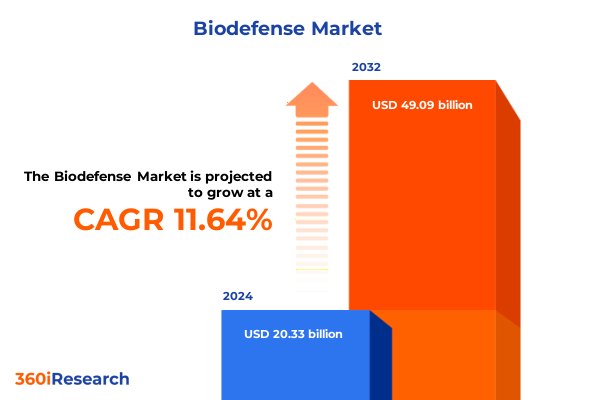

The Biodefense Market size was estimated at USD 22.71 billion in 2025 and expected to reach USD 24.97 billion in 2026, at a CAGR of 11.64% to reach USD 49.09 billion by 2032.

Comprehensive overview of current biodefense landscape highlighting evolving threats strategic priorities and resilience imperatives

The biodefense arena has entered a phase of unprecedented complexity, driven by converging factors such as advanced synthetic biology capabilities, shifting geopolitical tensions, and the enduring lessons of global health crises. Stakeholders now face a dynamic threat environment where engineered pathogens, emerging zoonotic diseases, and the persistent risk of bioterrorism coexist, requiring a multifaceted approach to preparedness. This report establishes a foundational understanding of these evolving threats, situating them within the context of broader public health and national security priorities.

Against this backdrop, the increasing integration of civilian and defense infrastructures has blurred traditional boundaries. Critical sectors including healthcare, agriculture, and laboratory research must now operate in concert to build resilience, accelerate detection, and refine response mechanisms. Furthermore, the proliferation of next generation sequencing platforms and biosurveillance networks underscores a pivot toward early warning systems, enabling proactive rather than reactive interventions. In this introductory section, we outline the strategic imperatives that inform investment, policy development, and innovation pathways across the biodefense value chain.

Disruptive technological advancements policy realignments and collaborative frameworks reshaping the global biodefense ecosystem

Over the past several years, the biodefense landscape has undergone transformative shifts fueled by rapid technological breakthroughs and recalibrated policy frameworks. Synthetic biology techniques now facilitate the creation of novel molecular probes that enhance the sensitivity and specificity of pathogen detection, while advanced immunoassay platforms support portable diagnostics capable of near-instantaneous field deployment. These innovations are complemented by artificial intelligence-driven analytics, which synthesize vast genomic and epidemiological datasets to predict outbreak trajectories and allocate resources with unprecedented precision.

Simultaneously, governments and private sector entities are forging new collaborative models, recognizing that no single organization can address the complexity of modern biological threats alone. Public-private partnerships have emerged as critical conduits for sharing intellectual property, co-funding large-scale clinical trials, and coordinating cross-border emergency response drills. Policy realignments, such as streamlined regulatory pathways for emergency use authorizations and increased funding for platform technologies, are accelerating the transition from bench to deployment. Together, these shifts are redefining the contours of biodefense, enabling more agile, anticipatory, and integrated defense postures worldwide.

Extensive analysis of how 2025 US tariff measures have altered critical supply chains pricing structures and strategic sourcing decisions in biodefense

The introduction of new tariff measures by the United States in 2025 has exerted multifaceted impacts on the biodefense sector’s global supply chains. Key inputs for decontamination solutions, including specialized disinfectants and personal protective equipment components, now face increased import duties, elevating production costs for manufacturers and end users alike. These changes have prompted organizations to reexamine their procurement strategies, with many opting to diversify sourcing from allied markets or accelerate onshore production capabilities to mitigate tariff exposure.

In parallel, tariffs on advanced detection devices have influenced the pricing dynamics of biosensors and pathogen detection systems, driving a recalibration of capital expenditure plans among government agencies and private laboratories. The cumulative effect extends into the therapeutic domain as well, where antiviral therapies and monoclonal antibody manufacturing often rely on imported reagents and bioreactor consumables. Faced with tightening budgets, stakeholders must now balance the imperative of maintaining operational readiness against the necessity of cost containment, prompting a wave of innovation aimed at substituting critical inputs with domestically produced alternatives or novel materials.

In-depth examination of product pathogen technology application end user and distribution channel segments driving differential opportunities and risks

An in-depth examination of the biodefense market reveals that distinct segments exhibit unique drivers and constraints, underscoring the importance of tailored strategies for each category. Within the product type domain, decontamination solutions encompass both disinfectants and personal protective equipment, each responding to different regulatory standards and end-user requirements. Detection technologies split between biosensors optimized for rapid point-of-care screening and comprehensive pathogen detection systems designed for laboratory confirmation, while therapeutics are bifurcated into antiviral treatments and monoclonal antibody formulations that address acute and prophylactic needs. Vaccines remain a critical pillar, with anthrax, botulism, and smallpox immunizations representing long-standing countermeasure portfolios.

Pathogen type further stratifies the market, distinguishing between bacterial agents, toxins, and viral threats, each demanding specific analytical techniques and mitigation strategies. Technology segmentation underscores the rise of immunoassays that deliver high-throughput screening, the precision of mass spectrometry in molecular fingerprinting, the depth of next generation sequencing for comprehensive genetic analysis, and the ubiquity of polymerase chain reaction assays for rapid nucleic acid amplification. In parallel, application-based divisions separate detection and diagnostics from prevention measures, such as vaccination programs, and treatment modalities encompassing both small-molecule and biologic therapeutics.

End users present yet another layer of complexity. Academic and research institutions drive fundamental innovation, while government and defense agencies prioritize robust, scalable solutions for national security. Hospitals and clinics require integration with existing clinical workflows and electronic health systems, and pharmaceutical and biotechnology companies focus on commercial viability and regulatory compliance. Lastly, distribution channel dynamics split between offline networks-leveraging established medical and industrial supply chains-and online platforms that enable rapid procurement and logistical flexibility, each demanding aligned distribution strategies to optimize market penetration.

This comprehensive research report categorizes the Biodefense market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pathogen Type

- Technology

- Application

- End User

- Distribution Channel

Comparative perspectives on Americas Europe Middle East Africa and Asia Pacific revealing region specific drivers barriers and collaboration prospects

Regional dynamics in the biodefense ecosystem vary considerably, shaped by differing policy priorities, infrastructure capacities, and threat perceptions. In the Americas, a substantial emphasis on public health security has led to sustained investments in nationwide biosurveillance networks and border-control diagnostics. This focus is complemented by strong private-sector engagement in therapeutic development and the establishment of advanced manufacturing hubs oriented toward rapid scale-up during health emergencies.

Within Europe, the Middle East, and Africa, regulatory harmonization efforts are accelerating cross-border collaboration, particularly around vaccine supply chain resilience and standardized testing protocols. The EMEA region’s diverse economic landscape yields both high-capacity centers of excellence and emerging markets where foundational biodefense capabilities remain under development. Partnerships between regional labs and international health bodies are playing a pivotal role in bridging capability gaps and fostering technology transfer.

In the Asia-Pacific, the convergence of high population densities and frequent zoonotic spillover events has catalyzed a strong emphasis on early detection platforms and next generation sequencing initiatives. Several nations are pioneering government-backed innovation funds, incentivizing private actors to co-develop pathogen surveillance tools tailored to local epidemiological profiles. Overall, these regional distinctions underscore the need for geostrategic alignment and context-specific market approaches.

This comprehensive research report examines key regions that drive the evolution of the Biodefense market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic moves competitive dynamics and innovation trajectories of leading organizations shaping the competitive landscape of biodefense

Leading organizations in the biodefense sector are employing differentiated strategies to capture emerging opportunities and mitigate evolving threats. Major life sciences corporations have expanded their footprints through targeted acquisitions of specialized diagnostics firms, integrating immunoassay and sequencing platforms into broader service suites. At the same time, innovative biotech companies are carving out niche positions by leveraging proprietary monoclonal antibody pipelines and synthetic biology capabilities to accelerate the development of bespoke therapeutics.

Collaborative ventures between established defense contractors and agile technology startups are reshaping capability roadmaps, with an emphasis on modular, field-deployable detection kits and scalable vaccine production systems. These partnerships enable rapid iteration cycles, marrying the agility of small-scale research operations with the manufacturing and regulatory expertise of larger players. Strategic investments in digital health infrastructure, notably in cloud-based data analytics and AI-driven threat modeling, are further differentiating the competitive landscape by offering end users integrated solutions that span prevention, detection, and response.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biodefense market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Alnylam Pharmaceuticals, Inc.

- Altimmune, Inc.

- Bavarian Nordic A/S

- Bio-Rad Laboratories

- Biofourmis Singapore Pte. Ltd.

- Cleveland Biolabs Inc.

- Dynavax Technologies Corporation

- DynPort Vaccine Company LLC

- Ecolab Inc.

- Elusys Therapeutics, Inc.

- Emergent BioSolutions Inc.

- Ichor Medical Systems

- Lucentix SA

- Luminex Corporation

- Nova Biomedical Corporation

- QIAGEN N.V.

- SD BIOSENSOR

- Siemens Healthcare

- Siga Technologies, Inc.

- Strados Labs

- Thermo Fisher Scientific

- Xoma Corporation

Prioritized strategies for enhancing resilience fostering innovation and strengthening partnerships to address emerging biodefense vulnerabilities effectively

To navigate the complex and rapidly evolving biodefense environment, industry leaders should prioritize forging resilient supply chains by establishing multi-sourcing agreements and regional production partnerships. By embedding redundancy into procurement strategies for critical inputs-from disinfectants to sequencing reagents-organizations can safeguard operational continuity in the face of trade disruptions or geopolitical tensions. It is equally essential to invest in advanced manufacturing platforms capable of pivoting between different products, such as generative vaccine vectors or modular diagnostic cartridges, to meet surge demands without compromising quality.

Leaders must also cultivate deep collaborations with regulatory authorities to streamline emergency authorization pathways, ensuring that novel countermeasures can be deployed rapidly during crises. Engaging early with policy makers will help align clinical trial designs and data requirements, reducing time to market. Furthermore, embracing data interoperability standards and AI-powered analytics will empower decision-makers with predictive insights into outbreak trajectories, resource allocation, and cost optimization. Finally, fostering public-private partnerships that integrate academic research, government mandates, and private sector agility will create a unified front against both natural and synthetic biological threats.

Rigorous research framework combining primary interviews secondary data sources and quantitative analysis to ensure comprehensive biodefense market insights

This research report is built upon a rigorous methodological framework combining primary and secondary intelligence gathering techniques. Primary data was collected through in-depth interviews with subject matter experts across government agencies, research institutions, and commercial enterprises, providing nuanced perspectives on regulatory developments, technology adoption, and strategic priorities. These qualitative insights were complemented by secondary research, which entailed a comprehensive review of open-source publications, patent databases, clinical trial registries, and policy white papers.

Quantitative analysis was performed using a structured database of company announcements, government funding allocations, and technology licensing agreements. Cross-validation procedures ensured the accuracy of data points and the consistency of trend interpretations. Finally, expert panel reviews were conducted to corroborate key findings, refine segmentation definitions, and identify emerging areas for future investigation, thereby ensuring a comprehensive and robust set of market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biodefense market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biodefense Market, by Product Type

- Biodefense Market, by Pathogen Type

- Biodefense Market, by Technology

- Biodefense Market, by Application

- Biodefense Market, by End User

- Biodefense Market, by Distribution Channel

- Biodefense Market, by Region

- Biodefense Market, by Group

- Biodefense Market, by Country

- United States Biodefense Market

- China Biodefense Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of critical findings underscoring strategic imperatives stakeholder considerations and the path forward for resilient biodefense preparedness

Throughout this executive summary, critical findings have been synthesized to illuminate strategic imperatives for stakeholders across the biodefense continuum. From the rising importance of portable detection devices and the strategic recalibration induced by new tariff measures to the nuanced segmentation and regional dynamics that define market opportunities, the report underscores the interconnected nature of technological innovation, policy evolution, and supply chain resilience.

Decision-makers are called upon to integrate these insights into multidimensional strategies that address both current exigencies and long-term preparedness requirements. By aligning investment priorities with demonstrated threat profiles, fostering cross-sector collaborations, and capitalizing on emerging platform technologies, organizations can position themselves at the forefront of biodefense excellence. The path forward demands agility, foresight, and a willingness to embrace collaborative models that transcend traditional institutional boundaries.

Engage with Ketan Rohom to unlock detailed biodefense market insights drive strategic decision making and secure your comprehensive research report today

For those ready to gain an authoritative edge in biodefense strategy and execution, reaching out to Ketan Rohom will unlock the full breadth of market intelligence and tailored insights you need. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through a detailed briefing of the comprehensive research report. His expertise in translating complex technical findings into actionable business decisions ensures that every stakeholder, from C-suite executives to operational leads, can leverage the report’s insights to drive growth and resilience.

By engaging with Ketan Rohom, you will receive personalized support in understanding how regulatory shifts, supply chain dynamics, and technological innovations intersect to create opportunities within your specific niche. This direct connection guarantees rapid access to proprietary data, expert perspectives, and scenario analyses designed to inform strategic investment, R&D prioritization, and partnership development. Don’t miss the opportunity to secure your copy of this indispensable resource-contact Ketan Rohom today to ensure your organization is fully prepared to navigate the evolving biodefense landscape.

- How big is the Biodefense Market?

- What is the Biodefense Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?