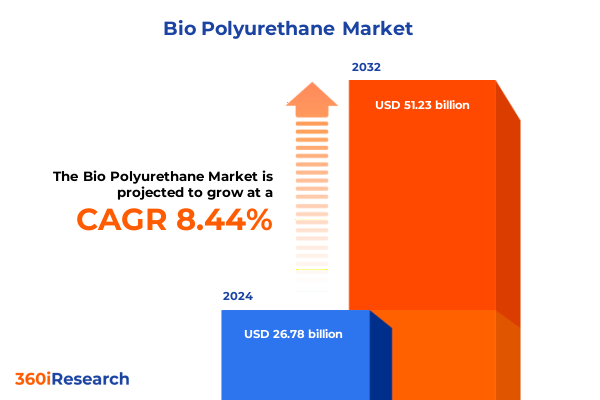

The Bio Polyurethane Market size was estimated at USD 28.62 billion in 2025 and expected to reach USD 30.60 billion in 2026, at a CAGR of 8.66% to reach USD 51.23 billion by 2032.

Embracing a Renewable Future: Unveiling the Imperative of Bio-Based Polyurethane Solutions Amid Global Sustainability and Performance Demands

As industries worldwide pivot toward sustainable and high-performance materials, bio-based polyurethane emerges as a critical solution that satisfies both environmental mandates and stringent application requirements. This report meticulously examines the drivers behind the global shift, evaluating how renewable feedstocks are transforming traditional production paradigms and fostering a more resilient supply chain. Through a balanced lens, the narrative explores the intersection of regulatory pressures, corporate sustainability targets, and evolving consumer preferences that are propelling bio-derived polymers from niche specialty segments into mainstream applications.

In addition to environmental imperatives, the report delves into the intrinsic performance benefits that differentiate bio-based polyurethane from conventional petrochemical-derived counterparts. Enhanced mechanical strength, tailored thermal stability, and superior lifecycle profiles lend themselves to opportunities across multiple industries, ranging from construction and automotive to medical devices and electronics. By setting the context for the ensuing analysis, this introduction underscores the strategic importance of understanding market dynamics, technological breakthroughs, and shifting value propositions. Stakeholders will gain clarity on how bio-based polyurethane is not merely an alternative material, but a pivotal enabler of next-generation products that balance ecological stewardship with uncompromised performance.

Navigating Revolutionary Innovations and Regulatory Accelerations That Are Reshaping Bio-Based Polyurethane Production and Application Landscapes Worldwide

The bio-based polyurethane landscape is witnessing transformative shifts as technological innovations converge with regulatory frameworks to redefine production and application potential. Breakthroughs in polyol chemistry now allow manufacturers to derive feedstocks from a diverse array of biomass sources, spanning agricultural residues to novel microbial pathways. These advancements are complemented by process intensification techniques that reduce energy consumption during polymerization, enhancing both cost-efficiency and environmental credentials. As a result, what was once perceived as a premium, specialty-grade material is increasingly adopted in large-volume applications.

Simultaneously, regulatory accelerations at regional and national levels have created a fertile environment for bio-based materials. Incentives such as credits for renewable content, carbon tax avoidance, and green public procurement are motivating end-users to prioritize sustainable inputs. In parallel, voluntary corporate commitments to achieve net-zero targets drive original equipment manufacturers and brand owners to demand certified bio-based solutions. This interplay between policy and private-sector ambition fuels a virtuous cycle, catalyzing research investments and fostering strategic partnerships. Consequently, the industry is transitioning from incremental enhancements to paradigm-level shifts, reshaping the economic and environmental case for bio-based polyurethane.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Revisions on Bio-Based Polyurethane Supply Chains, Cost Structures, and Competitive Dynamics

In 2025, the United States implemented a series of tariff adjustments on polyurethane intermediates and finished products, significantly altering the competitive landscape. By imposing higher duties on imports of methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI), policymakers sought to incentivize domestic production and strengthen supply chain resilience. Although these measures provided spur to local capacity expansions, they also introduced cost volatility for manufacturers heavily reliant on imported raw materials.

Consequently, end users experienced fluctuating input prices, prompting a reevaluation of sourcing strategies and broader cost management protocols. Some downstream processors accelerated vertical integration into polyol production to hedge against future tariff shifts, while others explored partnerships with emerging bio-based polyol suppliers that offered more stable pricing structures. Furthermore, the introduction of safeguard measures triggered legal challenges under international trade agreements, generating uncertainty that reverberated through procurement cycles. Ultimately, the cumulative impact extended beyond immediate price fluctuations; it reshaped market entry barriers, reinforced regional supply ecosystems, and accelerated the strategic pivot toward renewable feedstock integration.

Decoding Segment-Specific Growth Drivers Across Product Types, Raw Materials, and Multifaceted Applications That Illuminate the Bio-Based Polyurethane Market Fabric

Examining the bio-based polyurethane market through multiple segmentation lenses reveals distinct growth trajectories that are shaping business strategies. When viewed through the product type dimension, adhesive and sealant formulations demonstrate heightened demand driven by the construction sector’s sustainability mandates, while specialty coatings benefit from advanced polyol chemistries that enable superior corrosion resistance. Elastomers, differentiated into thermoplastic and thermoset variants, continue to expand in applications demanding both flexibility and durability, whereas flexible and rigid foams capitalize on insulating properties critical for energy-efficient buildings and lightweight automotive components.

From a raw material standpoint, bio-based polyols-further classified into polyester and polyether families-are commanding premium positioning as they deliver tailored performance attributes and reduced carbon intensity. Competing alongside these renewable feedstocks are established MDI and TDI intermediates, which remain integral to polyurethane synthesis but face increasing scrutiny over their environmental footprint. As manufacturers explore blends of bio-based polyols with conventional isocyanates, hybrid formulations emerge that balance cost considerations with sustainability objectives.

Application segmentation underscores the market’s multifaceted potential, as automotive end uses span body panels, interior seating, and thermal insulation systems, while construction encompasses insulation, sealants, and load-bearing structural components. In electronics, bio-derived coatings, encapsulation resins, and thermal management gels address miniaturization and heat-dissipation challenges. Footwear brands embrace renewable midsoles and outsoles, and the mattress and upholstery segments within furniture and bedding pursue eco-label certifications to meet consumer expectations. Medical device manufacturers also leverage bio-based elastomer coatings and device components to enhance biocompatibility and reduce environmental impact.

This comprehensive research report categorizes the Bio Polyurethane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Raw Material

- Application

Uncovering Regional Nuances in Demand, Regulation, and Innovation That Define the Americas, EMEA, and Asia-Pacific Trajectories in Bio-Based Polyurethane Markets

Geographic dynamics play a pivotal role in determining adoption rates and technology diffusion for bio-based polyurethane. In the Americas, robust policy frameworks supporting renewable content and federally backed research grants stimulate collaborations between universities and private entities, leading to early commercialization of novel bio-polyol platforms. The presence of established petrochemical infrastructure also offers a strategic springboard for scaling production quickly, although domestic manufacturers must navigate shifting trade policies and regional feedstock availability nuances.

Within Europe, the Middle East, and Africa region, stringent environmental regulations and ambitious carbon reduction targets are forcing supply chains to adopt circular economy principles. This has driven significant investment in advanced recycling and bio-refinery capabilities, enabling end-to-end sustainable material loops. Meanwhile, Middle East petrochemical hubs are investing in downstream integration to diversify economies and capitalize on emerging bio-based applications. Across Africa, nascent initiatives focus on leveraging agricultural residues for low-cost feedstock generation.

In Asia-Pacific, rapid urbanization and escalating infrastructure development generate substantial demand for energy-efficient insulation and lightweight automotive components, thereby boosting bio-based foam and elastomer uptake. Government incentives in key markets such as China, South Korea, and Japan are designed to accelerate industrial decarbonization, supporting pilot programs and scale-up projects. Transition economies in Southeast Asia are also exploring public–private partnerships to harness local biomass resources, reinforcing the region’s role as a critical growth engine for bio-based polyurethane.

This comprehensive research report examines key regions that drive the evolution of the Bio Polyurethane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Imperatives and Market Maneuvers of Leading Bio-Based Polyurethane Players Driving R&D, Partnerships, and Sustainable Portfolio Diversification

Industry leaders are increasingly positioning themselves through targeted innovations, capacity investments, and strategic alliances designed to assert dominance in the bio-based polyurethane arena. Major chemical companies with legacy polyurethane operations are retrofitting existing plants to accommodate bio-based polyol streams, thereby safeguarding utilization rates while diversifying portfolios. Concurrently, specialized proptech and green chemistry startups are forging partnerships with multinationals to co-develop drop-in renewable feedstocks that meet stringent technical specifications.

Collaboration models have become central to rapid market entry, with joint ventures spanning cross-border academic–industrial research clusters and public–private consortia accelerating go-to-market timelines. Several leading players have also announced merger and acquisition activity focused on securing intellectual property for next-generation bio-refining processes and proprietary catalyst systems. In parallel, cross-industry coalitions are emerging, uniting stakeholders from automotive OEMs, construction conglomerates, and healthcare device manufacturers to establish standardized lifecycle assessments and sustainability benchmarks.

Moreover, manufacturers are expanding their global footprint by commissioning new production lines in strategically located bio-refinery hubs, ensuring proximity to feedstock sources and end-market clusters. This geographically balanced expansion not only mitigates supply risk but also aligns with customer preferences for localized sourcing and reduced transportation emissions. Collectively, these strategic maneuvers underscore a concerted push to capture first-mover advantage in a market poised for exponential growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio Polyurethane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allnex Germany GmbH

- Arkema S.A.

- BASF SE

- Cargill, Incorporated

- COIM Group

- Covestro AG

- Eastman Chemical Company

- Emery Oleochemicals Group

- Evonik Industries AG

- FoamPartner Group

- FXI Holdings, Inc.

- Huntsman International LLC

- Inoac Corporation

- Lubrizol Corporation

- Malama Composites LLC

- Manali Petrochemicals Limited

- Mitsui Chemicals, Inc.

- Perstorp Holding AB

- RAMPF Holding GmbH & Co. KG

- Recticel NV/SA

- Stepan Company

- The Dow Chemical Company

- TSE Industries

- UBE Industries, Ltd.

- Wanhua Chemical Group Co., Ltd.

- Woodbridge Foam Corporation

Translating Market Intelligence into Strategic Actions to Propel Bio-Based Polyurethane Leadership Through Innovation, Sustainability, and Responsive Supply Chain Design

To capitalize on the accelerating transition toward bio-based polyurethane, industry stakeholders should pursue a multidisciplinary approach that integrates technological innovation with strategic ecosystem engagement. First, prioritizing investment in advanced bio-refinery research can yield proprietary polyol chemistries that offer unique performance differentiators, thereby commanding premium positioning in competitive markets. Secondly, establishing cross-functional partnerships-encompassing feedstock suppliers, process technology licensors, and end-user OEMs-will enable co-innovation and de-risk large-scale commercialization initiatives.

Furthermore, companies must adopt agile supply chain frameworks that blend conventional and bio-based intermediates, allowing for rapid adjustments in response to tariff shifts, raw material scarcity, or regulatory changes. Embedding digital traceability solutions ensures transparency in carbon accounting and product provenance, which is increasingly critical in sustainability reporting and green procurement requirements. In addition, proactive engagement with policy makers to shape favorable incentive structures and standards can accelerate market adoption and reduce regulatory uncertainty.

Finally, integrating robust lifecycle assessment protocols into product development cycles helps quantify environmental benefits and identify hotspots for continuous improvement. By embedding sustainability metrics into commercial decision frameworks, organizations can not only meet evolving customer expectations but also secure access to green financing and innovation grants, thereby strengthening their competitive moat.

Detailing the Comprehensive Research Framework Employing Primary Interviews, Secondary Data Triangulation, and Rigorous Validation to Ensure Robust Market Insights

This research report relies on a rigorous multi-step methodology that synthesizes qualitative and quantitative insights to ensure comprehensive market coverage and analytical depth. Primary research comprised in-depth interviews with industry executives, technology providers, end users, and thought leaders to validate emerging trends and gather firsthand perspectives on technical feasibility and commercial readiness. These interactions were supplemented by a structured survey of procurement specialists and R&D managers to quantify adoption barriers, performance priorities, and strategic investment plans.

Secondary research involved systematic analysis of industry publications, regulatory databases, patent filings, and white papers to inform competitive benchmarking and technology landscaping. We employed a triangulation approach, cross-verifying data points across multiple sources to enhance reliability and minimize bias. Our segmentation framework was developed to capture variations across product types, raw materials, and application domains, enabling targeted insights for diverse stakeholder groups.

Data quality was maintained through meticulous validation routines, including peer reviews by domain experts and consistency checks against historical market patterns. Finally, we applied strategic analysis tools-such as SWOT assessments, Porter’s Five Forces, and scenario planning-to contextualize findings and derive actionable implications. This methodological rigor ensures that the report’s conclusions are grounded in empirical evidence and industry-leading best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio Polyurethane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio Polyurethane Market, by Product Type

- Bio Polyurethane Market, by Raw Material

- Bio Polyurethane Market, by Application

- Bio Polyurethane Market, by Region

- Bio Polyurethane Market, by Group

- Bio Polyurethane Market, by Country

- United States Bio Polyurethane Market

- China Bio Polyurethane Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Consolidating Core Findings and Strategic Perspectives to Illuminate the Future Trajectory of Bio-Based Polyurethane Adoption and Industry Evolution

The convergence of sustainability imperatives, technological advancements, and evolving regulatory landscapes is ushering in a new epoch for bio-based polyurethane. Stakeholders across the value chain must recognize that traditional supply models are giving way to circular economy principles, where renewable feedstocks and lifecycle optimization dictate competitive advantage. As tariffs reshape trade flows and new production hubs emerge, agility and resilience become critical success factors.

Key segmentation insights reveal that tailored solutions across adhesives, elastomers, foams, and specialty coatings will unlock differentiated growth opportunities, while raw material innovation continues to redefine performance standards. Regional analysis underscores the importance of localized strategies that align with policy incentives and feedstock availability in the Americas, EMEA, and Asia-Pacific corridors. Strategic moves by leading companies highlight the effectiveness of partnerships, capacity expansions, and proprietary technology development in capturing first-mover advantage.

Looking ahead, industry participants that adopt integrated approaches-combining advanced R&D, dynamic supply chain design, and proactive policy engagement-will be best positioned to navigate the complexities of the emerging bio-based polyurethane ecosystem. By leveraging the insights contained in this report, decision-makers can chart a roadmap toward sustainable growth, enhanced profitability, and enduring market leadership.

Engage Directly with Associate Director Ketan Rohom to Secure Exclusive Access to the In-Depth Bio-Based Polyurethane Market Research Report Tailored to Your Needs

Ready to elevate your strategic planning and secure a competitive edge in the expanding bio-based polyurethane arena? Reach out to Associate Director Ketan Rohom to discuss how this comprehensive report can be tailored to your organization’s unique needs, providing you with actionable insights and market intelligence that drive sustainable growth and innovation. Unlock the full potential of bio-based polyurethane with expert guidance and bespoke service offerings designed to empower your decision-making process

- How big is the Bio Polyurethane Market?

- What is the Bio Polyurethane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?