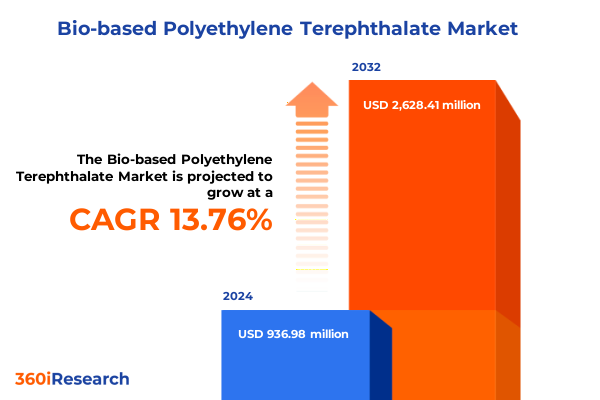

The Bio-based Polyethylene Terephthalate Market size was estimated at USD 1.05 billion in 2025 and expected to reach USD 1.18 billion in 2026, at a CAGR of 13.92% to reach USD 2.62 billion by 2032.

Unveiling the Evolution and Sustainability Imperatives Shaping Growth and Innovation in the Global Bio-based Polyethylene Terephthalate Ecosystem

The global materials landscape is undergoing a profound transformation as sustainable alternatives rise to prominence, and bio-based polyethylene terephthalate has emerged at the forefront of this evolution. Derived from renewable feedstocks such as cassava, corn, and sugarcane, this innovative polymer offers a clear pathway to reduce reliance on fossil resources while maintaining the performance characteristics that have driven PET’s widespread adoption in packaging and materials applications. Against a backdrop of tightening environmental regulations and growing corporate commitments to carbon reduction, bio-based PET is redefining how stakeholders conceive of circularity and lifecycle management in polymer science.

Industry participants are responding to mounting pressure from consumers and regulators alike by accelerating investments in renewable feedstock procurement and refining conversion processes that enhance material purity and consistency. Simultaneously, public policy initiatives across major markets are incentivizing the deployment of bio-based resins to meet ambitious greenhouse gas reduction targets, further bolstering research and development pipelines. As a result, manufacturers are actively exploring new biorefinery concepts and forging strategic partnerships to secure stable, cost-effective biomass supply chains capable of scaling with anticipated demand.

This section introduces the foundational context for understanding how renewable feedstock innovation, shifting regulatory landscapes, and intensified sustainability imperatives are converging to position bio-based polyethylene terephthalate as a pivotal driver of the next generation of recyclable, low-carbon materials.

Exploring the Transformative Technological, Regulatory, and Market Shifts Redefining Bio-based PET Production and Adoption

Technological breakthroughs have become a defining force in the bio-based PET domain, catalyzing improvements across process efficiency, feedstock conversion, and polymer quality. Advanced enzymatic and catalytic techniques are improving the yield and reducing the energy intensity of converting renewable biomass into monoethylene glycol and terephthalic acid, the critical building blocks of PET. These innovations are complemented by continuous reactor designs and modular biorefinery configurations, which lower capital expenditures and shorten time-to-market for new production facilities.

At the same time, regulatory landscapes are undergoing rapid shifts, as government agencies introduce mandates and incentives designed to reduce lifecycle emissions and encourage renewable content in consumer goods. Combined with voluntary corporate sustainability pledges, policies such as low-carbon fuel standards and recycled content requirements are shaping investment flows and prompting incumbents to diversify their resin portfolios. Regional regulations also vary in their approach to bio-derived content thresholds, driving manufacturers to develop flexible technology platforms capable of meeting a spectrum of compliance profiles.

Market forces further amplify these shifts, with end-use sectors such as packaging, textiles, and industrial strapping demonstrating differentiated adoption curves. In packaging applications, brand owners are prioritizing bio-based materials to reinforce circularity narratives and meet evolving consumer expectations. Meanwhile, the textile industry is experimenting with high-purity staple and filament fibers to leverage bio-based PET’s mechanical properties and enhance the sustainability credentials of performance fabrics. These converging dynamics are reshaping traditional supply chains and redefining competitive advantage within the emerging bio-based PET ecosystem.

Assessing the Economic and Strategic Ramifications of 2025 United States Tariffs on Bio-based PET Supply Chains and Competitiveness

In 2025, the United States implemented a series of tariff adjustments aimed at imported polymers and feedstocks linked to conventional PET production, thereby creating a more economically favorable environment for domestically produced bio-based resins. These tariffs have introduced a new layer of complexity into supply chain management, as importers of fossil-derived monoethylene glycol and terephthalic acid face higher landed costs while domestic biorefineries gain a relative cost advantage. As a result, buyers are reevaluating long-term procurement strategies and increasingly sourcing material from North American bio-based PET suppliers.

The cumulative effect of these tariff policies has spurred a reevaluation of production footprints. Companies that once depended on low-cost imports have accelerated plans to retrofit existing petrochemical facilities or construct greenfield biorefineries closer to feedstock sources. This shift is realigning logistics networks and creating fresh opportunities for agricultural producers to establish stable offtake partnerships. Furthermore, the tariff-induced reshuffle in global trade flows has prompted industry alliances focused on technology transfer and localized production, reinforcing regional resilience in the face of geopolitical uncertainties.

While the immediate impact has been felt in cost structures and supply reliability, longer-term considerations center on investment dynamics and innovation incentives. Domestic players are capturing incremental margin improvements, which are being reinvested into R&D programs that advance catalyst performance and polymer functionalization. At the same time, buyers are demanding transparent lifecycle assessments to validate the environmental benefits of onshore production. In this evolving policy environment, success will hinge on the ability to integrate tariff-driven savings with continuous process improvements and robust sustainability claims.

Revealing Key Segmentation Perspectives Unveiling Performance Drivers Across Feedstock, Resin Variation, Purity Grade, and Application Domains

Understanding the varied performance of bio-based polyethylene terephthalate requires a nuanced examination across multiple dimensions. On the feedstock front, cassava-based routes have demonstrated exceptional growth potential in tropical regions due to high starch yields and low land-use competition, whereas corn-derived pathways benefit from established agricultural infrastructure and integrated processing facilities in North America and Europe. Sugarcane offers a middle ground, combining renewable energy co-generation opportunities with relatively mature supply chains in Latin America and Asia-Pacific. Each feedstock source inherently influences feedstock logistics, conversion efficiencies, and end-product carbon footprints.

Resin typology also plays a pivotal role, as fully bio-based PET resins appeal to brands seeking to maximize renewable content, while partially bio-based variants offer a compromise between performance consistency and cost competitiveness. The selection between fully and partially bio-based resin types directly impacts supplier collaboration models and pricing structures, shaping how end-users navigate budget constraints alongside sustainability goals. Within polymer grade classifications, food grade resins command rigorous compliance standards to secure approvals for direct food contact applications, whereas industrial grade counterparts prioritize mechanical robustness and chemical resistance to accommodate demanding environments such as strapping and industrial film.

The diversity of application requirements further accentuates these segmentation insights. For bottle applications, carbonated drinks manufacturers prioritize high clarity and barrier properties, while water bottle producers emphasize lightweight design and recyclability. In textile markets, filament fiber producers rely on consistent molecular weight distributions, whereas staple fiber applications focus on blending and dye uptake performance. Film and sheet segments necessitate tailored orientation processes, with biaxial designs delivering enhanced strength and monoaxial variants offering cost-effective solutions. Strapping applications bifurcate into machine- and manual-operated processes, each demanding specific tensile and elongation characteristics that influence material selection and downstream processing investments.

This comprehensive research report categorizes the Bio-based Polyethylene Terephthalate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock

- Resin Type

- Purity Grade

- Application

Highlighting Regional Nuances and Strategic Opportunities Across the Americas, EMEA, and Asia-Pacific Bio-based PET Markets

Regional market dynamics underscore the importance of localized strategies in the bio-based PET landscape. In the Americas, strong policy support for agricultural biomass utilization, coupled with established petrochemical infrastructure, has accelerated feedstock-to-resin conversion projects. Producers benefit from reliable corn and sugarcane supplies while leveraging proximity to large-scale consumer goods manufacturers headquartered in North America. This synergy fosters collaboration on closed-loop recycling initiatives and branded packaging launches that feature renewable content disclosures.

In Europe, the Middle East, and Africa, regulatory frameworks increasingly favor low-carbon materials through mandates on recycled and bio-based content. European Union directives are driving major beverage and consumer goods companies to adopt fully bio-based resin blends, encouraging innovation hubs to optimize fermentation and catalysis techniques. Meanwhile, strategic partnerships between feedstock producers in North Africa and manufacturing clusters in southern Europe are emerging, highlighting the potential of sugarcane and alternative biomass sources in widening the feedstock base.

Across the Asia-Pacific region, rapid urbanization and rising environmental awareness are fueling demand for sustainable packaging and performance textiles. Sugarcane-established industries in Southeast Asia offer cost advantages for bio-based resin extruders, while corn-rich agricultural zones in China and India provide scale opportunities for large-scale biorefinery investments. Government-led circularity programs and consumer-focused sustainability campaigns are catalyzing pilot projects that integrate renewable PET into premium packaging and fast-moving consumer goods, positioning Asia-Pacific as a critical growth engine for the bio-based PET ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Bio-based Polyethylene Terephthalate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Competitive Landscape with Insights into Innovation Strategies and Partnerships among Leading Bio-based PET Players

The competitive landscape of bio-based polyethylene terephthalate is defined by a handful of vertically integrated players and innovative start-ups that are advancing proprietary technologies. Leading the charge, NatureWorks has demonstrated the ability to scale fermentation-driven processes to produce high-purity monoethylene glycol precursors, complementing strategic alliances with global consumer brands to validate performance in beverage packaging and fiber applications. Indorama Ventures has leveraged its robust petrochemical heritage to retrofit existing PTA plants and incorporate bio-based feedstocks, thereby optimizing capital efficiency and accelerating market entry timelines.

Braskem has made significant strides in commercializing sugarcane-derived routes for both PET and co-polyesters, integrating renewable energy co-generation into mill operations to enhance margin profiles. Avantium’s renewable chemistry platform focuses on catalyzing biomass into building block chemicals, underscoring the potential for next-generation bio-based terephthalic acid production. Eastman has targeted circularity by developing molecular recycling technologies that complement bio-based resin offerings, enabling a hybrid approach to feedstock diversification and post-consumer resin recovery.

These leading companies exemplify a trend toward strategic partnerships and joint ventures that combine feedstock sourcing expertise, catalytic innovation, and application development. Smaller challengers are carving out niches through specialty polymer formulations and high-purity grade resins tailored to demanding industrial and textile use cases. Collectively, this competitive constellation is driving speed-to-market and shaping the long-term cost structure of bio-based PET as it transitions from emerging alternative to mainstream polymer solution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-based Polyethylene Terephthalate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpek S.A.B. de C.V.

- Alpla Werke Alwin Lehner GmbH & Co. KG

- Anellotech, Inc.

- Avantium N.V.

- BioAmber Inc.

- Biokunststofftool

- Braskem S.A.

- Danone S.A.

- FKuR Kunststoff GmbH

- Indorama Ventures Public Company Limited

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- NatureWorks LLC

- Novamont S.p.A.

- Origin Materials, Inc.

- PepsiCo, Inc.

- Plastipak Holdings, Inc.

- PTT Global Chemical Public Company Limited

- SUNTORY HOLDINGS LIMITED

- Teijin Limited

- The Coca-Cola Company

- TotalEnergies SE

- Toyota Tsusho Corporation

- Virent, Inc.

Strategic Imperatives and Recommended Actions for Industry Leaders to Capitalize on Bio-based PET Trends and Sustain Competitive Advantage

Industry leaders seeking to navigate the evolving bio-based PET market should prioritize diversification of renewable feedstock sources while forging collaborative partnerships with agricultural producers. By establishing multi-year offtake agreements for cassava, corn, or sugarcane, companies can secure price stability and reduce exposure to commodity fluctuations, laying the groundwork for predictable production economics. Simultaneously, investment in advanced catalytic and enzymatic process platforms will accelerate yield improvements and lower energy consumption, delivering incremental cost savings that can be reinvested into scale-up initiatives.

Aligning corporate sustainability objectives with emerging regulatory frameworks is essential. Companies should proactively engage with policymakers to shape incentive structures for bio-based content and to ensure compatibility across regional compliance landscapes. Investing in transparent lifecycle assessment tools and third-party validation will bolster environmental claims and reinforce brand credibility. Moreover, exploring co-locations of biorefineries adjacent to virgin feedstock suppliers and recycling operations can further optimize logistics, reducing overall carbon footprints and creating closed-loop material streams.

Innovation in application development remains a critical differentiator. Brand owners and resin producers should collaborate on performance testing for targeted end-use scenarios, such as high-barrier beverage packaging or mechanically demanding strapping systems. Incorporating digital twins and predictive analytics into process control can refine polymer properties in real time, enabling rapid customization to meet diverse application needs. By integrating these strategies, industry leaders will enhance resilience, accelerate market adoption, and cement their position at the vanguard of the sustainable materials revolution.

Detailing the Rigorous Multistage Research Methodology Underpinning Comprehensive Bio-based PET Market Analysis and Insights

The insights presented in this report are grounded in a robust, multistage research methodology designed to capture both macrolevel trends and granular market dynamics. Secondary research sources included peer-reviewed journals, industry conference proceedings, regulatory filings, and corporate sustainability disclosures to develop a comprehensive understanding of technological advancements and policy environments. This phase established the foundational knowledge base and informed the selection of key focus areas for deeper investigation.

Primary research was conducted through structured interviews with executives from leading resin producers, agricultural feedstock suppliers, brand owners, and technical experts in polymer chemistry. These dialogues provided firsthand perspectives on strategic priorities, operational challenges, and emerging adoption drivers. Data collected through expert interviews was triangulated with publicly available sales data, patent filings, and trade flow records to validate findings and ensure reproducibility.

Analytical rigor was maintained through quantitative modeling of cost drivers, feedstock logistics, and regional policy impact scenarios, complemented by qualitative assessments of consumer sentiment and corporate sustainability strategies. The segmentation framework was tested against real-world case studies spanning multiple geographies and application areas, ensuring that the report’s conclusions rest on a balanced integration of empirical data and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-based Polyethylene Terephthalate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-based Polyethylene Terephthalate Market, by Feedstock

- Bio-based Polyethylene Terephthalate Market, by Resin Type

- Bio-based Polyethylene Terephthalate Market, by Purity Grade

- Bio-based Polyethylene Terephthalate Market, by Application

- Bio-based Polyethylene Terephthalate Market, by Region

- Bio-based Polyethylene Terephthalate Market, by Group

- Bio-based Polyethylene Terephthalate Market, by Country

- United States Bio-based Polyethylene Terephthalate Market

- China Bio-based Polyethylene Terephthalate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Trajectory of Bio-based PET and Its Transformative Role in Advancing a Circular Carbon Economy

The trajectory of bio-based polyethylene terephthalate underscores a pivotal shift toward renewable, circular materials that meet rigorous performance, regulatory, and sustainability criteria. As production technologies mature and regional policy incentives align, bio-based PET is positioned to supplant significant volumes of fossil-derived polymers across packaging, textile, and industrial applications. The interplay of diversified feedstock supply chains, advanced catalytic processes, and collaborative industry partnerships will determine the pace and scale of market adoption.

Stakeholders across the value chain-from farmers and biorefinery operators to brand owners and end consumers-stand to benefit from reduced carbon footprints, enhanced supply chain resilience, and evolving consumer preferences for sustainable products. Strategic recommendations outlined herein offer a roadmap for leveraging technology, policy engagement, and market intelligence to navigate potential disruptions and capitalize on growth opportunities. By embracing a holistic approach that integrates environmental objectives with commercial imperatives, industry participants can drive the transition to a low-carbon economy while capturing new value in the emerging bio-based PET landscape.

Ultimately, the ability to adapt to shifting regulatory regimes, innovate in feedstock-to-resin conversion, and deliver differentiated application performance will define competitive advantage. Those who harness these transformative forces will not only shape the future of polymer science but also play a central role in advancing global sustainability goals.

Engage with Ketan Rohom to Unlock In-Depth Bio-based PET Market Intelligence and Drive Strategic Decision-Making Today

To gain an in-depth understanding of emerging material science developments, regional demand dynamics, and strategic growth pathways within the bio-based polyethylene terephthalate sector, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex market analytics into actionable intelligence will empower your organization to make informed investment decisions and capitalize on evolving sustainability mandates. By partnering with him, you will secure tailored insights into feedstock optimization strategies, resin innovation trajectories, and application-specific growth vectors that align with your corporate objectives.

Act now to accelerate your competitive positioning and access proprietary research methodologies that uncover hidden market opportunities. Ketan Rohom is ready to guide you through the comprehensive report, ensuring your team leverages these insights for maximum impact. Reach out to schedule a personalized briefing and explore volume purchase options to equip your stakeholders with the most authoritative bio-based PET market intelligence available today.

- How big is the Bio-based Polyethylene Terephthalate Market?

- What is the Bio-based Polyethylene Terephthalate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?