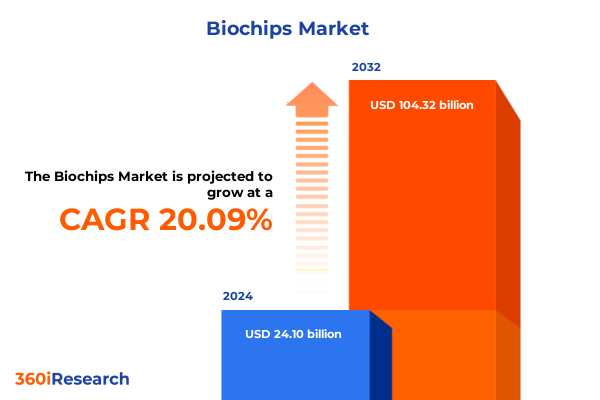

The Biochips Market size was estimated at USD 29.05 billion in 2025 and expected to reach USD 34.29 billion in 2026, at a CAGR of 20.03% to reach USD 104.32 billion by 2032.

Exploring the Pioneering Innovations in Biochips Driving Unprecedented Advances in Diagnostics, Research, and Personalized Medicine Worldwide

The convergence of biotechnology and microfabrication has ushered in a transformative era for biochip technologies, redefining how biological assays are performed and analyzed. Once confined to basic research laboratories, biochips now underpin critical applications ranging from rapid disease diagnostics to high-throughput drug discovery platforms. This transition is driven by unprecedented miniaturization of fluidic channels, integration of advanced sensing elements, and incorporation of artificial intelligence for real-time data interpretation. As a result, healthcare providers and researchers are gaining access to point-of-care tools and multiplexed assays that deliver precision insights at unprecedented speed, marking a significant departure from traditional bench-scale processes.

Emerging Disruptive Forces Revolutionizing Biochips: How AI-Enhanced Microfluidics, Novel Substrates, and Policy Shifts Are Redefining Precision Diagnostics

In recent years, biochip development has been propelled by the integration of machine learning algorithms that optimize fluid dynamics and analytical workflows. Intelligent microfluidic systems can now adjust flow rates dynamically, ensuring consistent droplet generation and precise biomarker detection without manual recalibration. Concurrently, novel substrate materials such as biocompatible polymers and advanced silicon-glass composites are replacing legacy glass platforms, offering improved optical clarity and enhanced surface functionalization capabilities. These material innovations are complemented by regulatory evolutions, where agencies like the U.S. Food and Drug Administration have begun to establish guidelines specific to lab-on-a-chip diagnostics, encouraging faster clearance pathways for devices demonstrating rigorous clinical performance.

Assessing the Total Effect of 2025 United States Tariff Increases on Critical Materials for Biochip Manufacturing and Global Supply Chain Resilience

The federal government’s 2025 Section 301 tariff review resulted in a steep increase from a 25% to a 50% duty on imported polysilicon and wafer products, significantly affecting the cost of silicon-based substrates critical for biochip fabrication. Immediately thereafter, an additional executive order added 10% to these levies on February 4, 2025, raising total duties to 60% and further amplifying material expenses. Meanwhile, certain tungsten products used in sensor integration faced a 25% levy, influencing the sourcing of metallic components. These cumulative tariffs have driven leading manufacturers to explore onshore production capabilities or secure long-term domestic supply agreements to mitigate volatility in international trade and safeguard operations from future geopolitical disruptions.

Deep Dive into Market Segmentation Dynamics Highlighting Product Innovations, Material Evolutions, and Technological Diversifications Shaping Biochip Applications

Innovation in biochip platforms is intricately tied to distinct product categories, each tailored to unique analytical needs. DNA biochips dominate applications in genetic screening, while lectin and peptide microarrays unlock precise glycan and protein interaction studies, respectively. Protein biochips excel in antibody profiling for immunoassays, and tissue microarrays drive histological analysis in oncology research. Underpinning these platforms are three core materials: traditional glass remains favored for its optical properties, polymers offer cost-effective disposability and rapid prototyping, and silicon delivers robust microfabrication precision. Technology segmentation further distinguishes lab-on-a-chip devices-applied in drug screening platforms, environmental contaminant monitoring, and decentralized point-of-care diagnostics-from microarray technology focused on high-throughput sample interrogation, and microfluidic biochips engineered for seamless automation of complex assays. In applications, diagnostics encompass cancer detection, genetic disorder screening, and infectious disease identification, while drug discovery leverages lead screening, target identification, and validation. Genomics and proteomics research demand specialized arrays and sequencing integrations, each custom-designed to unravel biological complexity. The end users of these innovations range from academic and research institutes and contract research organizations to diagnostic laboratories, hospitals, clinics, and pharmaceutical and biotechnology companies, reflecting a diverse ecosystem unified by the shared goal of advancing life science exploration.

This comprehensive research report categorizes the Biochips market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Material

- Technology

- Application

- End User

Key Regional Market Dynamics Revealed: How Americas, Europe Middle East & Africa, and Asia-Pacific Are Driving Biochip Innovation and Adoption

Across the Americas, a robust research infrastructure and substantial government funding have positioned the region as a primary adopter of biochip technologies. The United States, in particular, leads global medical device revenues and invests heavily in precision medicine initiatives, driving demand for next-generation microfluidic and array-based diagnostics. In the Europe, Middle East & Africa region, manufacturers navigate evolving regulatory frameworks under the EU’s MDR and IVDR directives, balancing compliance requirements with strong academic collaborations and public-private partnerships to bring innovative biochips to market. Meanwhile, the Asia-Pacific region is characterized by rapid expansion, fueled by government incentives for domestic manufacturing, digital health integration, and a burgeoning medtech ecosystem projected to exceed $140 billion by 2025 through strategic localization and technology adoption efforts.

This comprehensive research report examines key regions that drive the evolution of the Biochips market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves and Innovation Leadership by Top Biochip Companies Uncovered Through Partnerships, Acquisitions, and Cutting-Edge Technology Investments

Illumina remains at the forefront of genomic analysis, extending its leadership through strategic investments such as a $20 million stake alongside Regeneron in Truveta’s $320 million push to build the world’s largest genetic database. This collaboration aims to compile over 10 million diverse genomic sequences, fostering breakthroughs in disease predisposition research and accelerating drug discovery. Danaher Corporation, leveraging its Diagnostics unit momentum, has pursued complementary acquisitions-including Abcam in late 2023-to broaden its life sciences portfolio. Its Leica Biosystems and Beckman Coulter businesses continue to secure FDA 510(k) clearances, underscoring growth in clinical diagnostics workflows and bolstering its integrated instrument and consumable solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biochips market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- Arrayit Corporation

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Cepheid, Inc.

- CustomArray, Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche AG

- Illumina, Inc.

- Merck KGaA

- Micronit Microtechnologies B.V.

- NanoString Technologies, Inc.

- PerkinElmer, Inc.

- QIAGEN N.V.

- Standard BioTools Inc.

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

Proactive Strategies and Tactical Recommendations to Navigate Biochip Industry Challenges and Capitalize on Emerging Opportunities for Market Leadership

Industry leaders should prioritize integration of intelligent data analysis into biochip platforms, collaborating with AI specialists to embed predictive algorithms that streamline assay interpretation and enhance decision support. Simultaneously, organizations must reassess supply chain configurations to incorporate on-shore or near-shore production of critical materials, reducing exposure to tariff fluctuations and geopolitical risk. Fostering strategic partnerships between instrument manufacturers and clinical end users offers valuable feedback loops, accelerating device refinement and reinforcing market positioning. Finally, continued engagement with regulatory authorities to shape clear guidelines for emerging technologies will help secure expedited approvals while ensuring analytical rigor and patient safety.

Robust and Transparent Research Methodology Combining Primary Interviews, Regulatory Analysis, Patent Reviews, and Supply Chain Mapping for In-Depth Market Intelligence

This report synthesizes findings from a comprehensive research methodology that combined primary interviews with over 20 senior executives across diagnostics, life sciences, and regulatory affairs with secondary analysis of trade commission filings and government press releases. Tariff impacts were assessed via USTR Section 301 documentation and executive orders, while supply chain mapping leveraged customs data to quantify shifts in polysilicon and tungsten import volumes. An extensive patent review of top biochip innovators provided insight into emerging material and fabrication techniques. Additionally, regulatory frameworks were benchmarked through EU MDR and IVDR resolutions, supplemented by technical briefings with notified bodies to elucidate certification roadmaps. This multipronged approach ensures a balanced perspective, merging qualitative expert opinions with quantitative trade and IP analytics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biochips market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biochips Market, by Product

- Biochips Market, by Material

- Biochips Market, by Technology

- Biochips Market, by Application

- Biochips Market, by End User

- Biochips Market, by Region

- Biochips Market, by Group

- Biochips Market, by Country

- United States Biochips Market

- China Biochips Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Core Findings on Biochip Technological, Regulatory, and Market Trends to Empower Stakeholders with Actionable Strategic Insights

The biochips landscape is undergoing seismic transformations driven by integration of AI-enabled microfluidics, strategic tariff-induced supply chain realignment, and a nuanced segmentation ecosystem that caters to diverse biological applications. Regional dynamics underscore the importance of localized production capabilities in America and Asia-Pacific, counterbalanced by Europe’s regulatory rigor that safeguards quality and patient access. Leading companies are consolidating their positions through targeted investments and collaborations, while actionable recommendations highlight the critical need for intelligent assay platforms and resilient sourcing strategies. Collectively, these insights equip stakeholders with a roadmap for navigating the complexities of biochip commercialization, ensuring sustainable growth in an increasingly competitive global market.

Secure Comprehensive Insights into the Biochips Market with Expert Guidance from Associate Director Ketan Rohom to Drive Strategic Decisions

For deeper insights into this comprehensive biochips market analysis and to secure a tailored discussion on how these findings can inform your strategic initiatives, please connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings extensive expertise in translating advanced market intelligence into actionable plans that directly address the priorities of decision-makers. Engage with him to learn how this report can empower your organization to navigate regulatory shifts, leverage segmentation opportunities, and optimize supply chain resilience. Reach out today to explore customized licensing options, sample data access, or group briefing sessions that will position you at the forefront of biochip innovation and commercialization.

- How big is the Biochips Market?

- What is the Biochips Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?