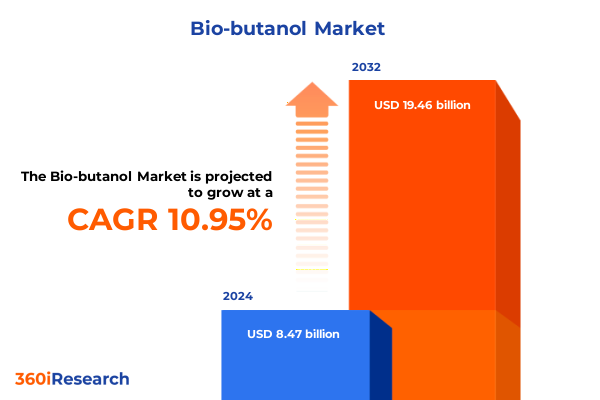

The Bio-butanol Market size was estimated at USD 2.24 billion in 2025 and expected to reach USD 2.44 billion in 2026, at a CAGR of 9.13% to reach USD 4.14 billion by 2032.

Comprehensive Exploration of Bio-Butanol Market Evolution Highlighting Technological Advances Policy Disruptions Competitive Dynamics and Strategic Opportunities

The bio-butanol market is at a pivotal juncture as global industries seek sustainable alternatives to petrochemical solvents and fuel additives. This introduction provides a foundational overview of the bio-butanol landscape, tracing its evolution from early-stage fermentation processes to today’s advanced biotechnological platforms. It explores how shifts in feedstock availability, driven by agricultural residue utilization and expanding bioenergy mandates, have positioned bio-butanol as a versatile building block for diverse industrial applications.

Moreover, the intrinsic properties of bio-butanol-its high energy density, compatibility with existing fuel infrastructure, and favorable solvent characteristics-underscore its potential to replace conventional butanol in automotive, marine, and aviation sectors. At the same time, rising consumer demand for green chemicals has accelerated research into specialty grades, particularly pharmaceutical and high-purity chemical variants. This section lays the groundwork for subsequent analysis by highlighting the critical factors influencing production, distribution, and end-use adoption, thereby establishing a clear context for the strategic insights that follow.

In-Depth Analysis of Paradigm Shifts Redefining Bio-Butanol Production Across Advanced Fermentation Catalytic Technologies and Emerging Policy Incentives

In recent years, the bio-butanol sector has experienced transformative shifts driven by breakthroughs in fermentation science and catalytic conversion techniques. Innovations in ABE fermentation, including genetically modified strains and optimized bioreactor designs, have markedly improved butanol yields and reduced downstream purification costs. Parallel progress in catalytic pathways-leveraging both chemical catalysis and syngas fermentation-has opened avenues for utilizing nontraditional feedstocks such as municipal solid waste and industrial off-gases.

Concurrently, policy landscapes have evolved to incentivize low-carbon fuels and bio-based chemicals, fostering public–private partnerships that accelerate pilot-scale demonstrations. Incentive programs and carbon credit mechanisms have fueled investment in integrated biorefineries capable of co-producing bio-butanol alongside ethanol, organic acids, and renewable electricity. These structural changes, underscored by shifting regulatory frameworks in North America, Europe, and Asia-Pacific, are redefining competitive parameters and compelling traditional petrochemical incumbents to diversify their portfolios.

Comprehensive Assessment of the Cumulative Impact of 2025 United States Tariff Measures on Bio-Butanol Supply Chains Cost Structures and Stakeholder Engagement

Throughout 2025, updated United States tariff measures on imported bio-based chemicals have exerted a pronounced impact on bio-butanol supply chains and cost structures. The imposition of additional duties on select feedstock derivatives has prompted downstream producers to reevaluate sourcing strategies, often shifting toward domestic agricultural residues such as corn stover and wheat straw. As a result, logistic networks have been realigned to accommodate new regional feedstock hubs, altering the competitive balance between coastal and inland production facilities.

At the same time, these tariff adjustments have catalyzed dialogue between suppliers, regulatory bodies, and end-use manufacturers seeking to mitigate price volatility. Collaborative initiatives aimed at streamlining customs procedures and establishing preferential treatment for bio-based imports are under discussion. In the interim, producers are leveraging long-term supply agreements and flexible tolling arrangements to hedge against further policy fluctuations. This comprehensive assessment examines how the 2025 tariff landscape is reshaping stakeholder engagement across the entire value chain, from raw material procurement to final product delivery.

Critical Insights into Bio-Butanol Market Segmentation Revealing Feedstock End-Use Technology Purity Distribution and Application Dynamics

A nuanced understanding of bio-butanol segmentation illuminates the multifaceted drivers of market growth. Feedstock diversity is a cornerstone of this landscape, where agricultural residues such as corn stover, rice straw, and wheat straw coexist with sugarcane juice and bagasse in tropical regions. Corn starch continues to dominate in North America, leveraging well-established grain supply chains, while syngas derived from industrial waste streams and wood chips is gaining traction among integrated biorefineries focused on circular economy principles.

End-use segmentation reveals that biofuels lead demand, particularly within aviation fuel, gasoline blending, and marine applications. High-blend gasoline formulations are capturing interest for their compatibility with existing infrastructure, while low-blend variants serve as transitional fuels. Beyond transportation, the coatings and solvents sector benefits from butanol’s solvency properties, and pharmaceutical applications demand premium purity grades. Plasticizers are an emerging niche, leveraging bio-butanol in esterification processes that yield more sustainable polymers.

On the technology front, traditional ABE fermentation platforms-often using Clostridium acetobutylicum or Clostridium beijerinckii-remain prevalent. Yet, advanced ABE processes employing genetically modified strains and integrated biorefinery configurations are accelerating adoption. Catalytic conversion methods, including chemical catalysis and syngas fermentation, complement these fermentative pathways by enabling feedstock flexibility. Emerging enzymatic approaches promise further efficiency gains.

Purity grade segmentation underscores the dominance of fuel-grade butanol, accounting for the majority of volume, while chemical-grade applications maintain stability in industrial markets. Pharmaceutical-grade butanol, with its stringent quality requirements, commands a premium positioning. Distribution channels differ accordingly: direct sales underpin large industrial accounts, distributors service mid-market chemical buyers, and e-commerce platforms are increasingly facilitating specialty-grade transactions. Application-based segmentation highlights bio-butanol’s versatility as a chemical feedstock for butadiene production, esterification, and plastic synthesis, as well as its role as a fuel additive in aviation, engine, and marine environments, and as a high-performance solvent across multiple industries.

This comprehensive research report categorizes the Bio-butanol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Feedstock

- Production Process

- Application

- End-User Industry

- Distribution Channel

Detailed Examination of Regional Variations in Bio-Butanol Market Development Across Americas Europe Middle East Africa and Asia-Pacific Divergence Patterns

Regional dynamics in the bio-butanol market reflect divergent policy frameworks, feedstock endowments, and industrial infrastructures. In the Americas, the United States anchors the landscape with its corn starch–based fermentation capacity, driven by Midwestern feedstock surpluses and robust biofuel mandates. Canada’s emphasis on lignocellulosic residues, including wheat straw, aligns with federal clean fuel standards, while Brazil leverages its sugarcane juice and bagasse resources to feed both domestic demand and export markets.

Europe, Middle East, and Africa present a mosaic of regulatory environments. The European Union’s Renewable Energy Directive and Circular Economy Action Plan underpin investments in advanced ABE fermentation and integrated biorefineries, particularly in Scandinavia and the Iberian Peninsula. In the Middle East, emerging petrochemical hubs are exploring syngas fermentation, utilizing abundant natural gas resources. African initiatives, though nascent, focus on agricultural residue valorization and partnerships to build localized production capacity.

Within Asia-Pacific, China’s large-scale syngas fermentation facilities and expanding sugarcane acreage signal a strategic push toward self-sufficiency in bio-based chemicals. India’s reliance on rice straw and bagasse for cellulosic processes is complemented by government incentives for rural biogas and bio-refineries. Japan’s investment in enzymatic conversion pathways reflects a broader commitment to circular economy principles. These regional patterns illustrate how feedstock availability, policy incentives, and infrastructure investments shape distinctive market trajectories across the globe.

This comprehensive research report examines key regions that drive the evolution of the Bio-butanol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Analysis of Leading Bio-Butanol Market Players Highlighting Competitive Strategies Technological Leadership and Collaboration Models Driving Innovation

Leading companies in the bio-butanol arena are differentiating themselves through proprietary technologies, strategic collaborations, and integrated value chain models. One prominent player has invested heavily in genetically engineered microbial strains to optimize butanol yield, while establishing downstream partnerships to streamline purification and distribution. Another market leader operates a network of integrated facilities combining ethanol, butanol, and chemical co-products, thereby enhancing operational flexibility and revenue diversification.

In addition, collaborative ventures between petrochemical incumbents and biotechnology firms are gaining momentum. Strategic joint ventures enable the leveraging of existing infrastructure for feedstock handling and product blending, while biotech partners contribute cutting-edge fermentation know-how. Several specialty chemical manufacturers have launched dedicated e-commerce platforms to cater to niche segments, such as pharmaceutical-grade and high-purity industrial solvents.

Furthermore, some companies are pioneering syngas-to-butanol routes, converting industrial off-gases into valuable liquid products and tapping into carbon capture incentives. These initiatives underscore a broader competitive trend: the convergence of sustainable feedstock utilization, advanced process technologies, and end-use integration. As a result, the leading market players are building resilient supply chains, unlocking new revenue streams, and reinforcing their position in a rapidly evolving bio-based chemical ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-butanol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Eastman Chemical Company

- GranBio LLC

- Gevo, Inc.

- Cathay Industrial Biotech

- Godavari Biorefineries Ltd.

- Celtic Renewables

- Lee Enterprises Consulting

- Celignis Limited

- KH Neochem Co., Ltd.

- Sasol Limited

- Ataman Kimya A.Ş.

- BASF SE

- Dow Chemical Company

- ETIP Bioenergy

- Evonik Industries AG

- Merck KGaA

- Mitsubishi Chemical Corporation

- Phytonix Corporation

- Prosense Technology Industry Inc.

- Saudi Basic Industries Corporation

- Solventis Ltd

- Thermo Fisher Scientific Inc.

- Working Bugs, LLC.

Actionable Strategic Recommendations for Bio-Butanol Industry Leaders to Navigate Market Volatility Enhance Value Chains and Capitalize on Emerging Opportunities

Industry leaders should prioritize investment in advanced fermentation and catalytic conversion platforms that maximize feedstock flexibility and process efficiency. By diversifying raw material sourcing to include agricultural residues and industrial waste streams, organizations can hedge against commodity volatility and align with circular economy imperatives. Concurrently, establishing integrated biorefinery capabilities-where multiple co-products are generated within a single facility-can unlock new revenue opportunities and improve margin stability.

Engaging in strategic partnerships with technology developers, academic institutions, and downstream end users is essential to accelerate commercialization timelines. Such collaborations facilitate the sharing of risk, access to proprietary strains, and rapid scaling of pilot projects. Moreover, stakeholders should advocate for harmonized regulatory frameworks and streamlined customs procedures to reduce tariff-related disruptions. Aligning with policy advocacy groups and participating in standards-setting bodies can help shape conducive operating environments.

To capture premium market segments, companies must develop specialized product grades that meet the stringent purity and performance requirements of pharmaceuticals, high-end coatings, and advanced solvents. Leveraging digitalization-through predictive analytics and real-time process monitoring-will enhance production yields and minimize downtime. Finally, exploring e-commerce channels and direct-to-consumer platforms will expand distribution reach, enabling agile responses to emerging demand patterns and niche application needs.

Rigorous Research Methodology Leveraging Multi-Source Data Triangulation Expert Interviews and Analytical Frameworks Delivering Bio-Butanol Market Insights

This report draws on a rigorous research methodology that integrates primary and secondary data sources, ensuring comprehensive coverage of the bio-butanol market. Primary research included in-depth interviews with industry executives, process engineering experts, and policy makers across major producing regions. These qualitative insights were complemented by surveys conducted with end-use companies to gauge demand drivers and adoption barriers for bio-based butanol products.

Secondary research encompassed an extensive review of academic literature, peer-reviewed journals, regulatory filings, and trade association publications. The data triangulation process cross-validated findings from multiple sources to enhance accuracy and reliability. An analytical framework was employed to segment the market by feedstock type, end-use industry, technology pathway, purity grade, distribution channel, and application, providing a multi-dimensional perspective.

Throughout the research, standard definitions and classifications were adhered to for geographic regions, ensuring consistency with international benchmarks. Quality checks, including data sanity tests and peer reviews, were conducted at each stage. While the methodology ensures robust insights, limitations include potential shifts in policy landscapes and emerging technologies that may alter trends. Nonetheless, this structured approach delivers a clear, actionable understanding of the current and near-term bio-butanol ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-butanol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-butanol Market, by Product Type

- Bio-butanol Market, by Feedstock

- Bio-butanol Market, by Production Process

- Bio-butanol Market, by Application

- Bio-butanol Market, by End-User Industry

- Bio-butanol Market, by Distribution Channel

- Bio-butanol Market, by Region

- Bio-butanol Market, by Group

- Bio-butanol Market, by Country

- United States Bio-butanol Market

- China Bio-butanol Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesis of Critical Bio-Butanol Market Learnings and Strategic Imperatives to Guide Stakeholders in Capitalizing on Technological and Regulatory Opportunities

The bio-butanol market is characterized by dynamic shifts in technology, policy, and supply chain configurations. Innovations in fermentation and catalytic processes are driving efficiency gains, while policy incentives and tariff measures reshape competitive landscapes. Regional variations underscore the importance of feedstock endowments and regulatory frameworks in determining production and adoption patterns.

Segmentation analysis reveals that feedstock diversity, end-use applications, and distribution channels each play pivotal roles in shaping market trajectories. Key players have responded by forging strategic alliances and developing integrated value chains that optimize resource utilization and product differentiation. Actionable insights point to the value of investing in advanced process technologies, nurturing collaborative partnerships, and engaging in policy advocacy to mitigate supply disruptions.

As the industry progresses, a rigorous, data-driven approach to decision making will remain indispensable. Stakeholders equipped with granular segmentation, regional intelligence, and competitive benchmarking will be poised to capitalize on emerging opportunities. Ultimately, the convergence of technological innovation, regulatory support, and strategic investment will define success in the growing bio-butanol sector.

Compelling Call to Action Encouraging Engagement with Associate Director Sales Marketing Ketan Rohom to Secure In-Depth Bio-Butanol Market Research Insights

We invite industry stakeholders seeking a comprehensive understanding of the bio-butanol landscape to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in market intelligence and deep familiarity with technology trends will guide you through tailored insights that align with your strategic objectives. By partnering with Ketan, organizations can access exclusive data-driven recommendations, uncover untapped opportunities, and build resilient supply chain strategies.

Take the next step in your competitive journey by securing the full bio-butanol market research report. Ketan’s consultative approach ensures you receive personalized support, from navigating regulatory complexities to identifying optimal investment pathways. Connect today to transform high-level analysis into actionable plans that drive sustainable growth and innovation within your organization.

- How big is the Bio-butanol Market?

- What is the Bio-butanol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?