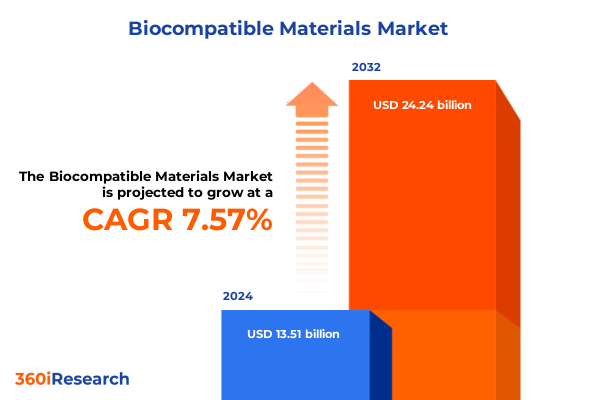

The Biocompatible Materials Market size was estimated at USD 14.48 billion in 2025 and expected to reach USD 15.51 billion in 2026, at a CAGR of 7.63% to reach USD 24.24 billion by 2032.

Exploring the Evolution and Critical Importance of Biocompatible Materials in Shaping the Future of Medical Science and Patient-Centric Innovations

The field of biocompatible materials has emerged as a cornerstone of modern medical science, offering transformative pathways for diagnostics, therapeutics, and regenerative technologies. Over recent years, advances in materials science have propelled the development of ceramics, polymers, metals, composites, and hydrogels that can seamlessly integrate with biological systems. This progression has been fueled by interdisciplinary collaborations spanning biomedical engineering, chemistry, and clinical research. As a direct result, next-generation implants and devices now exhibit enhanced functionality, tailored biodegradability, and superior mechanical properties, meeting the rigorous demands of patient-centric care and personalized medicine.

In parallel, regulatory frameworks around the world have evolved to address the complexity and potential risks associated with novel biomaterials. Agencies have refined standards for biocompatibility testing, sterilization processes, and long-term safety assessments to ensure that innovative materials not only perform effectively but also adhere to the highest levels of patient safety. Consequently, manufacturers are increasingly adopting a quality-by-design philosophy, integrating materials selection, process validation, and risk management early in the product development lifecycle. This shift underscores the importance of strategic alignment between research and regulatory affairs, accelerating the path from laboratory to clinic.

Looking ahead, the confluence of emerging technologies such as additive manufacturing, nanotechnology, and biofabrication promises to open entirely new frontiers in tissue engineering and organ regeneration. By harnessing these capabilities, stakeholders can envision custom-tailored constructs that mimic native tissue architecture and function. This report will explore these critical pathways, setting the stage for a nuanced understanding of market dynamics, policy impacts, segmentation structures, regional nuances, leading corporate players, and strategic imperatives that define the evolving landscape of biocompatible materials.

Uncovering Revolutionary Breakthroughs and Emerging Technologies Redefining the Biocompatible Materials Space for Manufacturing and Clinical Applications

Recent years have witnessed an unprecedented acceleration in the development and adoption of biocompatible materials, driven by breakthroughs in additive manufacturing, biomimetic design, and molecular engineering. Three-dimensional printing has enabled the fabrication of complex geometries and patient-specific implants with unparalleled precision. Concurrently, the integration of nano-reinforcements and surface functionalization techniques has enhanced osseointegration and antimicrobial properties, thereby extending device longevity and reducing post-operative complications. These technological advancements have fundamentally redefined the boundaries of what is possible in medical device design, opening promising pathways for personalized therapy and minimally invasive interventions.

Equally impactful has been the growing emphasis on sustainability and circular economy principles within the materials supply chain. Manufacturers are now exploring bio-derived polymers and recyclable composites to reduce environmental footprint without compromising performance. This shift toward greener production methods not only aligns with global regulatory trends but also resonates with end users increasingly sensitive to ecological considerations. Industry collaborations between academic institutions, material suppliers, and device manufacturers are fostering open innovation platforms that accelerate the translation of academic insights into market-ready solutions.

Moreover, the maturation of digital health platforms and advanced biomanufacturing analytics is enabling real-time quality monitoring and predictive maintenance for critical medical components. Data-driven decision frameworks, underpinned by machine learning algorithms, are optimizing process parameters and quality control thresholds, leading to cost efficiencies and improved supply resilience. Collectively, these transformative shifts highlight a dynamic landscape where innovation, regulation, and sustainability converge to set new benchmarks for performance and patient safety.

Assessing the Comprehensive Implications of the United States Tariff Adjustments in 2025 on Biocompatible Material Supply Chains and Manufacturing Ecosystems

In 2025, the United States implemented a series of tariff adjustments targeting imported raw materials critical to biocompatible material production. These measures primarily affected specialty ceramics, advanced polymer resins, high-performance metal alloys, and key composite feedstocks. The intention behind these tariffs was to strengthen domestic manufacturing capabilities, incentivize local sourcing, and mitigate vulnerabilities exposed by recent geopolitical disruptions. However, the introduction of elevated duties has had multifaceted consequences across the supply chain, reshaping cost structures, procurement strategies, and innovation trajectories.

Short-term impacts have included upward pressure on input prices, prompting manufacturers to re-evaluate supplier portfolios and seek alternative feedstock channels. In response, some industry players have accelerated investments in domestic production facilities, leveraging scalable processes to produce hydroxyapatite, zirconia, and titanium alloys on home soil. Concurrently, composites developers have intensified efforts to optimize polymer-ceramic formulations, aiming to reduce reliance on imported components while maintaining performance benchmarks. Despite these adaptive measures, certain niche materials remain concentrated within specialized global hubs, necessitating strategic partnerships and long-term supply agreements.

Looking forward, the cumulative effect of these tariffs is expected to spur innovation in material engineering and process efficiency. By driving greater synergy between material science research and domestic industrial infrastructure, the policy has catalyzed a wave of collaborative consortia uniting academic research centers with original equipment manufacturers. These alliances are exploring novel synthesis pathways, high-throughput screening methods, and continuous manufacturing techniques to enhance throughput and ensure cost competitiveness. As a result, the biocompatible materials ecosystem is evolving toward a more resilient, innovation-driven model, prepared to navigate future trade uncertainties and regulatory shifts.

Illuminating Segmentation Perspectives Spanning Material Types, Product Forms, Applications, Distribution Channels, and End Users to Drive Strategic Clarity

A granular examination of market segmentation offers invaluable clarity on how different material categories, product designs, and end markets are converging to shape the biocompatible materials landscape. Material type delineation reveals that ceramics such as bioactive glass, hydroxyapatite, and zirconia exhibit pronounced activity in orthopedic and dental applications, owing to their mechanical strength and bioactivity. Metal categories including silver alloys, stainless steel, and titanium alloys continue to underpin high-load-bearing implants, with titanium’s biocompatibility and corrosion resistance driving ongoing adoption. In parallel, composite segments combining metal-ceramic or polymer-ceramic matrices are gaining traction for hybrid applications that demand a balance of strength and elasticity.

Turning to product form, the gel form has emerged as a preferred choice in soft tissue repair and drug delivery systems because of its tunable viscoelastic properties and ease of application. Powder form remains integral to additive manufacturing workflows, providing the feedstock for precision 3D printing of intricate geometries. Solid forms maintain their relevance in traditional implant fabrication, benefiting from well-established machining and finishing processes.

Application-wise, diagnostic devices leverage advanced polymers and hydrogels for sensitive biosensing platforms, while drug delivery systems exploit smart polymer networks for controlled release profiles. Medical devices span a broad spectrum, from sterilizable surgical instruments to next-generation wound dressings. Surgical implants remain a cornerstone application, with tissue engineering advancing toward scaffold-based approaches that mimic native extracellular matrices.

Distribution channels present a duality between established offline networks and rapidly growing online platforms, the latter driven by telemedicine integration and digital procurement portals. Finally, end users including academic and research institutes, biopharmaceutical and pharmaceutical companies, and medical device manufacturers each exercise distinct buying behaviors, ranging from exploratory collaborations for early-stage materials research to strategic partnerships for high-volume production.

This comprehensive research report categorizes the Biocompatible Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Form

- Application

- Distribution Channel

- End-user

Exploring Regional Dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific Shaping Adoption and Innovation in Biocompatible Materials

Region-specific dynamics are shaping both innovation pipelines and commercialization strategies in the field of biocompatible materials. In the Americas, robust funding for translational research and a well-established medical device manufacturing base create an environment conducive to pilot-scale applications and rapid clinical adoption. Partnerships between leading universities and domestic industry players are fostering proof-of-concept studies that transition quickly into regulatory submission pathways.

Europe, the Middle East, and Africa present a more heterogeneous landscape. While Western European nations benefit from harmonized regulatory frameworks and incentives for sustainable manufacturing, emerging economies in the Middle East and Africa are increasingly investing in biomedical research hubs and specialized production clusters. This bifurcation drives localized innovation ecosystems that cater to region-specific healthcare challenges, such as affordable implant solutions and infection-resistant materials tailored to local clinical environments.

Turning to the Asia-Pacific region, rapid industrialization, coupled with proactive government policies and high-volume clinical trial activity, has propelled the adoption of advanced biocompatible materials. Manufacturing powerhouses such as Japan, South Korea, and China are not only scaling up production capacity but also focusing on proprietary compound development and process automation. This region’s strategic emphasis on cost efficiencies and large-scale distribution channels is accelerating the diffusion of innovative materials across both domestic and international markets.

This comprehensive research report examines key regions that drive the evolution of the Biocompatible Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Insights into Leading Companies Advancing Biocompatible Materials through Innovation, Partnerships, and Competitive Differentiation

The competitive landscape in biocompatible materials is marked by a convergence of established material suppliers, innovative start-ups, and multidisciplinary research institutions. Leading organizations with deep experience in metals and ceramics are investing heavily in advanced coating technologies and surface treatments to enhance osseointegration and reduce infection risk. Meanwhile, polymer specialists are channeling R&D resources toward multifunctional hydrogels and smart material platforms capable of responding dynamically to biological cues.

Strategic partnerships have become a key mechanism for staying ahead in this fast-moving sector. Collaborative alliances between original equipment manufacturers and specialty material developers enable co-creation of customized solutions, particularly in high-value applications such as cardiovascular stents and neuroprosthetics. Furthermore, mergers and acquisitions are driving portfolio diversification, allowing companies to integrate complementary material platforms under unified R&D frameworks.

Smaller players and academic spin-offs are also reshaping competitive dynamics by introducing novel chemistries and bioinspired structures that challenge incumbent technologies. Through venture funding and public–private partnerships, these emerging entities are scaling innovative processes such as biofabrication and continuous flow synthesis. This infusion of fresh perspectives is catalyzing cross-pollination across material classes, fueling a broader wave of innovation in biocompatible design and manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biocompatible Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems, Inc.

- AMSilk GmbH

- BASF SE

- Baxter International Inc.

- Celanese Corporation

- Corbion NV

- Covestro AG

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Elix Polymers SLU

- Ensinger GmbH

- EOS GmbH

- Evonik Industries AG

- Formlabs Inc.

- Foster Corporation.

- Henkel AG & Co. KGaA,

- Merck KGaA

- Mitsubishi Chemical Corporation

- Shin-Etsu Chemical Co., Ltd.

- Stratasys Ltd.

- Stryker Corporation

- Wacker Chemie AG

Providing Actionable Guidance for Industry Leaders to Navigate Biocompatible Materials Challenges and Harness Emerging Opportunities

Industry leaders must adopt a multifaceted strategy to thrive in the evolving biocompatible materials landscape. Prioritizing investment in advanced material engineering capabilities will enable organizations to explore next-generation composites and hybrid structures that address unmet clinical needs. Integrating cross-disciplinary R&D teams with expertise in computational modeling, nanotechnology, and surface science will accelerate proof-of-concept validation and reduce time to market.

Supply chain diversification is equally critical. Establishing regional manufacturing hubs and forging strategic alliances with both upstream and downstream partners can mitigate the risks associated with tariffs, geopolitical tensions, and raw material shortages. By implementing digital procurement platforms and real-time analytics, decision makers can maintain end-to-end visibility and responsiveness.

Engagement with regulatory bodies should be proactive and ongoing. Early dialogue on material characterization standards and clinical evaluation protocols will smooth regulatory pathways and support the adoption of novel biomaterials. Equally, fostering partnerships with academic centers and standards organizations can help shape future guidelines, ensuring that emerging innovations receive timely approval.

Finally, embedding sustainability metrics into product design and lifecycle management will resonate with both payers and patients who increasingly demand eco-friendly solutions. By adopting renewable feedstocks, optimizing waste reduction, and documenting carbon footprints, companies can build differentiated value propositions that align with global environmental objectives.

Detailing the Research Methodology Underpinning Insights into Biocompatible Materials through Qualitative and Quantitative Analytical Techniques

This research leverages a rigorous, multi-pronged methodology to ensure the highest levels of accuracy and reliability. The initial phase comprised an extensive review of peer-reviewed scientific literature, patent filings, and white papers to identify foundational material properties, emerging synthesis methods, and application-specific performance criteria. Complementary data collection from industry publications and regulatory filings provided insight into evolving policy landscapes and standardization efforts.

Primary research involved in-depth interviews with key stakeholders, including material scientists, product development heads, regulatory affairs experts, and procurement managers from medical device manufacturers. These qualitative discussions were designed to capture nuanced perspectives on current challenges, innovation drivers, and anticipated technology transitions. Survey instruments targeting end users across academic institutions, biopharmaceutical companies, and manufacturing organizations further quantified the adoption trends and preference hierarchies.

Quantitative analyses employed data triangulation techniques, cross-validating insights from secondary research, expert inputs, and survey results. This approach ensured consistent interpretation of emerging trends, supply chain dynamics, and competitive strategies. Geographic market dynamics were assessed through regional case studies, enabling tailored insights for the Americas, Europe Middle East & Africa, and Asia-Pacific. The combination of qualitative depth and quantitative rigor delivers a holistic view of the biocompatible materials ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biocompatible Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biocompatible Materials Market, by Material Type

- Biocompatible Materials Market, by Product Form

- Biocompatible Materials Market, by Application

- Biocompatible Materials Market, by Distribution Channel

- Biocompatible Materials Market, by End-user

- Biocompatible Materials Market, by Region

- Biocompatible Materials Market, by Group

- Biocompatible Materials Market, by Country

- United States Biocompatible Materials Market

- China Biocompatible Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights and Strategic Imperatives from the Biocompatible Materials Landscape to Empower Decision-Makers and Drive Future-Ready Innovations

The biocompatible materials sector stands at a critical juncture where cutting-edge science, policy interventions, and market forces intersect to define future trajectories. Innovations in ceramics, metals, composites, polymers, and hydrogels are setting new standards for safety, efficacy, and patient-specific performance. Concurrently, tariff policies and regional dynamics are reshaping supply chains, prompting a strategic reorientation toward domestic sourcing and collaborative consortia.

Segment-focused insights clarify how distinct material types and product forms map to diverse clinical applications and distribution pathways. Regional analyses underscore the importance of localized innovation ecosystems and regulatory nuances, while competitive scrutiny reveals that leading companies are mobilizing strategic partnerships and novel technology platforms to solidify their market positions.

Actionable recommendations emphasize the need for integrated R&D capabilities, supply chain resilience, proactive regulatory engagement, and sustainable design principles. By harnessing these imperatives, stakeholders can navigate current challenges and capitalize on emerging windows of opportunity.

Overall, this executive summary underscores the strategic significance of biocompatible materials as a pivotal enabler for next-generation healthcare solutions. The comprehensive insights presented herein will guide decision makers in aligning their innovation roadmaps with evolving market realities and ultimately deliver enhanced patient outcomes.

Take the Next Step to Secure Comprehensive Biocompatible Materials Market Intelligence by Connecting with Ketan Rohom to Elevate Your Strategic Positioning

Unlock your competitive edge in the dynamic field of biocompatible materials by leveraging comprehensive insights tailored to your strategic needs. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to gain immediate access to the full market research report and empower your organization with data-driven intelligence. This collaboration will equip your leadership team with the actionable knowledge required to navigate emerging challenges, capitalize on new opportunities, and reinforce your innovation roadmap. Engage today and transform your strategic positioning to stay ahead in an increasingly competitive environment.

- How big is the Biocompatible Materials Market?

- What is the Biocompatible Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?