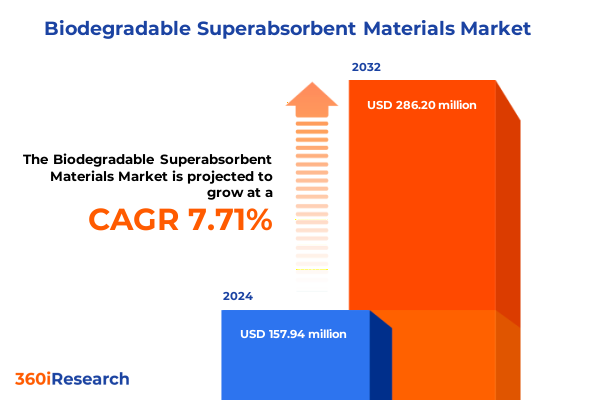

The Biodegradable Superabsorbent Materials Market size was estimated at USD 169.92 million in 2025 and expected to reach USD 186.01 million in 2026, at a CAGR of 7.73% to reach USD 286.20 million by 2032.

Understanding the Strategic Emergence of Biodegradable Superabsorbent Materials as a Groundbreaking Eco-Conscious Innovation Transforming Agriculture Hygiene and Medical Applications

The evolution of biodegradable superabsorbent materials represents a fundamental shift in how industries approach sustainable resource management and environmental stewardship. Unlike traditional superabsorbent polymers that rely heavily on synthetic petrochemical feedstocks, these new materials leverage natural polymers or chemically modified biopolymers to achieve comparable absorption performance while offering significantly improved end-of-life profiles. This transition aligns with escalating concerns over plastic pollution and regulatory measures targeting microplastic emissions, fostering a climate in which eco-friendly innovations can flourish.

Sustainability concerns, coupled with consumer demand for greener products, have catalyzed research into alternatives that balance high absorbency with rapid biodegradation. Agricultural applications have particularly benefited from superabsorbent hydrogels derived from agro-waste materials, which demonstrate the dual advantage of reducing water consumption and valorizing crop residues through circular economy principles. In parallel, hygiene and medical sectors are exploring cellulose-based and starch-based formulations that decompose under composting conditions, addressing both product performance and post-use environmental impact.

Advances in polymer chemistry, microbial enzymatic degradation pathways, and eco-design principles have synergized to propel this field forward. As a result, biodegradable superabsorbents are now positioned at the intersection of performance and sustainability, offering a compelling alternative for applications spanning agriculture, hygiene, industrial processes, and medical devices.

Exploring the Regulatory and Technological Transformations Propelling Biodegradable Superabsorbents Toward Enhanced Performance and Environmental Resilience

Regulatory dynamics are reshaping the landscape for superabsorbent materials by imposing stringent restrictions on persistent microplastics and single-use plastics. Since October 2023, the European Union has enforced Regulation (EU) 2023/2055, which restricts synthetic polymer microparticles in consumer and industrial products to mitigate environmental microplastic pollution. Concurrently, EU legislators have advanced measures to eliminate select single-use plastic packaging and introduce deposit return systems to boost recycling rates. These policies create a favorable environment for biodegradable superabsorbents that naturally degrade, aligning with the broader objectives of waste reduction and resource efficiency.

Technological innovation is advancing in lockstep with policy initiatives. The uptake of polyitaconic acid and starch-based polymers is accelerating, driven by their rapid biodegradation under composting conditions and reduced reliance on fossil feedstocks. Meanwhile, agro-waste derived hydrogels showcase how circular economy strategies can be successfully implemented, converting crop residues into value-added superabsorbent materials and reducing dependency on virgin raw materials. Together, these regulatory and technological shifts are forging pathways to more sustainable absorption solutions, compelling stakeholders across the value chain to adopt green chemistry principles.

Evaluating the Far Reaching Impacts of 2025 United States Tariff Measures on Supply Chains Cost Structures and Market Access for Superabsorbent Materials

In early April 2025, the United States implemented a sweeping 10 percent tariff on nearly all imported goods, encompassing most chemical feedstocks and superabsorbent polymers except for a narrow set of strategic exemptions. This broad duty has prompted heightened input cost volatility, compelling manufacturers to reconsider supply chain configurations and to explore domestic or tariff-exempt raw materials in order to preserve cost competitiveness.

Further complexity arose with the imposition of a 25 percent tariff on specialty chemical intermediates and a tiered 10 to 15 percent levy on base chemicals such as ethylene, propylene, and select alcohols. These additional measures have had a pronounced effect on the price and availability of performance polymers, catalyzing gradual shifts toward alternative feedstocks like starch derivatives and polyaspartic acid that may attract more favorable tariff treatment due to their classification as biobased materials.

The anticipation of escalating duties has also fueled strategic stockpiling among major chemical suppliers, with companies like Lanxess reporting increased U.S. customer orders in advance of tariff enforcement to buffer against potential cost escalation. This preemptive behavior has temporarily bolstered volumes, yet it underscores underlying supply chain fragilities and the pressing need for resilient sourcing strategies to navigate an uncertain tariff environment.

Uncovering Substantive Market Segmentation Insights Spanning End Uses Raw Materials Product Forms and Distribution Channels to Enhance Strategic Focus

End use segmentation reveals that biodegradable superabsorbent materials are finding traction in diverse sectors. In agriculture, advanced hydrogels designed to optimize soil moisture and nutrient retention are reducing irrigation requirements, while in the hygiene domain, compostable formulations for adult incontinence, baby diapers, and feminine hygiene products are capturing consumer interest for their reduced ecological footprint. The industrial segment is exploring these materials for spill control and wastewater treatment, and the medical field is leveraging them in wound dressings and controlled release drug delivery systems.

Raw material segmentation underscores a dynamic shift from traditional petrochemical-based polymers toward bio-derived constituents. Cellulose-based superabsorbents offer established biodegradation pathways and compatibility with existing manufacturing infrastructure, while polyaspartic acid derivatives are being innovated to balance absorbency and degradability. Starch-based polymers, derived from maize or potato, present compelling cost and environmental profiles, though they require performance enhancements to match incumbent technologies.

Form-based segmentation highlights the importance of processing and application compatibility. Fibers are instrumental in creating absorbent nonwoven textiles, granules offer dosing precision in agricultural or spill-management contexts, and powders facilitate rapid absorption rates in hygiene and medical applications. Each form factor boasts unique handling, performance, and end-of-life considerations.

Distribution channel segmentation illuminates how market accessibility varies by supply pathway. Direct sales afford strategic partnerships and co-development opportunities, distributors enable broader geographic reach and localized inventory buffers, and online retail platforms accelerate access to niche or low-volume biodegradable products, meeting the specialized needs of emerging customer segments.

This comprehensive research report categorizes the Biodegradable Superabsorbent Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Raw Material

- End Use

- Distribution Channel

Examining Distinct Regional Dynamics Illuminating Growth Drivers and Challenges Across the Americas EMEA and Asia Pacific in the Biodegradable Superabsorbent Sector

In the Americas, legislative actions and shifting trade policies have created a nuanced landscape for sustainable materials. United States tariff exemptions for core bulk chemicals like polyethylene and ethylene have momentarily shielded certain supply chains, yet the 2025 tariff regime has injected cost uncertainty across diverse polymer segments. Latin American producers, such as those in Brazil, have faced contract cancellations and financing challenges due to looming duties, prompting exporters to diversify into alternative markets and to explore biobased feedstocks that may avoid punitive levies.

Europe, Middle East & Africa is at the forefront of regulatory innovation with stringent microplastic restrictions and single-use plastic bans setting a high bar for environmental compliance. Deposit return systems and packaging waste targets are accelerating circular economy adoption, compelling manufacturers to integrate biodegradable superabsorbents into product designs that meet extended producer responsibility requirements and to align with ambitious emissions reduction targets enshrined in regional policy frameworks.

Asia-Pacific markets are characterized by robust agricultural demand and rapid industrial expansion, driving interest in superabsorbent hydrogels for water management and spill control applications. Petchems producers in Taiwan, South Korea, and Japan have navigated lower refining margins by shifting to cheaper feedstocks like ethane and modeling agile supply strategies, setting a precedent for adopting alternative polymer chemistries that can meet both performance and environmental criteria. Meanwhile, China’s leadership in agro-waste valorization underscores the region’s capacity to scale innovative biodegradable solutions.

This comprehensive research report examines key regions that drive the evolution of the Biodegradable Superabsorbent Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Their Strategic Initiatives Shaping Innovation Partnerships and Competitive Positioning in Biodegradable Superabsorbent Technologies

Leading polymer producers and specialty chemical manufacturers are pivoting toward sustainable superabsorbent solutions by leveraging core competencies in polymer synthesis and formulation. The Lubrizol Corporation and BASF SE have announced R&D initiatives focused on integrating biodegradable backbone chemistries into high-performance absorbent systems, aiming to retain moisture management efficacy while enhancing post-use degradability. ADM is expanding its portfolio of starch-based derivatives, catering to demand for compostable hygiene and agricultural products.

Innovators like Itaconix Corporation and Amereq, Inc. are developing polyitaconic acid-based and polyaspartic acid-based superabsorbents that combine robust absorption capacities with accelerated biodegradation pathways. SNF and NIPPON SHOKUBAI CO., LTD. are leveraging their global distribution networks to introduce agritech-focused hydrogels in emerging markets, while JRM Chemical, Inc. is advancing high-purity powder formats optimized for rapid fluid uptake. These strategic partnerships and product launches reflect a competitive landscape where sustainability and performance coalesce.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biodegradable Superabsorbent Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Chemika

- Anhui Wanwei Group Co., Ltd

- Archer-Daniels-Midland Company

- Astrra Chemicals

- BASF SE

- Chang Chun Petrochemical Co., Ltd.

- Demi Co LLC

- Denka Company Limited

- Eastman Chemical Company

- ECOMAVI S.r.l.

- Itaconix Corporation

- J.M. Huber Corporation

- Kuraray Europe GmbH

- Lonza Group Ltd.

- Merck KGaA

- Mitsubishi Chemical Corporation

- M² Polymer Technologies, Inc.

- Nippon Shokubai Co., Ltd.

- Otto Chemie Pvt. Ltd.

- Sekisui Specialty Chemicals America, LLC

- Shin-Etsu Chemical Co., Ltd.

- Sinopec Sichuan Vinylon Works

- Wacker Chemie AG

- Zhejiang Guoguang Biochemistry Co.,Ltd.

Actionable Strategic Recommendations to Navigate Regulatory Complexities Supply Chain Disruptions and Sustainability Imperatives in the Superabsorbent Materials Industry

Industry leaders should prioritize the diversification of raw material sources by integrating biobased feedstocks such as starch derivatives, cellulose nanofibrils, and polyaspartic acid analogues. Securing strategic alliances with agricultural cooperatives or biomass suppliers can mitigate exposure to petrochemical price volatility while reinforcing sustainability credentials.

To navigate regulatory complexities, companies must establish dedicated compliance functions that monitor evolving policies on microplastics and single-use plastics. Proactive engagement with regulatory bodies and participation in standardization committees will ensure that product development aligns with global environmental mandates, reducing the risk of market access barriers.

Supply chain resilience demands the development of multi-sourcing strategies and investment in flexible manufacturing capabilities. By incorporating modular production lines and decentralized inventory hubs, organizations can respond swiftly to tariff-triggered disruptions or logistic bottlenecks, safeguarding production continuity and customer service levels.

Innovation roadmaps should emphasize life-cycle assessments and circular economy integration, guiding R&D toward materials that exhibit high absorbency, rapid biodegradation, and compatibility with existing recycling or composting infrastructures. Collaborations with academic institutions and specialized test laboratories will accelerate time-to-market for next-generation biodegradable superabsorbents.

Detailing the Comprehensive Research Methodology Underpinning Data Collection Analytical Frameworks and Validation Protocols for In Depth Market Analysis

The research methodology underpinning this study combines rigorous secondary and primary research to ensure comprehensive coverage and analytical accuracy. Secondary sources include peer-reviewed journals, industry white papers, governmental publications, and regulatory databases, which inform the macroenvironmental analysis and competitive mapping.

Primary data collection involved structured interviews and surveys with key stakeholders including polymer scientists, product developers, procurement heads, and sustainability officers. Qualitative insights gleaned from these interactions were triangulated with quantitative data where available to validate market trends and technology adoption trajectories.

A robust analytical framework was applied to segment the market by end use, raw material, form, and distribution channel, enabling detailed comparative assessments. Each segment was evaluated for performance metrics such as absorption capacity, biodegradation rate, and cost considerations, ensuring that strategic recommendations are grounded in objective criteria.

To maintain methodological transparency, data sources and assumptions are documented in an appendix. Where data gaps were identified, informed estimations were derived through expert consultations and analogy-based modeling, followed by peer review to uphold the study’s credibility and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biodegradable Superabsorbent Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biodegradable Superabsorbent Materials Market, by Form

- Biodegradable Superabsorbent Materials Market, by Raw Material

- Biodegradable Superabsorbent Materials Market, by End Use

- Biodegradable Superabsorbent Materials Market, by Distribution Channel

- Biodegradable Superabsorbent Materials Market, by Region

- Biodegradable Superabsorbent Materials Market, by Group

- Biodegradable Superabsorbent Materials Market, by Country

- United States Biodegradable Superabsorbent Materials Market

- China Biodegradable Superabsorbent Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Crucial Insights on Sustainability Innovation and Supply Chain Resilience to Chart the Future Trajectory of Biodegradable Superabsorbent Materials

The analysis reaffirms that biodegradable superabsorbent materials are poised to redefine industry benchmarks by merging high-performance absorption with environmentally responsible end-of-life profiles. Sustainability imperatives and regulatory momentum are the primary catalysts driving innovation, leading to breakthroughs in agro-waste valorization and biobased polymer chemistry.

Resilient supply chains and flexible manufacturing architectures emerge as critical success factors in an era of tariff uncertainties and fluctuating raw material costs. Strategic collaboration across the value chain - from biomass suppliers to product end users - will unlock efficiencies and accelerate market penetration of green superabsorbents.

As stakeholders navigate this dynamic landscape, the integration of circular economy principles through life-cycle assessments and material recovery strategies will differentiate market leaders. By embracing a holistic approach to product development and regulatory compliance, organizations can achieve sustainable growth while delivering on performance expectations.

Ultimately, the convergence of policy, technology, and strategic foresight will shape the future trajectory of biodegradable superabsorbent materials, establishing them as indispensable components in efforts to address global resource management and environmental challenges.

Contact Ketan Rohom Associate Director of Sales Marketing to Secure Exclusive Access to the In Depth Biodegradable Superabsorbent Materials Market Research Report Today

For a deeper dive into the comprehensive analysis of biodegradable superabsorbent materials, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the full breadth of insights, strategic implications, and technical evaluations contained in the report. Secure your copy today to equip your organization with the knowledge and foresight needed to stay ahead in this rapidly evolving market.

- How big is the Biodegradable Superabsorbent Materials Market?

- What is the Biodegradable Superabsorbent Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?