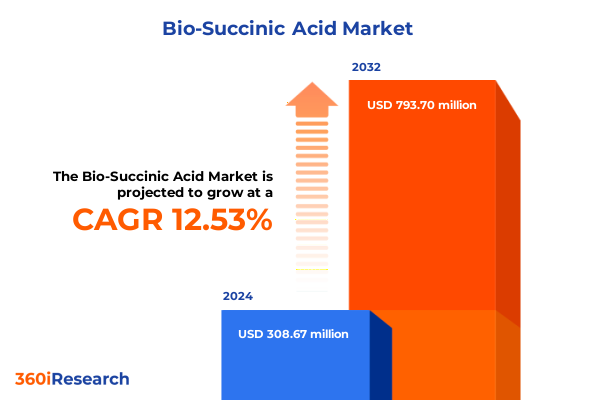

The Bio-Succinic Acid Market size was estimated at USD 339.07 million in 2025 and expected to reach USD 378.07 million in 2026, at a CAGR of 12.91% to reach USD 793.70 million by 2032.

Unveiling Bio-Succinic Acid’s Strategic Importance and the Crucial Drivers Fueling Its Adoption Across Sustainable Industries

The rising imperative of sustainable industrial practices has cast bio-succinic acid into the spotlight as a versatile building block for next-generation chemicals and materials. Derived from renewable biomass, this four-carbon dicarboxylic acid bridges the gap between petrochemical reliance and green innovation. As global industries strive to reduce carbon footprints and align with circular economy objectives, bio-succinic acid emerges as a critical enabler for applications spanning biodegradable polymers, eco-friendly plasticizers, and performance-grade solvent formulations.

Key strategic drivers underlie this expanding role. Technological advancements in fermentation processes and catalytic conversion pathways have significantly lowered production costs and enhanced yield efficiencies, fostering broader commercial adoption. Concurrently, regulatory frameworks increasingly favor bio-based solutions through tax incentives and renewable content mandates, catalyzing market pull from sectors such as packaging, automotive components, and personal care formulations. Moreover, corporate sustainability commitments and investor interest in low-carbon materials are generating new collaboration models between biomanufacturers and end-use industries.

In this context, stakeholders across the value chain must navigate a complex interplay of innovation, policy evolution, and shifting consumer preferences. Understanding the foundational drivers of this transformation is essential for positioning products, optimizing supply chains, and aligning R&D roadmaps. This report provides an executive overview of these critical elements, setting the stage for deeper analysis of emerging trends, tariff implications, and targeted segmentation insights that shape the bio-succinic acid landscape today.

Examining the Rapid Technological and Market Shifts Transforming the Bio-Succinic Acid Landscape with Innovation and Sustainability at the Forefront

The bio-succinic acid market is undergoing a rapid metamorphosis, marked by breakthroughs in microbial engineering and continuous processing techniques that are reshaping production economics. Recent advances in strain optimization, leveraging metabolic pathway engineering and adaptive evolution strategies, have yielded microbial cell factories with superior substrate conversion rates and reduced downstream purification burdens. At the same time, innovations in pervaporation, membrane filtration, and reactive distillation are streamlining separation processes, thus driving economies of scale previously unattainable in biocatalytic systems.

Beyond the manufacturing floor, strategic alliances between specialty chemical producers and biotechnology firms are accelerating the co-development of application-specific formulations. These partnerships are fostering novel bio-resins and polyurethane precursors that meet stringent performance criteria, while simultaneously capitalizing on the innate environmental advantages of bio-derived succinic acid. Moreover, the integration of digital twins and process analytics has enhanced operational transparency, enabling real-time monitoring, predictive maintenance, and reduced energy consumption across production facilities.

This dynamic convergence of technology and collaboration reflects a broader transformation in the industrial chemicals sector, where sustainability is no longer a peripheral objective but a core competency. As firms refine their value propositions around circularity, low-carbon footprints, and resource efficiency, bio-succinic acid is positioned at the nexus of innovation and environmental stewardship. These trends not only redefine competitive benchmarks but also open doors to new market segments that value both performance and ecological responsibility.

Analyzing the Comprehensive Effects of Recent United States 2025 Tariff Policies on Bio-Succinic Acid Trade Dynamics and Supply Chain Resilience

In early 2025, the United States implemented revised tariff schedules on select bio-based platform chemicals, directly impacting the importation costs of suucinic acid derived through foreign fermentation processes. The new measures, designed to incentivize domestic manufacturing, introduced a differentiated duty rate structure that elevated the tariffs on high-purity crystalline imports while offering modest relief for solution-phase intermediates. This recalibration of trade policy has immediate implications for pricing strategies and supply chain configurations.

Domestic producers have experienced a tangible uplift in market competitiveness as the tariff differentials narrow the landed cost gap between local and imported succinic acid. However, downstream formulators reliant on imported high-concentration solution grades are facing upward pressure on raw material expenses, prompting a reevaluation of procurement strategies. In response, several multinational corporations are accelerating investments in US-based fermentation facilities and forging joint ventures to safeguard against future trade uncertainties. This strategic pivot not only mitigates exposure to further tariff escalations but also aligns with federal incentives for renewable chemical production.

Furthermore, the tariff implementation has fostered resilience among domestic logistics networks by encouraging the diversification of feedstock sources and the development of regional inland terminals. These adjustments enhance throughput flexibility and reduce lead times, ultimately supporting stable production scheduling. As a result, stakeholders can better anticipate and adapt to policy fluctuations, ensuring continuity of supply even in the face of evolving trade landscapes.

Delivering Deep Insights into Distinct Product and Production Method Segments Driving Diverse Applications and Sales Channels in the Bio-Succinic Acid Market

The bio-succinic acid ecosystem is characterized by a multifaceted segmentation that defines production modalities, product configurations, application arenas, and distribution pathways. Within the product form segment, crystalline, powder, and solution grades cater to distinct processing requirements, with high-concentration solutions gaining traction among formulators seeking seamless integration into downstream polymerization and esterification operations. In parallel, low and medium concentration solutions serve niche applications where precise acid loading and rheological control are paramount.

Production methods bifurcate into chemical synthesis and fermentation routes. Catalytic hydrogenation and butadiene oxidation underpin the chemical synthesis pathway, offering established catalytic cycles but relying on petrochemical feedstocks. Meanwhile, the fermentation segment leverages microbial platforms-bacteria, fungi, and yeast strains each offering trade-offs in yield, robustness, and substrate versatility. Advances in bioreactor design and media optimization are steadily enhancing the volumetric productivity of each organism class, narrowing the historical gap in cost competitiveness with chemical synthesis.

Applications span food additives, personal care, and pharmaceuticals, while the plasticizer subset divides into PVC and rubber plasticizers tailored for flexibility enhancement and low-temperature performance. Polyester polyols derived from bio-resins and polyurethane prepolymers underscore the importance of succinic acid in high-performance coatings and elastomers, whereas solvent applications, including coatings and inks alongside industrial cleaning solutions, underscore its multifunctional utility.

End-use industries range from agriculture and automotive to consumer goods, packaging, and pharmaceuticals. Aftermarket and OEM channels in automotive underscore distinct quality and certification demands, while flexible and rigid packaging formats exploit succinic acid’s biodegradability. Sales channels traverse direct engagements with key accounts to distributor networks offering regional coverage and logistical convenience. This intricate segmentation matrix underscores the necessity for targeted strategies that address the unique requirements within each domain.

This comprehensive research report categorizes the Bio-Succinic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Production Method

- Application

- End Use Industry

- Sales Channel

Exploring the Divergent Regional Trends Shaping Bio-Succinic Acid Demand and Investment Patterns across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the bio-succinic acid arena exhibit nuanced divergences that reflect varying policy environments, feedstock availability, and end-user demand profiles. In the Americas, robust infrastructure investments and favorable renewable chemical incentives have catalyzed domestic capacity expansions. The region’s integrated downstream ecosystem, encompassing polymer converters and specialty chemical formulators, leverages close proximity to major feedstock sources, reinforcing a competitive advantage in high-purity product grades and solution formulations.

Within Europe, Middle East and Africa, stringent environmental regulations and ambitious decarbonization targets drive robust policy support for bio-based alternatives. The European Union’s circular economy action plan and the Middle East’s diversification initiatives are generating co-investment opportunities in green chemical parks and pilot-scale biorefineries. African markets, while nascent, are attracting international interest for biomass feedstock cultivation and small-scale fermentation ventures designed to serve regional agricultural and packaging sectors.

The Asia-Pacific region stands out for its rapidly growing demand, fueled by large-scale industrial applications and government-backed sustainability mandates. China’s strategic focus on biomanufacturing corridors and India’s expanding polymer processing industry are accelerating localized production capacities, reducing dependence on imports. Southeast Asia’s emerging consumer goods and personal care markets are likewise driving uptake of bio-succinic acid in performance formulations, while Australia’s clean technology initiatives further diversify the regional opportunity set.

These disparate regional trajectories underscore the importance of tailored market entry and expansion strategies, as each geography presents unique regulatory considerations, logistical challenges, and growth vectors that industry participants must navigate to optimize their competitive positioning.

This comprehensive research report examines key regions that drive the evolution of the Bio-Succinic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Initiatives and Competitive Positioning of Leading Bio-Succinic Acid Producers Shaping Industry Evolution

Leading organizations in the bio-succinic acid domain are advancing their market positions through a blend of capacity scaling, strategic partnerships, and targeted R&D initiatives. Companies with established fermentation platforms are expanding production footprints to meet surging demand for high-purity solution grades, while chemical synthesis players are diversifying their feedstock inputs to include bio-derived intermediates and renewable hydrogen sources.

Collaborative ventures between biotechnology startups and legacy chemical enterprises are a hallmark of the current landscape, with joint investments in demonstration facilities serving as proving grounds for process intensification technologies. These alliances facilitate knowledge transfer, risk sharing, and accelerated commercialization timelines. At the same time, proprietary catalyst development and enzyme engineering programs are yielding next-generation conversion pathways that promise further cost reduction and performance enhancement.

Commercial agreements with polymer compounders and international OEMs provide a direct conduit for end-market feedback, enabling iterative improvements in product specification and formulation compatibility. Concurrently, intellectual property portfolios are being fortified through strategic patent filings around novel fermentation strains, downstream processing units, and derivative chemistries, ensuring long-term barriers to entry.

By integrating sustainability metrics into core business strategies and engaging in cross-sector collaborations, these companies are not only securing short-term revenue growth but also laying the groundwork for a resilient, low-carbon chemicals industry ecosystem that is poised to redefine value creation in the decades ahead.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-Succinic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Sunsing Chemicals Co., Ltd.

- Anqing Hexing Chemical Co., Ltd.

- BASF SE

- BioAmber Inc.

- Biobased Succinic Acid Company

- Corbion N.V.

- DSM N.V.

- DSM‑Firmenich AG

- Gadiv Petrochemical Industries Ltd.

- GC Innovation America LLC

- Jiangsu Yabang Chemical Group Co., Ltd.

- Kawasaki Kasei Chemicals Ltd.

- Kawaski Kasei Chemicals Ltd.

- Lanzatech Inc.

- Mitsubishi Chemical Corporation

- Myriant Corporation

- Myriant Technologies LLC

- Nippon Shokubai Co., Ltd.

- PTT Global Chemical Public Company Limited

- Reverdia B.V.

- Roquette Frères

- Shandong Lixing Chemical Co., Ltd.

- Shandong Shouguang Luqing Petrochemical Co., Ltd.

- Shanghai Tongli Bioengineering Co., Ltd.

- Succinity GmbH

Presenting Actionable Recommendations for Industry Leaders to Capitalize on Bio-Succinic Acid Innovations and Strengthen Market Competitiveness

To harness the full potential of bio-succinic acid, industry leaders should prioritize investments in advanced fermentation technologies, including continuous‐flow bioreactors and real-time analytics, to drive down production costs and enhance operational agility. Embracing modular process designs will allow for rapid scaling of capacity in response to dynamic market signals, while joint development agreements with downstream end users can accelerate application validation and reduce time-to-market.

Corporate stakeholders are advised to diversify supply chains by establishing partnerships with regional biomass suppliers and contract manufacturers, thereby mitigating the risk of feedstock price volatility and regulatory uncertainty. Engaging in industry consortia to shape supportive policy frameworks and standardization efforts can further strengthen the ecosystem and unlock incentives for renewable chemical adoption.

From a commercial standpoint, segment-specific go-to-market strategies should be tailored based on product form and concentration requirements, leveraging direct account management for high-value OEM collaborations and distributor networks to penetrate decentralized end-use industries. Additionally, capturing emerging opportunities in bio-resins, sustainable plasticizers, and eco-certified solvents will require coordinated marketing campaigns that highlight the unique performance and environmental benefits of bio-succinic acid offerings.

Finally, embedding lifecycle assessment metrics into product development and client reporting will enhance transparency and credibility, positioning companies as trusted partners in corporate sustainability journeys. By aligning technological innovation with strategic collaboration and policy engagement, industry players can secure long-term growth and competitive differentiation in the evolving bio-succinic acid landscape.

Outlining Rigorous Research Methodology and Analytical Framework Underpinning the Bio-Succinic Acid Market Study with Emphasis on Data Integrity and Validation

The research underpinning this market analysis was conducted through a rigorous, multi-stage methodology designed to ensure data integrity and comprehensive coverage of industry dynamics. Initially, an extensive review of secondary sources, including patent databases, regulatory filings, and technical journals, provided contextual grounding for emerging technologies and policy environments. This foundation was augmented by primary interviews with senior executives, process engineers, and purchasing managers across the value chain, ensuring first-hand insights into operational challenges and commercial priorities.

Quantitative data collection encompassed shipment volumes, capacity expansions, and tariff schedules, collated from trade associations, government publications, and logistics providers. Triangulation techniques were employed to validate data points, cross-referencing diverse sources to minimize discrepancies. Additionally, a proprietary framework facilitated the segmentation of product forms, production methods, applications, end-use industries, and sales channels, enabling a nuanced interpretation of market drivers.

Analytical procedures incorporated SWOT analyses, Porter’s Five Forces evaluation, and scenario planning to assess competitive pressures and strategic trajectories. Regional assessments were informed by country-specific policy analyses and feedstock availability studies, while company profiles were developed through financial disclosures, press releases, and expert consultations.

Throughout the process, strict quality control measures were enforced, including peer reviews, data audits, and consistency checks. This methodological rigor ensures that the insights presented herein are robust, actionable, and reflective of current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-Succinic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-Succinic Acid Market, by Product Form

- Bio-Succinic Acid Market, by Production Method

- Bio-Succinic Acid Market, by Application

- Bio-Succinic Acid Market, by End Use Industry

- Bio-Succinic Acid Market, by Sales Channel

- Bio-Succinic Acid Market, by Region

- Bio-Succinic Acid Market, by Group

- Bio-Succinic Acid Market, by Country

- United States Bio-Succinic Acid Market

- China Bio-Succinic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Summarizing the Critical Takeaways from the Bio-Succinic Acid Analysis and Emphasizing the Imperatives for Future Industry Momentum

The analysis of the bio-succinic acid landscape reveals a market in the midst of transformative growth, driven by technological innovation, regulatory support, and evolving sustainability priorities. Key takeaways highlight the importance of advanced fermentation and separation technologies in achieving cost competitiveness, the strategic impact of recent tariff adjustments on regional supply chains, and the critical role of targeted segmentation in addressing diverse application requirements.

Regional insights underscore the need for tailored market entry strategies that reflect distinct policy frameworks and infrastructure capabilities in the Americas, Europe, Middle East, Africa, and Asia-Pacific. Leading companies are solidifying their positions through capacity expansions, collaborative ventures, and intellectual property development, setting the stage for a low-carbon chemicals ecosystem that balances performance with environmental stewardship.

To capitalize on these opportunities, industry participants must embrace modular process designs, supply chain diversification, and proactive engagement with regulatory bodies. By aligning commercial strategies with lifecycle transparency and sustainability metrics, organizations can unlock new growth vectors and enhance their competitive differentiation.

In essence, the bio-succinic acid sector offers a compelling platform for innovation and strategic value creation. Stakeholders who integrate technological excellence, collaborative partnerships, and policy advocacy into their core strategies will be best positioned to navigate future market shifts and drive enduring success.

Driving Immediate Engagement with a Personalized Call to Action to Secure Comprehensive Bio-Succinic Acid Market Insights from Associate Director Sales Marketing

To obtain the comprehensive report and unlock strategic insights that will guide your organization’s initiatives in the bio-succinic acid domain, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in translating technical analysis into actionable business opportunities ensures a seamless engagement process. By securing the full study, stakeholders will gain unparalleled visibility into segment-specific dynamics, regional variances, regulatory impacts, and competitive benchmarks that are crucial for informed decision-making.

Connect with Ketan to explore customized licensing, volume access, and tailored consultancy services that extend beyond the standard deliverables. Whether you are seeking in-depth application case studies, targeted R&D roadmaps, or strategic partnership frameworks, his team is prepared to facilitate expedited access and support your strategic priorities. Act now to leverage the most current and authoritative research on bio-succinic acid, empowering your organization to capitalize on sustainability-driven growth and secure competitive advantage.

- How big is the Bio-Succinic Acid Market?

- What is the Bio-Succinic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?