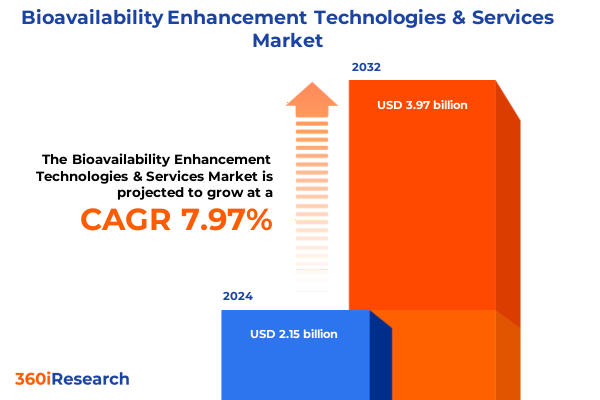

The Bioavailability Enhancement Technologies & Services Market size was estimated at USD 2.32 billion in 2025 and expected to reach USD 2.49 billion in 2026, at a CAGR of 7.95% to reach USD 3.97 billion by 2032.

Revolutionizing drug delivery through cutting-edge bioavailability enhancement technologies to elevate therapeutic outcomes and patient compliance

Innovations in drug formulation continue to confront one of the pharmaceutical industry’s most persistent challenges: inadequate bioavailability of active pharmaceutical ingredients. Poor aqueous solubility and limited permeability of many therapeutic compounds have historically impeded their clinical efficacy, resulting in sub-optimal dosing regimens and patient compliance hurdles. By enhancing solubility and absorption, modern bioavailability enhancement strategies not only refine pharmacokinetic profiles but also unlock new possibilities for existing molecules previously deemed impractical for development.

Over the past decade, a diverse array of enhancement technologies has emerged to address these limitations. Cyclodextrin complexation has evolved to leverage both beta cyclodextrin and hydroxypropyl beta cyclodextrin derivatives, improving drug solubility through molecular encapsulation. Lipid-based systems now encompass liposomes and self-emulsifying drug delivery systems that facilitate lymphatic transport and mitigate first-pass metabolism. Concurrently, the nanotechnology space has burgeoned with nanocrystals, polymeric nanoparticles, and solid lipid nanoparticles that enable controlled release and targeted delivery. Additional avenues such as particle engineering via micronization or nanonization, prodrug approaches including amide and ester conjugates, and solubilization techniques through co-solvents, pH adjustment, and surfactants underscore the multifaceted efforts to elevate therapeutic performance.

This executive summary delivers a foundational overview of these scientific advances alongside critical shifts in regulatory frameworks and global trade policies. It sets the stage for subsequent sections, offering a concise yet comprehensive introduction to the rapidly evolving landscape of bioavailability enhancement.

Navigating transformative shifts in bioavailability enhancement catalyzed by regulatory changes, digital integration, and next-generation formulation strategies

The bioavailability enhancement ecosystem is experiencing transformative momentum driven by converging regulatory, technological, and market forces. Recent guidance from major regulatory bodies has sharpened focus on demonstrating in vivo performance improvements and ensuring robust safety profiles, prompting innovators to integrate early-stage pharmacokinetic modelling into formulation design. At the same time, pharmaceutical developers are embracing digital tools and artificial intelligence to screen thousands of formulation candidates rapidly, reducing time-to-clinic and focusing resources on the most promising strategies.

Meanwhile, sustainability considerations have emerged as a critical driver of innovation. Industry stakeholders are prioritizing eco-friendly excipients, solvent-minimization processes, and biodegradable carriers. This shift is complemented by an emphasis on circular economy principles within supply chains, where raw material sourcing and waste management protocols are re-evaluated to align with global environmental goals. As a result, end-to-end service providers are expanding their capabilities to include not only analytical and formulation development but also lifecycle assessments and green chemistry consultations.

Collectively, these shifts are redefining competitive advantage in the bioavailability enhancement market. Companies that can demonstrate regulatory compliance, digital integration, and sustainability credentials are emerging as preferred partners for both large-scale pharmaceutical firms and emerging biotech ventures. This section elucidates how these forces intersect to recalibrate priorities and unlock new growth trajectories.

Assessing the cumulative repercussions of United States 2025 tariffs on global bioavailability enhancement supply chains and cost structures

The enactment of new United States tariffs in early 2025 has introduced a complex layer of considerations for the bioavailability enhancement sector. Levies on key excipients and specialized carriers, including certain lipid derivatives and pharmaceutical-grade cyclodextrins, have driven import costs upward. Consequently, supply chain stakeholders are increasingly evaluating alternative sourcing routes, with some turning to domestic production of raw materials and intermediate excipients to mitigate exposure to border adjustments and fluctuating duties.

In response, strategic realignments have unfolded across the value chain. Contract manufacturing organizations and raw material suppliers have accelerated nearshoring initiatives, establishing facilities within favorable trade jurisdictions to avoid tariff burdens. At the same time, integrated service providers are renegotiating supplier contracts to secure fixed-cost agreements and enhance predictability. These measures have proven particularly impactful for formulations reliant on advanced nanotechnology platforms, where raw material purity and consistency remain paramount.

From a cost-management perspective, the enhanced duty structure has heightened emphasis on process optimization. Formulation scientists are collaborating more closely with supply chain teams to streamline excipient usage, reduce waste, and identify lower-cost alternatives without compromising product performance. This holistic response to the tariffs underscores the industry’s agility, with organizations adopting flexible procurement strategies to preserve margins while sustaining innovation pipelines.

Illuminating strategic segmentation insights across technology modalities, service offerings, drug categories, administration routes, and end-user applications

Deep analysis of technology type reveals distinct adoption patterns and maturity curves. Cyclodextrin complexation solutions, leveraging both beta cyclodextrin and hydroxypropyl beta cyclodextrin, remain established methods for solubility enhancement in small molecule drugs. Simultaneously, lipid-based systems such as liposomes and self-emulsifying drug delivery systems are gaining traction for biologics and peptide therapeutics, owing to their ability to facilitate lymphatic uptake and protect labile compounds. The nanotechnology arena, encompassing nanocrystals, polymeric nanoparticles, and solid lipid nanoparticles, continues to expand into targeted delivery applications, while particle engineering techniques including micronization and nanonization are being refined to ensure consistent bioavailability improvements. Prodrug approaches featuring amide and ester conjugates are increasingly explored to modulate pharmacokinetic profiles, and solubilization techniques through co-solvents, pH adjustment, and surfactants remain foundational methods, particularly in early-stage development.

Turning to service type, integrated analytical services now encompass a comprehensive suite of bioanalytical assays, in vitro and in vivo testing, and stability assessments, ensuring that formulation strategies are validated at every stage. Contract manufacturing entities are expanding pilot-scale capabilities, and contract research operations are embedding formulation expertise within preclinical workflows. Formulation development providers are differentiating through bespoke preformulation studies, pilot scale formulation, and process optimization services, enabling seamless transition from bench to GMP manufacturing.

From a drug type perspective, small molecule drugs dominate traditional solubility challenges, while biologics-particularly monoclonal antibodies and recombinant proteins-demand advanced carriers to preserve structural integrity. Peptide conjugates and peptidomimetics are emerging as niche segments within peptide therapeutics, each requiring tailored enhancement strategies to improve stability and absorption. In terms of administration routes, oral delivery continues to be the most prevalent focus, but parenteral routes-including intramuscular, intravenous, and subcutaneous injections-are driving investment in sterile lipid-based and nanoparticle formulations. Topical applications remain an important entry point for certain APIs, balancing local efficacy with minimal systemic exposure.

Finally, end users ranging from academic research institutes to contract research organizations and pharmaceutical companies exhibit diverse priorities. Academic centers emphasize proof-of-concept studies and novel carriers, while CROs focus on standardized, high-throughput platforms. Pharmaceutical companies seek end-to-end partnerships that integrate analytical validation, formulation development, and commercial manufacturing, underscoring the need for versatile and scalable service offerings.

This comprehensive research report categorizes the Bioavailability Enhancement Technologies & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Service Type

- Drug Type

- Route Of Administration

- End User

Unveiling distinctive regional dynamics shaping bioavailability enhancement adoption in the Americas, EMEA, and Asia-Pacific markets

Distinct regional dynamics are shaping the adoption and evolution of bioavailability enhancement technologies. In the Americas, robust pharmaceutical R&D infrastructure and well-established regulatory pathways have fostered rapid uptake of advanced delivery platforms. Leading academic institutions partner with biotech startups to pioneer novel cyclodextrin derivatives and lipid nanoparticle carriers, while major pharmaceutical manufacturers invest in pilot-scale facilities to accelerate commercial translation. This collaborative ecosystem has also enabled streamlined scale-up of nanotechnology-based formulations and versatile contract development and manufacturing arrangements.

Across Europe, the Middle East, and Africa, harmonization of regulatory requirements within the European Union has reduced barriers for market entry, encouraging cross-border collaborations and joint ventures. Nations within the Gulf Cooperation Council are emerging as innovation hubs, leveraging strategic investments in life sciences parks and tax incentives to attract formulation development activities. In Africa, targeted public-private partnerships are addressing endemic health challenges by applying solubilization and nanoparticle strategies to essential medicines, thereby demonstrating the global relevance of enhancement technologies.

The Asia-Pacific landscape exhibits robust growth driven by cost-competitive manufacturing capabilities in China and India, coupled with expanding domestic R&D budgets. Local firms have scaled production of lipid excipients and cyclodextrin complexes, while international service providers establish joint ventures to access these economies of scale. Furthermore, government-led biotech initiatives in Japan, South Korea, and Southeast Asia are promoting advanced drug delivery research, integrating AI-led screening tools with traditional formulation expertise to foster next-generation enhancements.

This comprehensive research report examines key regions that drive the evolution of the Bioavailability Enhancement Technologies & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategic profiles and innovation trajectories of leading organizations driving bioavailability enhancement breakthroughs and competitive differentiation

Leading industry players are differentiating through a blend of platform innovation and strategic partnerships. Companies with deep expertise in nanotechnology have expanded their portfolios by introducing next-generation solid lipid nanoparticles and polymeric systems optimized for biologic payloads. Others, specializing in cyclodextrin complexation, have developed proprietary high-purity derivatives that offer enhanced stability and reduced toxicity, securing key licensing agreements with global pharmaceutical firms.

In the service domain, contract organizations are broadening their end-to-end capabilities, integrating advanced analytical services with pilot-scale manufacturing and regulatory support. This consolidation enables streamlined workflows, from preformulation to commercial production, reinforcing customer loyalty. Simultaneously, formulation development specialists are forging collaborations with academia and biotech incubators to access breakthrough technologies such as AI-driven solubility prediction and high-throughput screening platforms.

Across drug modalities, market leaders are investing in specialized solutions for biologics and peptides, including bespoke lipid and nanoparticle carriers that balance delivery efficiency with biocompatibility. In addition, key companies have established global supply networks to counter tariff-driven cost volatility, strengthening their competitive position. By combining innovation pipelines with flexible manufacturing footprints, these organizations are setting the benchmark for comprehensive bioavailability enhancement services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioavailability Enhancement Technologies & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adare Pharma Solutions

- Alexion Pharmaceuticals

- Ardena

- Catalent, Inc.

- Corden Pharma International GmbH

- Eurofins Scientific SE

- Ferring Pharmaceuticals

- Formulex Ltd.

- Hovione

- Janssen Pharmaceuticals

- Lonza Group AG

- Mayne Pharma Group Limited

- Merck KGaA

- Novo Nordisk

- Pace Analytical Services, LLC

- Particle Sciences

- Pensatech Pharma GmbH

- Quotient Sciences

- Renejix Pharma Solutions

- The Lubrizol Corporation

- Thermo Fisher Scientific Inc.

Implementable strategic and operational recommendations to accelerate adoption of advanced bioavailability enhancement solutions and drive sustainable growth

To maintain a competitive edge, industry leaders should prioritize development of modular platform technologies that can be rapidly adapted to diverse molecular classes. Establishing internal cyclodextrin and lipid formulation libraries, paired with AI-enabled solubility prediction tools, will reduce iterative testing cycles and accelerate time-to-clinic. Furthermore, investing in flexible pilot-scale manufacturing lines capable of handling both sterile and non-sterile processes will support seamless transitions from proof of concept to commercial-scale production.

Strengthening supply chain resilience is equally critical. Organizations should diversify raw material sourcing by cultivating relationships with multiple approved suppliers in favorable trade jurisdictions. Nearshoring essential excipient production and leveraging long-term agreements can mitigate risks associated with tariff fluctuations and logistical disruptions. At the same time, collaborative forecasting mechanisms with suppliers will enhance transparency and buffer inventory against demand spikes.

Building strategic alliances across academic institutions, contract service providers, and technology vendors will unlock access to cutting-edge research and specialized skill sets. Joint development agreements focused on novel nanoparticle constructs or prodrug conjugation chemistry can yield differentiated portfolios and shared intellectual property advantages. Finally, embedding digital transformation-through integrated data management platforms, machine learning algorithms for formulation optimization, and remote monitoring solutions-will drive operational efficiencies and support evidence-based decision-making across the product lifecycle.

Comprehensive overview of methodological approaches, data sources, and analytical frameworks underpinning this bioavailability enhancement technologies study

This study employed a rigorous mixed-methodology approach to ensure comprehensive coverage and data validity. Primary research included in-depth interviews with key opinion leaders across pharmaceutical companies, contract research organizations, and academic laboratories, focusing on emerging enhancement modalities and service preferences. These qualitative insights were triangulated with secondary data drawn from regulatory filings, patent registries, peer-reviewed journals, and company annual reports to construct a holistic view of technological and commercial trends.

Quantitative analysis entailed mapping global supply chains for critical excipients and carriers, assessing the impact of United States tariff policies through cost-model scenarios, and evaluating service utilization patterns across geographies. The segmentation framework was validated through cross-referencing multiple data sources, including industry association publications and proprietary databases, to corroborate the relative prominence of technology types, service offerings, drug classes, administration routes, and end users.

Analytical frameworks such as SWOT, Porter’s Five Forces, and technology lifecycle assessments underpinned the evaluation of competitive dynamics and innovation trajectories. Limitations related to proprietary confidentiality and evolving policy landscapes were addressed by continuous data updates and expert panel reviews, ensuring the study’s resilience against rapid market shifts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioavailability Enhancement Technologies & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioavailability Enhancement Technologies & Services Market, by Technology Type

- Bioavailability Enhancement Technologies & Services Market, by Service Type

- Bioavailability Enhancement Technologies & Services Market, by Drug Type

- Bioavailability Enhancement Technologies & Services Market, by Route Of Administration

- Bioavailability Enhancement Technologies & Services Market, by End User

- Bioavailability Enhancement Technologies & Services Market, by Region

- Bioavailability Enhancement Technologies & Services Market, by Group

- Bioavailability Enhancement Technologies & Services Market, by Country

- United States Bioavailability Enhancement Technologies & Services Market

- China Bioavailability Enhancement Technologies & Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Conclusive insights synthesizing critical trends and strategic imperatives to inform decision-making in bioavailability enhancement sectors

In summary, the bioavailability enhancement landscape is undergoing rapid transformation, fueled by advances in cyclodextrin complexation, lipid-based carriers, and nanotechnology, alongside supportive regulatory shifts and digital integration. The cumulative impact of United States tariffs in 2025 has prompted supply chain realignments and cost-management innovations, underscoring industry adaptability.

Segmentation insights highlight the interplay between technology types, service models, drug categories, administration routes, and end users, revealing tailored strategies for diverse stakeholder groups. Regionally, the Americas, EMEA, and Asia-Pacific exhibit unique adoption patterns influenced by infrastructure, regulation, and cost structures. Key companies are leveraging platform innovation, strategic alliances, and global supply networks to secure competitive advantage.

As market dynamics continue to evolve, organizations that align modular technology platforms with resilient supply chains, collaborative partnerships, and digital transformation will be best positioned to capitalize on emerging opportunities. This study synthesizes critical trends and strategic imperatives to guide decision-makers in navigating the complexities of bioavailability enhancement.

Engage directly with our Associate Director to secure tailored insights and access the definitive bioavailability enhancement market report

To obtain the comprehensive market research report on bioavailability enhancement technologies and services, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through a tailored consultation to ensure the report aligns precisely with your strategic priorities and delivers the actionable insights your organization requires.

Engaging with Ketan Rohom provides an opportunity to discuss custom data integration, address specific questions about technology types or service offerings, and explore flexible licensing arrangements. Connect now to secure your copy of the definitive industry analysis and empower your decision-making with specialized expertise.

- How big is the Bioavailability Enhancement Technologies & Services Market?

- What is the Bioavailability Enhancement Technologies & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?