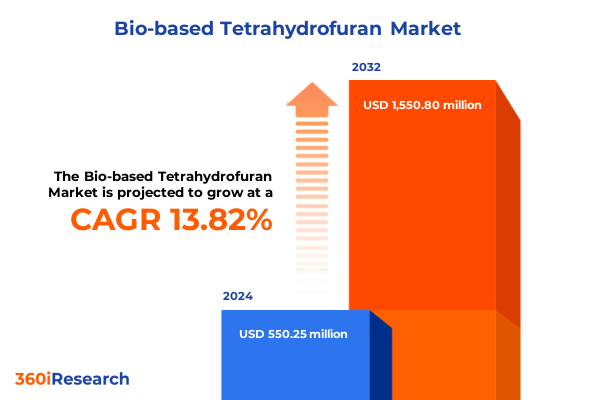

The Bio-based Tetrahydrofuran Market size was estimated at USD 620.50 million in 2025 and expected to reach USD 709.19 million in 2026, at a CAGR of 13.98% to reach USD 1,550.80 million by 2032.

Pioneering the Path to Sustainable Chemical Production through Bio-Based Tetrahydrofuran Innovations Driving Decarbonization and Shaping Tomorrow’s Green Economy

Bio-based tetrahydrofuran is emerging as a cornerstone of sustainable chemistry, offering a compelling alternative to its petroleum-derived counterpart. Derived from renewable biomass through innovative catalytic pathways, this cyclic ether combines the functionality of a solvent, chemical intermediate, and polymer precursor while significantly reducing carbon footprint. The confluence of environmental mandates, corporate net-zero pledges, and consumer demand for greener materials has accelerated investment and research in bio-based THF production.

Revolutionary Catalyst Developments and Feedstock Breakthroughs Redefining the Bio-Based Tetrahydrofuran Landscape for Sustainable Chemical Manufacturing

The bio-based tetrahydrofuran landscape has been redefined by breakthroughs in catalyst design and process integration, unlocking new avenues for yield improvement and cost reduction. Recent electrocatalytic conversion studies have demonstrated promising selectivity for furan-based platform molecules, enabling lower-temperature hydrogenation routes that reduce energy consumption and operational costs. Parallel advances in biochar-supported Ru–Re catalysts have revealed that waste-derived carbon materials can outperform traditional activated carbons, offering enhanced activity and prolonged catalyst lifetimes for furan-to-THF conversion.

Analyzing the Far-Reaching Effects of 2025 United States Tariff Measures on the Bio-Based Tetrahydrofuran Value Chain and Trade Dynamics

In 2025, the United States introduced a sweeping set of tariff measures that have reshaped global chemical supply chains. In April, a universal 10% import duty was enacted under emergency trade powers, designed to address persistent trade imbalances and compel reciprocal market access. Shortly thereafter, targeted duties of 20% on European imports and 24% on Japanese chemicals were applied, excluding an extensive list of base petrochemicals and polymers. However, the most profound impact was felt by imports from China, which now face an effective rate exceeding 50% after layering new measures on existing tariffs. These policies have prompted U.S. biorefineries to recalibrate sourcing strategies for glycerol, lignocellulosic sugars, and fermentation feedstocks, mitigating cost pressures while ensuring supply continuity.

Unveiling Crucial Segmentation Perspectives Illuminating Application, Source, and Industry-Specific Drivers Shaping the Bio-Based Tetrahydrofuran Market

Application-driven demand for bio-based tetrahydrofuran is expanding rapidly, with its role as a versatile chemical intermediate enabling next-generation solvents and polymer precursors. Its adoption as a renewable polymer precursor has unlocked new performance attributes in polyurethanes and elastomers, while high-purity grades serve as precision solvents in electronic and pharmaceutical manufacturing. Source diversification underpins this growth narrative, with glycerol conversion platforms offering a cost-competitive feedstock coexisting alongside lignocellulosic-derived furfural hydrogenation processes and sugar fermentation pathways. End-user industries reveal nuanced adoption patterns: automotive OEMs leverage bio-based THF in sustainable coatings and high-performance interior materials; electronics manufacturers integrate the solvent into circuit board fabrication and thermal interface materials; oil and gas companies deploy it in fluid system additives and specialty solvents; packaging innovators utilize it to engineer both flexible and rigid bio-based films; and textile producers incorporate it in advanced fiber finishes for both apparel and industrial textiles.

This comprehensive research report categorizes the Bio-based Tetrahydrofuran market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Application

- End User Industry

Exploring Divergent Regional Drivers and Policy Landscapes Shaping Adoption of Bio-Based Tetrahydrofuran Across the Americas, EMEA, and Asia-Pacific

Regional landscapes for bio-based tetrahydrofuran are shaped by distinct policy frameworks and industrial ecosystems. In the Americas, the U.S. clean fuel tax credits and Inflation Reduction Act incentives have spurred feedstock investments and pilot-scale biorefineries, while Canadian provincial grants have catalyzed glycerol valorization projects. Europe, navigating the transition under the Carbon Border Adjustment Mechanism (CBAM), is prioritizing low-carbon chemical imports from compliant non-EU producers and accelerating domestic bioeconomy strategies to preserve competitiveness. In Asia-Pacific, the Regional Comprehensive Economic Partnership’s phased tariff reductions on petrochemicals bolster intraregional polymer value chains, facilitating scale-up of bio-based THF for electronics and automotive applications in key markets such as Japan, South Korea, and Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Bio-based Tetrahydrofuran market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborations Pioneering Bio-Based Tetrahydrofuran Commercialization and Sustainability Initiatives

Strategic corporate initiatives are crystallizing around bio-based tetrahydrofuran’s commercial viability. BASF has extended its biomass balance certification to include THF and polytetrahydrofuran volumes produced in North America, Europe, and Asia, enabling customers to substitute renewable feedstocks on a mass-balance basis. Additionally, a high-profile partnership between BASF and Asahi Kasei is deploying certified THF in sustainable textile fibers, targeting up to 50% carbon footprint reduction in apparel applications. Meanwhile, Evonik and BioAmber’s long-term catalysts collaboration advances hydrogenation processes that convert bio-based succinic acid into THF, GBL, and BDO, exemplifying integrated platform approaches to bio-based diols and ethers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-based Tetrahydrofuran market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Inc.

- Banner Chemicals Limited

- BASF SE

- Bhagwati Chemicals

- DCC Group

- Hefei TNJ Chemical Industry Co., Ltd.

- Henan GP Chemicals Co., Ltd.

- INVISTA Textiles (U.K.) Limited

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation

- Mitsui Chemicals, Inc.

- Nan Ya Plastics Corporation

- REE Atharva Lifescience Pvt. Ltd.

- Sahara International Petrochemical Company (Sipchem)

- Shanxi Sanwei Group Co., Ltd.

- Shenyang East Chemical Science-Tech Co., Ltd.

- The Chemours Company

Strategic Roadmap for Industry Leaders to Accelerate Bio-Based Tetrahydrofuran Adoption through Innovation, Partnerships, and Policy Engagement

Industry leaders can capitalize on the momentum by forging cross-sector alliances, investing in next-generation catalyst research, and engaging proactively with regulatory stakeholders. Collaborative R&D consortia that integrate academic, corporate, and government expertise will accelerate the optimization of lignocellulosic furfural pathways and streamline downstream hydrogenation steps. Piloting integrated biorefineries co-locating glycerol valorization with THF production can unlock feedstock synergies and reduce logistics costs. Finally, proactive participation in policy design-particularly around lifecycle carbon accounting standards and border adjustment mechanisms-will safeguard market access and incentivize further decarbonization efforts.

Comprehensive Research Methodology Combining Primary Interviews, Regulatory Analysis, and Triangulated Data Sources to Ensure Rigorous Insights

This analysis leverages a multifaceted research methodology combining primary interviews with industry executives, technology providers, and chemical associations, alongside secondary data from peer-reviewed journals, regulatory filings, and government policy publications. Quantitative insights were triangulated through supply chain mapping, feedstock cost benchmarking, and trade flow analyses. Rigorous validation was achieved via cross-referencing proprietary pilot plant data with publicly available case studies and patent filings. The result is a robust framework that captures both macroeconomic drivers and granular technology trends, ensuring actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-based Tetrahydrofuran market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-based Tetrahydrofuran Market, by Source

- Bio-based Tetrahydrofuran Market, by Application

- Bio-based Tetrahydrofuran Market, by End User Industry

- Bio-based Tetrahydrofuran Market, by Region

- Bio-based Tetrahydrofuran Market, by Group

- Bio-based Tetrahydrofuran Market, by Country

- United States Bio-based Tetrahydrofuran Market

- China Bio-based Tetrahydrofuran Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Concluding Insights on Bio-Based Tetrahydrofuran’s Role in Driving a Circular Chemical Economy and Sustainable Manufacturing Transformation

The convergence of sustainability imperatives, technological breakthroughs, and evolving trade policies has propelled bio-based tetrahydrofuran from niche innovation to mainstream consideration. Advances in catalytic processes and feedstock diversification have lowered barriers to commercialization, while corporate and governmental commitments have provided the necessary policy and financial support. As regional markets adapt to new carbon pricing mechanisms and trade agreements, the competitive landscape is poised for rapid transformation. Bio-based THF stands at the nexus of environmental stewardship and industrial performance, offering a tangible pathway toward a circular chemical economy.

Unlock Tailored Bio-Based Tetrahydrofuran Market Strategies by Partnering with Our Expert Sales Director

Elevate your strategic planning with exclusive insights and detailed analyses tailored for decision-makers in the bio-based tetrahydrofuran sector. Collaborate with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to gain privileged access to comprehensive market intelligence, actionable strategies, and bespoke recommendations. Engage with a dedicated expert who understands the complexity of renewable chemical markets and can guide your organization toward achieving sustainability targets, optimizing supply chains, and capturing emerging growth opportunities. Connect today to secure your copy of the in-depth market research report and empower your team with the knowledge required to lead the transition to a more sustainable chemical industry.

- How big is the Bio-based Tetrahydrofuran Market?

- What is the Bio-based Tetrahydrofuran Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?