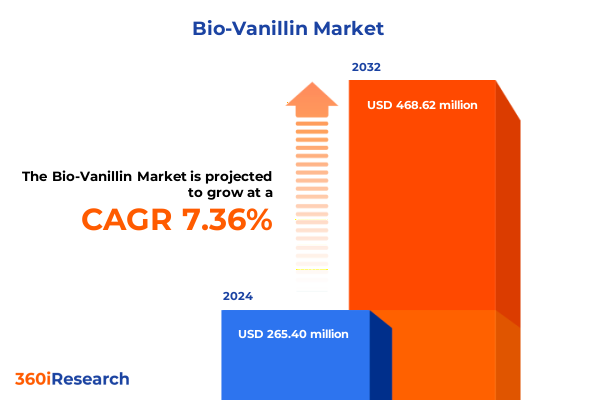

The Bio-Vanillin Market size was estimated at USD 280.29 million in 2025 and expected to reach USD 296.10 million in 2026, at a CAGR of 7.61% to reach USD 468.62 million by 2032.

Navigating the Emergence of Bio-Vanillin as a Sustainable Flavoring Alternative in a Rapidly Evolving Global Ingredients and Clean Label Market

Vanillin has long been revered as one of the most ubiquitous and cherished flavor compounds, infusing sweetness and complexity into a vast array of products ranging from confectionery and beverages to fragrances and pharmaceuticals. Yet traditional vanilla bean extract meets less than one percent of global demand, constrained by volatile harvests, climatic uncertainties, and labor-intensive cultivation methods. As a result, industry stakeholders have sought viable alternatives capable of delivering identical sensory profiles without the supply-chain vulnerabilities inherent to natural vanilla pods. In response, bio-vanillin has emerged as a compelling solution that marries consumer preference for natural ingredients with the reliability and scalability of biotechnological production.

Bio-vanillin encompasses the spectrum of nature-identical vanillin produced through renewable feedstocks such as lignin, ferulic acid, and other agro-industrial byproducts. Biotechnological platforms leverage microbial fermentation, metabolic engineering, and enzyme-catalyzed reactions to yield high-purity vanillin molecules that mirror the flavor profile of vanilla bean extract. These processes enable manufacturers to decouple supply from crop yields, reduce environmental impact, and respond swiftly to shifts in market demand.

The advent of bio-vanillin coincides with a broader clean-label movement, in which brands and consumers place a premium on transparency, sustainability, and ingredient provenance. With regulatory agencies increasingly recognizing fermentation-derived vanillin as a nature-identical flavor in certain contexts, the stage is set for bio-vanillin to redefine standards for authentic taste, supply resilience, and environmental stewardship.

Transformative Production Paradigms with Metabolic Engineering, Enzyme Innovations and Regulatory Labeling Policies Driving Bio-Vanillin Adoption Worldwide

The bio-vanillin landscape has undergone a profound transformation driven by breakthroughs in metabolic engineering and enzyme technology. Recent academic and industrial research has spotlighted microalgae and prokaryotic hosts as promising platforms for vanillin biosynthesis, with metabolic pathways optimized to harness C O₂ capture and convert ferulic acid into flavor-grade compounds. Metabolic engineering strategies have produced host strains capable of delivering nature-identical vanillin at yields and titers previously unattainable through conventional extraction methods.

In parallel, enzyme innovation has introduced cofactor-independent catalysts that facilitate one-step conversion of plant-derived ferulic acid into vanillin. A recent study from Tokyo University of Science demonstrated an evolved dioxygenase variant that achieves gram-scale vanillin production under ambient conditions, eliminating the need for costly cofactors and streamlining downstream purification. This enzyme-driven process offers a sustainable pathway to natural vanillin that could be integrated into commercial biorefineries.

Microbial hosts beyond traditional yeast and E. coli are also making strides. Corynebacterium glutamicum strains engineered to express heterologous aromatic carboxylic acid reductases have achieved a record accumulation of 22 grams per liter of vanillin, underscoring the commercial viability of microbial fermentation for flavor compound production. These advances in strain engineering and process optimization highlight the potential for bio-vanillin to achieve cost parity with synthetic alternatives while meeting clean-label requirements.

Regulatory frameworks are likewise evolving to accommodate these innovations. The U.S. Food and Drug Administration now permits labeling fermentation-derived vanillin as “vanillin derived naturally through fermentation,” provided that branding does not imply vanilla-bean origin. At the same time, the Alcohol and Tobacco Tax and Trade Bureau has approved specific natural processes for nonbeverage products, enabling companies to market fermentation-sourced vanillin without synthetic flavor designations. These regulatory adaptations are accelerating market acceptance and opening new avenues for product differentiation.

Assessing the Far-Reaching Effects of Newly Imposed United States Antidumping and Countervailing Duties on the Vanillin Supply Chain in 2025

In 2025, the United States solidified its stance on vanillin imports by issuing affirmative injury determinations and imposing both antidumping and countervailing duties on Chinese-produced vanillin. The U.S. International Trade Commission concluded that subsidized and unfairly priced imports were materially injuring domestic industry, prompting the Department of Commerce to prepare countervailing duty and antidumping orders. These measures will require importers to face preliminary subsidy rates of 27.33 percent on vanillin from China, with final determinations expected to raise the rate above 42 percent. Concurrently, antidumping margins have been established at rates approaching 190.20 to 379.87 percent, reflecting the breadth of dumping margins identified across key exporters.

These tariff actions have reverberated throughout the supply chain, reshaping competitive dynamics and cost structures. Imports from major Chinese producers are now subject to steep cash deposit requirements, effectively limiting their market share and creating an opportunity for domestic and non-Chinese suppliers to capture incremental volume. This supply-side realignment has prompted U.S. manufacturers to accelerate investments in local bio-vanillin fermentation facilities and seek alternative sourcing from within the Americas and Europe.

The market response has been swift and pronounced. Domestic upstream suppliers of ferulic acid and lignin, as well as downstream flavor houses, have reported increased inquiries for fermentation-derived vanillin, driven by a need to secure supply and mitigate the risk of retroactive duty liabilities. The imposition of duties has also led to a surge in share prices for companies positioned to benefit from reduced Chinese competition, illustrating investor confidence in the long-term resilience of bio-vanillin as a strategic response to trade barriers.

Illuminating Key Segmentation Insights in Source Types, Forms, Purity Grades and Multifaceted Applications of the Bio-Vanillin Market Landscape

The source of bio-vanillin offers critical insights into cost, sustainability, and consumer perception. Natural vanillin extracted directly from vanilla beans commands premium positioning in luxury and artisanal applications, while fermentation-sourced vanillin bridges the gap between natural appeal and scalable production. Synthetic vanillin, derived from petrochemical precursors, remains cost-effective but faces declining consumer acceptance as clean-label trends intensify. Within the natural category, extraction methods rely on vanilla pod yields and are subject to agricultural constraints, whereas fermentation processes harness renewable feedstocks such as ferulic acid and lignin, providing greater supply flexibility and reduced environmental footprint.

Form influences both application and processing requirements. Powdered vanillin is favored for dry blends, baking mixes, and confectionery due to its stability and ease of metering, while liquid vanillin is increasingly adopted in beverage systems and flavor premixes where rapid solubility and homogeneous distribution are paramount. This duality allows manufacturers to tailor form factors to specific production lines, balancing convenience and functionality.

Purity grade directly impacts end-use integrity and regulatory compliance. High-purity vanillin is essential for pharmaceutical formulations and high-end fragrance compounds, ensuring consistent olfactory and organoleptic profiles. Standard-grade vanillin satisfies the quality demands of food and beverage applications, where trace levels of impurities pose minimal risk to consumer safety. This stratification of purity facilitates optimized cost-to-performance ratios across diverse market segments.

Applications for bio-vanillin span multiple industries. Within cosmetic and personal care, vanillin enhances hair care formulations, enriches perfume accords, and provides soothing aromatic notes in skin care products. In the food and beverage sector, vanillin imparts signature flavor characteristics to beverages, confectionery items, and dairy products, driving consumer appeal and product differentiation. The fragrance industry leverages bio-vanillin for its warm, creamy top notes, while pharmaceutical companies utilize it to mask bitter APIs and improve patient compliance. This breadth of applications underscores bio-vanillin’s versatility and strategic importance across value chains.

This comprehensive research report categorizes the Bio-Vanillin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Purity Grade

- Application

Unveiling Critical Regional Dynamics Shaping Bio-Vanillin Demand and Production Trends Across the Americas, EMEA and Asia-Pacific Regions

In the Americas, the United States remains at the forefront of bio-vanillin innovation, driven by robust demand for clean-label ingredients in food, beverage, and cosmetic applications. U.S. producers are rapidly scaling fermentation capabilities to meet domestic demand while navigating newly imposed trade duties on Chinese imports. Latin American vanilla-bean exporters, particularly Mexico and Guatemala, have also attracted interest from manufacturers seeking natural extraction sources, further diversifying supply within the hemisphere.

Europe, the Middle East, and Africa represent a dynamic and highly regulated market. The European Union’s stringent food additive regulations and the growing emphasis on sustainability have accelerated adoption of bio-vanillin produced via biotechnological routes. Regions within the Middle East and Africa are increasingly investing in local fermentation capacities to reduce import reliance, while North African vanilla-bean producers benefit from strategic geographic proximity to European flavor houses.

The Asia-Pacific region remains the largest global producer of synthetic vanillin, with China, India, and Southeast Asian nations dominating output. However, interest in fermentation-derived and extraction-based bio-vanillin is on the rise as governments introduce regulations to curb synthetic additives and foster biotechnology development. Japan and South Korea lead in high-purity applications for cosmetics and pharmaceuticals, while Australia and New Zealand focus on sustainable sourcing and organic certification to meet consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the Bio-Vanillin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deep Dive into Leading Bio-Vanillin Innovators, Flavor and Fragrance Manufacturers and Strategic Partnerships Shaping Market Competitiveness

Key innovators in the bio-vanillin space have secured regulatory recognition for their processes, enabling them to market fermentation-derived vanillin as a natural flavor. Companies such as Spero Renewables, Advanced Biotech, Apple Flavors & Fragrances, Axxence Aromatic, Comax Flavors, Ennolys, Kunshan Asia Aroma, Mane, Premium Flavor Systems, Shaanxi Healthful Bioengineering, Shenzhen Siyomicro, Solvay SA, Symrise, Vigon, Xiamen Bestally Biotech, Givaudan, and Shanghai Zelixir have successfully demonstrated to U.S. authorities that their production pathways meet criteria for natural process designations.

Despite the headwinds of global trade tariffs, established fragrance and flavor conglomerates have reported resilient financial performance. In 2024, Givaudan achieved a gross margin of 44.1 percent and EBITDA growth of 23.8 percent, driven by higher volumes and efficiency measures. In the first half of 2025, the company maintained a stable 44.0 percent gross margin and expanded its EBITDA margin to 25.2 percent, underscoring its ability to absorb increased input costs including tariff impacts.

Symrise has outlined a strategy to drive annual organic growth of five to seven percent through 2030 by focusing on health-oriented and natural ingredients, high-margin product applications, and strategic acquisitions. The company aims to further enhance profitability within a target EBITDA margin corridor of 20 to 23 percent, leveraging its proven track record of innovation in natural flavor solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bio-Vanillin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Biotech Inc.

- Apple Flavor & Fragrance Group Co., Ltd.

- Archer‑Daniels‑Midland Company

- Axxence Aromatic GmbH

- Borregaard ASA

- Camlin Fine Sciences Ltd.

- Comax Flavors Inc.

- De Monchy Aromatics

- Ennolys

- Evolva Holding S.A.

- Firmenich S.A.

- Fujian Zhiyuan Biochemical Co., Ltd.

- Givaudan S.A.

- International Flavors & Fragrances Inc.

- Lesaffre S.A.

- Nielsen‑Massey Vanillas LLC

- Omega Ingredients Ltd.

- Prinova Group LLC

- Shank’s Extracts Inc.

- Solvay S.A.

- Symrise AG

- Takasago International Corporation

- Xiamen Oamic Biotech Co., Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Bio-Vanillin’s Growth Potential Amid Tariff Challenges and Regulatory Shifts

Industry leaders should prioritize strategic investment in advanced fermentation platforms and enzyme engineering collaborations to achieve cost efficiencies and enhance yield. By forming targeted partnerships with biotechnology firms and academic institutions, companies can accelerate the transition from bench-scale processes to commercial-scale production while sharing development risks.

To navigate tariff-induced market shifts, organizations must diversify supply chains across multiple regions and feedstocks. Securing alternative sources of vanilla beans, ferulic acid, and lignin within the Americas and EMEA, as well as exploring in-country fermentation footprint expansion in Asia-Pacific, can mitigate the impact of retroactive duties and supply disruptions.

Clear communication of sustainable credentials and natural process certifications is essential for brand differentiation. Engagement with regulatory bodies to secure favorable labeling approvals and participation in industry consortiums will bolster market credibility. Moreover, adopting robust risk management practices-including forward contracts and hedging strategies-will protect margins against commodity price volatility and trade policy fluctuations.

Finally, embedding sustainability metrics-such as life-cycle assessment outcomes and carbon footprint reductions-into value propositions will resonate with increasingly conscious consumers. By aligning product innovation with environmental and social governance objectives, companies can build resilient brands poised for long-term growth in the evolving bio-vanillin landscape.

Comprehensive Research Methodology Leveraging Primary Interviews, Regulatory Filings, Academic Literature and Expert Validation for Bio-Vanillin Insights

This analysis integrates primary research with secondary data sources to ensure comprehensive coverage of the bio-vanillin market. Primary research activities included in-depth interviews with flavor technologists, process engineers, and regulatory experts at leading biotechnology firms and flavor houses. These discussions provided firsthand insights into production challenges, capacity expansion plans, and evolving labeling policies.

Secondary research leveraged publicly available regulatory filings from the U.S. International Trade Commission, Federal Register notices, and Department of Commerce determinations to assess the impact of antidumping and countervailing duty investigations. Additional data were sourced from academic journals, including peer-reviewed articles on metabolic engineering and enzyme catalysis, as well as technical briefings from the U.S. Food and Drug Administration and the Alcohol and Tobacco Tax and Trade Bureau.

Data triangulation and expert validation sessions were conducted to reconcile disparate data points, refine production cost estimates, and validate regulatory interpretations. Market participants reviewed draft findings to ensure factual accuracy and relevance to strategic decision-making. This multi-method approach underpins the report’s actionable insights, ensuring rigor, reliability, and relevance for stakeholders evaluating opportunities in bio-vanillin production and commercialization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bio-Vanillin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bio-Vanillin Market, by Source

- Bio-Vanillin Market, by Form

- Bio-Vanillin Market, by Purity Grade

- Bio-Vanillin Market, by Application

- Bio-Vanillin Market, by Region

- Bio-Vanillin Market, by Group

- Bio-Vanillin Market, by Country

- United States Bio-Vanillin Market

- China Bio-Vanillin Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Reflections on Bio-Vanillin’s Role in Sustainable Flavoring Innovation, Tariff Resilience and Future Growth Pathways for Stakeholders

Bio-vanillin stands at the nexus of innovation, sustainability, and regulatory evolution, offering a strategic pathway to address the global demand-supply mismatch in vanilla flavoring. Advances in microbial fermentation, enzyme catalysis, and metabolic engineering have positioned bio-vanillin as a scalable, nature-identical alternative that meets consumer expectations for transparency and clean-label credentials. Meanwhile, newly imposed trade measures have reshaped competitive dynamics, elevating domestic production and diversifying sourcing strategies.

The segmentation analysis underscores how source category, form factor, and purity grade inform application-specific opportunities, while regional insights reveal varied adoption drivers across the Americas, EMEA, and Asia-Pacific. Leading companies have demonstrated resilience in navigating tariff headwinds through performance improvement programs, strategic acquisitions, and targeted process innovations.

Looking ahead, industry stakeholders must continue to refine production platforms, engage proactively with regulatory authorities, and communicate sustainability outcomes to maintain a competitive edge. By aligning technical capabilities with market needs and policy frameworks, bio-vanillin producers and users can chart a path toward resilient supply chains, differentiated product offerings, and sustainable growth in the evolving flavor landscape.

Engage with Ketan Rohom to Secure the Most Comprehensive Bio-Vanillin Market Research Report and Strategically Position Your Business for Success

To explore this in-depth analysis and gain access to the complete market research report on bio-vanillin, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By engaging with Ketan, you will secure strategic insights, customized data, and dedicated support tailored to your organization’s needs. Position your business at the forefront of the bio-vanillin evolution by obtaining this report today and capitalize on emerging opportunities in sustainability, innovation, and regulatory compliance. Contact Ketan Rohom now to initiate your acquisition process and begin charting your path to growth with confidence.

- How big is the Bio-Vanillin Market?

- What is the Bio-Vanillin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?