreements and premium market positioning. Furthermore, the resilience demonstrated in responding to trade policy disruptions underscores the sector’s capacity for rapid adaptation.

Ultimately, the confluence of technological advancement, policy incentives, and stakeholder commitment will define the next phase of growth. Organizations that proactively embrace these trends and align their strategic initiatives accordingly will be best positioned to drive both commercial success and environmental stewardship in the years ahead.

Engage with Ketan Rohom to Secure In-Depth Market Insights and Empower Strategic Decision-Making with the Comprehensive Bio-Based Platform Chemicals Report

To explore this comprehensive market research report and gain invaluable insights into the evolving bio-based platform chemicals landscape, engage with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the report’s in-depth analysis, clarify any queries, and help customize solutions that align with your organization’s strategic objectives. His expertise will ensure you secure the critical intelligence needed to inform investment decisions, optimize supply chain strategies, and harness emerging growth opportunities in this rapidly transforming market. Reach out today to take the next step toward driving innovation and sustainability within your operations.

- How big is the Bio-Based Platform Chemical Market?

- What is the Bio-Based Platform Chemical Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?