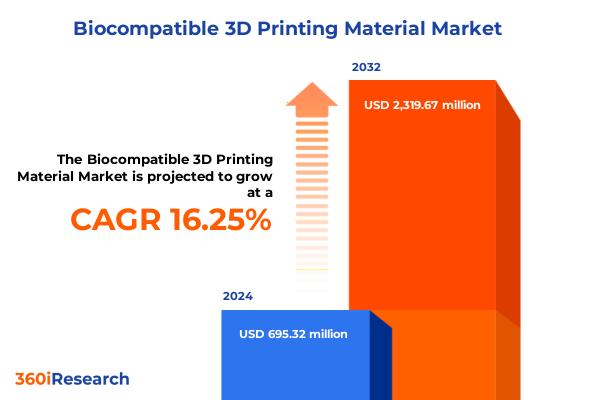

The Biocompatible 3D Printing Material Market size was estimated at USD 794.56 million in 2025 and expected to reach USD 913.76 million in 2026, at a CAGR of 16.53% to reach USD 2,319.67 million by 2032.

Introducing Biocompatible 3D Printing Materials as a Catalyst for Next-Generation Medical Device Innovation and Personalized Healthcare Solutions

Biocompatible 3D printing materials are redefining the boundaries of medical device innovation, enabling unprecedented levels of customization, precision, and functional performance. As regulatory bodies continue to refine standards for patient safety, material developers are racing to engineer advanced formulations that meet stringent biocompatibility requirements while maintaining versatility across diverse medical applications. This introduction outlines how the confluence of material science breakthroughs, additive manufacturing capabilities, and evolving clinical needs is setting the stage for a new era in personalized healthcare solutions.

In recent years, the integration of alumina and zirconia ceramics with advanced polymer composites has resulted in hybrid materials that offer both mechanical robustness and bioinertness. Simultaneously, metal alloys such as titanium, cobalt chromium, and stainless steel are being tailored with nanoscale surface treatments to enhance osseointegration in orthopedic implants. Complementing these material innovations, printing technologies ranging from binder jetting to stereolithography are evolving to address challenges in resolution, throughput, and process reliability. As adoption accelerates, stakeholders across contract manufacturing organizations, medical device manufacturers, healthcare providers, and research institutes will need to adapt strategies to harness these capabilities effectively.

This report begins by contextualizing the market landscape, presenting key factors driving growth and areas ripe for disruption. It then transitions to an examination of transformative shifts affecting materials and processes, assesses regulatory and tariff influences, and delivers segmentation insights across material types, printing technologies, product forms, applications, and end users. Finally, strategic recommendations and a detailed research methodology provide a clear roadmap for decision makers seeking to capitalize on the promise of biocompatible 3D printing materials.

Unveiling the Technological Advances and Evolving Regulatory Standards Revolutionizing the Biocompatible 3D Printing Materials Ecosystem

The landscape of biocompatible 3D printing materials is undergoing transformative shifts driven by both technological advancements and evolving regulatory frameworks. On the technological front, the advent of multi-material printers and hybrid additive manufacturing platforms has enabled the simultaneous deposition of metals, ceramics, and polymers within a single build process. This capability is facilitating the creation of composite structures that exhibit tailored mechanical gradients and localized functional properties, advancing applications from scaffold fabrication in tissue engineering to patient-specific surgical instruments.

Regulatory bodies in the United States, Europe, and Asia are responding to the proliferation of these technologies by updating guidelines to ensure both material safety and process validation. As a result, manufacturers are investing heavily in in-house testing facilities and collaborating closely with contract research organizations to secure faster approvals. These shifts are fostering an ecosystem where research institutes, medical device manufacturers, and healthcare providers can leverage standardized protocols to streamline product development and reduce time to market.

Moreover, emerging digital workflows that integrate real-time process monitoring with predictive analytics are reshaping quality assurance practices. By capturing process parameters and correlating them with post-printing performance metrics, stakeholders can refine material formulations and printing recipes with unprecedented precision. Consequently, the industry is moving toward a future where adaptive materials and closed-loop manufacturing systems will converge to deliver highly customized therapeutic solutions.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Supply Chains and Adoption of Advanced Biocompatible Materials

In 2025, the United States implemented updated tariff policies that have materially affected the cost structure and supply chain dynamics for key biocompatible 3D printing materials. Imports of high-purity metal powders, including titanium alloys and cobalt chromium, have faced increased duties that, in turn, have pressured pricing for additive manufacturing service providers and medical device manufacturers. Concurrently, ceramics such as alumina and zirconia, traditionally sourced from a mix of domestic and foreign suppliers, have encountered mid-range tariffs that have incentivized companies to reevaluate their supply chain strategies.

These policy shifts have spurred investments in domestic powder production facilities and prompted a wave of partnerships between material innovators and regional manufacturing hubs. As companies seek to mitigate tariff-induced price volatility, they are establishing secure supply agreements and diversifying raw material sourcing to include regional refiners and recyclers capable of delivering consistent quality. This transition is also driving a broader focus on circular economy principles, where spent powder recovery and reprocessing protocols are becoming integral to cost management and sustainability goals.

Looking ahead, industry participants are closely monitoring proposed adjustments to duty rates and their potential implications for cross-border research collaborations. The cumulative impact of these tariffs underscores the necessity for agile procurement policies, robust supplier relationships, and in-house material qualifications, all of which will determine competitive positioning in an increasingly complex regulatory landscape.

Revealing Deep-Dive Segmentation Insights Across Material Types, Printing Technologies, Product Forms, Applications, and End Users

A nuanced understanding of market segmentation is critical for identifying where biocompatible 3D printing materials will have the greatest effect and how to allocate resources strategically. When examining material type, ceramics deliver exceptional hardness and wear resistance, with alumina favored for dental crowns bridges and zirconia providing high fracture toughness in orthopedic implants. Composite systems, which blend metal and ceramic or polymeric elements, are unlocking new possibilities for lightweight structural components and tailored degradation profiles in tissue engineering. Metal alloys, including cobalt chromium and titanium variants, continue to dominate high-load orthopedic applications, while polymers are gaining traction in drug delivery implants where controlled degradation is essential.

Technological segmentation reveals that binder jetting and powder bed fusion technologies such as selective laser melting and electron beam melting are driving the adoption of metal and ceramic parts, whereas stereolithography and fused deposition modeling are preferred for polymer and composite formulations. The choice of product form-filament, powder, resin, or wire-influences design freedom and production speed, with powder-based systems excelling in complex geometries and filament-based approaches offering cost-effective prototyping. In the realm of applications, dental uses remain a strong entry point due to established regulatory pathways for crowns bridges and orthodontic devices, while drug-eluting implants and microneedle arrays represent high-potential niches in drug delivery.

Across end users, research institutes are spearheading early-stage innovation, contract manufacturing organizations are bridging R&D to commercialization, and healthcare providers are validating clinical efficacy. Medical device manufacturers integrate these materials into final products, underscoring the importance of collaboration at each stage of the value chain.

This comprehensive research report categorizes the Biocompatible 3D Printing Material market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Printing Technology

- Product Form

- Application

- End User

Exploring Regional Dynamics in the Americas, Europe Middle East Africa, and Asia Pacific That Are Driving Market Evolution for Biocompatible Materials

Regional dynamics play a pivotal role in shaping market opportunities and influencing strategic decisions for stakeholders across the biocompatible 3D printing material ecosystem. In the Americas, strong investments in domestic manufacturing have driven the expansion of titanium and polymer powder production, particularly in the United States and Canada. This regional emphasis on local sourcing has reduced dependency on overseas suppliers and provided companies with greater control over quality and lead times. Meanwhile, early adopters in healthcare systems are partnering with innovators to accelerate clinical trials for custom implants and tissue scaffolds.

In Europe, the Middle East, and Africa, regulatory harmonization initiatives are streamlining approval processes across multiple jurisdictions. Countries with established additive manufacturing clusters, such as Germany and the United Kingdom, are leveraging public–private partnerships to fund research on next-generation materials, including bioactive ceramics and degradable polymer composites. Investment corridors in the Middle East and North Africa are attracting technology transfers, creating opportunities for localized manufacturing hubs and capacity building.

The Asia-Pacific region is emerging as a global production powerhouse, with China, Japan, and South Korea leading in metal powder technology and resin development. A combination of favorable government incentives and robust manufacturing infrastructure has enabled rapid scaling of advanced printing platforms. Additionally, growing healthcare expenditures across Southeast Asia are fostering demand for cost-effective dental and orthopedic solutions tailored to regional patient demographics.

This comprehensive research report examines key regions that drive the evolution of the Biocompatible 3D Printing Material market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players Driving Breakthroughs in Biocompatible 3D Printing Material Development

Innovation in the biocompatible 3D printing material space is being propelled by a diverse set of companies ranging from established polymer producers to agile metal powder specialists. Key players are investing heavily in R&D to expand their material portfolios and enhance biocompatibility through surface functionalization techniques and nanoparticle reinforcements. Strategic collaborations with academic institutions and medical centers are enabling rapid prototyping and clinical validation of novel formulations.

Meanwhile, emerging material suppliers are differentiating themselves by focusing on niche applications such as biofabrication of tissue scaffolds using polymer ceramic composites, and micro needle arrays for advanced drug delivery. These companies are leveraging modular production platforms that allow for quick customization of powder compositions and resin chemistries. At the same time, large industrial conglomerates are integrating in-line quality assurance systems to support high-volume production of orthopedic implants and surgical instruments.

Across the competitive landscape, the convergence of software-driven process control, predictive quality analytics, and advanced material science is setting the stage for strategic alliances. Organizations that can seamlessly integrate end-to-end workflows-from raw material preparation to post-printing sterilization-are achieving significant differentiation. As a result, partnerships spanning material suppliers, equipment manufacturers, and healthcare providers are becoming essential to accelerate innovation and commercial deployment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biocompatible 3D Printing Material market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems

- Arkema

- BASF Forward AM

- Cellink

- Covestro AG

- EOS GmbH

- Evonik Industries AG

- Formlabs Inc.

- GE Healthcare

- Henkel AG

- Materialise

- Renishaw

- SABIC

- Stratasys

- Victrex

Translating Comprehensive Market Intelligence into Actionable Strategies That Drive Adoption and Competitive Advantage

Industry leaders seeking to capitalize on the momentum in biocompatible 3D printing materials must adopt a multi-pronged approach that balances technological investments with market intelligence. First and foremost, establishing internal centers of excellence that focus on cross-functional collaboration between material scientists, design engineers, and regulatory experts will streamline development cycles and ensure compliance from project inception. Concurrently, fostering partnerships with contract manufacturing organizations and research institutes will provide access to specialized testing facilities and clinical validation pathways.

Equally important is the deployment of advanced digital platforms for real-time process monitoring and quality control. Leveraging machine learning algorithms to correlate process data with material performance will enable continuous refinement of printing parameters and reduce scrap rates. In parallel, companies should explore vertical integration strategies by investing in localized powder and resin production capabilities to mitigate tariff risks and strengthen supply chain resilience.

Finally, aligning product roadmaps with high-growth application segments-such as drug-eluting implants and patient-specific surgical tools-will maximize return on investment. By engaging healthcare providers early in the development phase, organizations can co-develop solutions that address unmet clinical needs and accelerate market acceptance. Together, these strategic moves will position industry leaders to capture the full potential of biocompatible additive manufacturing in healthcare.

Detailing a Robust, Multi-Stage Research Methodology Integrating Secondary Analysis, Primary Expert Interviews, and Site Validations

This research employs a rigorous, multi-stage methodology designed to ensure the accuracy and reliability of insights. The process began with an extensive secondary data collection phase, in which public filings, patent databases, regulatory documents, and peer-reviewed publications were analyzed to establish a baseline understanding of material technologies, printing processes, and market activities.

Complementing the secondary research, primary data was gathered through in-depth interviews and surveys with senior executives, R&D directors, and clinical experts across contract manufacturing organizations, medical device manufacturers, healthcare providers, and material suppliers. These engagements provided firsthand perspectives on emerging trends, adoption barriers, and strategic priorities. Additionally, site visits to leading additive manufacturing facilities across North America, Europe, and Asia-Pacific validated process capabilities and quality assurance protocols.

Quantitative analysis leveraged proprietary databases to map competitive landscapes, track M&A activity, and identify innovation hotspots. Finally, findings were synthesized through iterative validation workshops with an advisory panel of industry veterans to produce a coherent narrative that aligns market realities with actionable recommendations. This robust combination of secondary and primary research ensures that the report delivers comprehensive, fact-based insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biocompatible 3D Printing Material market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biocompatible 3D Printing Material Market, by Material Type

- Biocompatible 3D Printing Material Market, by Printing Technology

- Biocompatible 3D Printing Material Market, by Product Form

- Biocompatible 3D Printing Material Market, by Application

- Biocompatible 3D Printing Material Market, by End User

- Biocompatible 3D Printing Material Market, by Region

- Biocompatible 3D Printing Material Market, by Group

- Biocompatible 3D Printing Material Market, by Country

- United States Biocompatible 3D Printing Material Market

- China Biocompatible 3D Printing Material Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings and Strategic Implications to Guide Decision Makers in the Biocompatible 3D Printing Materials Arena

This analysis underscores that biocompatible 3D printing materials are at the forefront of medical innovation, offering transformative benefits for personalized implants, regenerative medicine, and minimally invasive devices. Key trends include the maturation of hybrid materials that blend the strength of metals with the bioactivity of ceramics, the rise of digital quality controls that accelerate regulatory approvals, and the emergence of circular supply chains that enhance sustainability.

Stakeholders must remain vigilant to evolving tariff environments and regional dynamics that influence material availability and cost structures. By focusing on strategic segmentation-whether by material families, printing technologies, product forms, applications, or end users-companies can pinpoint high-value opportunities and tailor go-to-market plans accordingly. Furthermore, competitive advantages will hinge on integrated partnerships that connect material innovation with process expertise and clinical validation.

In conclusion, the interplay of technological progress, regulatory shifts, and market segmentation insights provides a comprehensive lens for decision makers. Organizations that harness these findings and implement the recommended strategies will be ideally positioned to drive the next wave of growth in biocompatible 3D printing materials, ultimately shaping the future of patient-centric healthcare.

Unlock Critical Market Insights and Propel Your Biocompatible 3D Printing Material Strategy—Contact Ketan Rohom to Purchase the Detailed Report

For organizations poised to pioneer advancements in medical devices and tissue engineering, securing a detailed understanding of the biocompatible 3D printing material landscape is paramount. Engaging with Ketan Rohom, Associate Director of Sales & Marketing, ensures direct access to tailored insights that align with your strategic priorities. His expertise in navigating complex industry dynamics will empower your team to make informed decisions rooted in robust research.

By purchasing the comprehensive market research report, you will gain granular visibility into technological breakthroughs, regulatory shifts, and competitive benchmarks across ceramics, metals, composites, and polymers. This intelligence will guide investment choices, optimize supply chain strategies, and identify high-impact applications in dental implants, orthopedic devices, drug delivery systems, and beyond. With our data-driven recommendations, you can accelerate product development cycles and capture emerging opportunities in key regional markets.

Act now to transform your organization’s approach to biocompatible materials. Contact Ketan Rohom today to unlock exclusive access to the full report, including in-depth company profiles, segmentation analyses, and actionable recommendations. Position your organization at the forefront of innovation and secure a definitive competitive edge in the rapidly evolving biocompatible 3D printing materials arena.

- How big is the Biocompatible 3D Printing Material Market?

- What is the Biocompatible 3D Printing Material Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?