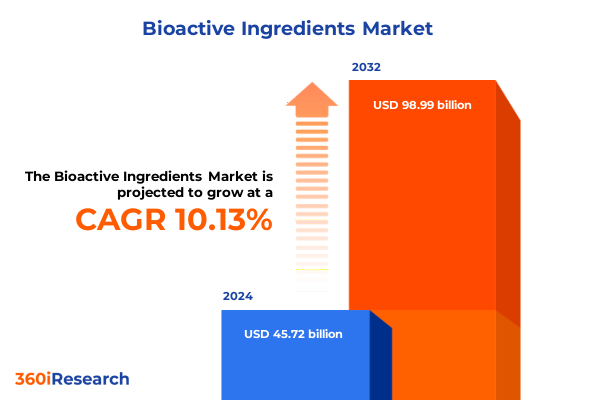

The Bioactive Ingredients Market size was estimated at USD 50.12 billion in 2025 and expected to reach USD 54.94 billion in 2026, at a CAGR of 10.21% to reach USD 98.99 billion by 2032.

Unlocking the Potential of Bioactive Ingredients: An Executive Overview of Emerging Health Drivers, Regulatory Advances, and Market Dynamics

In recent years, bioactive ingredients have transcended niche health supplement markets to become foundational elements in consumer wellness, personal care, and pharmaceutical innovation. Explosive interest in functional nutrition and preventative health has propelled compounds such as omega fatty acids, carotenoids, and polyphenols into the mainstream, while rising concerns over chronic diseases have underscored their relevance in daily regimens. Simultaneously, advances in biotechnology and extraction techniques have expanded the potential of proteins and peptides, enabling manufacturers to deliver targeted health benefits with greater consistency and potency.

Against this backdrop, the bioactive ingredient landscape is characterized by rapid scientific breakthroughs, evolving consumer preferences, and shifting regulatory frameworks that shape product formulation and market entry. Greater transparency demands throughout supply chains, fueled by digital traceability solutions, are catalyzing a shift toward natural and sustainably sourced compounds. Moreover, personalized nutrition platforms that leverage genetic and microbiome data are redefining the role of functional ingredients, turning generic formulations into customized wellness solutions.

This executive summary presents a concise yet comprehensive exploration of these forces, providing an integrated perspective on transformative shifts, tariff impacts, segmentation dynamics, regional nuances, and competitive trends. Drawing on rigorous mixed-method research, the insights herein will equip decision-makers with the clarity and strategic direction required to capitalize on the burgeoning opportunities in the global bioactive ingredients sphere.

How Demanding Consumers, Technological Innovations, and Sustainability Imperatives Are Reshaping the Bioactive Ingredients Ecosystem

The bioactive ingredients sector is in the midst of a sweeping metamorphosis driven by the convergence of conscientious consumers, technological breakthroughs, and sustainability imperatives. Health-savvy individuals are no longer satisfied with generalized wellness claims; they demand ingredient provenance, evidence-based efficacy, and formulations attuned to their specific lifestyle needs. As a result, manufacturers are integrating advanced analytics, machine learning, and artificial intelligence in product development to predict consumer preferences, optimize formulation matrices, and accelerate time to market.

Simultaneously, shifts in environmental accountability are demanding that every stage of production, from raw material cultivation to packaging disposal, aligns with circular economy principles. Companies are now exploring biodegradable carriers for encapsulation, waterless extraction platforms, and partnerships with regenerative agriculture initiatives to secure feedstock while reducing ecological footprint. Parallel to this, emerging extraction technologies such as supercritical fluid extraction and enzymatic bioconversion offer higher yields and purer extracts, fostering new opportunities for ingredient diversification and consistency.

Innovation is also taking shape in the digital domain, where smart labeling, blockchain traceability, and augmented reality applications are empowering consumers to access real-time information on ingredient origin, potency, and environmental impact. These transformative shifts converge to redefine not only how bioactive ingredients are produced and marketed but also how value is co-created across the entire ecosystem.

Assessing the Layered Effects of New United States Tariff Measures on Bioactive Ingredients Imports and Supply Chain Resiliency

The imposition of additional duties on key raw materials in 2025 has prompted a reappraisal of global supply chain architectures within the bioactive ingredients space. Ingredients previously sourced through cost-effective long-haul routes now face elevated landed costs, influencing sourcing patterns and compelling firms to diversify supplier portfolios. Strategic nearshoring initiatives have emerged as a direct response, as companies seek to mitigate tariff exposure by cultivating partnerships with domestic and regional producers.

Moreover, the tariff adjustments have illuminated latent vulnerabilities in vertically integrated ecosystems. Ingredient processors reliant on specialized imports-ranging from microbial cultures for probiotic production to microbial enzymes for peptide hydrolysis-have encountered input price volatility that squeezes margins. To maintain competitive positioning, firms are accelerating investments in process intensification and yield enhancement to offset elevated tariffs and preserve cost-competitiveness.

In parallel, these fiscal measures have reinforced the strategic importance of regulatory alignment and trade facilitation mechanisms. Industry stakeholders are engaging more proactively with governmental agencies to secure tariff exclusions for certain bioactive precursors and to participate in pilot programs for bonded warehouses. Collectively, these efforts underscore the lasting influence of trade policy on ingredient availability, pricing structures, and the ultimate innovation capacity of the sector.

Diving into Ingredient Type, Form, Source, and Application Segmentation to Uncover Strategic Opportunities in Bioactive Markets

A nuanced examination of ingredient type segmentation reveals differentiated growth trajectories and innovation hotspots. Within the carotenoids category, the heightened focus on antioxidant properties and eye health has invigorated research into novel sources such as algae-derived astaxanthin. Omega fatty acids remain anchored by steadfast demand for cardiovascular support, yet expansion is driven by marine-sourced EPA-rich oils and plant-based alternatives derived from algal biomass. Phytosterols are gaining traction for their cholesterol-modulating potential, while polyphenols continue to secure a foothold through their multifunctional antioxidant and anti-inflammatory effects. Probiotics lead the microbial brigade with flagship genera such as Bifidobacterium and Lactobacillus commanding attention for gut-brain axis modulation, while Saccharomyces strains are advancing research in immune enhancement. Proteins and peptides demonstrate remarkable versatility, with collagen peptides capturing the beauty and joint health segments, and hydrolyzed proteins unlocking opportunities in sports nutrition and metabolic health.

Form diversity further accentuates market intricacies. Capsules and tablets retain their stalwart positions due to consumer familiarity and ease of dosing, yet the growth narrative has shifted toward emulsion systems and oils optimized for bioavailability enhancement. Powder formats benefit from formulation flexibility, allowing incorporation into functional foods and beverages, while aqueous and concentrate liquid forms are pivotal for ready-to-drink offerings. These evolving preferences underscore the imperative for agile formulation strategies that harmonize efficacy with consumer convenience.

Source orientation continues to influence purchasing decisions, as natural origins command premium pricing. Animal-derived ingredients uphold a legacy of widespread adoption, yet microbial fermentation and plant extraction platforms are achieving parity through scalable production and consistent quality. Applications in dietary supplements remain foundational, but the infusion of bioactives into animal feed to support livestock productivity, food and beverage innovation across bakery, dairy, and functional beverages, personal care actives formulated for skin health, and pharmaceutical excipients tailored for targeted release, collectively broaden the addressable landscape. Recognizing these interdependencies empowers stakeholders to tailor product portfolios and capitalize on cross-segment synergies.

This comprehensive research report categorizes the Bioactive Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Form

- Source

- Application

Comparative Regional Analysis Reveals Distinct Consumer Preferences and Regulatory Landscapes Across Major Bioactive Ingredients Markets

Regional dynamics in the Americas illustrate a maturing marketplace where consumer education campaigns and healthcare professional endorsements underpin the steady adoption of functional ingredients. North American demand reflects an appetite for clinically validated compounds and high-purity extracts, while Latin American markets are energized by expanding distribution networks and rising disposable incomes that drive interest in wellness goods.

Conversely, Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and consumer preferences. The European Union’s stringent novel food approvals and health claim regulations necessitate meticulous dossier preparation, yet once approved, products enjoy robust market penetration. In the Middle East, sovereign wealth-funded initiatives support the development of specialized nutraceutical hubs, while African producers are gaining traction through indigenous botanical ingredients with a heritage appeal.

Asia-Pacific remains the most dynamic region, propelled by a blend of traditional medicine philosophies and modern wellness pursuits. China’s large-scale fermentation infrastructure and regulatory reforms have accelerated market entry for novel ingredients, while Japan’s consumer base values high-quality probiotic strains for digestive health. Southeast Asian economies are emerging as both consumers and producers of plant-derived bioactives, leveraging biodiversity to differentiate their offerings. Together, these diverse regional currents shape a global ecosystem where cross-border collaboration, regulatory harmonization, and adaptive marketing strategies become critical to success.

This comprehensive research report examines key regions that drive the evolution of the Bioactive Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players and Their Collaborations, Innovations, and Market Positioning to Capitalize on Demand for Advanced Bioactive Solutions

A review of industry-leading corporations highlights a strategic pivot toward integrated value chains and innovation-led partnerships. Established supplement manufacturers have adopted vertical integration models that encompass raw material cultivation, proprietary extraction platforms, and formulation expertise, thereby ensuring quality control and traceability from farm to finished product. Simultaneously, ingredient specialists form alliances with biotechnology firms to co-develop next-generation compounds, leveraging synthetic biology and precision fermentation to achieve novel functionalities and improved sustainability profiles.

Notably, companies that demonstrate agility in regulatory navigation and possess robust clinical validation pipelines maintain a competitive edge. Investments in collaborative research agreements with academic institutions and contract research organizations fortify product claims and accelerate approval timelines. Furthermore, strategic acquisitions of niche players with specialized microbial strain libraries or patented peptide technologies have emerged as a critical route to broaden portfolios overnight.

In the highly contested probiotics space, leading providers differentiate themselves through strain specificity, multi-omic characterization, and consumer-centric delivery platforms. Meanwhile, collagen peptide manufacturers optimize supply chains by partnering directly with sustainable fisheries and livestock operations, reinforcing traceability assurances. Across the board, the convergence of digital consumer engagement tools, from apps that track supplement adherence to platforms that personalize dosage regimens, signifies the evolving role of technology in driving brand loyalty and scientific credibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioactive Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- Arla Food Ingredients Group P/S

- BASF SE

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- Evonik Industries AG

- Givaudan SA

- Glanbia PLC

- Ingredion Incorporated

- Kemin Industries, Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Lonza Group

- Mazza Innovation Ltd

- Naturex S.A.

- Novozymes A/S

- ParkAcre Ltd.

- Roquette Frères

- Sabinsa Corporation

- Sensient Technologies Corporation

- Serinstall

- Vytrus Biotech

Strategic Imperatives for Industry Leaders to Enhance Innovation, Strengthen Supply Chains, and Unlock New Growth in Bioactive Ingredients

Industry leaders seeking to capture untapped segments should prioritize supply chain resilience through diversification of raw material sources and nearshoring initiatives that reduce exposure to tariff fluctuations. Concurrently, directing research and development budgets toward next-generation extraction and formulation techniques can unlock enhanced bioavailability, providing a tangible differentiator in a crowded marketplace. Integrating sustainability metrics into supplier contracts and product development roadmaps will not only meet stakeholder expectations but also future-proof operations against tightening regulatory landscapes.

In parallel, establishing cross-sector partnerships can accelerate market penetration; for example, collaborations with animal feed integrators can open novel applications for phytosterols and polyphenols in livestock nutrition, while alliances with personal care formulators can repurpose antioxidant-rich extracts for skin health. Embracing digital platforms to engage end-users and health professionals creates feedback loops that refine product efficacy and foster community advocacy. Moreover, undertaking proactive regulatory engagement-via petitioning for tariff relief, participating in working groups, and investing in translational clinical studies-will streamline market access and solidify evidence-based claims.

Ultimately, executives should adopt a holistic strategic lens, balancing short-term margin preservation with long-term innovation pipelines. By aligning organizational structures around agile cross-functional teams, harnessing data-driven decision-making tools, and embedding circular economy principles, the industry can sustain robust growth while meeting evolving consumer and regulatory demands.

Adopting a Robust Mixed-Method Research Approach Combining Primary Interviews and Secondary Data to Ensure Insight Reliability

This comprehensive analysis integrates both primary and secondary research methodologies to ensure robust and unbiased insights. Primary research involved direct interviews with more than two dozen executives from ingredient suppliers, contract manufacturers, regulatory bodies, and end-user organizations. These conversations provided firsthand perspectives on supply chain challenges, R&D priorities, and evolving end-market requirements. Complementing this, an extensive secondary research phase reviewed peer-reviewed journals, industry association reports, and publicly available regulatory filings to validate market drivers and identify emerging technology trends.

Data triangulation was employed to reconcile any discrepancies between primary feedback and secondary sources, leveraging quantitative datasets and financial disclosures to underpin qualitative findings. Expert panels comprising nutrition scientists, formulation specialists, and trade policy analysts critically reviewed draft insights to eliminate biases and reinforce methodological rigor. Additionally, case studies and real-world examples were incorporated to illustrate best practices in supply chain diversification, nearshoring, and sustainable sourcing.

Throughout the process, all data inputs were subjected to quality assurance protocols, including cross-verification with proprietary databases and adherence to strict confidentiality standards. This dual-layered approach ensures that the conclusions and recommendations presented here reflect a balanced, accurate, and actionable understanding of the bioactive ingredients market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioactive Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioactive Ingredients Market, by Ingredient Type

- Bioactive Ingredients Market, by Form

- Bioactive Ingredients Market, by Source

- Bioactive Ingredients Market, by Application

- Bioactive Ingredients Market, by Region

- Bioactive Ingredients Market, by Group

- Bioactive Ingredients Market, by Country

- United States Bioactive Ingredients Market

- China Bioactive Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Drawing Together Key Findings to Highlight Strategic Pathways for Future Success in the Bioactive Ingredients Market

The confluence of scientific innovation, shifting consumer expectations, and evolving trade policies defines a transformative era for bioactive ingredients. From the rise of precision fermentation techniques unlocking novel peptides to the growing prominence of algae-sourced carotenoids, the sector is ripe with opportunities for differentiation and value creation. Yet, persistent challenges-ranging from tariff-induced cost pressures to regulatory complexities across regions-demand strategic foresight and operational agility.

Key findings underscore the importance of segmentation strategies that align ingredient type, form, source, and application to targeted consumer needs. Regional nuances highlight the imperative of localized regulatory expertise and culturally tuned marketing approaches, while competitive analysis reveals the value of innovation ecosystems that blend biotechnology breakthroughs with traditional sourcing relationships. By drawing on the recommendations outlined herein, industry participants can chart a path toward resilient, forward-leaning business models that harness scientific progress and consumer trust.

As leaders navigate this dynamic environment, they must balance the pursuit of incremental product enhancements with bold investments in disruptive technologies. In doing so, they will unlock the full potential of bioactive ingredients to drive health outcomes-and in turn, secure sustainable growth for their organizations in the years ahead.

Connect with Associate Director Ketan Rohom to Unlock Comprehensive Bioactive Ingredients Market Intelligence and Drive Strategic Decisions

Engaging with Ketan Rohom offers the opportunity to delve into a meticulously researched and expertly contextualized report that brings the complexities and future trajectories of the bioactive ingredients landscape into clear focus. As the Associate Director of Sales & Marketing, Ketan Rohom provides a personalized consultation to align the findings of this comprehensive analysis with your organization’s strategic planning needs, ensuring that you harness the most relevant insights for product innovation, supply chain optimization, and go-to-market strategies. By reaching out, you gain not only direct access to proprietary data and case studies but also tailored recommendations that address your specific challenges and growth ambitions.

To initiate your journey toward data-driven decision-making and competitive advantage, simply connect with Ketan Rohom to arrange a detailed walkthrough of the report. This engagement will empower you with actionable intelligence on ingredient type performance, form preferences, regional dynamics, and evolving regulatory landscapes that define the bioactive ingredients ecosystem. Seize this opportunity to partner with an expert who can translate robust research into pragmatic solutions, enhancing your capability to outperform peers and capture emerging growth areas.

Take the next step by contacting Ketan Rohom to purchase the report, securing the strategic insights your team needs to innovate ahead of the curve. Delivering clarity on complex trends and empowering your organization with a definitive roadmap, this offering stands as the critical resource to drive informed choices and fuel sustained success in the rapidly evolving bioactive ingredients domain.

- How big is the Bioactive Ingredients Market?

- What is the Bioactive Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?