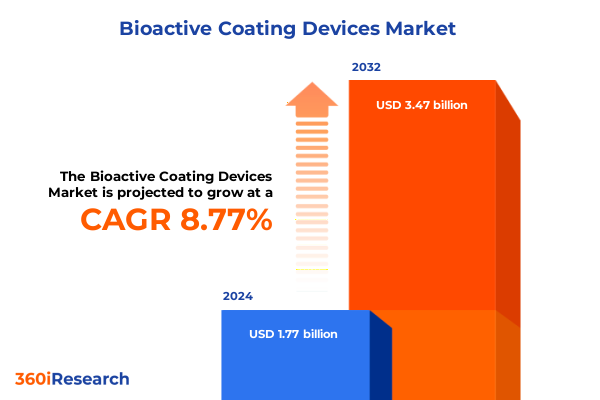

The Bioactive Coating Devices Market size was estimated at USD 1.93 billion in 2025 and expected to reach USD 2.10 billion in 2026, at a CAGR of 8.74% to reach USD 3.47 billion by 2032.

Revolutionary Advances in Bioactive Coating Devices Are Reshaping Medical Treatment Paradigms with Enhanced Outcomes and Unprecedented Biocompatibility

Bioactive coating devices encompass medical implants and instruments that incorporate specialized surface treatments designed to interface with biological tissues and fluids. By leveraging hydrophilic, antimicrobial, and drug-eluting chemistries, these coatings actively support cell adhesion, inhibit biofilm formation, and control localized release of therapeutic agents. Such multifaceted functionalities not only enhance device integration but also mitigate post-implantation complications, setting a new standard for patient-centric interventions. Recent innovations in ultra-thin polymeric layers and nanoparticle-infused formulations have enabled finely tuned interactions at the cellular level, bridging the gap between inert hardware and living tissue.

The momentum behind bioactive coatings is underpinned by demographic and clinical imperatives. An aging global population, projected to include 1.4 billion individuals aged 60 and over by 2030, has intensified demand for cardiovascular stents, orthopedic implants, and dental prostheses that support long-term performance without adverse immune responses. At the same time, the rise in chronic conditions-such as diabetes, cardiovascular disease, and osteoporosis-has fueled adoption of devices that can deliver localized drug therapies or exhibit anti-thrombogenic surfaces. Healthcare systems worldwide are seeking solutions that reduce readmission rates, lower overall treatment costs, and improve quality-of-life metrics, making bioactive coating devices an integral component of modern care pathways.

Emerging Technological Breakthroughs and Regulatory Innovations Are Driving Transformative Shifts in the Global Bioactive Coating Devices Landscape

The landscape of bioactive coating devices has undergone a profound transformation driven by cutting-edge deposition techniques and materials science breakthroughs. Vapor-phase methods such as chemical vapor deposition (CVD) have emerged as a cornerstone technology, offering atomically precise, conformal coatings on complex geometries. By tailoring precursor chemistries and process parameters, CVD-derived layers can deliver enhanced wear resistance, corrosion protection, and biofunctionalization within a single process step. These capabilities are especially pivotal for cardiovascular and orthopedic implants, where durability and biocompatibility are critical for long-term efficacy.

In parallel, solution-based approaches like sol-gel and electrophoretic deposition have matured to enable the integration of bioactive glass, hydroxyapatite, and silver nanoparticles onto implant surfaces. Such hybrid coatings achieve a controlled release of bioactive ions that promote osteointegration and antimicrobial defense. Additional innovations include matrix-assisted pulsed laser evaporation (MAPLE), which fabricates composite films of alendronate-doped hydroxyapatite to modulate osteoclast activity, and dip- and spin-coating processes that ensure uniformity across intricate scaffold architectures. Together, these advancements have shifted the paradigm from passive, single-function barriers to dynamic, multifunctional interfaces that actively direct healing and regeneration.

Accelerating Costs and Supply Chain Realignments Driven by the Cumulative Impact of United States Tariffs on Bioactive Coating Device Manufacturing in 2025

The cumulative impact of United States tariffs enacted in early 2025 has introduced significant headwinds across the bioactive coating devices supply chain. In February 2025, a 25% ad valorem tariff on imports from Canada and Mexico and a 10% levy on inputs from China were implemented, targeting raw materials including titanium dioxide, hydroxyapatite, and specialty polymers. This policy has accelerated efforts to secure domestic feedstocks but has also led to immediate cost pressures for device manufacturers reliant on established import channels.

Moreover, the March 4, 2025 activation of a uniform 25% tariff on Mexican-origin goods underlined the government’s broader strategy to fortify local production. While this measure is intended to enhance supply chain resilience and national security, it has also created a scramble among OEMs and coating formulators to identify alternative procurement strategies. Many firms are pursuing dual sourcing agreements, relocating portions of manufacturing to tariff-neutral regions, and investing in onshore capacity expansions. Although these strategic shifts promise long-term stability, the transition phase has produced inventory constraints and elongated lead times, underscoring the need for agile supply chain management and cost mitigation tactics.

Unveiling Critical Market Segmentation Insights Spanning Device Types, Coating Materials, Technologies, Applications, and End-User Dynamics

A nuanced understanding of market segmentation reveals the diverse pathways through which bioactive coating devices deliver value. When analyzed by device type, dressings, implants, scaffolds, and stents each present distinctive functional requirements that shape coating composition and performance criteria. For instance, dressings prioritize moisture management and antimicrobial efficacy, whereas orthopedic and cardiovascular implants demand mechanical robustness and controlled elution of bioactive agents.

Exploring the segment by coating material highlights a spectrum of bioactive glasses, chitosan, collagen, hydroxyapatite, silver nanoparticles, and titanium dioxide. Each material brings unique properties-from osteoconductivity and antimicrobial action to enhanced tissue adhesion-enabling customization across clinical use cases. Concurrently, technology segmentation-including chemical vapor deposition, dip coating, electrophoretic deposition, laser deposition, plasma spraying, sol-gel, and spin coating-underscores how process selection can influence layer thickness, porosity, and release profiles.

Application-driven segmentation further delineates cardiovascular stents, dental implants, orthopedic implants, tissue engineering scaffolds, and wound dressings, with additional granularity such as drug-eluting stents within the stent category and endosseous versus subperiosteal devices in dental applications. Each application segment conveys distinct end-user considerations, guiding coatings toward optimized designs for performance, safety, and ease of use. Finally, discerning end-user segmentation across ambulatory surgical centers, hospitals, and research laboratories illuminates how procurement strategies and operational requirements shape product development and market adoption.

This comprehensive research report categorizes the Bioactive Coating Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Coating Material

- Technology

- Application

- End-User

Strategic Regional Perspectives Highlighting Growth Drivers and Unique Characteristics across the Americas, Europe Middle East & Africa, and Asia-Pacific Zones

The Americas continue to lead global adoption of bioactive coating devices, propelled by a robust medical device industry, supportive regulatory frameworks, and significant public and private R&D investments. The United States in particular anchors this leadership through initiatives that prioritize advanced manufacturing and domestic supply chain development, solidifying its role as an innovation hub for biofunctional coatings.

In Europe, Middle East & Africa, stringent regulatory standards and an elevated emphasis on sustainability have fostered a market environment where eco-friendly coating materials and closed-loop manufacturing models thrive. The EU’s focus on biocompatible and low-VOC formulations has catalyzed partnerships between academic institutions and industry consortia to accelerate commercialization of next-generation coatings that meet both performance and environmental benchmarks.

Asia-Pacific exhibits the fastest growth trajectory, driven by expanding healthcare infrastructure, rising per capita healthcare spending, and government incentives to localize production. Nations such as China and India are scaling up capabilities in key technologies like sol-gel and plasma spraying, while emerging markets in Southeast Asia are increasing adoption of cost-effective coating solutions for wound care and dental applications. This regional dynamism underscores an evolving shift toward localized innovation and cross-border technology transfer initiatives.

This comprehensive research report examines key regions that drive the evolution of the Bioactive Coating Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Shaping Bioactive Coating Innovations through Strategic Partnerships, R&D Excellence, and Competitive Differentiation

Leading industry players are forging strategic partnerships and investing in R&D to differentiate their bioactive coating portfolios. DSM Biomedical has strengthened its presence in cardiovascular and orthopedic sectors through material science collaborations, focusing on novel polymer–nanoparticle composites that enhance drug-elution kinetics and surface durability.

SurModics stands out as a pioneer in surface modification, offering hydrophilic and anti-thrombogenic coatings tailored for percutaneous interventions. Its partnership with Cook Medical on advanced angioplasty balloon catheters exemplifies how co-development agreements can accelerate market entry and broaden clinical reach.

Biocoat and Covalon have capitalized on their expertise in hydrophilic and wound-care coatings, respectively, targeting ambulatory centers and research laboratories with specialized solutions for infection prevention and tissue regeneration. Meanwhile, legacy OEMs such as Stryker, Zimmer Biomet, and Medtronic leverage in-house coating capabilities, integrating bioactive treatments directly into implant manufacturing to secure proprietary advantages and deliver end-to-end product performance. This convergence of large-scale capabilities and startup agility continues to define competitive dynamics in the bioactive coating devices arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioactive Coating Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AST Products, Inc.

- AST Products, Inc.

- Biocoat Incorporated

- BioInteractions Ltd.

- Bruker Corporation

- Carmeda AB

- Harland Medical Systems, Inc.

- Hexacath Company

- Himed LLC

- Hydromer, Inc.

- implantcast GmbH

- Johnson & Johnson

- LipoCoat BV

- Medtronic plc

- OC Oerlikon Management AG

- Orthofix Medical Inc.

- Panacol-Elosol GmbH

- Picosun Oy by Applied Materials, Inc.

- Royal DSM

- Smith & Nephew plc

- Specialty Coating Systems Inc.

- Stryker Corporation

- SurModics Inc.

- Tissue Regeneration Systems, Inc.

- Zimmer Biomet Holdings, Inc.

Actionable Recommendations for Enhancing Innovation, Expanding Market Reach, and Navigating Regulatory Complexities in Bioactive Coating Devices

Industry leaders should prioritize strategic investments in advanced coating technologies, including machine-integrated deposition lines and closed-loop monitoring systems. Such infrastructure not only enhances manufacturing precision but also reduces variability, ensuring consistent product quality across high-volume production runs. Collaboration with academic and government laboratories can further accelerate development of novel material formulations and process validation studies, reinforcing the innovation pipeline.

Simultaneously, companies must continually diversify supply chains to mitigate exposure to tariff-induced disruptions and raw material shortages. Establishing partnerships with regional suppliers and pursuing onshore manufacturing alliances will bolster resilience, while scenario planning and dual sourcing strategies can shield operations from abrupt policy shifts. In parallel, expanding intellectual property portfolios around proprietary bioactive formulations and deposition techniques will strengthen competitive positioning.

Finally, a focused approach to regulatory engagement is essential. By proactively aligning development roadmaps with evolving agency guidelines-such as the FDA’s breakthrough device pathway and the European MDR-organizations can streamline approval processes and reduce time-to-market. Coupling these efforts with targeted market education campaigns will foster clinician awareness and accelerate adoption, translating technical advancements into tangible clinical and commercial outcomes.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Robust Validation Techniques to Ensure Rigorous Insights

This research leveraged a hybrid methodology combining primary and secondary data sources to ensure rigor and comprehensiveness. Primary insights were obtained through structured interviews with industry veterans, coating technologists, and regulatory experts, providing frontline perspectives on market dynamics, technology adoption, and future trajectories.

Secondary research encompassed analysis of peer-reviewed journals, patent databases, and technical conference proceedings, with a focus on recent publications in materials science and biomedical engineering. Trade association white papers, government policy documents, and industry reports supplemented these sources to contextualize regulatory frameworks and identify macroeconomic drivers.

Data validation and triangulation were achieved by cross-referencing multiple sources and conducting follow-up consultations with subject-matter experts. This iterative approach minimized bias, reconciled conflicting viewpoints, and ensured that conclusions reflect the most current and credible information available. All proprietary and publicly available datasets were processed through standardized quality checks and analytical protocols to deliver robust, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioactive Coating Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioactive Coating Devices Market, by Device Type

- Bioactive Coating Devices Market, by Coating Material

- Bioactive Coating Devices Market, by Technology

- Bioactive Coating Devices Market, by Application

- Bioactive Coating Devices Market, by End-User

- Bioactive Coating Devices Market, by Region

- Bioactive Coating Devices Market, by Group

- Bioactive Coating Devices Market, by Country

- United States Bioactive Coating Devices Market

- China Bioactive Coating Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives Emphasizing Strategic Importance, Innovation Imperative, and Collaborative Opportunities in Bioactive Coating Devices

The bioactive coating devices sector represents a pivotal intersection of materials innovation and clinical application, offering transformative potential across a spectrum of medical specialties. As deposition technologies evolve, and material formulations become increasingly sophisticated, the capacity to tailor device–tissue interactions will continue to expand, driving improved patient outcomes and operational efficiencies.

Moving forward, the integration of sustainable materials, digital process controls, and adaptive regulatory strategies will be paramount. Collaborative ecosystems that unite OEMs, startups, research institutions, and regulatory bodies will unlock new frontiers in personalized medical care, from infection-resistant implants to on-demand drug release systems.

With demographic trends and healthcare imperatives aligning in favor of bioactive coatings, the strategic imperative for industry stakeholders is clear: invest in innovation, fortify supply chain resilience, and engage regulators and clinicians early to translate technological breakthroughs into real-world impact. By embracing these priorities, leaders can navigate complexity, harness emerging opportunities, and cement their positions at the forefront of this dynamic market.

Take Action Now to Obtain In-Depth Bioactive Coating Devices Market Insights and Propel Your Strategic Initiatives with Expert Guidance from Ketan Rohom

Are you ready to unlock the full potential of the bioactive coating devices landscape and drive strategic growth? Connect with Ketan Rohom, Associate Director of Sales & Marketing for a tailored consultation. Ketan can provide you with an in-depth briefing on the latest industry dynamics and walk you through how the comprehensive market research report can inform your product development, commercial expansion, and regulatory planning. Don’t miss the chance to gain a competitive edge-reach out to Ketan today and secure your copy of the report to accelerate your success in this transformative field

- How big is the Bioactive Coating Devices Market?

- What is the Bioactive Coating Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?