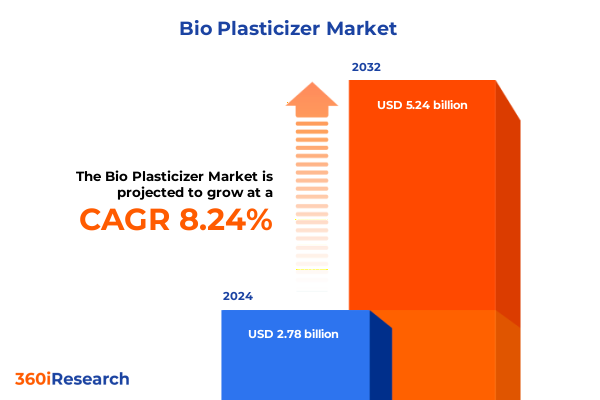

The Bio Plasticizer Market size was estimated at USD 2.98 billion in 2025 and expected to reach USD 3.20 billion in 2026, at a CAGR of 8.38% to reach USD 5.24 billion by 2032.

Setting the Stage for Sustainable Plasticizer Innovation Amid Rising Environmental Demands and Evolving Global Chemical Regulations

The escalating demand for sustainable alternatives within the chemical industry has brought bio plasticizers to the forefront of innovation. With mounting environmental pressures and an intensifying global regulatory landscape, manufacturers and end-use industries are seeking plasticizer solutions that not only match the performance of traditional counterparts but also align with circular economy principles. In response, bio plasticizers formulated from renewable feedstocks are gaining prominence, propelled by advances in green chemistry and lifecycle assessments that demonstrate reduced environmental burdens.

This executive summary provides a high-level overview of the critical forces reshaping the bio plasticizer sector. It outlines the strategic context in which market participants operate, highlights technological and regulatory inflection points, and presents key insights across segmentation, regional dynamics, and competitive positioning. By synthesizing these dimensions, this summary sets the stage for informed decision-making, guiding stakeholders through the complexities of supply chain optimization, innovation imperatives, and policy compliance while emphasizing sustainable growth trajectories.

How Technological Breakthroughs and the Circular Economy Are Redefining the Bio Plasticizer Landscape for Enhanced Sustainability

In recent years, the convergence of breakthrough technologies and circular economy frameworks has fundamentally altered the bio plasticizer landscape. Enzymatic catalysis techniques and microbial fermentation platforms now enable the cost-effective transformation of abundant biomass into high-purity plasticizing agents. Concurrently, integrated biorefinery models are unlocking the potential of agricultural residues and waste glycerol streams, thereby improving feedstock flexibility while reducing reliance on virgin petrochemical inputs.

These transformative shifts are accelerating the adoption of bio plasticizers across traditionally fossil-dependent segments, such as coatings, adhesives, sealants, and PVC compounding. Water-based coating formulations are increasingly leveraging bio-derived citrates for enhanced low-VOC performance, while high-temperature engineering plastics are utilizing bio-based adipates and trimellitates to achieve thermal stability. As sustainability becomes a competitive differentiator, the industry is moving from proof-of-concept to commercial rollout, marking a pivotal transition toward fully circular material lifecycles.

Assessing the Broad Repercussions of New United States Tariff Measures in 2025 on Raw Materials, Supply Chains, and Cost Structures

The implementation of new United States tariff measures in 2025 has introduced significant cost and supply-chain considerations for plasticizer producers and end users. By imposing duties on key fossil-based intermediates imported from established global suppliers, these measures aim to incentivize domestic bio-based alternative production and fortify supply-chain resilience. However, the immediate effect has been upward pressure on raw material costs for adipate and phthalate grades, prompting many downstream processors to re-evaluate long-term sourcing strategies.

In response to these cumulative tariff impacts, businesses are actively exploring near-shoring options, investing in localized manufacturing capacities, and diversifying feedstock portfolios. These strategic adjustments are fostering greater collaboration between chemical producers and agricultural stakeholders, while also catalyzing pilot projects to validate bio-sourced equivalents under real-world processing conditions. Despite transitional hurdles, the alignment of tariff incentives with broader sustainability mandates is anticipated to accelerate the commercialization of next-generation bio plasticizers.

Unearthing Critical Market Segmentation Insights by Source, Type, Application, and End-Use for Informed Strategic Decision Making

A nuanced segmentation framework reveals critical dynamics shaping demand and innovation pathways in the bio plasticizer market. When evaluated by source, bio-derived grades are increasingly favored over fossil-based counterparts in applications where sustainability certifications are paramount, although cost-sensitive sectors continue to rely on traditional chemistries for price stability. Analysis by type indicates that citrate derivatives are gaining traction for low-temperature flexibility and regulatory compliance, while adipate variants remain prevalent for general-purpose plasticizing. Phthalates are facing progressive restrictions across major jurisdictions, driving a shift toward sebacate and trimellitate specialties for high-performance niches.

Application-level insights underscore a bifurcation between coatings and adhesives sectors, which are capitalizing on the environmental and performance benefits of bio-sourced citrates, and PVC compounding, where compatibility and cost considerations guide material selection. Within coatings, solvent-based formulations still command a significant share, but water-based systems are growing rapidly as waterborne platforms become more technically viable. End-use industry segmentation highlights robust demand from the automotive sector for durable, weather-resistant elastomers, while construction materials prioritize flame retardancy and low-odor profiles. Consumer goods manufacturers emphasize product safety and eco-labeling, and packaging converters are seeking specialized chemistries for food-grade, industrial, and medical applications that meet stringent regulatory thresholds.

This comprehensive research report categorizes the Bio Plasticizer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Type

- Application

- End-Use Industry

Decoding Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Uncover Growth Hotspots and Demand Drivers

Regional analyses illuminate diverging growth trajectories and tailored adoption patterns for bio plasticizers. In the Americas, regulatory frameworks such as low-VOC mandates and green procurement policies in North America have stimulated robust uptake of citrate and adipate chemistries, while Latin American markets are emerging through public-private partnerships focused on bioeconomy development. Europe, Middle East & Africa present a heterogeneous picture: Europe’s stringent REACH regulations and circular economy action plans drive leadership in bio-based innovation, whereas the Middle East’s petrochemical legacy is gradually integrating bio-derived solutions for high-end construction and automotive applications. In Africa, nascent bioindustrial clusters are exploring agricultural residue valorization, laying the groundwork for future regional supply hubs.

The Asia-Pacific region remains a pivotal battleground, with China’s dual strategy of environmental remediation and self-sufficiency pushing large-scale investments into bio plasticizer plants. India’s rapid urbanization and expansion in consumer electronics create demand for specialty plasticizers with optimized performance and safety profiles. Japan continues to pioneer high-performance, low-odor solutions for electronics and healthcare devices, while Southeast Asian economies position themselves as flexible manufacturing bases, leveraging abundant biomass feedstocks and favorable investment climates. Each regional market exhibits distinct regulatory drivers, raw material access considerations, and customer requirements, underscoring the importance of tailored go-to-market strategies.

This comprehensive research report examines key regions that drive the evolution of the Bio Plasticizer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players Driving Competitive Advantage Through Next-Generation Bio Plasticizer Solutions

The competitive landscape of bio plasticizers is characterized by a blend of established chemical majors and agile specialty innovators. Leading manufacturers have intensified their bio-based R&D investments, forming strategic alliances with biotechnology firms to co-develop next-generation chemistries that offer superior performance and environmental credentials. Concurrently, niche players are carving out high-value segments by focusing on feedstock exclusivity, such as second-generation biomass and non-food agricultural residues, while leveraging patent portfolios to protect proprietary synthesis pathways.

Across this evolving arena, capacity expansions, joint ventures, and targeted acquisitions are reshaping the supplier hierarchy. Forward-integrated producers are securing long-term feedstock supply agreements, while service providers offer end-to-end formulation support and lifecycle analysis. The convergence of digital formulation platforms, predictive analytics, and sustainability scoring systems is enabling real-time product optimization, granting first movers a distinct edge. As competition intensifies, agility in product innovation and customer collaboration will define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio Plasticizer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Avient Corporation

- BASF SE

- Cargill, Incorporated

- DIC Corporation

- Dow Inc.

- Eastman Chemical Company

- Emery Oleochemicals

- Evonik Industries AG

- Lanxess AG

- Matrìca S.p.A.

- Mitsubishi Chemical Corporation

- Novamont S.p.A.

- TotalEnergies Corbion

- Vertellus

Strategic Imperatives and Actionable Recommendations Enabling Industry Leaders to Seize Opportunities in the Evolving Bio Plasticizer Market

To capitalize on emerging opportunities within the bio plasticizer domain, industry leaders must pursue a constellation of strategic imperatives. Prioritizing research and development efforts toward novel feedstock conversion technologies will unlock cost efficiencies and performance enhancements, while partnerships with agricultural cooperatives can secure sustainable supply chains. Engaging proactively with regulatory bodies and participating in standards development initiatives will ensure timely compliance and foster trust among environmentally conscious end users.

Furthermore, establishing demonstration projects and collaborative pilot trials with key customers will accelerate market validation and showcase application-specific benefits. Organizations should also invest in digital tools for formulation optimization, lifecycle impact modeling, and supply chain transparency to differentiate their offerings. Finally, integrating circular economy principles-such as post-consumer recycling streams and take-back programs-will resonate with brand owners and end consumers alike, strengthening market positioning in a sustainability-driven marketplace.

Comprehensive Research Methodology Integrating Primary Interviews, In-Depth Secondary Data, and Rigorous Validation for Credible Insights

This research employs a multi-method approach to ensure comprehensive, credible insights. Secondary research encompassed a deep dive into regulatory filings, patent databases, and industry association publications to map the evolving policy and innovation landscape. Concurrently, primary inputs were gathered through in-depth interviews with C-level executives, procurement specialists, and technical advisors across major manufacturing hubs, enabling firsthand perspectives on supply chain dynamics and application performance.

Quantitative data points were triangulated with proprietary database analytics, facilitating robust validation of observed trends. Throughout the process, a rigorous quality control protocol was maintained, with cross-functional peer review and iterative feedback loops ensuring methodological transparency and consistency. This integrated framework provides a resilient foundation for strategic decision-making by aligning empirical evidence with on-the-ground expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio Plasticizer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio Plasticizer Market, by Source

- Bio Plasticizer Market, by Type

- Bio Plasticizer Market, by Application

- Bio Plasticizer Market, by End-Use Industry

- Bio Plasticizer Market, by Region

- Bio Plasticizer Market, by Group

- Bio Plasticizer Market, by Country

- United States Bio Plasticizer Market

- China Bio Plasticizer Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Key Findings and Strategic Insights to Empower Stakeholders in Charting a Resilient and Sustainable Bio Plasticizer Future

In summation, the bio plasticizer sector stands at the nexus of environmental stewardship and high-performance material science. Technological advancements and circular economy imperatives are dovetailing with regulatory incentives to accelerate the transition toward renewable plasticizing agents. While the introduction of United States tariffs in 2025 has temporarily reshaped cost benchmarks and supply chain flows, it has also catalyzed domestic innovation and diversification efforts.

Strategic alignment across segmentation pillars-from source and type to application and end-use-coupled with region-specific go-to-market models will be critical for future success. By adopting the actionable recommendations outlined herein, stakeholders can position themselves at the forefront of sustainable plasticizer adoption, driving resilience and competitive differentiation. Ultimately, this integrated perspective serves as a roadmap for navigating the evolving landscape and capitalizing on the compelling growth potential of bio-based plasticizer solutions.

Engage with Ketan Rohom for Customized Bio Plasticizer Market Intelligence and Secure Your Definitive Research Report to Drive Strategic Decisions

To access the full breadth of market intelligence and receive a tailored consultation that aligns with your strategic priorities, reach out to Associate Director of Sales & Marketing, Ketan Rohom. Engaging with Ketan provides direct access to exclusive expert analyses, proprietary data models, and actionable insights that will empower your organization to navigate competitive landscapes and regulatory shifts with confidence.

Whether you require customized data extracts, scenario planning workshops, or briefing sessions with subject-matter experts, Ketan will guide you through the process of securing the definitive bio plasticizer research report. Don’t miss the opportunity to leverage this in-depth resource to inform product development roadmaps, investment decisions, and go-to-market strategies. Connect with Ketan Rohom today and equip your team with the knowledge needed to lead in the sustainable plasticizer era

- How big is the Bio Plasticizer Market?

- What is the Bio Plasticizer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?