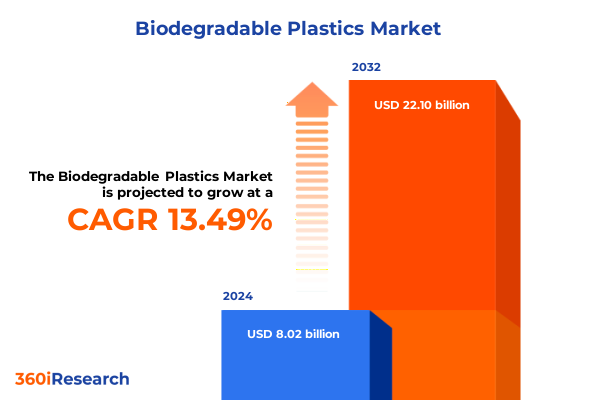

The Biodegradable Plastics Market size was estimated at USD 9.06 billion in 2025 and expected to reach USD 10.24 billion in 2026, at a CAGR of 13.57% to reach USD 22.10 billion by 2032.

Unveiling the Imperative Shift Toward Biodegradable Plastics Amid Rising Environmental, Regulatory, and Consumer Pressures

The global imperative to transition toward biodegradable plastics has never been more urgent as mounting environmental concerns and shifting consumer expectations converge. Recent analyses highlight the detrimental impacts of conventional plastics, ranging from microplastic contamination in marine and terrestrial ecosystems to significant greenhouse gas emissions throughout the production and end-of-life stages. This environmental reckoning has catalyzed a growing demand for materials that can safely re-enter natural cycles without imposing persistent pollution burdens. Start-ups and established chemical producers alike are responding to scrutiny over plastic waste by developing innovative polymer alternatives derived from renewable feedstocks, such as corn, sugarcane, and even algae, which promise reduced carbon footprints and enhanced biodegradability.

Concurrently, evolving consumer preferences are driving a fundamental shift in purchasing behaviors and brand expectations. A 2023 survey conducted by McKinsey & Company found that half of U.S. consumers are willing to pay a premium for products packaged in materials that demonstrate genuine environmental benefits, with a clear preference for recyclable, compostable, or biodegradable solutions. This willingness to invest in sustainability has pressured corporations to integrate eco-friendly packaging into their core strategies, recognizing that transparent, verifiable claims can bolster brand loyalty and market differentiation.

Regulatory momentum is further amplifying this transition, with jurisdictions implementing ambitious mandates to curb single-use plastics and elevate recycling and composting standards. Notably, California’s recent legislation requires all packaging sold within the state to be recyclable or compostable by 2032, establishing one of the most stringent frameworks in North America to date. In tandem, federal agencies and international bodies are evaluating extended producer responsibility schemes that hold manufacturers accountable for post-consumer waste management, creating a policy environment that aligns economic incentives with circular economy objectives. As this landscape continues to evolve, industry stakeholders must navigate a complex matrix of environmental, consumer, and regulatory drivers shaping the future of biodegradable plastics.

How Regulatory Mandates, Technological Breakthroughs, and Corporate Commitments Are Catalyzing a Paradigm Change in Biodegradable Plastics

The biodegradable plastics landscape is being fundamentally redefined by a confluence of transformative shifts spanning policy, technology, and corporate leadership. On the regulatory front, the European Union’s Circular Economy Action Plan has set ambitious targets for reducing non-recycled plastic waste and mandating compostable solutions in defined applications, signaling a paradigm shift in how member states approach packaging and waste management. Simultaneously, the U.S. federal government is intensifying its scrutiny of single-use plastic reduction and exploring extended producer responsibility frameworks, while states such as California enforce compostability mandates that demand rapid industry adaptation. As a result, companies face an increasingly complex policy mosaic that rewards sustainable innovation yet penalizes non-compliance, compelling stakeholders to reevaluate supply chains and invest in compliant materials.

Technological breakthroughs are accelerating the development of next-generation biodegradable polymers that combine performance parity with conventional plastics and enhanced environmental outcomes. Advances in polylactic acid (PLA) chemistry and polydioxanone-based polyhydroxyalkanoates (PHA) have yielded materials that can biodegrade in both industrial composting facilities and, in some cases, natural environments. These innovations address longstanding challenges around durability, barrier properties, and processing efficiency, creating viable alternatives for food packaging, agricultural films, and medical devices. Notable collaborations between chemical innovators and research institutions are driving material property enhancements, such as improved tensile strength, thermal stability, and controlled degradation rates, enabling broader application across sectors previously hindered by technical limitations.

Corporate commitments are amplifying these technological strides, as leading global brands and chemical producers allocate capital toward expanding biodegradable plastics capacity and refining proprietary formulations. For example, a high-profile partnership between a major beverage company and a pioneering catalyst developer has produced a plant-based bottle prototype designed to fully compost within one year under commercial conditions. These strategic alliances not only underscore the commercial viability of bioplastics but also establish critical supply chain partnerships that accelerate commercialization. Together, these regulatory, technological, and corporate dynamics are catalyzing a holistic industry transformation, laying the foundation for a circular plastics economy where sustainability and performance are inextricably linked.

Assessing the Far-Reaching Effects of the United States’ 2025 Tariff Regime on the Biodegradable Plastics Value Chain and Competitiveness

The cumulative impact of the United States’ 2025 tariff measures on the biodegradable plastics value chain has introduced significant cost pressures and strategic realignments. Early in the year, the federal government imposed a 25 percent tariff on imported plastics products from Canada and Mexico, alongside a 10 percent duty on analogous shipments from China, citing national security and border enforcement rationales. These elevated duties have disrupted established trade flows, affecting critical inputs such as polylactic acid (PLA) resins, polymerization catalysts, and extrusion-grade films sourced from North American and Asian producers.

Economic analyses from the U.S. Congressional Budget Office project that these tariffs will contribute to a 0.4 percentage point increase in headline inflation for both 2025 and 2026, exerting downward pressure on real household incomes and corporate investment plans. The higher import costs are expected to cascade through manufacturing ecosystems, leading to a notable rise in production expenses for downstream converters and brand owners. With preliminary data indicating that approximately $14.9 billion in plastics-related imports from Canada and Mexico fall under the tariff umbrella, the sector faces a substantive cost shock that may erode profit margins and slow capacity expansion plans.

Industry responses have been swift and vocal, as trade associations representing recycled materials and plastic converters warn of potential disruptions to domestic recycling streams and manufacturing operations. Critics argue that the sweeping tariff policy could undermine the competitiveness of U.S.-based producers by increasing reliance on higher-cost domestic feedstocks and discouraging economies of scale derived from integrated North American supply chains. Concurrently, market intelligence highlights that Mexican plastics exports destined for the U.S.-valued at approximately $800 million in prior years-are particularly vulnerable, threatening to curtail cross-border trade and exacerbate regional economic tensions if duties persist.

Despite efforts to delay implementation and pursue diplomatic engagements, the 2025 tariff regime underscores the delicate balance between national policy objectives and the economic realities of a globalized biodegradable plastics ecosystem. Companies are reassessing sourcing strategies, exploring alternative feedstock pathways, and engaging with policymakers to advocate for targeted exemptions or tariff rate quotas that preserve access to vital materials without compromising trade relations.

Exploring the Multifaceted Segmentation of the Biodegradable Plastics Market Across Material Types, Sources, Processing Techniques, Products, Channels, and Applications

The biodegradable plastics market can be understood through a multifaceted segmentation framework that illuminates the distinct material chemistries, sourcing paradigms, and application-specific demands shaping industry growth. A foundational lens involves the classification by material type, which encompasses cellulose-derived polymers, bio-based polybutylene succinate (PBS), microbially sourced polyhydroxyalkanoates (PHA), polylactic acid (PLA), and starch-based blends. Each of these chemistries offers unique performance characteristics-from the high tensile strength of PLA to the rapid biodegradation profiles of PHA-that influence formulation choices for diverse end uses.

Material sourcing further differentiates the landscape, as feedstocks range from marine biomass and agricultural residues to purpose-grown plant crops and even post-consumer waste streams. These source pathways not only drive sustainability narratives but also affect supply chain resilience and cost dynamics. For instance, marine-based polymers leverage underutilized seaweed biomass, while waste-based approaches integrate circular economy principles by repurposing organic refuse into monomer precursors.

Decomposition techniques provide another critical axis, with industrial aerobic processes, anaerobic digestion, and home or municipal composting each demanding specific polymer design considerations and waste infrastructure investments. Producers must tailor polymer backbone chemistry and additive packages to ensure compatibility with targeted end-of-life scenarios, balancing degradation kinetics against functional longevity.

On the manufacturing front, production processes such as extrusion, injection molding, and thermoforming underpin the conversion of biopolymers into films, sheets, and molded articles. These techniques affect material properties, processing efficiency, and scalability, informing capital investment decisions and operational footprints. Distribution channels span traditional offline routes-encompassing wholesalers, distributors, and brick-and-mortar retail-to burgeoning online platforms that facilitate direct-to-consumer fulfillment and niche application penetration.

Finally, application segmentation reveals the breadth of market opportunities, spanning agricultural and horticultural films for greenhouse coverings and mulch applications; construction materials including insulation panels and composite plasterboard; consumer goods from household items to woven textiles; healthcare devices ranging from drug delivery vehicles to single-use medical components; and packaging formats that span the flexible film sector and rigid containers. This holistic segmentation model provides stakeholders with a clear roadmap for aligning product development, market entry strategies, and investment priorities with the evolving dynamics of biodegradable plastics adoption.

This comprehensive research report categorizes the Biodegradable Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Source

- Decomposition Technique

- Production Processes

- Product Type

- Distribution Channel

- Application

Uncovering Regional Dynamics Shaping the Biodegradable Plastics Market in the Americas, EMEA, and Asia Pacific in Response to Regulatory and Consumer Dynamics

Regional dynamics are playing a pivotal role in defining the trajectory of biodegradable plastics adoption by aligning policy frameworks, consumer demand, and industrial capacities within distinct economic zones. In the Americas, state-level mandates such as California’s 2032 directive for recyclable or compostable packaging have elevated the baseline requirements for polymer formulations, driving early adoption and infrastructure expansion for industrial composting facilities. Meanwhile, federal tariff policies introduced in 2025 have imposed higher duties on imported resin and films, prompting North American producers and converters to reassess cross-border supply chains and consider localized feedstock investments to mitigate cost volatility.

Across Europe, the Middle East, and Africa (EMEA), the European Union’s Circular Economy Action Plan and related directives have set rigorous targets for reducing plastic waste intensity and increasing recycled content in packaging. This regulatory momentum is complemented by a growing extended producer responsibility regime that holds manufacturers financially accountable for end-of-life management. In parallel, emerging economies in the Middle East are formulating national sustainability strategies that include bioplastic incentives, while select African nations are piloting biodegradable mulching films to address soil health and plastic debris challenges, positioning the region as both a regulatory pioneer and an incubation ground for innovative biodegradable solutions.

In the Asia-Pacific region, ambitious single-use plastic bans in countries like China and India have accelerated demand for compostable and biodegradable alternatives. China’s phased prohibition of non-biodegradable bags by 2025 has catalyzed significant PLA capacity expansions, whereas India’s nationwide ban on 19 single-use plastic items has spurred market entry of domestically produced starch-based polymers and PHA blends. These legislative measures, coupled with robust manufacturing infrastructures in Southeast Asia, are propelling the region to the forefront of biodegradable plastics growth, even as stakeholders navigate implementation challenges and the need for complementary waste management systems to realize full environmental benefits.

This comprehensive research report examines key regions that drive the evolution of the Biodegradable Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market-Defining Companies Driving Biodegradable Plastics Advancements from R&D to Commercial Scale

Leading innovators and established chemical companies are actively shaping the competitive landscape of biodegradable plastics through strategic investments, capacity expansions, and advanced material offerings. NatureWorks stands out as a dominant force in the polylactic acid segment, operating an existing global production capacity of 165,000 metric tons per year in North America and commissioning a new 75,000-ton facility in Thailand slated for full operation by 2025. This expansion underscores the company’s commitment to serving surging demand in Asia-Pacific markets and supports applications ranging from industrial compostable coffee pods to high-performance biaxially oriented films, bolstered by the recent launch of its Ingeo™ 3D300 and Ingeo™ Extend platforms for additive manufacturing and BOPLA film producers respectively.

BASF is another key market-definer, leveraging its expansive ecovio® biopolymer portfolio to address home and industrial compostability requirements across packaging and agricultural applications. Recent product introductions include a home-compostable paper coating grade certified under EN 13432 and AS 5810 standards, as well as an industrial-grade ecovio® 60 IA 1552 targeted at greenhouse plant clips that biodegrade within six weeks in specialized facilities. Additionally, the company has debuted a biomass-balanced ecoflex® PBAT compound that replaces fossil feedstocks with waste-derived alternatives, demonstrating a 60 percent reduction in product carbon footprint while maintaining processability compatible with existing extrusion lines.

Complementing these global leaders, strategic partnerships and joint ventures are emerging as critical mechanisms to accelerate market penetration. Collaborative research initiatives and co-development agreements between major brands, polymer producers, and compounding specialists are unlocking new application spaces and refining material performance. As a result, the competitive landscape is evolving toward integrated value chains that span feedstock sourcing, polymer synthesis, compounding, and end-of-life management, enabling both agility and scale for biodegradable plastics innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biodegradable Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armando Álvarez S.A.

- BASF SE

- BEWI ASA

- Biome Technologies PLC

- BioSphere Plastic LLC

- Braskem S.A.

- Cardia Bioplastics

- CHUKOH CHEMICAL INDUSTRIES, LTD.

- Clondalkin Group

- Danimer Scientific, Inc.

- Eastman Chemical Company

- EcoBharat

- FKuR Kunststoff GmbH

- Futamura Group

- Futerro SA

- Green Dot Bioplastics Inc.

- Kingfa Sci & Tec Co

- Kuraray Co., Ltd.

- MAIP SRL

- NatureWorks LLC

- Ningbo Tianan Biomaterials Co., Ltd.

- Northern Technologies International Corporation

- Polymateria Limited

- PTT MCC Biochem Co., Ltd.

- Shimadzu Corporation

- Toray Industries Inc.

- TotalEnergies Corbion BV

- Trinseo PLC

- Versalis SpA

Strategic Actionable Recommendations for Industry Leaders to Navigate the Complexities of Growth, Innovation, and Sustainability in Biodegradable Plastics

To succeed in the rapidly evolving biodegradable plastics sector, industry leaders should pursue a multi-pronged strategy focused on feedstock diversification, infrastructure investment, and collaborative innovation. First, expanding feedstock portfolios to incorporate marine biomass, waste-derived streams, and purpose-grown crops will reduce exposure to commodity price fluctuations and strengthen supply chain resilience. Integrated partnerships across agriculture, waste management, and polymer synthesis can facilitate reliable access to sustainable inputs.

Second, targeted investment in production capacity and advanced processing technologies is essential to meet surging demand and achieve economies of scale. Establishing modular, scalable manufacturing sites proximate to key markets-coupled with retrofits of existing equipment for drop-in compatibility-can accelerate time-to-market for new biopolymer grades and diversified product formats. Concurrently, funding pilot and demonstration projects for industrial composting and anaerobic digestion facilities will ensure that end-of-life pathways are established in tandem with production expansions.

Third, fostering precompetitive collaborations and industry consortia can drive standardization of biodegradability testing protocols, certification criteria, and consumer communication. By aligning on uniform definitions for terms such as ‘industrial compostable’, ‘marine biodegradable’, and ‘biobased content’, stakeholders can enhance supply chain transparency and consumer trust. Engaging with policy makers to advocate for targeted incentives-such as tariff exemptions for certified bioplastics or tax credits for composting infrastructure-will further level the playing field and accelerate regulatory harmonization.

Finally, embedding circular economy principles into product design and corporate strategy will ensure long-term competitiveness. This entails integrating recycled content and mass-balance approaches, designing materials for recyclability or biodegradability at end-of-life, and implementing take-back programs that close the loop. By embracing this holistic, systems-oriented approach, companies can mitigate regulatory risks, optimize resource efficiency, and capture the strategic value of sustainable innovation in the biodegradable plastics market.

Detailing the Rigorous Research Methodology and Data Validation Processes Underpinning a Comprehensive Analysis of the Biodegradable Plastics Market

This analysis is grounded in a rigorous research methodology that synthesizes primary and secondary data sources to ensure comprehensive coverage and accuracy. Primary insights were obtained through in-depth interviews with polymer scientists, manufacturing executives, waste management experts, and brand decision-makers, providing frontline perspectives on technological capabilities, market entry challenges, and regulatory imperatives. These qualitative inputs were complemented by proprietary surveys targeting converter firms and packaging end-users, enabling triangulation of demand-side trends and adoption barriers.

Secondary research involved the systematic review of regulatory filings, patent databases, industry association reports, and peer-reviewed publications to map the global policy environment and identify emerging material innovations. Trade data from customs authorities and specialized intelligence platforms informed the analysis of current import-export flows and tariff impacts. Market intelligence was further enriched by company press releases, earnings calls, and investor presentations, facilitating detailed profiling of competitive strategies and capacity expansions.

Quantitative data was validated through cross-referencing multiple independent sources, while statistical techniques were employed to normalize unit metrics and reconcile discrepancies. The segmentation framework was developed using a bottom-up approach, where consumption patterns at the application level were aggregated to material-type and regional estimates. Each segment underwent sensitivity analysis to assess the robustness of assumptions around feedstock availability, technological readiness, and regulatory adoption timelines.

Finally, the findings were peer-reviewed by an internal expert panel and external advisors specializing in circular economy policy, polymer science, and sustainable supply chains. This multi-layered validation process ensures that the conclusions and recommendations presented herein reflect a balanced, fact-based perspective capable of guiding strategic decision-making in the biodegradable plastics domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biodegradable Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biodegradable Plastics Market, by Material Type

- Biodegradable Plastics Market, by Source

- Biodegradable Plastics Market, by Decomposition Technique

- Biodegradable Plastics Market, by Production Processes

- Biodegradable Plastics Market, by Product Type

- Biodegradable Plastics Market, by Distribution Channel

- Biodegradable Plastics Market, by Application

- Biodegradable Plastics Market, by Region

- Biodegradable Plastics Market, by Group

- Biodegradable Plastics Market, by Country

- United States Biodegradable Plastics Market

- China Biodegradable Plastics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Drawing Insights From Key Findings to Illuminate the Future Trajectory of the Biodegradable Plastics Landscape and Investment Imperatives

The convergence of environmental imperatives, regulatory mandates, and consumer advocacy has propelled biodegradable plastics from niche applications into mainstream consideration across multiple industries. As the global policy landscape tightens restrictions on conventional polymers, and technology continues to address performance limitations, the market for compostable, bio-based materials is poised for sustained growth.

Key findings underscore the importance of diversified material portfolios, including cellulose-based plastics, PLA, PHA, PBS, and starch blends, to meet the broad spectrum of application requirements-from flexible packaging to medical devices. Regional analyses reveal that while North America and Europe lead in regulatory stringency and infrastructure readiness, Asia-Pacific is emerging as a growth epicenter driven by large-scale legislative bans and robust manufacturing ecosystems.

Corporate leadership and strategic partnerships are central to scaling production capacity and accelerating innovation. Industry frontrunners such as NatureWorks and BASF exemplify how integrated investments in advanced polymer platforms and sustainable feedstock sourcing can drive cost efficiencies and product differentiation. However, the 2025 U.S. tariff regime serves as a cautionary reminder of geopolitical and trade policy factors that can reshape cost structures and supply chain configurations.

Looking ahead, success will hinge on the ability of stakeholders to synchronize feedstock strategies, build end-of-life infrastructure, and collaborate on standardized certification frameworks. By adopting a holistic approach that aligns technological capabilities with circular economy principles, industry leaders can navigate uncertainties and capitalize on the transformative potential of biodegradable plastics to reduce environmental impact while delivering enhanced value to consumers and businesses alike.

Seize the Opportunity to Gain In-Depth Biodegradable Plastics Market Intelligence by Connecting With Ketan Rohom Today

Unlock unprecedented market insights and stay ahead in the competitive landscape of biodegradable plastics by securing your comprehensive research report today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions that align with your strategic priorities and investment goals. Whether you seek deeper analysis on tariffs, regional trends, or emerging material technologies, Ketan will guide you through the report’s key findings, methodologies, and customization options to ensure actionable intelligence for your organization. Connect now to gain early access to exclusive data, expert commentary, and forward-looking recommendations designed to empower decision-making in an evolving market. Your partnership with our team will equip you with the clarity and confidence to drive sustainable innovation, optimize supply chains, and capitalize on emerging opportunities. Reach out to Ketan Rohom today and unlock the full potential of your biodegradable plastics strategy with an authoritative, market-defining research resource

- How big is the Biodegradable Plastics Market?

- What is the Biodegradable Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?