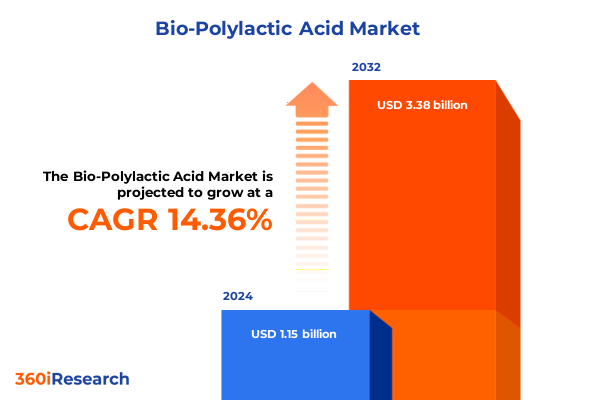

The Bio-Polylactic Acid Market size was estimated at USD 1.31 billion in 2025 and expected to reach USD 1.50 billion in 2026, at a CAGR of 14.40% to reach USD 3.38 billion by 2032.

How Bio-Based Polylactic Acid is Revolutionizing Sustainable Materials with Eco-Conscious Innovation, Competitive Performance, and Global Market Transformation

Bio-based polylactic acid represents a pivotal shift in material science, offering a renewable alternative to traditional petroleum-derived polymers. Derived through the fermentation of plant-based starches, PLA combines compostability with versatile processing capabilities, positioning it at the forefront of sustainable innovation. As the world grapples with plastic pollution and climate imperatives, PLA’s unique balance of performance and environmental credentials has become instrumental in advancing circular economy objectives.

Global momentum behind PLA stems from an urgent environmental mandate. Conventional plastics have long contributed to microplastic accumulation and elevated greenhouse gas emissions, driving regulatory bodies and corporations to prioritize greener alternatives. In markets ranging from North America to Europe and Asia-Pacific, policymakers have introduced bans on certain single-use plastics and incentives for renewable materials. This regulatory tailwind, coupled with rising consumer awareness of lifecycle impacts, has propelled PLA from niche applications into mainstream consideration.

Despite its promise, PLA adoption faces technical and infrastructural hurdles. Industrial composting facilities remain unevenly distributed, and the polymer’s thermal and mechanical properties require ongoing enhancement to meet rigorous application demands. Stakeholders are intensifying research efforts to develop second-generation feedstocks and innovative compounding techniques to bolster heat resistance and durability. Such advancements are critical to ensuring that PLA can fully replace conventional plastics across diverse end uses, from packaging to automotive components.

Emerging Technological, Regulatory, and Consumer-Driven Forces Propelling Bio-Polylactic Acid towards Mainstream Adoption and Sustainable Industry Impact

Technological breakthroughs are redefining what polylactic acid can achieve. Researchers are exploring lignocellulosic feedstocks and engineered microbial fermentation to reduce reliance on food crops, while material scientists are integrating novel copolymers and compatibilizers to elevate PLA’s heat stability and toughness. These innovations have catalyzed prototype applications in durable goods, with companies demonstrating compostable coffee pods and high-heat film formulations. By mid-2025, leading biopolymer producers are actively piloting next-generation PLA grades designed for nonwoven hygiene products and automotive interiors.

Simultaneously, the regulatory landscape is undergoing a paradigm shift. Stringent single-use plastics directives in Europe are mandating minimum bio-based content in packaging, while in the United States, federal and state programs are incentivizing closed-loop recycling and composting infrastructure. The upcoming Global Plastics Treaty, expected to finalize targets for recycled content and end-of-life management, will further propel PLA into regulatory compliance frameworks worldwide. In response, manufacturers are aligning product roadmaps with evolving standards to ensure market readiness.

Consumer behavior is also driving transformative change. Eco-conscious customers increasingly demand transparent material sourcing and end-of-life solutions, leading brands to integrate PLA into premium packaging, disposable cutlery, and textile fibers. Digital traceability platforms now enable verification of biobased content, reinforcing brand commitments to sustainability. The convergence of advanced material formulations, policy support, and consumer expectations is ushering in a new era in which PLA is not just an alternative, but a preferred polymer solution.

Assessing the Ripple Effects of 2025 U.S. Trade Tariffs on Polylactic Acid Supply Chains, Cost Structures, and Competitive Market Dynamics

In early 2025, the U.S. implemented sweeping trade measures under a national emergency declaration, imposing a 25% duty on imports from Canada and Mexico and a 10% duty on Chinese polymer products, with the latter rising to 20% cumulatively by March 4, 2025. These tariffs have raised costs for imported lactic acid, bio-based monomers, and polymer intermediates, including those integral to polylactic acid production. While PLA resin itself was not targeted directly, duties on upstream feedstocks and compounding machinery have cascaded into higher production expenses across the value chain.

Notably, China’s export volumes of PLA to the United States have historically been minimal-only 13 tons in 2023 and 12 tons in 2024-mitigating direct tariff impacts on imported PLA. Conversely, the United States exported approximately 23,000 tons of PLA to China in 2024, where countermeasures increased duties by 34%, undermining competitiveness for downstream PLA applications in that market. These reciprocal tariffs underscore the geopolitical complexity shaping bioplastics trade flows.

The cumulative tariff environment has triggered strategic shifts among U.S.-based PLA producers and their customers. Facing elevated input costs, many stakeholders are accelerating nearshoring initiatives and investing in domestic fermentation capacity to secure local biomass feedstocks. Additionally, companies are reevaluating supply agreements, stockpiling critical intermediates, and exploring alternative co-monomers to diversify sourcing. Collectively, these adaptations are reshaping the PLA supply landscape, fostering resilience in a tariff-influenced market.

Unpacking Market Segmentation to Reveal Source Origins, Processing Methods, Grades, Forms, End Uses, and Application Pathways Driving PLA Market Insights

The polylactic acid market can be dissected through multiple lenses to unveil critical growth drivers and competitive differentiators. From a source type perspective, key feedstocks such as cassava, corn, sugarcane, and tapioca lay the foundation for PLA production, with corn undergoing both dry and wet milling to optimize starch extraction. Each origin presents distinct cost, yield, and environmental profiles that influence downstream processing investments.

Analyzing production modalities, batch fermentation remains prevalent for specialized PLA grades, offering greater control over molecular weight distribution, whereas continuous fermentation systems deliver economies of scale and enhanced throughput for high-volume commoditized grades. This divergence underscores the need to tailor process selection to target applications and desired performance characteristics.

Grade segmentation further clarifies market positioning: compounding grade PLA caters to custom formulations and blend applications, industrial grade addresses standard manufacturing requirements, medical grade PLA adheres to stringent biocompatibility standards for implants and sutures, and packaging grade PLA balances barrier properties with processability for flexible films and rigid containers.

PLA’s end forms-fiber, film, pellet, and powder-each unlock unique value propositions. Fiber applications leverage PLA’s inherent moisture management and dyeability in textiles and nonwoven hygiene products, while film formats, including mono-layer and multi-layer constructions, enable compostable packaging solutions for food service and retail. Pellet and powder forms facilitate molding and extrusion in consumer goods, automotive components, and electronic housings.

A granular examination of end-use segments reveals diverse PLA penetration: in agriculture, mulch films and seed coatings benefit from controllable degradation profiles; the automotive sector integrates PLA in exterior and interior parts to reduce vehicle weight; consumer goods rely on disposable cutlery and housewares that meet compostability standards; medical applications incorporate PLA in implants and sutures; packaging utilizes both flexible films and rigid bottles and containers with designated barrier and shelf-life requirements; and the textile industry adopts PLA in filament, nonwoven, and staple formats for sustainable fabric innovations.

Finally, application-specific insights highlight the nuanced engineering of PLA: solvent-based and water-based coatings enhance substrate adhesion, nonwoven and textile fiber production taps into PLA’s polymer crystallinity, mono-layer and multi-layer films deliver tailored barrier performance, and blow molding and injection molding processes translate PLA resin properties into high-strength, lightweight components. This multifaceted segmentation framework equips stakeholders with the analytical clarity necessary to pinpoint high-value growth opportunities.

This comprehensive research report categorizes the Bio-Polylactic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source Type

- Process

- Grade

- Form

- End Use

- Application

Regional Dynamics Shaping PLA Demand Growth, Innovation, and Sustainability Across the Americas, EMEA, and Asia-Pacific Bioplastics Ecosystems

Regional markets for polylactic acid are shaped by distinct regulatory frameworks, feedstock availability, and end-user demands. In the Americas, the United States is doubling down on domestic biomass sourcing and fermentation infrastructure to mitigate tariff-induced cost volatility. Tariff measures targeting Canadian and Mexican intermediates have elevated production expenses, prompting U.S. producers to nearshore compounding and molding operations and secure long-term offtake agreements with local feedstock suppliers.

Across Europe, the Middle East, and Africa, regulatory cohesion under the EU’s Packaging and Packaging Waste Regulation is catalyzing demand for certified compostable materials. European stakeholders leverage stringent liner standards and eco-label frameworks to differentiate PLA offerings, while manufacturers navigate higher energy costs and labor rates by emphasizing value-added services and specialized high-performance grades. Meanwhile, emerging markets in the Middle East and Africa are exploring PLA as part of broader circular economy initiatives but face infrastructure and supply chain limitations.

In the Asia-Pacific region, feedstock-rich countries such as Thailand and China are scaling capacity through collaborative ventures. Thailand hosts major PLA complexes underpinned by fully integrated facilities-from lactic acid fermentation to polymerization-backed by significant financing and local sugarcane supply agreements. Simultaneously, joint ventures between global energy majors and leading bioscience firms are establishing world-scale PLA plants in both Thailand and Europe to leverage competitive production costs and proximity to key manufacturing clusters. These developments affirm Asia-Pacific as both a production powerhouse and a rapidly growing consumption market.

This comprehensive research report examines key regions that drive the evolution of the Bio-Polylactic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Shaping the Bio-Polylactic Acid Sector through Strategic Partnerships, Innovation Pipelines, and Competitive Differentiation

NatureWorks continues to cement its leadership in the PLA sector through strategic investment and capacity expansion. In mid-2024, the company finalized landmark financing in Thailand to establish a fully integrated Ingeo PLA manufacturing facility, encompassing lactic acid production, lactide monomer synthesis, and polymerization. This investment underscores NatureWorks’ commitment to securing regional feedstock partnerships and advancing biopolymer solutions in Asia-Pacific markets.

TotalEnergies Corbion has distinguished itself by commercializing the world’s first chemically recycled PLA, offering both 30% and 100% recycled grades through a low-energy hydrolysis process. This pioneering approach positions rPLA as a key enabler of circular economy mandates under forthcoming global plastics regulations, while maintaining food-contact approvals and industrial compostability credentials.

Jindan Technology, a vertically integrated lactic acid producer, has navigated heightened U.S. export duties by optimizing its product mix and pursuing differentiated strategies to maintain profitability. The company’s swift adjustments to pricing and supply chain alignment demonstrate resilience amid shifting tariff landscapes.

Strategic partnerships, such as NatureWorks’ licensing deal with 3Dom Filaments for Ingeo PLA-based 3D printing filaments, are expanding PLA’s reach into additive manufacturing. This collaboration marks the first use of the Ingeo brand name in the 3D printing sector, ensuring high-quality monofilament production under established brand guidelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-Polylactic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Carbios SA

- COFCO Group Limited

- Danimer Scientific, Inc.

- FKuR Kunststoff GmbH

- Futerro SA

- Good Natured Products Inc.

- Kingfa Science & Technology Co., Ltd.

- Mitsubishi Chemical Corporation

- Nanjing Tianan Biological Material Co., Ltd.

- NatureWorks LLC

- Radici Partecipazioni S.p.A.

- Shanghai Tong‑Jie‑Liang Biomaterials Co., Ltd.

- SpecialChem

- Sulzer Ltd.

- Synbra Technology B.V.

- Teijin Limited

- Toray Industries, Inc.

- TotalEnergies Corbion PLA S.A.

- Unitika Ltd.

- Unitika Ltd.

- Zhejiang Hisun Biomaterials Co., Ltd.

Transformative Strategies for Industry Leaders to Leverage PLA Sustainability, Optimize Supply Chains, and Capitalize on Emerging Bioplastic Opportunities

Industry leaders should prioritize diversified feedstock strategies to reduce vulnerability to geopolitical and tariff fluctuations, including exploring second-generation lignocellulosic and waste-based biomass sources. By integrating multiple feedstocks, companies can balance cost, sustainability, and supply security.

Advancing product portfolios through targeted research collaborations and joint ventures can accelerate enhancements in thermal stability and mechanical performance. Partnerships between biopolymer producers and material science laboratories will be essential for co-developing high-heat PLA grades and specialty compounds that broaden market applicability.

Stakeholders must actively engage in policy dialogues to shape pragmatic regulatory frameworks that harmonize compostability standards and incentivize both chemical recycling and industrial composting infrastructure. By aligning corporate advocacy with government initiatives, industry players can secure supportive incentives and ensure clarity in end-of-life pathways.

Investments in digital traceability and blockchain-enabled certification will reinforce consumer confidence in biobased credentials, enabling brands to substantiate sustainability claims and mitigate greenwashing risks. Transparent supply chain data will also facilitate compliance with emerging global plastics treaties.

Finally, enhancing supply chain resilience through nearshoring, strategic stockpiles of critical intermediates, and flexible manufacturing footprints will enable firms to navigate cost volatility and maintain reliable delivery commitments under uncertain trade conditions.

Comprehensive Research Framework Combining Primary Interviews, Secondary Data Analysis, and Expert Validation to Deliver Transparent PLA Market Intelligence

Our research methodology integrates primary interviews with key stakeholders across the PLA value chain, including feedstock growers, fermentation technology providers, polymer producers, converters, and end users. These insights are complemented by secondary data sourced from industry publications, trade association reports, regulatory filings, and specialized journals.

Data triangulation ensures robust validation of market trends and technological advancements. Quantitative metrics are cross-referenced with qualitative expert opinions to contextualize supply chain dynamics, tariff impacts, and regulatory shifts. Proprietary databases are leveraged to map production capacities, patent filings, and joint venture activities.

Expert validation workshops were convened to stress-test preliminary findings, involving industry veterans and policy advisors. This collaborative review refined our growth driver analysis and segmentation framework. Lastly, scenario modeling was employed to assess the resilience of supply networks under variable tariff and feedstock availability scenarios, providing actionable intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-Polylactic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-Polylactic Acid Market, by Source Type

- Bio-Polylactic Acid Market, by Process

- Bio-Polylactic Acid Market, by Grade

- Bio-Polylactic Acid Market, by Form

- Bio-Polylactic Acid Market, by End Use

- Bio-Polylactic Acid Market, by Application

- Bio-Polylactic Acid Market, by Region

- Bio-Polylactic Acid Market, by Group

- Bio-Polylactic Acid Market, by Country

- United States Bio-Polylactic Acid Market

- China Bio-Polylactic Acid Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Concluding Insights Highlighting the Strategic Imperatives and Evolutionary Pathways Defining the Future Trajectory of the Bio-Polylactic Acid Industry

The bio-polylactic acid industry stands at a critical juncture where innovation, regulation, and sustainability converge. Technological progress in feedstock diversification and performance optimization is unlocking new applications, while robust policy mandates are driving integration of circularity principles. Trade dynamics, including tariff-induced cost pressures, have catalyzed domestic production initiatives and supply chain realignment.

As global demand for eco-friendly materials intensifies, PLA’s role as a renewable, compostable polymer will expand across sectors ranging from packaging and consumer goods to medical devices and automotive components. Strategic investments in capacity, research collaborations, and policy advocacy will be essential for suppliers seeking to differentiate and scale in an increasingly competitive landscape.

Ultimately, stakeholders that navigate segmentation complexities, fortify supply resilience, and embrace circular economy imperatives will secure first-mover advantages. By synthesizing market intelligence with operational agility, industry participants can seize the strategic opportunities that define the future of bio-polylactic acid.

Engage with Associate Director Ketan Rohom to Access the Definitive Bio-Polylactic Acid Market Report and Empower Your Strategic Decision-Making

To gain unparalleled clarity on the evolving dynamics of the bio-polylactic acid landscape, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Leverage this opportunity to explore comprehensive insights tailored to your strategic priorities and discover how cutting-edge data can inform your next move. Secure expert guidance and access to the definitive market research report to empower informed decision-making and gain a competitive edge in the rapidly shifting bioplastics arena.

- How big is the Bio-Polylactic Acid Market?

- What is the Bio-Polylactic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?