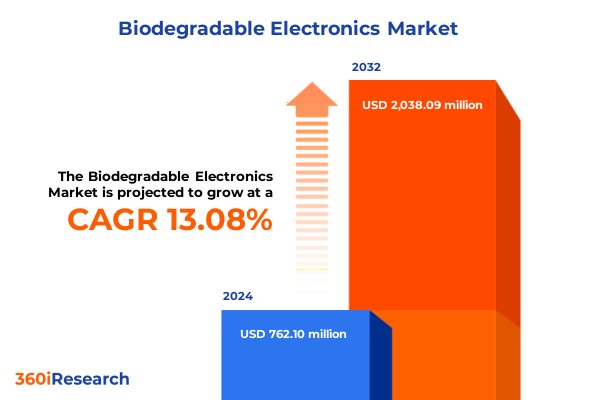

The Biodegradable Electronics Market size was estimated at USD 861.09 million in 2025 and expected to reach USD 974.04 million in 2026, at a CAGR of 13.09% to reach USD 2,038.08 million by 2032.

Revolutionary Convergence of Sustainable Materials and Advanced Electronics Shaping the Biodegradable Electronics Frontier

The emergence of biodegradable electronics represents a watershed moment, marrying cutting-edge technology with environmental stewardship. Driven by mounting regulatory scrutiny and heightened consumer consciousness around e-waste, researchers and manufacturers have pivoted toward materials that naturally decompose after their lifecycle ends. Unlike conventional electronic components that persist in landfills for centuries, biodegradable alternatives leverage organic polymers, transient metals, and novel composites designed for controlled disintegration. This paradigm shift addresses both the tangible environmental burden of electronic waste and the intangible demand for a circular economy.

Anchored by innovations in organic and printed electronics, biodegradable devices are surging across prototypes spanning batteries, sensors, displays, and transistors. The convergence of material science breakthroughs and scalable manufacturing techniques is dismantling the historical trade-off between performance and disposability. With pressure intensifying on automotive, healthcare, logistics, and consumer electronics sectors to demonstrate sustainability credentials, the introduction of impermanent yet reliable components underscores a broader industrial transformation. Consequently, stakeholders across the value chain-from R&D labs to end-users-are realigning their strategies to prioritize eco-friendly functionality without compromising operational rigor.

How Cutting-Edge Fabrication Techniques and Transient Material Innovations Are Redefining Biodegradable Electronic Capabilities

Over the past decade, the biodegradable electronics landscape has undergone profound shifts, propelled by advancements in organic semiconductors, thin-film printing, and transient metal formulations. Early research focused on single-use sensing and diagnostic patches, but the field has rapidly expanded into more robust applications. Flexible organic OLED displays and printed sensors now approach the performance thresholds required for automotive in-vehicle systems and consumer wearables. Meanwhile, transient electronics capable of disintegrating on demand have unlocked novel medical implants that safely dissolve after delivering therapeutic functions.

Emerging fabrication techniques, such as inkjet printing and screen-printing of conductive inks, have democratically lowered barriers to prototyping and small-batch production. This has enabled startups and academic spinouts to challenge incumbent electronics manufacturers by offering greener alternatives at competitive costs. Simultaneously, the rise of transient electronics has catalyzed partnerships among material suppliers, semiconductors, and packaging innovators to co-develop end-to-end biodegradable solutions. Through these collaborative ecosystems, the industry is fast evolving from proof-of-concept demonstrations to commercially viable products ready for rigorous environmental and performance certifications.

Analyzing the Ripple Effects of 2025 United States Tariff Measures on Domestic Supply Chains and Biodegradable Electronics Innovation

In 2025, the United States imposed tariffs targeting imported electronic components containing non-traditional, environmentally degradable materials, aiming to protect domestic manufacturers and incentivize local supply chains. These measures have reverberated through the biodegradable electronics sector, creating both headwinds and strategic inflection points. On one hand, higher duties on certain organic semiconductors and composite substrates have elevated production costs for companies reliant on offshore supply, prompting nearshoring initiatives and vertical integration efforts.

Conversely, domestic producers of biodegradable inks, thin-film substrates, and transient metals have experienced renewed demand and investment, spurring capacity expansions and R&D collaborations. Startups are forging alliances with established chemical firms to localize critical feedstocks, reducing exposure to tariff volatility. The policy-induced realignment underscores a wider geopolitical narrative in which sustainability-driven technologies are increasingly viewed through the prism of national competitiveness. As a result, organizations are recalibrating sourcing strategies, accelerating domestic pilot lines, and engaging with policymakers to shape future trade frameworks that balance economic security with environmental objectives.

Comprehensive Multidimensional Segmentation Reveals Crucial Product, Application, Technology, End-User, and Material Dynamics Driving Biodegradable Electronics

Deep insight into the biodegradable electronics arena emerges from a multidimensional examination of product type, revealing that energy storage and energy harvesting components are rapidly evolving. Batteries, in particular, showcase diverse chemistry explorations spanning lithium-ion formulations to emerging organic and thin-film architectures as well as zinc-air designs optimized for impermanence. Simultaneously, display technologies rooted in e-paper, LCD, and OLED platforms are being reengineered for transient use cases where readability and low power consumption supersede longevity. Sensor arrays extend across biosensor, environmental, humidity, pressure, and temperature modalities, each tailored for temporary deployment in medical diagnostics or environmental monitoring. Finally, transistor innovations from MOSFET, organic transistor, to TFT variants underscore the critical balance between signal fidelity and biodegradability.

Simultaneously, application-based insights highlight how biodegradable solutions integrate into sectors such as automotive, where in-vehicle electronics and sophisticated sensor systems offer temporary diagnostics; consumer electronics, where user-facing devices demand both functionality and end-of-life eco-compatibility; logistics and tracking, where asset tracking and supply chain monitoring devices benefit from single-use lifecycle management; medical devices, wherein diagnostic instruments, implantable devices, and wearable patches can biodegrade post-procedure; and packaging, which leverages biodegradable films and smart packaging to reduce plastic waste while embedding active monitoring. Layered upon application dynamics, end-user segmentation clarifies that automotive and consumer electronics continue to pioneer adoption, but healthcare-in its diagnostic, home care, and hospital environments-and logistics and supply chain industries are accelerating deployment due to stringent regulatory mandates and rising operational risks associated with electronic waste.

Technological segmentation further delineates the market into organic electronics, encompassing OLED and organic transistor frameworks; printed electronics driven by inkjet and screen printing techniques; thin-film electronics including both amorphous and polycrystalline silicon substrates; and transient electronics, differentiated into chemically transient and physically transient categories that determine decomposition triggers. Material segmentation complements these insights by illustrating the nuanced roles of composites, such as polymer-metal and polymer-semiconductor blends; metals including iron, magnesium, and zinc selected for their benign environmental profiles; polymers like cellulose, PHA, and PLA designed for compostability; and silicon variants, both amorphous and crystalline, engineered for controlled degradation.

This comprehensive research report categorizes the Biodegradable Electronics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Material

- Application

- End User

How Regional Regulatory Frameworks, Investments, and Collaborative Ecosystems Are Accelerating Biodegradable Electronics Across Global Markets

Regional dynamics play a pivotal role in shaping biodegradable electronics adoption, beginning with the Americas, where progressive environmental regulations and government incentives in North America have stimulated R&D investments and pilot manufacturing lines. In the United States, policies targeting e-waste reduction and funding for sustainable materials research have created a favorable landscape for startups and established electronics companies to collaborate on next-generation prototypes.

Moving to Europe, Middle East & Africa, stringent circular economy directives in the European Union have mandated higher reuse and recycling thresholds, catalyzing industry consortia to explore transient electronics for packaging and IoT use cases. The Middle East is positioning itself as a hub for sustainable innovations through sovereign wealth-backed incubators, while South African research institutions are forging partnerships to assess biodegradable sensor networks for environmental monitoring.

Asia-Pacific presents both opportunity and complexity, as leading manufacturing powerhouses navigate a delicate balance between economic growth and environmental responsibility. East Asian economies are pioneering high-throughput printed electronics facilities with integrated compostable materials lines, whereas Southeast Asian nations are piloting biodegradable smart packaging solutions to address mounting plastic pollution. Across these regions, cross-border collaborations and harmonized standards are emerging as vital enablers for scaling biodegradable electronic technologies.

This comprehensive research report examines key regions that drive the evolution of the Biodegradable Electronics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Material Scientists, Technology Firms, and Agile Startups Forge Partnerships to Pioneer Commercially Viable Biodegradable Electronics

Dominant players and emerging disruptors alike are reshaping the biodegradable electronics market through strategic R&D, partnerships, and diversified materials portfolios. Established semiconductors and materials firms are leveraging core competencies to develop eco-friendly conductive inks, polymer composites, and transient metal films. Concurrently, agile startups are translating academic breakthroughs into commercial prototypes, often forging alliances with contract manufacturers to validate scalable production methods.

Collaborations between multinational technology corporations and research institutions are unlocking new classes of organic and printed electronic devices. Material science leaders are establishing open innovation platforms to accelerate the translation of biodegradable polymers and composite substrates into functional batteries, sensors, and displays. Furthermore, packaging innovators are integrating active biodegradable smart labeling capabilities, teaming up with IoT providers to deliver end-to-end solutions. Through a synthesis of deep material expertise, advanced manufacturing capabilities, and digital design tools, these companies are charting pathways from lab-bench innovation to revenue-generating product lines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biodegradable Electronics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantium N.V.

- BASF SE

- Biome Bioplastics Ltd.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- FlexEnable Ltd.

- Fujitsu Limited

- Intel Corporation

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- NatureWorks LLC

- Novamont S.p.A.

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Toray Industries, Inc.

Strategic Interdisciplinary Collaboration and Policy Engagement to Embed Sustainability and Scale Biodegradable Electronics Globally

Industry leaders must prioritize the integration of sustainable design principles from the earliest stages of product development to ensure that biodegradable functionality aligns with performance requirements. Cross-functional collaboration between material scientists, electronics engineers, and environmental compliance teams will be critical for navigating complex regulatory landscapes while accelerating time to market.

Companies should establish strategic alliances with academic labs and pilot facilities to de-risk manufacturing scale-up and foster knowledge exchange around novel organic semiconductors, printed electronics techniques, and transient metal processing. Establishing transparent supply chain traceability for biodegradable feedstocks-such as cellulosic polymers, PHA, and PLA-will enhance brand credibility and mitigate environmental compliance risks. Moreover, proactive engagement with policymakers and standards bodies can help shape favorable trade, tariff, and certification frameworks that support domestic production and global interoperability.

Finally, embedding end-of-life considerations in product roadmaps by designing for disassembly, validating compostability metrics, and leveraging digital tagging technologies will unlock new service and circular business models. By orchestrating these interdisciplinary efforts, industry leaders can secure competitive differentiation, satisfy evolving stakeholder expectations, and catalyze a new era of eco-innovation in electronics.

Rigorous Multi-Phase Methodology Integrating Primary Stakeholder Engagement and Comprehensive Secondary Research for Credible Biodegradable Electronics Analysis

This research is founded on a rigorous, multi-phase methodology that blends primary and secondary investigations to ensure robust analysis. Secondary data was compiled from government publications, peer-reviewed journals, patent filings, and regulatory frameworks, complemented by white papers and conference proceedings to map historical and emerging trends in biodegradable materials and electronics fabrication.

Primary research involved in-depth interviews with key stakeholders, including materials suppliers, electronics manufacturers, regulatory body representatives, and end users in sectors such as automotive, healthcare, logistics, and packaging. Insights drawn from these discussions were triangulated with on-site visits to pilot manufacturing facilities and lab demonstrations of transient and printed electronics processes.

Quantitative inputs were enriched through a comprehensive evaluation of patent landscapes and supply chain mappings, while qualitative assessments considered technology readiness levels, adoption barriers, and sustainability impact metrics. Synthesizing these data sources enabled the development of clear segment definitions, regional dynamics, tariff analyses, and competitive benchmarking. This holistic approach ensures that the findings deliver actionable intelligence for decision-makers seeking to navigate the complex intersection of sustainable materials and electronic innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biodegradable Electronics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biodegradable Electronics Market, by Product Type

- Biodegradable Electronics Market, by Technology

- Biodegradable Electronics Market, by Material

- Biodegradable Electronics Market, by Application

- Biodegradable Electronics Market, by End User

- Biodegradable Electronics Market, by Region

- Biodegradable Electronics Market, by Group

- Biodegradable Electronics Market, by Country

- United States Biodegradable Electronics Market

- China Biodegradable Electronics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Converging Innovations and Policy Frameworks Herald a New Era of Circularity in Electronics Driven by Biodegradable Solutions

The journey toward mainstream adoption of biodegradable electronics is marked by remarkable material science breakthroughs, evolving regulatory pressures, and the imperative to reconcile technological progress with ecological responsibility. As the industry advances, the interplay between organic, printed, thin-film, and transient electronics will unlock new frontiers in sustainable device design. Key challenges around supply chain localization, tariff impacts, and performance optimization will necessitate agile strategies and deep collaboration across the ecosystem.

Yet, the momentum is unmistakable: pioneering prototypes are transitioning into pilot production, and strategic alliances are scaling capabilities to meet nascent market demand. Regional policy harmonization, coupled with industry-led certification frameworks, is laying the groundwork for global interoperability. Collectively, these developments herald a paradigm shift, where impermanent electronic solutions become integral components of a circular economy, reducing waste and redefining lifecycle management.

Looking ahead, the success of biodegradable electronics will hinge on the ability of stakeholders to integrate environmental considerations at every phase-from material selection through end-of-life processes-while maintaining rigorous performance standards. This confluence of innovation, policy, and sustainability strategy will chart the course for an electronics industry in harmony with planetary health and resource stewardship.

Unlock Strategic Advantage by Collaborating with Ketan Rohom to Acquire In-Depth Biodegradable Electronics Market Research and Drive Sustainable Growth

Engaging with Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch, opens the door to tailored insights and bespoke solutions that will empower your organization to harness the potential of biodegradable electronics. By connecting with Ketan Rohom, you gain access to a comprehensive market research report that delves into the critical trends, regulatory dynamics, and technological breakthroughs shaping this transformative sector. His expert guidance ensures you receive the precise data and strategic analysis necessary to drive innovation, inform product development, and optimize market entry strategies.

Securing your copy of the market research report through Ketan Rohom guarantees a personalized consultation that aligns with your unique business objectives. Whether you are assessing supply chain resilience, evaluating partnership opportunities, or planning new product portfolios, Ketan’s commitment to client success will help you translate complex insights into actionable plans. Reach out today to begin a collaborative discovery process that will arm your executive team with the clarity and confidence needed to navigate the evolving landscape of sustainable electronic solutions. Invest in the knowledge that positions you at the forefront of an industry revolution and accelerate your journey toward eco-innovative leadership.

- How big is the Biodegradable Electronics Market?

- What is the Biodegradable Electronics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?