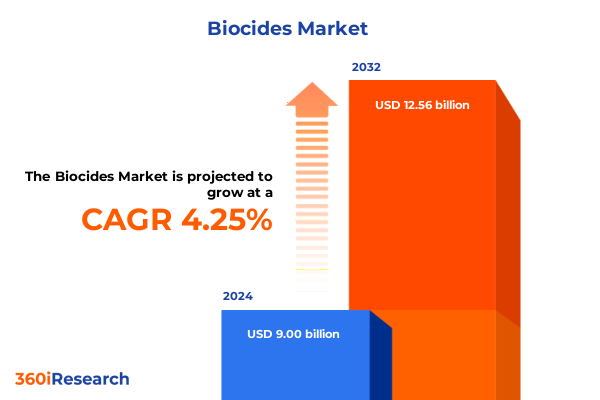

The Biocides Market size was estimated at USD 9.38 billion in 2025 and expected to reach USD 9.77 billion in 2026, at a CAGR of 4.26% to reach USD 12.56 billion by 2032.

Exploring the Evolving Global Biocides Landscape Fueled by Heightened Hygiene Imperatives and Breakthrough Preservation Technologies

In an era marked by unprecedented focus on health, safety, and sustainability, the global biocides industry is undergoing profound shifts in response to evolving industrial, commercial, and consumer demands. Against a backdrop of tightening regulations and heightened awareness of microbial threats, stakeholders across food and beverage, water treatment, pharmaceuticals, and beyond are seeking innovative solutions to enhance preservation and control contamination. This introduction examines how innovation in active chemistries, coupled with rising demand for eco-friendly and efficacious compounds, is redefining competitive opportunities for market participants.

Moreover, the ongoing digital transformation and adoption of data-driven monitoring tools are providing new avenues to optimize biocide performance in real time. As manufacturers integrate smart dosing systems and remote sensing technologies, they gain deeper insights into microbial load fluctuations and can fine-tune treatment regimens for maximum effectiveness. These technological advancements not only improve operational efficiency but also reinforce regulatory compliance by delivering precise control over dosing and emissions.

Furthermore, evolving consumer preferences are accelerating the shift toward biocides that balance potency with environmental safety. In particular, the drive to replace legacy chemistries with next-generation formulations that minimize byproducts and biodegrade cleanly is reshaping R&D priorities. Consequently, research partnerships between chemical companies, academic institutions, and specialty ingredient producers are more critical than ever. This collaborative ecosystem sets the stage for a dynamic landscape in which sustainable innovation and robust efficacy coexist to meet the complex demands of the modern market.

Regulatory Intensification Technological Fusion and Sustainability Imperatives Reshaping the Biocide Industry Landscape

As the biocides sector advances, several transformative shifts are reshaping its trajectory and value proposition. In recent years, regulatory agencies around the world have intensified scrutiny of chemical efficacy and environmental impact, prompting manufacturers to reformulate legacy products or invest in greener alternatives. Simultaneously, life-cycle assessments and eco-toxicity evaluations are becoming standard prerequisites for market approval, driving the adoption of advanced testing methodologies and predictive modeling frameworks.

In parallel, the proliferation of antimicrobial resistance concerns has spurred interest in combination chemistries and synergistic active ingredients. This paradigm shift encourages cross-functional innovation, as formulators combine oxidizing agents with non-oxidizing counterparts to achieve rapid kill rates while extending residual efficacy. Given the complexity of modern microbial ecosystems, such hybrid approaches are gaining traction for applications spanning cooling water systems to personal care products.

Equally significant is the ascent of digital and IoT solutions that enable real-time monitoring of biocide performance. Smart sensors and analytics platforms now allow for continuous tracking of key parameters such as oxidation–reduction potential, pH, and microbial load. This convergence of chemistry and data science not only optimizes dosing strategies but also reduces chemical usage and wastewater discharge, thereby aligning with circular economy goals.

Taken together, these transformative shifts underscore a move toward sustainable, data-empowered biocide management. Companies that anticipate and adapt to these trends will be best positioned to capitalize on emerging growth opportunities while ensuring compliance with evolving global standards.

Supply Chain Diversification Onshore Production Incentives and Formulation Efficiency Driven by New United States Biocide Tariff Landscape

The introduction of United States tariffs on selected biocide intermediates and formulated products in early 2025 has triggered a ripple effect across domestic supply chains and procurement strategies. Manufacturers that traditionally relied on imported isothiazolinones, metal-based agents, and specialty oxidizers have been compelled to reassess sourcing models and build greater resilience against rising input costs. Consequently, procurement teams are diversifying supplier portfolios and negotiating long-term contracts to stabilize pricing and maintain continuity of supply.

Moreover, the cost pressures induced by tariffs are catalyzing onshore production initiatives. Chemical companies are scaling up local manufacturing capacities for certain active ingredients, leveraging tax incentives and infrastructure grants to offset capital expenditure. This onshoring trend is not only designed to mitigate tariff exposure but also to address growing customer demand for supply chain transparency and shorter lead times.

At the same time, additive costs are influencing formulation strategies. Biocide developers are exploring synergistic blends and performance enhancers that can achieve target efficacy with reduced loadings of higher-cost components. Through advanced formulation science, they aim to preserve biological activity across diverse pH ranges and temperature conditions while optimizing cost structures.

Taken together, the tariff environment in 2025 has accelerated a strategic pivot toward supply chain diversification, onshore production, and formulation efficiency. Stakeholders that proactively adapt to these dynamics will secure competitive advantage by ensuring product availability and cost predictability amid a shifting trade landscape.

Holistic Segmentation Analysis Reveals Diverse Application-Specific Requirements and Targeted Biocide Innovation Pathways

Drawing insights from application-based market segmentation reveals a tapestry of opportunity that spans multiple industries. In food and beverage preservation, baked goods, dairy, and meat processors are increasingly prioritizing antimicrobial agents that deliver both immediate microbial control and extended shelf life, while beverage producers demand solutions compatible with reverse osmosis, membrane treatment, and stainless-steel sanitation protocols. Equally, in paints and coatings, architectural formulators balance aesthetic performance with corrosion protection, whereas marine and industrial protective segments require robust oxidizing agents capable of withstanding saline environments and heavy mechanical wear.

In paper and pulp processing, packaging paperboard operations focus on biocides that hinder bacterial growth during recycling and storage, while tissue manufacturers seek agents that preserve softness without compromising hygiene. Pharmaceuticals and personal care brands continue to challenge formulators to innovate with phenolic and quaternary ammonium chemistries that are gentle on skin yet potent against pathogens. Similarly, water treatment applications range from municipal drinking water disinfection protocols that safeguard public health to industrial wastewater treatments designed to comply with tightening effluent regulations without generating harmful byproducts.

From the perspective of chemical type, disinfectants featuring both oxidizing and non-oxidizing actives are tailored to specific contact times and organic loads, while pest control agents provide targeted interventions against fungal, insect, and rodent infestations. Preservative demand is rising for isothiazolinones in industrial coatings and organosulfur compounds in oil and gas equipment protection. Active-ingredient priorities further highlight chlorine-based oxidizers for high-throughput water systems and silver-based metal biocides for electronic component preservation.

In terms of form and mode of action, liquid and powder formats remain prevalent across industrial applications, whereas tablets and granules find favor in municipal settings for ease of dosing. Non-oxidizing modes of action, such as biguanides, phenolics, and quaternary ammonium compounds, maintain strong adoption where material compatibility and surface safety are paramount, while oxidizing strategies persist for rapid kill kinetics and biofilm management.

This comprehensive research report categorizes the Biocides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Solubility

- Source

- Application

- Distribution Channel

Navigating Complex Regulatory Regimes and Local Demand Patterns to Capitalize on Regional Biocide Market Opportunities

Regional dynamics underscore unique drivers and barriers across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, stringent FDA and EPA oversight of antimicrobial agents in food contact and drinking water applications compels suppliers to submit robust safety dossiers, fueling demand for comprehensive toxicological data packages. North American petrochemical hubs are also integrating biocide management into broader sustainability initiatives, seeking solutions that minimize environmental footprint while maintaining operational reliability.

Across Europe, Middle East & Africa, regulatory harmonization under REACH and local directives has elevated the importance of registration timelines and dossier completeness. Manufacturers in EMEA are consequently investing in cross-border regulatory intelligence to navigate divergent requirements, particularly for novel active ingredients. Simultaneously, water utilities throughout the region are modernizing infrastructure and adopting advanced oxidation processes that pair ultraviolet irradiation with peroxygen chemistries to achieve multi-barrier disinfection.

In Asia-Pacific, rapid industrialization, expanding urban populations, and rising per-capita consumption of packaged foods and personal care products drive robust biocide growth. However, localized raw material sourcing and tariff regimes vary widely, prompting multinational formulators to establish regional production hubs. China, India, and Southeast Asian markets are witnessing increased collaboration between domestic ingredient suppliers and global technology licensors to accelerate product registrations and technology transfers.

These regional insights highlight that success in the global biocides market hinges on navigating complex regulatory environments, aligning product development with localized end-use needs, and forging strategic partnerships within each geography.

This comprehensive research report examines key regions that drive the evolution of the Biocides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Collaborations Consolidations and R&D Synergies Defining the Competitive Dynamics of the Biocide Industry

The competitive landscape features leading chemical and specialty ingredient companies that drive innovation through diverse portfolios and global reach. Established players leverage integrated R&D networks to streamline the development of next-generation biocides, optimizing efficacy, safety, and environmental performance through high-throughput screening and computational modeling techniques. At the same time, agile regional manufacturers excel at rapid formulation adaptation, tailoring solutions to local water chemistries, substrate types, and application protocols.

Strategic collaborations between major corporations and niche technology providers have become commonplace, enabling co-development of proprietary chemistries and application-specific solutions. These alliances often focus on high-value segments such as pharmaceutical water systems, protective coatings for extreme environments, and antimicrobial additives for advanced textiles. Through joint ventures and licensing agreements, companies expand geographic reach and accelerate time to market for innovative offerings.

Moreover, mergers and acquisitions continue to reshape the industry, as firms seek to augment their active ingredient pipelines or gain footholds in adjacent market segments. Such consolidation can unlock synergies across R&D, manufacturing, and distribution channels, but also poses integration challenges that require careful management of regulatory registrations and brand equity.

In this dynamic competitive environment, success depends on harmonizing global product strategies with localized execution, leveraging partnerships to fill capability gaps, and maintaining robust pipelines of environmentally responsible biocide solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biocides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Arxada AG

- Baker Hughes Company

- BASF SE

- Berkshire Corporation

- ChemTreat, Inc.

- Clariant AG

- Dow Chemical Company

- Ecolab Inc.

- Enviro Tech Chemical Services, Inc.

- Evonik Industries AG

- ICL Group Ltd.

- Israel Chemicals Ltd.

- Italmatch Chemicals S.p.A.

- Kemin Industries, Inc.

- Kemira Oyj

- LANXESS AG

- Melzer Chemicals Pvt. Ltd.

- Nouryon B.V.

- Solenis LLC

- Solvay SA

- Stepan Company

- Thor Group Limited

- Valtris Specialty Chemicals

- Veolia Environnement S.A.

- Vink Chemicals GmbH & Co. KG

Embedding Sustainability Driven Innovation and Supply Chain Resilience to Strengthen Market Leadership in Biocide Solutions

Industry leaders should prioritize the integration of green chemistry principles throughout their product development pipelines. By embedding life-cycle thinking early in formulation design, organizations can reduce downstream compliance risks and foster brand distinction among end users increasingly sensitive to environmental impact. In parallel, investing in smart dosing technologies and digital analytics platforms will drive operational efficiencies, enabling precise control over biocide application rates and minimizing chemical consumption.

To mitigate supply chain disruptions driven by trade policy shifts, companies must diversify sourcing strategies, cultivate relationships with multiple raw material suppliers, and explore onshore or nearshore manufacturing options where feasible. Establishing strategic inventory buffers and leveraging predictive demand planning can further buffer against volatility in input costs and lead times.

Engaging proactively with regulatory bodies through pre-submission consultations and joint research partnerships can expedite time to market for novel actives. Securing regulatory buy-in for environmentally benign biocides not only accelerates commercialization but also bolsters corporate reputation. Finally, building cross-industry alliances-such as collaborations between water utilities and chemical innovators-can unlock co-innovation opportunities across emerging application areas.

By executing these recommendations, orchestrating multidisciplinary teams, and aligning strategic objectives with robust governance structures, industry leaders can strengthen their competitive positioning and drive sustainable growth in the biocides market.

Deploying Integrated Primary and Secondary Research With Data Triangulation to Deliver Robust Biocide Market Insights

This research employed a rigorous methodology combining primary and secondary data sources to ensure comprehensive coverage of market dynamics. Secondary research involved an extensive review of scientific literature, regulatory filings, patent databases, and industry white papers to map the evolution of active ingredients and regulatory frameworks. These insights laid the groundwork for quantitative assessments and facilitated the identification of critical market drivers.

Primary research comprised in-depth interviews with key stakeholders, including formulators, regulatory affairs experts, procurement managers, and end-use application specialists across multiple industries. These conversations provided nuanced perspectives on emerging formulation challenges, approval timelines, and regional market nuances. Concurrently, a survey of over one hundred decision-makers in food processing, water utilities, and coatings helped validate findings and quantify qualitative observations.

Data triangulation was achieved by cross-referencing primary insights with trade data analyses, customs statistics, and company annual reports. A structured validation process ensured consistency and resolved discrepancies, while peer reviews by subject-matter experts confirmed the robustness of conclusions. Finally, all data points underwent quality checks to eliminate outliers and ensure alignment with current regulatory and technological developments.

This methodological approach offers reliable, actionable intelligence, equipping stakeholders with the strategic insights needed to navigate the complex global biocides landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biocides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biocides Market, by Type

- Biocides Market, by Form

- Biocides Market, by Solubility

- Biocides Market, by Source

- Biocides Market, by Application

- Biocides Market, by Distribution Channel

- Biocides Market, by Region

- Biocides Market, by Group

- Biocides Market, by Country

- United States Biocides Market

- China Biocides Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Advancing Sustainable Innovation Strategic Partnerships and Data-Driven Strategies as Pillars for Future Biocide Market Success

In summary, the biocides industry stands at a pivotal juncture as regulatory pressures, sustainability imperatives, and technological advancements converge to redefine market expectations. Companies that embrace eco-friendly chemistries, deploy digital monitoring tools, and foster resilient supply chains will be positioned to thrive amidst shifting trade landscapes and evolving end-use requirements. Furthermore, segmented insights underscore the importance of application-specific solutions, from food and beverage sanitation to protective coatings in harsh environments.

Regional perspectives highlight the need for tailored go-to-market strategies, whether navigating stringent EMEA registration protocols or responding to rapid industrial growth in Asia-Pacific. Meanwhile, strategic collaborations and mergers continue to reshape competitive dynamics, offering pathways to expand capabilities but requiring careful integration planning.

Ultimately, the future of the biocides market hinges on the ability of industry participants to innovate sustainably, engage proactively with regulators, and leverage data-driven decision-making. By adopting the recommendations outlined herein, organizations can secure competitive advantage and drive long-term growth.

Unlock Exclusive Biocides Market Intelligence by Collaborating Directly with our Associate Director for Tailored Strategic Insights

For a detailed exploration of how these transformative trends and strategic insights can drive your organization’s success in the global biocides market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who will guide you through the comprehensive market research report and help tailor solutions to your unique business challenges

- How big is the Biocides Market?

- What is the Biocides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?