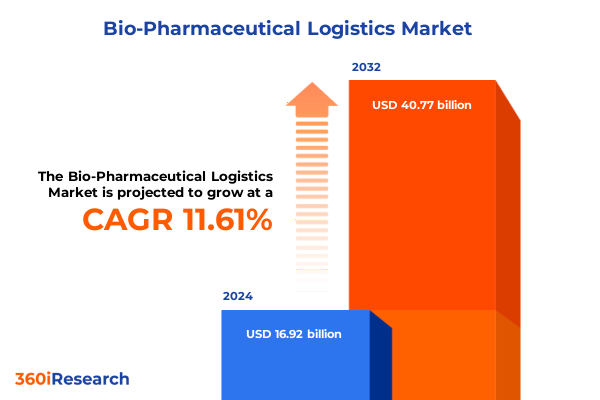

The Bio-Pharmaceutical Logistics Market size was estimated at USD 18.71 billion in 2025 and expected to reach USD 20.69 billion in 2026, at a CAGR of 11.76% to reach USD 40.77 billion by 2032.

Navigating Complex Global Supply Chain Dynamics with Resilient Strategies to Ensure Regulatory Compliance and Patient-Centric Delivery Excellence

The bio-pharmaceutical logistics sector represents a vital nexus where patient safety, regulatory compliance, and operational efficiency converge. Today’s market demands unprecedented levels of precision and agility, as products ranging from complex biologics to life-saving vaccines must traverse global supply chains without compromising quality or efficacy. At the heart of this ecosystem lies an intricate web of stakeholders, each contributing specialized capabilities-from cold chain packaging innovations to specialized kitting and quality inspection services.

As stakeholders navigate increasingly complex regulatory landscapes and heightened customer expectations, the imperative for a cohesive strategy has never been stronger. Successful operators are those who align cross-functional teams with advanced digital tracking systems, robust temperature-monitoring protocols, and agile distribution networks. Furthermore, collaboration between pharmaceutical manufacturers, contract research organizations, and logistics providers is essential for streamlining clinical trial supply chains and ensuring timely product launches.

Amid ongoing shifts in trade policies, technological breakthroughs, and evolving healthcare delivery models, organizations that harness a clear understanding of value-added services, multimodal transport options, and end-user requirements will be positioned to respond proactively to disruptions. This introduction lays the groundwork for a comprehensive executive overview, illuminating how leaders can fortify their supply chain resilience while championing patient-centric outcomes.

Unveiling the Technological and Strategic Shifts Reshaping Bio-Pharmaceutical Logistics Toward Hybrid Digitalization and Collaborative Resilience

The bio-pharmaceutical logistics industry is undergoing a fundamental transformation driven by the convergence of digitalization, sustainability imperatives, and collaborative ecosystems. Emerging technologies such as blockchain-enabled traceability and Internet of Things sensors have elevated transparency across every link of the supply chain, facilitating real-time temperature monitoring and tamper-proof documentation. This digital acceleration is complemented by the integration of artificial intelligence algorithms that optimize route planning and predictive maintenance, thereby reducing downtime and spoilage risks.

Simultaneously, environmental sustainability has become a strategic priority, propelling investments in eco-friendly packaging solutions and carbon-neutral transport modes. Organizations are forging alliances with green energy providers and repurposing logistics assets to minimize their environmental footprint while meeting rigorous cold chain requirements.

Collaboration between end users, service providers, and regulatory bodies has also entered a new phase, characterized by shared data platforms and co-development initiatives. These partnerships foster accelerated product releases and enhanced compliance through standardized processes and continuous improvement frameworks. As a result, the sector is evolving into a more resilient, transparent, and adaptive landscape, where the seamless integration of technological, ecological, and collaborative advances sets a new benchmark for industry excellence.

Assessing the Broad Implications of New Trade Tariffs on Bio-Pharmaceutical Logistics in the United States and Strategic Adaptations for Stakeholders

The introduction of updated tariffs in 2025 has generated tangible effects on cost structures, operational strategies, and stakeholder relationships within the United States bio-pharmaceutical logistics market. Increased duties on specialized packaging materials and temperature-controlled transport components have compelled organizations to reassess supplier networks and negotiate new contractual terms. While some freight providers have absorbed portions of these additional costs to maintain customer loyalty, others have strategically realigned service portfolios toward higher-value offerings.

These tariff-induced cost pressures have also influenced decisions around inventory positioning and distribution center locations. To mitigate escalating import expenses, many companies have reassessed onshore versus offshore warehousing strategies, favoring domestic consolidation hubs that reduce cross-border flow volumes. This shift has accelerated investments in warehousing automation and scalable modular facilities that can adapt to fluctuating product volumes without compromising strict temperature controls.

In response to the new trade environment, collaborative partnerships between logistics operators and pharmaceutical firms have deepened, focusing on joint scenario planning, shared risk models, and transparent cost allocation mechanisms. By co-creating end-to-end supply chain solutions, stakeholders not only offset tariff burdens but also enhance responsiveness to demand surges and regulatory changes.

Harnessing Multidimensional Segmentation Perspectives to Illuminate Service, Transport Mode, Temperature, Product, and End-User Dynamics

A nuanced understanding of service offerings is essential for designing tailored logistics solutions that align with diverse customer needs. Cold chain packaging innovations ensure temperature integrity for sensitive products, while customs clearance expertise navigates complex regulatory frameworks across jurisdictions. Freight forwarding specialists orchestrate multimodal transfers, complemented by storage and distribution networks that maintain rigorous environmental controls. Value-added services such as kitting assembly, precision labeling, and comprehensive quality inspection enhance product readiness and regulatory compliance.

Transport modalities significantly influence delivery speed and cost efficiency. Air services offer rapid transit for time-critical shipments, whereas rail and road transport provide reliable, cost-effective options for large volumes or regional moves. Sea freight remains the backbone for high-volume international consignments, with advanced temperature-controlled containers safeguarding product integrity.

Temperature requirements impose distinct operational protocols. Ambient shipments accommodate stable products with minimal thermal sensitivity, whereas cryogenic handling is indispensable for materials requiring ultra-low temperatures. Frozen and refrigerated regimes each demand calibrated infrastructure and contingency plans to manage temperature excursions.

Product characteristics further shape logistics strategies. Biologics necessitate continuous monitoring throughout transit, blood products require stringent sterility and traceability protocols, and vaccines must comply with both cold chain mandates and rapid distribution imperatives.

Finally, end-user segments-ranging from clinics and hospitals to contract research organizations, pharmaceutical manufacturers, and research institutes-drive service customization. Each customer category presents unique volume patterns, regulatory touchpoints, and collaboration models, underscoring the importance of flexible, segmented approaches in bio-pharmaceutical logistics.

This comprehensive research report categorizes the Bio-Pharmaceutical Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Service Type

- Mode Of Transport

- Temperature Requirement

- End User

Comparative Regional Analysis Revealing Divergent Infrastructure, Regulatory, and Demand Patterns Across Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping bio-pharmaceutical logistics strategies, as infrastructure capabilities, regulatory landscapes, and market maturity vary significantly across geographies. In the Americas, comprehensive cold chain networks are bolstered by advanced road and air connectivity, enabling swift distribution to urban and remote locales alike. The presence of established life sciences clusters and progressive regulatory frameworks further accelerates market responsiveness.

Europe, the Middle East, and Africa present a heterogeneous environment where stringent European Union regulations coexist with emerging markets in the Middle East and Africa that grapple with infrastructure development challenges. Logistics providers in this region balance compliance with localized adaptations, investing in regional hubs and strategic alliances to navigate customs complexities and deliver consistent service levels.

Asia-Pacific showcases one of the fastest-growing bio-pharmaceutical markets, propelled by expanding manufacturing capabilities and rapidly evolving healthcare systems. High-density urban centers in East and Southeast Asia benefit from robust port facilities and intermodal linkages, while inland regions increasingly rely on rail and road corridors to maintain temperature-sensitive product flows. Cross-border collaboration and government partnerships further enhance supply chain resilience in this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Bio-Pharmaceutical Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Logistics Innovators and Strategic Partnerships Driving Competitive Advantage in the Bio-Pharmaceutical Sector

Leading logistics organizations are driving sector innovation through integrated service portfolios and strategic partnerships. Several global carriers have invested heavily in proprietary cold chain networks, combining advanced packaging technologies with real-time tracking systems to deliver end-to-end visibility. Meanwhile, specialized third-party providers have carved niches by focusing on regulatory advisory services and customized temperature-controlled solutions for niche product segments.

Collaborative ventures between pharmaceutical manufacturers and logistics firms have given rise to co-developed digital platforms that streamline order management, track compliance metrics, and enable predictive analytics. Such partnerships reduce lead times and foster continuous improvement cycles rooted in shared performance data.

Moreover, emerging startups are disrupting traditional models by introducing modular, on-demand warehousing and crowd-sourced transport capabilities that flex to fluctuating clinical trial and market launch requirements. These agile players often collaborate with established operators to scale innovative solutions globally, ensuring both reliability and speed.

Across the competitive landscape, the convergence of technology, sustainability goals, and collaborative frameworks is redefining value propositions. Organizations that blend robust asset networks with digital finesse stand to capture new growth opportunities while elevating service quality and compliance adherence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-Pharmaceutical Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agility Public Warehousing Company K.S.C.P.

- Air Canada Cargo Inc.

- Almac Group Limited

- AmerisourceBergen Corporation

- Biocair Limited

- C.H. Robinson Worldwide, Inc.

- Cardinal Health, Inc.

- CEVA Logistics AG

- Cryoport Inc.

- DB Schenker

- Deutsche Post DHL Group

- DSV Panalpina A/S

- FedEx Corporation

- GEODIS S.A.

- Kerry Logistics Network Limited

- Kuehne + Nagel International AG

- MNX Global Logistics LLC

- Movianto Group

- Nippon Express Co., Ltd.

- PCI Pharma Services Holdings LLC

- QuickSTAT Global Life Science Logistics Inc.

- SF Express Co., Ltd.

- Thermo Fisher Scientific Inc.

- United Parcel Service, Inc.

- World Courier Inc.

Strategic Imperatives and Tactical Roadmaps for Industry Leaders to Enhance Efficiency, Compliance, and Customer-Centric Innovation

To thrive amidst evolving complexities, industry leaders must align operational excellence with strategic foresight. Prioritizing end-to-end visibility through integrated digital platforms enables proactive risk management, real-time decision-making, and enhanced customer trust. Complementing these investments with eco-efficient packaging and transport solutions underscores a commitment to sustainability, which resonates with both regulatory bodies and end users.

Strategic collaborations are equally critical: co-development agreements with pharmaceutical firms and technology providers accelerate innovation cycles and facilitate shared accountability for product integrity. Joint risk-sharing models can mitigate the financial impact of tariffs and regulatory changes while deepening mutual commitment to performance targets.

Building modular infrastructure-ranging from flexible warehousing to adaptable transport fleets-ensures capacity can scale in response to demand surges or unforeseen disruptions. Combined with scenario-based planning and regular stress testing, this approach enhances supply chain resilience.

Finally, cultivating a culture of continuous improvement-driven by data analytics, cross-functional training, and customer feedback loops-positions organizations to anticipate market shifts and deliver differentiated service. By embedding these strategic imperatives, industry leaders can secure a sustainable competitive advantage in the dynamic bio-pharmaceutical logistics arena.

Methodological Framework Integrating Qualitative Stakeholder Perspectives and Quantitative Trend Analysis to Ensure Rigor and Relevance

The research methodology underpinning this analysis integrates qualitative and quantitative approaches to ensure comprehensiveness and rigor. Primary insights were gathered through interviews with key stakeholders, including logistics executives, regulatory experts, and end-user representatives across various geographic markets. These dialogues provided firsthand perspectives on operational challenges, emerging priorities, and collaborative best practices.

Complementing these qualitative inputs, secondary research involved the systematic review of peer-reviewed journals, industry white papers, and regulatory publications to triangulate findings and validate emerging trends. Emphasis was placed on understanding digital transformation adoption rates, tariff policy impacts, and regional infrastructure developments.

Data analytics techniques, including trend analysis and scenario modeling, were applied to synthesize disparate information streams and reveal underlying patterns. Geographic and segmentation breakdowns were constructed to highlight nuanced differences in transport modes, temperature regimes, product categories, and end-user requirements.

Throughout the process, validation rounds with subject matter experts and peer reviewers ensured that conclusions were both accurate and actionable. Ethical guidelines and data privacy standards were strictly adhered to, reinforcing the integrity of the research outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-Pharmaceutical Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-Pharmaceutical Logistics Market, by Product Type

- Bio-Pharmaceutical Logistics Market, by Service Type

- Bio-Pharmaceutical Logistics Market, by Mode Of Transport

- Bio-Pharmaceutical Logistics Market, by Temperature Requirement

- Bio-Pharmaceutical Logistics Market, by End User

- Bio-Pharmaceutical Logistics Market, by Region

- Bio-Pharmaceutical Logistics Market, by Group

- Bio-Pharmaceutical Logistics Market, by Country

- United States Bio-Pharmaceutical Logistics Market

- China Bio-Pharmaceutical Logistics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Insights to Reinforce Strategic Vision and Prepare Stakeholders for Evolving Bio-Pharmaceutical Logistics Challenges

This overview has illuminated the multifaceted dynamics shaping the bio-pharmaceutical logistics landscape, from transformative technological leaps to the tangible effects of new tariff regimes. By dissecting segmentation nuances and regional idiosyncrasies, stakeholders gain a holistic view of the operational imperatives and collaborative pathways that define industry leadership.

The convergence of digital traceability, sustainability commitments, and strategic risk-sharing underscores a paradigm shift toward more agile, transparent, and customer-centric supply chains. As market complexities intensify, organizations that adopt modular infrastructure designs, foster cross-sector partnerships, and invest in real-time analytics will be best positioned to drive growth and safeguard product integrity.

Ultimately, the resilience of the bio-pharmaceutical logistics ecosystem hinges on continuous innovation and adaptive strategies. Leaders who internalize these insights and translate them into actionable roadmaps will not only navigate present challenges effectively but also shape a future where safe, reliable, and efficient delivery of critical therapies becomes the standard.

Engage Expert Guidance with Ketan Rohom to Access In-Depth Bio-Pharmaceutical Logistics Intelligence and Secure Competitive Insights Today

For industry leaders seeking a competitive edge in the fast-evolving bio-pharmaceutical logistics landscape, engaging with Ketan Rohom as your trusted expert partner unlocks a suite of actionable insights and tailored strategies. By connecting directly with the Associate Director of Sales & Marketing, organizations secure exclusive access to advanced analytical perspectives, deep market intelligence, and strategic counsel that align with their unique operational imperatives.

Through a collaborative consultation, stakeholders gain clarity on critical supply chain challenges, from cold chain optimization to regulatory navigation, all contextualized within the latest tariff environments, emerging technologies, and customer expectations. Ketan Rohom’s in-depth understanding of sector nuances enables decision-makers to anticipate disruptions, capital expenditures, and partnership opportunities with greater confidence.

Initiate a dialogue today to explore customized research deliverables designed to illuminate transformative trends and drive sustainable growth. Whether refining service portfolios, expanding into new geographic territories, or enhancing digital capabilities, this one-on-one engagement ensures that your organization remains at the forefront of innovation and responsiveness.

Secure your strategic advantage now by contacting Ketan Rohom and take the first step toward operational excellence, regulatory agility, and unparalleled customer satisfaction in bio-pharmaceutical logistics.

- How big is the Bio-Pharmaceutical Logistics Market?

- What is the Bio-Pharmaceutical Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?