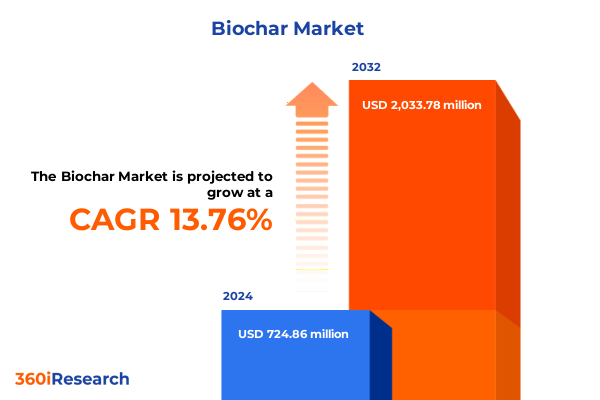

The Biochar Market size was estimated at USD 819.53 million in 2025 and expected to reach USD 928.60 million in 2026, at a CAGR of 13.86% to reach USD 2,033.78 million by 2032.

Uncovering the Emergence of Biochar as a Pivotal Sustainable Solution That Revolutionizes Soil Health and Carbon Sequestration Strategies

The increasing recognition of biochar as a game-changing solution for soil health, carbon sequestration, and environmental remediation signals a transformational moment for the industry. Major corporations and technology leaders are moving beyond pilot projects toward commercial-scale deployment, demonstrating the material’s potential to deliver both ecological and economic value. For example, Google’s recent contract with Charm Industrial to remove 100,000 tons of CO₂ by 2030 through the application of biochar underscores the confidence in its permanence and scalability, offering a powerful proof point for the technology’s viability in corporate decarbonization portfolios. Similarly, government agencies are directing targeted funding toward biochar integration in agriculture, with the U.S. Department of Agriculture allocating $50 million to soil health programs that include biochar amendments, further validating its role in sustainable land management.

As the industry matures, research into biochar’s long-term stability and multifunctional benefits continues to expand. Academic and independent studies are solidifying our understanding of how biochar can lock carbon in soils for centuries while improving water retention, nutrient availability, and microbial activity. This growing body of evidence is driving policy frameworks, carbon credit methodologies, and corporate sustainability strategies, positioning biochar at the forefront of climate-smart innovations. In turn, a diverse array of stakeholders-from technology providers to agribusinesses and regulators-are collaborating to develop standards and best practices that will underpin the next phase of market growth.

Exploring the Fundamental Shifts in Production Technologies and Market Dynamics That Are Accelerating Biochar Adoption Across Diverse Industries

Over the past two years, the biochar landscape has been reshaped by breakthroughs in production technologies and strategic shifts in feedstock sourcing. Advances in fast pyrolysis, gasification, hydrothermal carbonization, and slow pyrolysis are enabling higher yields, lower emissions, and scalable processes tailored to diverse operational needs. At the same time, feedstock portfolios have diversified markedly. Agricultural residues, forestry byproducts, industrial residues, and municipal solid waste are being upcycled into high-value biochars, creating new revenue streams for waste generators and strengthening supply chain resilience. These collective developments are driving down production costs and boosting the consistency of product quality, thereby expanding the technology’s accessibility across different geographies.

Simultaneously, the integration of digital tools and data-driven platforms is transforming the way biochar projects are measured, monetized, and optimized. Carbon registry protocols and remote sensing techniques now support rigorous verification of carbon removals, while precision agriculture applications leverage biochar’s moisture-retention and nutrient-delivery attributes to maximize crop yields. The intersection of sustainable materials science and industry 4.0 is fostering a new generation of biochar products designed to meet the specific requirements of soil types, crop systems, and environmental remediation projects. As a result, the market is witnessing a dynamic shift from small-scale demonstrations to industrial-grade solutions capable of addressing critical climate and agricultural challenges at scale.

Analyzing the Far-Reaching Cumulative Effects of Recent United States Tariff Policies on the Biochar Supply Chain and Market Economics

In early 2025, sweeping reciprocal tariffs under Executive Order 14257 imposed a 10% additional ad valorem levy on nearly all imported goods, effective April 5, 2025, as part of a broader strategy to bolster domestic manufacturing and address trade imbalances. While these tariffs apply to a vast array of commodities, certain critical materials such as pharmaceuticals and essential chemicals are exempted to preserve supply-chain stability. However, biochar shipments classified under the HTSUS subheading 3802.90.5000 are subject to a 4.8% ad valorem duty, as established in Customs Ruling NY N316692, adding an additional cost vector for importers of activated carbon products derived from biomass.

Adding complexity to the trade environment, the reintroduced Foreign Pollution Fee Act (FPFA) proposes tiered carbon tariffs on specific high-emission goods based on life-cycle carbon intensity benchmarks. Although the FPFA’s initial focus centers on steel, aluminum, cement, and fertilizer, it signals a directional risk for biochar imports if carbon accounting frameworks expand beyond their original scope. Collectively, the confluence of reciprocal tariffs, country-specific levies, and emerging carbon fees is reshaping cost structures throughout the biochar value chain, prompting stakeholders to reassess sourcing strategies and invest in localized production.

Revealing Critical Segmentation Insights That Illuminate Biochar Market Trends from Technology Platforms to End-Use Applications and Distribution Channels

The biochar market’s intricate segmentation offers critical insights into where innovation and opportunity intersect. Examining production platforms reveals that fast pyrolysis systems are prized for rapid throughput and bio-oil co-product generation, while gasification delivers synergies with energy production. Hydrothermal carbonization appeals to wet feedstocks and organic waste streams, and slow pyrolysis remains the workhorse for high-fixed-carbon applications. Each technology platform demands tailored capital expenditure and operational expertise, driving a spectrum of business models from modular kiln deployments to large centralized reactors.

The diversity of feedstock types further underscores the market’s adaptability. Agricultural waste, including straw and manure, is complemented by forestry residues like bark and wood chips. Industrial byproducts such as food processing sludges and paper mill waste are gaining traction as circular economy inputs, while municipal solid waste streams offer scale but introduce feedstock variability challenges. Product forms-granular, pelleted, and powdered-cater to differing application requirements. Granular biochar is favored for bulk soil amendments, pellets simplify distribution and dosing for fertilizers, and powders support specialty uses in water treatment and environmental remediation.

Applications range from agricultural industry uses-spanning compost enhancements, fertilizer formulations, livestock feed supplements, pest control solutions, and soil amendments-to forestry projects in reforestation and timber yard management. Waste management applications transform agricultural, industrial, and municipal residuals into value-added products, while water treatment applications encompass filtration media and pollution control systems. Distribution channels bifurcate into offline and online, the latter subdivided into brand websites and e-commerce platforms, reflecting the transition toward digital procurement and direct-to-farm sales.

This comprehensive research report categorizes the Biochar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Technology

- Feedstock Type

- Product Form

- Reactor Configuration

- Activation Type

- Application

- Distribution Channel

- End User

Unveiling Regional Nuances and Demand Drivers Shaping the Biochar Market in the Americas, Europe Middle East & Africa, and Asia Pacific Regions

Regional dynamics are shaping the biochar industry in distinct ways. In the Americas, the United States and Canada lead market activity, propelled by strong policy incentives, carbon credit programs, and agricultural commodity price pressures that encourage sustainable soil health interventions. Federal and state grants, alongside private-sector investments in climate-smart agriculture, are accelerating project pipelines for biochar production facilities and field demonstration trials, reinforcing the region’s dominance in biochar innovation and commercialization.

Europe, Middle East & Africa benefit from a robust regulatory framework that includes the European Green Deal, stringent carbon markets, and national decarbonization roadmaps. Producers in Germany, France, and the United Kingdom are leveraging partnerships with research institutes to optimize biochar formulations for soil remediation and brownfield regeneration. In Africa and the Middle East, pilot projects targeting desertification and nutrient-poor soils are emerging, supported by development finance and climate adaptation funds.

In Asia-Pacific, rapid urbanization and escalating waste management challenges are driving demand for waste-to-value pathways. China’s commitment to carbon neutrality by 2060 and Japan’s circular economy initiatives underpin government-led programs to integrate biochar into large-scale agricultural zones. Emerging economies across Southeast Asia and Australia are also exploring biochar’s role in wildfire recovery and water quality management, positioning the region as one of the fastest-growing biochar markets globally.

This comprehensive research report examines key regions that drive the evolution of the Biochar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies and Competitive Positioning of Leading Biochar Producers Driving Innovation, Scale, and Market Expansion Globally

Leading companies are pioneering diverse strategies to scale biochar production and penetrate new markets. Charm Industrial has demonstrated its market leadership by securing high-profile carbon removal contracts and leveraging integrated bio-oil and biochar processes to optimize economics and permanence. BiocharNow, a Colorado-based pioneer, has focused on modular kiln designs that allow seamless capacity expansion, enabling rapid site cloning to meet localized feedstock availability and customer demand. This modular approach reduces capital barriers and accelerates time to market for large-scale biochar deployments.

Elsewhere, Carbonfuture and Biochar Life have forged partnerships to trace and certify biochar-based carbon removal projects in emerging economies, building transparent supply chains and expanding the geographic footprint of carbon credit-qualified biochar products. Meanwhile, vertically integrated ag-tech firms are bundling biochar with seed treatments, fertilizers, and digital agronomy services to deliver turnkey solutions that resonate with farmers’ productivity needs. This combination of specialized production, strategic alliances, and differentiated product offerings is driving a competitive landscape defined by innovation, quality assurance, and value-added services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biochar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airex Energy

- Aries Clean Technologies

- ArSta eco Pvt Ltd.

- Biochar GmbH & Co. KG by CONVORIS Group

- Biochar Now, LLC

- Biochar Supreme

- CAPCHAR LTD

- Carbo Culture

- Carbofex

- Carbon Gold Ltd.

- Carbonis GmbH & Co. KG

- Chardust Ltd.

- CharGrow LLC

- CharLine GmbH

- Cookswell Jikos Ltd.

- Envigas AB

- Green Man Char

- NetZero S.A.S.

- Novocarbo GmbH

- ONNU LTD

- Oregon Biochar Solutions

- Pacific Biochar Benefit Corporation

- Phoenix Energy

- ProActive Agriculture

- Pyreg GmbH

- pyropower GmbH

- Safi Organics Ltd

- Sonnenerde GmbH

- TOWING Co., Ltd.

- Varaha ClimateAg Private Limited

Providing Strategic Actionable Recommendations for Industry Leaders to Capitalize on Biochar Opportunities While Navigating Regulatory and Market Challenges

Industry leaders should prioritize investments in localized production facilities that leverage readily available feedstocks to mitigate tariff exposure and transportation costs. By co-locating biochar reactors adjacent to biomass sources, companies can optimize logistics and reduce carbon footprints while ensuring feedstock supply stability. Additionally, adopting modular technology platforms enables rapid capacity scaling and flexible production, supporting a broader array of feedstock inputs and end-use specifications.

To capitalize on evolving carbon markets, stakeholders must engage with registry bodies and third-party verifiers to develop robust measurement, reporting, and verification (MRV) frameworks tailored to biochar’s unique permanence profiles. This will unlock premium pricing opportunities in voluntary and compliance carbon credit markets while solidifying biochar’s reputation as a trusted carbon sequestration instrument.

Collaboration across the value chain is essential. Producers, agribusinesses, research institutions, and policymakers should co-develop product standards, application guidelines, and policy incentives that streamline permitting and lifecycle assessments. This multi-stakeholder approach will enhance market confidence, lower adoption barriers, and accelerate the integration of biochar into mainstream agricultural and industrial practices.

Detailing the Comprehensive Research Methodology and Data Triangulation Approach Underpinning the Biochar Market Analysis Report

This market analysis is underpinned by a rigorous research methodology that integrates secondary data, primary stakeholder interviews, and data triangulation techniques. Secondary research involved reviewing industry publications, government reports, academic studies, and trade associations to establish foundational insights into production technologies, feedstock dynamics, and policy frameworks.

Primary research comprised structured interviews with executives from technology providers, feedstock suppliers, agribusinesses, environmental consultants, and carbon registry representatives. These interviews provided firsthand perspectives on emerging trends, regulatory developments, and commercial milestones.

Data triangulation was achieved by cross-referencing quantitative datasets, such as tariff schedules and investment flows, with qualitative insights from expert interviews. The resulting synthesis ensures that the analysis reflects current market realities and identifies actionable intelligence. Additionally, scenario analyses were conducted to model the potential impacts of tariff changes, policy shifts, and technology cost curves on supply-chain economics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biochar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biochar Market, by Production Technology

- Biochar Market, by Feedstock Type

- Biochar Market, by Product Form

- Biochar Market, by Reactor Configuration

- Biochar Market, by Activation Type

- Biochar Market, by Application

- Biochar Market, by Distribution Channel

- Biochar Market, by End User

- Biochar Market, by Region

- Biochar Market, by Group

- Biochar Market, by Country

- United States Biochar Market

- China Biochar Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3498 ]

Synthesizing Key Insights and Future Outlook on Biochar’s Role in Sustainable Agriculture, Environmental Remediation, and Carbon Management Strategies

Biochar stands at the nexus of multiple global imperatives, from regenerative agriculture and waste valorization to climate mitigation and environmental remediation. The integration of advanced production technologies, diversified feedstock ecosystems, and innovative financing mechanisms is propelling the industry from proof-of-concept projects toward commercial maturity. Regional policy landscapes and evolving trade dynamics, including reciprocal tariffs and emerging carbon fees, are introducing complexity but also catalyzing investment in localized production.

Key market participants are differentiating through technological agility, strategic partnerships, and value-added service models that extend beyond raw material supply to encompass agronomic insights and carbon asset management. Segmentation across technology, feedstock, product form, application, and distribution channels reveals a market characterized by both specialization and convergence. As biochar applications expand into water treatment, forestry, and waste management, the opportunity to address pressing environmental and agricultural challenges becomes increasingly tangible.

Looking ahead, the alignment of robust MRV frameworks, supportive policy incentives, and scalable production platforms will determine the pace at which biochar achieves mainstream adoption. Stakeholders who proactively engage in standardization efforts, accelerate capacity deployment, and navigate evolving tariff regimes will be best positioned to capitalize on the sector’s transformative potential.

Engage with Ketan Rohom to Secure the Comprehensive Biochar Market Research Report and Unlock Strategic Insights for Growth and Investment

To gain comprehensive, actionable insights into the evolving biochar market and secure the strategic intelligence required to drive growth, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s expertise will guide you through customized research options, detailed data breakdowns, and expert consultations designed to meet your organization’s unique needs. Engage with Ketan to explore tailored licensing models, commission bespoke analyses, or schedule a strategic briefing that aligns with your business objectives. Transform knowledge into competitive advantage by partnering with Ketan Rohom and access the unparalleled biochar market research report today

- How big is the Biochar Market?

- What is the Biochar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?