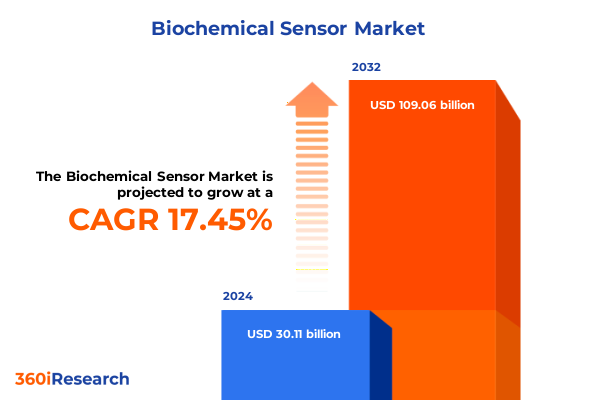

The Biochemical Sensor Market size was estimated at USD 34.94 billion in 2025 and expected to reach USD 40.54 billion in 2026, at a CAGR of 17.65% to reach USD 109.06 billion by 2032.

Biochemical Sensors as the Cornerstone of Next-Generation Diagnostics and Monitoring Across Diverse Industries

Biochemical sensors stand at the confluence of scientific innovation, industrial demand, and regulatory evolution, creating an imperative to understand their complex ecosystem. As researchers and engineers push the boundaries of detection limits and miniaturization, the market contends with an expanding range of applications, from healthcare diagnostics and environmental monitoring to food safety and bioprocess control. This introduction lays the groundwork for exploring how advanced materials, system integration, and policy shifts converge to influence investment strategies and R&D priorities in the biochemical sensor domain.

Over the past decade, the proliferation of point-of-care testing and wearables has underscored the need for reliable, rapid-response sensors capable of detecting biomolecules with high specificity and sensitivity. Concurrent advancements in microfluidics, nanotechnology, and biofunctionalization have fueled remarkable performance gains, yet the path from lab prototype to commercial deployment remains fraught with challenges. Throughout this report, we will examine how core technological innovations intersect with global supply chain dynamics, regulatory frameworks, and end-user expectations to shape the current landscape of biochemical sensing technologies.

Convergence of AI, Advanced Materials, and Energy-Harvesting IoT Networks Is Redefining Biochemical Sensor Capabilities

The biochemical sensor landscape is undergoing a profound transformation driven by the integration of emerging digital technologies, next-generation materials, and novel energy solutions. Artificial intelligence and machine learning algorithms are increasingly embedded at the edge of wearable and stationary platforms, enabling predictive analytics that forewarns of potential health issues or environmental hazards in real time. Meanwhile, Internet of Things connectivity has matured beyond proof-of-concept, establishing ambient IoT ecosystems that leverage energy harvesting techniques and open communication standards to power and interlink distributed sensor networks.

At the same time, materials science breakthroughs-such as the use of graphene, organic polymers, and stretchable conductive textiles-are driving the development of flexible, miniaturized sensors that can conform to biological tissues or integrate seamlessly into industrial processes. These advances are complemented by efforts in edge AI, which reduce latency and bolster data security by processing sensitive biomolecular signals locally on the device, reducing reliance on cloud transmission while preserving performance integrity.

Taken together, these shifts are fostering a landscape in which sensor platforms evolve from single-purpose tools into multifunctional, interoperable systems capable of continuous wellness monitoring, closed-loop process control, and remote diagnostics. As a result, businesses and innovators must adapt to a continuous cycle of technology convergence, regulatory adaptation, and evolving user requirements.

Layered Tariff Measures in 2025 Are Elevating Material Costs and Reshaping Supply Chain Strategies for Biochemical Sensor Manufacturers

Beginning in early 2025, the United States implemented a 10% global tariff on nearly all imported goods, encompassing critical healthcare items, active pharmaceutical ingredients, and diagnostic instruments. This sweeping tariff measure has created immediate cost pressures on manufacturers of biochemical sensors, whose complex assemblies of microelectronics and biological interfaces often rely on cross-border components sourced from diverse regions. For companies that import specialized sensor substrates or proprietary biological reagents, these additional duties have translated into material cost increases that must be absorbed or passed on to customers.

Concurrently, 25% tariffs on imports from Canada, Mexico, and China have heightened expenses for scientific instruments and laboratory equipment, drawing particular concern from academic and industrial research institutions that depend heavily on cross-border supply chains for consumable components. Experts warn that these tariffs are likely to elevate the cost of running research and diagnostic operations, exacerbating budget constraints at a time when federal funding for life sciences research is already under pressure.

Further compounding these challenges, the final Section 301 tariff schedule introduced on January 1, 2025, escalated duty rates on semiconductors and specific medical device parts to up to 50%, affecting the production of electrochemical, optical, and piezoelectric sensor modules. Manufacturers of integrated sensor platforms are now faced with a multilayered tariff environment that has disrupted established sourcing models, triggered nearshoring considerations, and compelled strategic reallocation of capital to maintain production resilience.

Comprehensive Segmentation Highlights Distinct Product Types, Forms, Materials, and Application Domains Driving Biochemical Sensor Innovation

An analysis of the biochemical sensor market through the lens of product type reveals five key technological categories, each underpinned by distinct operational principles and enabling different application niches. Electrochemical sensors depend on redox reactions to quantify analyte concentrations, whereas gas sensors detect volatile compounds through physicochemical interactions at specialized interfaces. Optical sensors harness light-matter interactions to achieve high sensitivity, while piezoelectric devices convert mechanical perturbations into electrical signals. Thermal sensors, though less ubiquitous, play a critical role in contexts requiring precise temperature monitoring of biochemical reactions.

Considering product form, the market spans implantable devices designed for long-term in vivo monitoring to portable handheld tools that deliver rapid diagnostic outputs in field settings. Stationary platforms form the backbone of laboratory workflows and industrial process control, offering high-throughput and multiplexing capabilities. Wearable biochemical sensors, by contrast, prioritize unobtrusive continuous monitoring, integrating seamlessly into textiles and flexible substrates for real-time physiological feedback.

The choice of biological material further delineates the market’s complexity: antibody-based sensors provide immunochemical specificity, cell culture systems offer living analytics for drug screening, and enzyme-linked platforms exploit catalytic amplification for ultra-low detection thresholds. Nucleic acid sensors, targeting DNA or RNA sequences, are essential for genetic and pathogen detection, while receptor-based constructs facilitate molecular recognition across diverse analytes.

Finally, applications span environmental monitoring-encompassing air quality, soil contamination, and water quality assessments-to food quality control, where sensors detect contaminants and monitor spoilage. In healthcare, the spectrum extends from blood glucose and cholesterol tracking to drug discovery and infectious disease diagnostics, as well as pregnancy testing. Industrial processes leverage biochemical sensors for bioprocess optimization and safety controls across manufacturing ecosystems.

This comprehensive research report categorizes the Biochemical Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Product Form

- Biological Materials

- Application

Distinct Regional Dynamics in the Americas, EMEA, and Asia-Pacific Are Shaping Investment, Regulation, and Adoption Patterns for Biochemical Sensors

The Americas region has emerged as a hub for innovation and deployment of biochemical sensors, benefitting from robust venture financing, supportive regulatory frameworks, and a mature healthcare infrastructure. North America, in particular, leads in clinical adoption of continuous monitoring platforms and houses several of the industry’s most influential technology companies. Research institutions across the United States and Canada continue to pioneer next-generation sensor modalities, while manufacturing capabilities are increasingly supplemented by U.S.-based production to mitigate tariff exposure.

Europe, the Middle East, and Africa collectively represent a diverse landscape, where stringent European Union regulations foster high standards of safety and efficacy, albeit at the cost of longer approval timelines. Nonetheless, the introduction of the EU’s In Vitro Diagnostic Regulation (IVDR) has elevated market entry requirements, prompting sensor developers to refine product dossiers and invest in rigorous clinical validation. In the Middle East and Africa, government-backed initiatives to bolster environmental monitoring and public health surveillance are driving pilot deployments of portable and wearable sensors.

Asia-Pacific displays the fastest growth trajectory, underpinned by substantial manufacturing capacities, expanding domestic demand, and aggressive digital health strategies. China, Japan, South Korea, and India are both major producers of sensor components and rapidly growing consumer markets for point-of-care diagnostics. Government programs aimed at modernizing healthcare infrastructure and improving food safety standards have fueled demand for biochemical sensing solutions, while local innovation ecosystems continue to mature, yielding homegrown technologies that compete on cost and performance.

This comprehensive research report examines key regions that drive the evolution of the Biochemical Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Industry Leaders Leverage Innovation, Strategic Alliances, and Operational Agility to Solidify Leadership in Biochemical Sensor Markets

Several leading companies are at the forefront of driving technological advancement and market expansion within the biochemical sensor domain. Abbott Laboratories, for example, reported a surge in continuous glucose monitoring product sales, with revenue rising by 18.3% year-over-year in the first quarter of 2025, underscoring its role as a market innovator in wearable health diagnostics. DexCom has likewise demonstrated strong momentum, achieving 14% organic revenue growth in Q1 2025 and expanding insurance coverage for its CGM platforms in the United States, while reinforcing its financial resilience through a $750 million share repurchase program.

Medtronic has been strategically augmenting its diabetes portfolio through both internal development and targeted partnerships. The company’s launch of its next-generation 780G automated insulin delivery system and the subsequent global partnership to integrate Abbott’s advanced CGM technology exemplify a collaborative approach to driving sustained growth in the diabetes care segment. Meanwhile, major players such as Roche, Thermo Fisher Scientific, and Siemens Healthineers continue to enhance their biochemical sensor offerings through acquisitions and incremental product innovations, focusing on expanding multiplexing capabilities, reducing sample volumes, and integrating digital analytics to enable predictive diagnostics.

Collectively, these companies are responding to competitive pressures and market complexity by investing in manufacturing agility, advancing modular platform architectures, and deepening engagement with regulatory bodies. Such measures aim to streamline time-to-market, fortify supply chain resilience, and foster strategic ecosystems that cross traditional boundaries between diagnostics, therapeutics, and digital health services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biochemical Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies Inc.

- Allonnia

- ams-OSRAM AG

- BBI Solutions

- Bio-Rad Laboratories, Inc.

- BioDot, Inc. by ATS Corporation

- Dexcom, Inc

- Eastprint Incorporated

- Endress+Hauser Group

- F. Hoffmann-La Roche Ltd.

- General Electric Company

- Hangzhou Freqcontrol Electronic Technology Ltd.

- Intricon Corporation

- Koninklijke Philips N.V.

- LifeScan IP Holdings, LLC

- LifeSignals, Inc.

- Masimo Corp.

- Medtronic PLC

- Merck KGaA

- Monod Bio, Inc

- Nova Biomedical Corporation

- Pinnacle Technology, Inc.

- Smiths Detection Group Ltd

- STMicroelectronics NV

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Actionable Strategies for Industry Stakeholders to Enhance Resilience, Achieve Regulatory Excellence, and Expand Market Reach

To navigate the rapid evolution of the biochemical sensor landscape, industry leaders should prioritize diversification of their supply chains, incorporating nearshoring and dual-sourcing strategies to mitigate tariff risks and geopolitical disruptions. Investment in flexible manufacturing cells capable of switching between sensor types will enhance operational resilience and reduce time-to-market in response to demand fluctuations. Furthermore, companies should deepen collaboration with artificial intelligence and data analytics partners to develop edge-AI enabled sensor systems, enhancing real-time decision support while ensuring data privacy and compliance.

Given the increasing stringency of regulatory frameworks, sensor developers must invest in robust clinical validation and quality management systems. Early engagement with regulatory bodies-particularly under the EU IVDR and U.S. FDA’s digital health initiatives-can streamline approval pathways and reduce post-market surveillance burdens. Building strategic alliances with clinical research organizations and healthcare providers will facilitate pragmatic trials that generate real-world evidence, bolstering user adoption and payor coverage decisions.

Finally, to unlock new market segments and extend the utility of biochemical sensors, organizations should explore adjacent ecosystems such as telemedicine platforms, precision agriculture networks, and industrial automation systems. By establishing interoperable standards and open application programming interfaces, sensor vendors can foster vibrant ecosystems that amplify the value proposition of their technologies, driving broad adoption across healthcare, environmental monitoring, and manufacturing domains.

Multi-Method Research Framework Combining Expert Interviews, Secondary Data, and Validated Analytics Ensures Comprehensive Market Insights

This market analysis is underpinned by a rigorous research methodology that integrates both qualitative and quantitative approaches. Primary research involved in-depth interviews with over 40 industry experts, including sensor R&D leads, manufacturing executives, and regulatory affairs specialists, to capture nuanced perspectives on technological advances and market dynamics. Secondary research encompassed a comprehensive review of peer-reviewed journals, government publications, patent filings, and reputable news sources, ensuring thorough triangulation of trends and data points.

Data modeling and analytics techniques were applied to synthesize information on supply chain configurations, tariff structures, and regional regulatory frameworks. Market segmentation was validated through cross-checking with industrial trade associations and key opinion leader roundtables. The research team employed scenario analysis to assess the impact of policy shifts, such as tariff escalations and IVDR implementation, on cost structures and time-to-market projections.

Finally, findings were subjected to a multi-stage validation process involving independent expert panels and stakeholder workshops. This iterative approach ensured accuracy, relevance, and actionable insight, equipping decision-makers with a robust evidence base to inform strategic planning and investment deliberations in the biochemical sensor market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biochemical Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biochemical Sensor Market, by Product Type

- Biochemical Sensor Market, by Product Form

- Biochemical Sensor Market, by Biological Materials

- Biochemical Sensor Market, by Application

- Biochemical Sensor Market, by Region

- Biochemical Sensor Market, by Group

- Biochemical Sensor Market, by Country

- United States Biochemical Sensor Market

- China Biochemical Sensor Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusion Emphasizing the Imperative for Strategic Agility and Technological Integration in the Biochemical Sensor Sector

In conclusion, the biochemical sensor industry stands at a pivotal juncture, characterized by accelerating technological convergence, growing end-user demand for real-time analytics, and a complex web of regulatory and trade considerations. The integration of AI, advanced materials, and ambient IoT technologies is reshaping sensor capabilities, expanding beyond traditional diagnostic use cases into continuous monitoring, closed-loop systems, and industrial automation. Regional dynamics underscore the importance of localized strategies, with Asia-Pacific leading growth, Europe demanding rigorous compliance, and the Americas driving innovation and commercialization.

However, the cumulative impact of 2025’s layered tariff measures has introduced new cost challenges and supply chain vulnerabilities, compelling companies to reevaluate sourcing strategies and invest in manufacturing agility. Leading organizations are responding through strategic partnerships, modular platform designs, and enhanced quality management practices, ensuring resilience amid evolving policy landscapes.

As the market continues to mature, success will hinge on a delicate balance between technological differentiation, operational excellence, and proactive engagement with regulatory stakeholders. Companies that effectively leverage interdisciplinary collaborations, prioritize scalable manufacturing, and anticipate policy shifts will be best positioned to capture emerging opportunities across healthcare, environmental monitoring, food safety, and industrial process control.

Contact the Associate Director of Sales and Marketing to Unlock Comprehensive Biochemical Sensor Market Insights

For bespoke insights and strategic guidance on the rapidly evolving biochemical sensor market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By partnering with his team, you can obtain the full comprehensive research report, which delivers in-depth analysis, actionable intelligence, and custom solutions to support your organization’s decision-making. Whether you are exploring new market segments, navigating tariff impacts, or forging partnerships to harness cutting-edge sensor technologies, Ketan’s expertise in market research and client engagement will ensure you access the right data and recommendations. Secure your competitive advantage today by connecting with Ketan to discuss your specific requirements, request tailored supplemental data, or arrange an executive briefing. The definitive resource you need to navigate complexities, anticipate trends, and accelerate your growth is just one conversation away.

- How big is the Biochemical Sensor Market?

- What is the Biochemical Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?