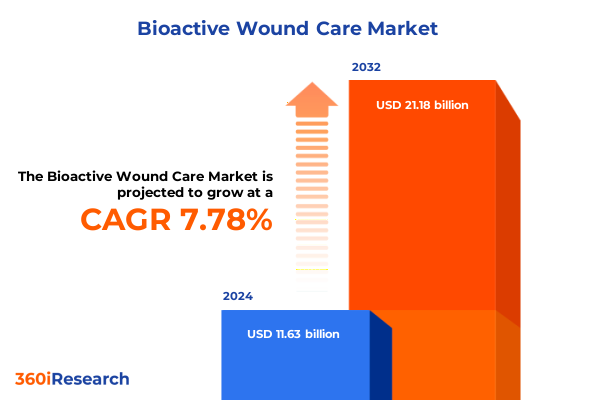

The Bioactive Wound Care Market size was estimated at USD 12.54 billion in 2025 and expected to reach USD 13.44 billion in 2026, at a CAGR of 7.77% to reach USD 21.18 billion by 2032.

Pioneering the Next Era of Advanced Wound Care with Bioactive Therapies Transforming Healing Pathways and Elevating Clinical Outcomes

The evolution of wound care has shifted dramatically over the past decade, driven by breakthroughs in material science and biotechnology. At the forefront of this revolution, bioactive wound care combines advanced polymers, growth factors, and cellular therapies to deliver targeted healing responses that traditional dressings cannot achieve. These innovative solutions not only protect the wound bed but actively participate in the tissue regeneration process by modulating the biochemical environment. This transformative approach has led to significant improvements in patient outcomes, such as accelerated closure rates and reduced risk of infection, showcasing the potential to revolutionize standard care protocols.

Beyond clinical performance, the integration of bioactive technologies into wound management has ignited cross-disciplinary collaboration among researchers, clinicians, and manufacturers. This convergence has produced a new ecosystem where insights from molecular biology, immunology, and engineering inform product design and clinical application. Consequently, healthcare institutions are investing in specialized training and infrastructure to adopt these therapies, while regulatory agencies refine guidelines to accommodate emerging modalities. As a result, the market for bioactive wound care is not only defined by advanced materials but also by an ecosystem of innovation that supports translation from bench to bedside and ultimately enhances patient-centric care.

Evolving Dynamics in Bioactive Wound Care Driven by Research Breakthroughs, Reimbursement Innovation, Digital Integration, and Sustainability Imperatives

The landscape of bioactive wound care is undergoing foundational shifts fueled by robust research initiatives and expanding reimbursement frameworks. Cutting-edge studies have elucidated the role of exosomes, antimicrobial peptides, and nanofiber scaffolds in modulating cellular responses, prompting manufacturers to integrate these components into next-generation platforms. Such scientific progress has been complemented by improved coding and reimbursement pathways, which have lowered barriers to market entry and enabled broader clinical adoption. Together, these developments are reshaping industry priorities, with a growing emphasis on evidence generation and health economics to substantiate the value proposition of premium wound care solutions.

Furthermore, digital health integration is emerging as a pivotal driver in the market’s evolution. Connected dressings embedded with biosensors are furnishing real-time wound analytics, enabling remote monitoring and predictive intervention. These innovations are not only streamlining clinician workflows but are also paving the way for value-based care models by quantifying treatment effectiveness. As telemedicine continues to expand its footprint, the convergence of digital monitoring and bioactive therapeutics is creating a holistic care paradigm that extends beyond hospital walls into home health and specialty clinic settings.

In parallel, sustainability has become a critical consideration for both providers and payers. The environmental impact of disposable dressings and the lifecycle of advanced materials are under scrutiny, encouraging stakeholders to prioritize biodegradable alternatives and circular economy principles. This shift is prompting R&D teams to develop bioactive scaffolds derived from renewable sources and to adopt manufacturing processes that minimize waste and carbon emissions. Ultimately, these transformative shifts in research, reimbursement, digital innovation, and sustainability are forging a more efficient, patient-focused, and environmentally conscious wound care ecosystem.

Quantifying the 2025 Impact of U.S. Trade Measures on Supply Chain Resilience, Sourcing Strategies, and Competitive Positioning in Bioactive Wound Care

In 2025, the cumulative impact of newly imposed United States tariffs has reverberated across the bioactive wound care supply chain, influencing raw material costs, manufacturing strategies, and pricing structures. Key inputs such as advanced polymers, collagen matrices, and hydrogel precursors originating from major overseas suppliers have experienced cost escalations of up to 15 percent, compelling manufacturers to reassess sourcing strategies and negotiate long-term agreements to mitigate price volatility. This escalation has underscored the importance of flexible supply chains and has accelerated nearshoring initiatives aimed at securing domestic production capacities for critical components.

These tariff-induced cost pressures have prompted industry participants to explore process efficiencies and alternative materials. Some manufacturers are investing in proprietary extraction techniques for collagen and alginate to reduce dependency on imported sources, while others are experimenting with synthetic analogs and recombinant proteins to achieve comparable bioactivity. Concurrently, pricing adjustments have led to tiered product portfolios designed to balance cost-conscious purchasing by hospitals and home health providers with premium offerings tailored for high-acuity care settings. This segmentation has helped preserve market access while maintaining margin integrity amidst tariff headwinds.

Moreover, the regulatory landscape has adapted in response to these economic shifts. Agencies have begun providing expedited reviews for products demonstrating supply chain resilience or significant domestic content, facilitating quicker market entry for manufacturers aligning with national strategic interests. Collectively, the tariff environment of 2025 has catalyzed supply chain diversification, propelled innovation in material sourcing, and influenced competitive positioning within bioactive wound care markets.

Illuminating Key Performance Drivers across Product, Wound Type, Application, End User, and Delivery Modalities in Bioactive Wound Care

Insights drawn from a multifaceted segmentation analysis reveal nuanced performance drivers across product types, wound categories, applications, end users, and distribution channels. Evaluation across alginate dressing, collagen dressing, film dressing, foam dressing, hydrogel dressing, and skin substitute categories highlights distinct adoption patterns. Within alginate dressings, calcium alginate variants are gaining traction in exuding wound management, whereas sodium alginate options are favored for their biocompatibility in chronic ulcers. Collagen dressings demonstrate variable demand across avian, bovine, human, and porcine sources, with porcine collagen leading in cost-effectiveness and human collagen prized for reduced immunogenicity. The polyurethane film segment is characterized by transparent, semi-permeable solutions optimally used in superficial wounds, while polyurethane and silicone foam dressings are differentiated by cushioning capacity and moisture retention profiles. Hydrogel dressings across amorphous, impregnated, and sheet forms continue to serve rehydration needs in dry wounds, and skin substitutes spanning allograft, biosynthetic, synthetic, and xenograft options underscore tailored approaches in complex wound repair.

In terms of wound types, the prevalence of diabetic foot ulcers has driven targeted innovation in moisture-balancing collagen and alginate materials, whereas pressure ulcers remain a key focus for antimicrobial foam systems. Burns management leans heavily on biosynthetic skin substitutes, and venous leg ulcers are showing favorable outcomes with advanced hydrogel therapies. Traumatic wounds in acute care settings are increasingly treated with composite dressings that combine a film barrier with bioactive agents to expedite closure.

Application-based segmentation distinguishes acute, chronic, surgical, and traumatic wound care pathways. Acute wounds benefit from rapid-acting hydrogel platforms, while chronic wounds in home healthcare demand extended wear collagen formulations. Surgical settings, particularly ambulatory surgical centers and hospitals, require film and foam materials compatible with minimal disruption during postoperative monitoring. End user analysis indicates that hospitals maintain dominance in clinical adoption due to established procurement processes, specialty clinics are driving innovation through pilot programs, and home healthcare providers are gravitating toward user-friendly dressings with digital monitoring capabilities. Distribution channel insights reveal that while offline channels continue to account for the lion’s share of sales, online platforms are emerging as vital conduits for direct-to-patient delivery and telehealth support services.

This comprehensive research report categorizes the Bioactive Wound Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Wound Type

- Application

- End User

- Distribution Channel

Deciphering Regional Dynamics Shaping Innovation, Access, and Adoption Trajectories in the Bioactive Wound Care Market

Regional heterogeneity defines the strategic focus and growth trajectories in the bioactive wound care domain. In the Americas, innovation hubs in North America are complemented by rising demand in Latin American markets seeking cost-effective biosynthetic and natural polymer-based dressings. This region’s robust healthcare infrastructure and favorable reimbursement pathways facilitate rapid adoption of premium bioactive technologies and digital monitoring solutions. Conversely, Europe, Middle East & Africa presents a diverse landscape where stringent regulatory standards in Western Europe drive high-quality product launches, while emerging markets in Eastern Europe and the Middle East prioritize affordability and accessibility of advanced wound care products. Africa’s expanding public health initiatives underscore the potential for humanitarian partnerships and philanthropic models to improve availability of life-saving skin substitutes.

In the Asia-Pacific region, a confluence of aging populations, increasing incidence of diabetes, and expanding healthcare expenditure propels market expansion. Key markets such as China, Japan, and Australia lead in local manufacturing and R&D of bioactive scaffolds, while Southeast Asian nations amplify distribution through public-private partnerships. A growing focus on medical tourism in countries like India and Thailand further enhances the adoption of premium wound care regimens. Across these regions, collaborative agreements between local distributors and global manufacturers are enhancing supply chain efficiencies and driving regionalized product innovations tailored to tropical climates and patient demographics.

This comprehensive research report examines key regions that drive the evolution of the Bioactive Wound Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves by Leading Bioactive Wound Care Entities Embracing Innovation, Alliances, and Real-World Evidence for Market Leadership

A competitive analysis of leading industry participants reveals a concerted emphasis on technological differentiation, strategic alliances, and portfolio diversification. Key players are reinforcing their market positions through acquisitions of niche developers specializing in exosome therapy and 3D-printed skin constructs. Collaborative research agreements with academic institutions and contract research organizations are accelerating the translation of novel bioactive compounds, such as antimicrobial peptides and extracellular matrix mimetics, into clinical pipelines. Simultaneously, incumbent manufacturers are broadening distribution networks via agreements with specialty distributors and digital health platforms, ensuring seamless integration of connected dressings into existing electronic medical record systems.

Innovation expenditure is being prioritized toward multifunctional dressings that combine hemostatic, antimicrobial, and regenerative properties within a single platform. Furthermore, companies are deploying real-world evidence programs to track long-term patient outcomes, positioning these insights to influence purchasing decisions among hospital systems. Strategic investment in manufacturing automation and modular facilities is also underway to bolster scale-up capacity for recombinant proteins and polymer blends. This collective activity underscores a shift from transactional sales models toward value-added service offerings, where patient monitoring, wound analytics, and post-market support are bundled with core products to deliver differentiated customer experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioactive Wound Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Medical Solutions Group plc

- B. Braun Melsungen AG

- Baxter International Inc.

- Cardinal Health, Inc.

- Coloplast A/S

- ConvaTec Group plc

- Covalon Technologies Ltd.

- Fibroheal Woundcare Pvt. Ltd.

- Hollister Incorporated

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- Kerecis ehf.

- Medtronic plc

- MiMedx Group, Inc.

- Mölnlycke Health Care AB

- Organogenesis Inc.

- Paul Hartmann AG

- Smith & Nephew plc

- Urgo Medical SAS

Implementing Strategic Alliances, Agile Manufacturing, Digital Integration, and Sustainability Practices to Drive Competitive Advantage in Bioactive Wound Care

Industry leaders seeking to capitalize on the dynamic bioactive wound care landscape should prioritize several strategic imperatives. First, partnering with research institutions to co-develop next-generation bioactive compounds can ensure a robust pipeline aligned with clinical needs. Simultaneously, establishing flexible sourcing arrangements and nearshore manufacturing capabilities will mitigate tariff-related risks and safeguard supply continuity. Adopting a modular production model that accommodates rapid scale-up and format diversification can position organizations to respond swiftly to shifts in clinical demand.

Moreover, integrating digital health solutions into product portfolios is essential for creating value-based care propositions. Companies should invest in connected dressing technologies and data analytics platforms to deliver actionable insights to providers and payers. Enhancing sustainability credentials through the use of renewable biomaterials and eco-friendly manufacturing processes can strengthen brand reputation and meet emerging regulatory and patient expectations. Finally, structuring reimbursement and pricing strategies around segmented portfolios-offering tiered solutions for cost-sensitive and premium care environments-will optimize market penetration across diverse healthcare settings.

Employing Robust Primary and Secondary Research Techniques to Illuminate Technological Advancements, Economic Influences, and Market Drivers in Bioactive Wound Care

This research leverages a comprehensive blend of primary and secondary methodologies to ensure the reliability and depth of insights. Primary research included extensive interviews with key opinion leaders, wound care specialists, and procurement executives across hospitals, ambulatory surgical centers, home healthcare agencies, and specialty clinics. These engagements provided granular perspectives on clinical utilization patterns, material preferences, and decision-making criteria. Secondary research involved systematic review of peer-reviewed journals, clinical trial registries, patent filings, and regulatory databases to capture emerging bioactive technologies, safety profiles, and approval timelines.

Quantitative analysis was derived from aggregating anonymized purchasing data from major distributors, supplemented by digital platform analytics to assess adoption trends in remote monitoring solutions. Supply chain cost modeling incorporated vendor price lists, tariff schedules, and currency fluctuations to evaluate the impact of trade policies on raw material sourcing. Additionally, regional market dynamics were mapped through collaboration with local industry associations and analysis of government healthcare expenditure reports. The convergence of these methodologies ensures a multi-dimensional understanding of technological advancements, regulatory influences, and market drivers in the bioactive wound care space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioactive Wound Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioactive Wound Care Market, by Product Type

- Bioactive Wound Care Market, by Wound Type

- Bioactive Wound Care Market, by Application

- Bioactive Wound Care Market, by End User

- Bioactive Wound Care Market, by Distribution Channel

- Bioactive Wound Care Market, by Region

- Bioactive Wound Care Market, by Group

- Bioactive Wound Care Market, by Country

- United States Bioactive Wound Care Market

- China Bioactive Wound Care Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing the Convergence of Innovation, Economic Dynamics, and Collaborative Ecosystems Shaping the Future Standard of Care in Bioactive Wound Management

The bioactive wound care market stands at an inflection point where scientific innovation, economic pressures, and shifting care paradigms converge to reshape how wounds are managed. The maturation of growth factor delivery systems, antimicrobial scaffolds, and digital monitoring platforms heralds a new standard of care defined by personalized, data-driven approaches. Despite challenges posed by trade policies and cost pressures, the industry’s resilience is evidenced by strategic investments in domestic manufacturing, material science breakthroughs, and collaborative research networks.

Looking ahead, success in this evolving landscape will hinge on organizations’ ability to adapt supply chains, leverage real-world evidence, and deliver integrated care solutions that align with evolving reimbursement models. By embracing sustainability and digital health, stakeholders can achieve not only improved clinical outcomes but also greater operational efficiency and patient satisfaction. Ultimately, the future of wound care lies in the synergy of bioactive innovation, evidence-led practice, and stakeholder collaboration, forging pathways to accelerated healing and enhanced quality of life for patients worldwide.

Empower Strategic Growth in Bioactive Wound Care by Connecting with Ketan Rohom for an Exclusive Customized Market Research Engagement

To explore comprehensive insights into the bioactive wound care market and unlock strategies tailored to your organization’s needs, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engage with an expert to receive a customized discussion outlining how this research can drive your competitive advantage and support data-driven decision-making across product development, market entry, and go-to-market initiatives. Secure access to the full report to empower your strategic planning and commercial activities, and collaborate with Ketan Rohom today to ensure your organization remains at the forefront of innovation in advanced wound care.

- How big is the Bioactive Wound Care Market?

- What is the Bioactive Wound Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?