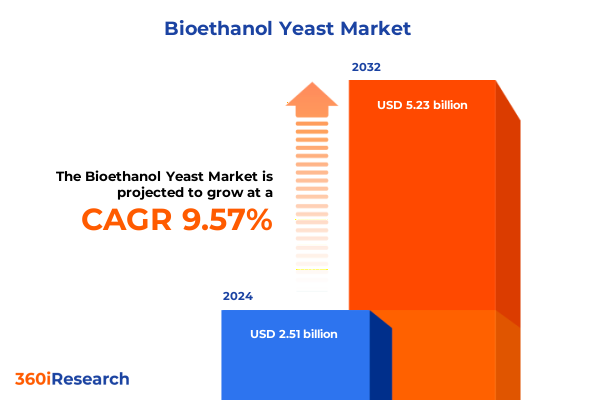

The Bioethanol Yeast Market size was estimated at USD 2.74 billion in 2025 and expected to reach USD 2.99 billion in 2026, at a CAGR of 9.65% to reach USD 5.23 billion by 2032.

Exploring the Critical Role of Yeast Innovations in Modern Bioethanol Manufacturing Under Accelerating Global Sustainability and Energy Security Demands

Global decarbonization commitments and rising mandates for renewable transportation fuels have propelled bioethanol into a central role within energy strategies worldwide. At the heart of this shift lies a microbial workhorse whose evolution has unlocked unprecedented gains in process efficiency, yield stability, and cost competitiveness. By harnessing advances in strain selection, metabolic engineering, and fermentation optimization, modern yeast platforms are delivering ethanol outputs that were inconceivable a decade ago, reinforcing bioethanol’s status as a pillar of the low-carbon energy transition.

This introduction lays out the compelling factors that make yeast biotechnology a critical fulcrum for scaling sustainable fuel production. Progress in genetic tools has enabled tailor-made yeast strains capable of tapping diverse feedstocks, from first-generation sugarcane and corn to lignocellulosic residues. Concurrent developments in downstream processing and bioreactor design have further raised the bar for operational excellence, minimizing resource inputs while maximizing ethanol titers and productivity.

Through this lens, the following analysis examines how technological breakthroughs, regulatory frameworks, market segmentation, and regional dynamics converge to reshape the bioethanol yeast landscape. It offers decision-makers an integrated view of emerging trends, stakeholder priorities, and strategic barriers, setting the stage for informed investments and collaborative innovation.

Identifying the Pivotal Technological Breakthroughs and Policy Reforms Reshaping the Bioethanol Yeast Ecosystem Amidst Emerging Renewable Fuel Mandates

The bioethanol yeast landscape is witnessing transformative shifts driven by a convergence of scientific breakthroughs and evolving policy frameworks. Breakthroughs in high-throughput screening and adaptive laboratory evolution are accelerating the pace at which novel yeast strains are identified and optimized for complex feedstocks. Simultaneously, the maturation of synthetic biology tools is facilitating precise rewiring of metabolic pathways to increase ethanol yields, improve tolerance to inhibitors, and expand substrate range without incurring trade-offs in growth kinetics.

On the regulatory front, escalating low-carbon fuel standards and aggressive greenhouse gas reduction targets have intensified demand for cellulosic and advanced bioethanol solutions. Governments are deploying incentive structures and grant funding, reducing up-front risks for pilot-scale demonstrations and full-scale integrations of next-generation yeast platforms. As a result, public-private partnerships are proliferating, fostering an ecosystem where research institutes, biotechnology firms, and fuel producers co-develop robust fermentation processes that can be replicated reliably at commercial scale.

Together, these dynamics are propelling a landscape in which incremental strain enhancements are yielding compound returns on operational metrics, while policy certainty is unlocking capital flows into downstream infrastructure. In turn, the bioethanol yeast sector is emerging as a bellwether for the broader bioeconomy, exemplifying how scientific ingenuity and strategic policymaking can coalesce to drive sustainable industrial transformation.

Analyzing the Comprehensive Effects of Newly Imposed United States Tariffs on Bioethanol Yeast Supply Chains Trade Dynamics and Cost Structures

In 2025, the introduction of revised United States import tariffs on yeast-derived bioethanol components has created ripples across global supply chains and cost structures. By imposing duties on select finished yeast biomass and enzyme preparations, these measures have recalibrated sourcing strategies, prompting domestic producers to recalibrate their export destinations and pricing models. Stakeholders are now conducting granular cost-benefit analyses to balance the premium for tariff-free local procurement against the innovation lead time that overseas suppliers may still command.

These tariff shifts have also galvanized investment in domestic capacity expansion, as integrated suppliers seek to internalize the full value chain and mitigate exposure to cross-border fee escalations. Consequently, end users are reassessing their vendor portfolios, incorporating more rigorous supplier scorecards that weigh not only technical performance but also geographic risk. This new procurement calculus has underscored the importance of agile manufacturing footprints capable of scaling production volumes in response to evolving tariff schedules.

As a cumulative effect, the United States landscape is seeing a reorientation toward vertically integrated models, where upstream yeast development and downstream enzyme formulation coexist within the same corporate envelope. While these changes have introduced short-term complexity in cost management, they are also fostering a more resilient domestic supply base-one that can adapt nimbly to future policy shifts and sustain uninterrupted bioethanol production.

Uncovering Strategic Perspectives Through Multifaceted Segmentation of Bioethanol Yeast Markets Enabling Targeted Product Development and Commercialization

Deconstructing the bioethanol yeast market through multiple segmentation lenses reveals nuanced opportunities for targeted innovation and tailored commercial approaches. When examining product classifications, active yeast products emerge as the backbone of fermentation scale-up, while dried and fresh yeast offerings cater to distinct operational preferences. Inactive yeast variants further bifurcate into feed yeast and nutritional yeast, each serving specialized end uses beyond ethanol synthesis.

Shifting focus to formulation types, liquid preparations deliver high viability with minimal rehydration time, suiting continuous fermentation schemes, whereas solid formulations offer longer shelf life and logistical flexibility for batch operations in remote facilities. In parallel, technological categorization spans traditional fermentation methods, both batch and continuous, and cutting-edge genetic engineering approaches that enhance metabolic flux and stress tolerance. Hybrid technology platforms are also gaining traction, blending biological and process intensification strategies to unlock incremental performance gains.

End-user industry segmentation underscores the diverse applications of yeast innovations, from food and beverage fermentations to fuel-grade ethanol. The nutraceutical sector leverages specialized yeast extracts for health-oriented ingredients, while the pharmaceutical arena applies yeast biotechnology for antibiotic production and probiotic formulations. Finally, applications themselves partition into core biofuel production pipelines, bioproduct creation for high-value chemicals, and environmental remediation uses, such as effluent treatment and carbon capture bioprocesses.

This comprehensive research report categorizes the Bioethanol Yeast market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Formulation Type

- Technology

- Applications

- End-User Industry

Examining Divergent Regional Dynamics Driving Bioethanol Yeast Adoption and Investment Trends Across the Americas Europe Middle East Africa and Asia Pacific

Geographic dynamics critically influence both demand patterns and innovation trajectories in the bioethanol yeast sector. In the Americas, a robust corn-derived ethanol industry drives steady consumption of optimized yeast strains, with investment flowing into mid-western fermentation clusters and logistics hubs. Concurrently, policy incentives in renewable fuel blending across Canada and Brazil are fostering cross-border collaborations in strain development and feedstock diversification.

Europe, Middle East & Africa present a mosaic of regulatory frameworks, where the European Union’s Fit for 55 agenda accelerates the adoption of cellulosic ethanol, incentivizing yeast developers to tailor strains for lignocellulosic feedstocks. In the Middle East, nascent biofuel initiatives are catalyzing pilot programs in arid-climate sugarcane and date-fruit molasses valorization, while select African nations are leveraging yeast biotechnology to convert agricultural residues into locally produced fuel, addressing both energy access and waste management objectives.

Asia-Pacific remains a hotbed of capacity expansion, with China and India scaling ethanol mandates that underpin significant yeast procurement volumes. Technological collaborations between regional bioprocess engineering firms and international biotech suppliers are driving hybrid technology platforms, optimized for high-temperature fermentations and alternative feedstocks such as cassava and sweet sorghum. These investments underscore the region’s strategic importance as both a consumer and innovator in the global bioethanol yeast ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Bioethanol Yeast market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Stakeholders Shaping Innovations Competitive Strategies and Strategic Partnerships in the Global Bioethanol Yeast Market

An ecosystem of specialized biotechnology companies, enzyme manufacturers, and integrated fuel producers is steering the competitive contours of the bioethanol yeast market. Leading players are leveraging in-house R&D hubs to push the envelope on strain engineering, focusing on attributes such as ethanol titer maximization, inhibitor resilience, and broad substrate conversion. These core capabilities are increasingly supplemented by strategic partnerships with fermentation equipment suppliers and academic laboratories to co-develop turnkey solutions.

Meanwhile, established enzyme formulators are expanding their yeast-based portfolios, bundling proprietary biomass hydrolysis enzymes with custom strain kits to deliver end-to-end process compatibility. In parallel, start-ups rooted in synthetic biology are disrupting traditional value chains by offering modular plug-and-play yeast chassis capable of rapid deployment across multiple feedstocks. This modularity not only accelerates time-to-market but also enables flexible licensing models that de-risk upfront capital commitments for fuel producers.

As these dynamics unfold, the boundary between pure-play yeast specialists and vertically integrated energy companies is blurring. In-house fermentation assets and deep pockets for technology acquisition are providing some vertically integrated firms with an edge in securing long-term supply agreements, while pure-play innovators are forging alliances to scale production capacity and broaden their geographic footprint.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioethanol Yeast market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Mauri

- Alltech, Inc.

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Associated British Foods plc

- BASF SE

- Biorigin

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- DSM N.V.

- DuPont de Nemours, Inc.

- Kemin Industries, Inc.

- Kerry Group plc

- Lallemand Inc.

- Lesaffre Group

- Novozymes A/S

- Oriental Yeast Co., Ltd.

- Pak Group

- Synergy Flavors

Formulating Pragmatic Strategic Recommendations to Optimize Bioethanol Yeast Production Market Positioning and Collaboration for Sustained Growth

To capitalize on the rapid evolution of bioethanol yeast technology, industry leaders should adopt a multipronged approach that balances internal capability building with external collaboration. Investing in advanced strain development platforms-particularly those leveraging machine learning–driven phenotype prediction-will enable R&D teams to shorten innovation cycles and focus resources on the most promising candidates. Concurrently, co-development agreements with enzyme formulators and hardware providers can accelerate commercialization timelines and ensure seamless process integration.

Operationally, producers should evaluate the merits of hybrid fermentation models that marry batch flexibility with continuous productivity enhancements. Piloting such systems in controlled micro-plant environments will reveal the optimal interplay between yeast physiology and process dynamics, informing scale-up protocols. On the procurement front, a diversified supplier mix, including regional players equipped to navigate tariff regimes, can insulate operations from geopolitical shocks and cost volatility.

Lastly, establishing open innovation consortia that bring together academic institutions, technology start-ups, and end users will foster cross-sector knowledge sharing and reduce duplication of effort. Such consortia can coalesce around common challenges, such as overcoming lignocellulosic fermentation inhibitors or improving co-product valorization, thus driving collective progress while safeguarding proprietary advancements.

Detailing the Rigorous Multi Stage Research Methodology Employed to Ensure Data Integrity Robust Market Analysis and Unbiased Industry Insights

This analysis rests upon a structured, multi-stage methodology designed to deliver robust and unbiased insights. The process began with extensive secondary research, encompassing academic journals, patent filings, and policy databases, to map the current state of yeast biotechnology and regulatory environments. Insights gleaned from this phase guided the formulation of targeted primary research instruments.

Subsequently, in-depth interviews and surveys were conducted with R&D directors, operations managers, and senior executives across technology providers, fermentation asset owners, and end-user industries. These engagements were complemented by site visits to key fermentation facilities, where operational parameters and scale-up challenges were observed firsthand. Quantitative data obtained from these activities were triangulated with industry publications and financial disclosures to validate emerging trends and assess market readiness.

Finally, the synthesis phase integrated qualitative narratives with performance metrics, ensuring that the insights presented align with real-world operational constraints and strategic imperatives. Rigorous peer review protocols and cross-validation steps were employed to eliminate bias, resulting in an analysis that stakeholders can trust for strategic planning, investment decisions, and technology roadmapping.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioethanol Yeast market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioethanol Yeast Market, by Product

- Bioethanol Yeast Market, by Formulation Type

- Bioethanol Yeast Market, by Technology

- Bioethanol Yeast Market, by Applications

- Bioethanol Yeast Market, by End-User Industry

- Bioethanol Yeast Market, by Region

- Bioethanol Yeast Market, by Group

- Bioethanol Yeast Market, by Country

- United States Bioethanol Yeast Market

- China Bioethanol Yeast Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Illuminate the Future Trajectory of Bioethanol Yeast Innovations Market Integration and Industry Transformation Strategies

Throughout this executive summary, key themes have emerged at the intersection of scientific innovation, policy evolution, and market dynamics. Advances in strain engineering and fermentation technologies are redefining what is operationally feasible, while regulatory incentives and trade policies are reshaping the competitive playing field. Segmentation insights have illuminated pathways for differentiated value propositions, whether through bespoke yeast formulations or end-user–specific enzyme bundles.

Regional analyses underscore the diverse strategic imperatives that drive yeast adoption across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Meanwhile, an evolving cast of industry players, from synthetic biology start-ups to vertically integrated energy majors, is orchestrating new collaborations and M&A activity to secure long-term advantage. Taken together, these findings map a landscape in which agility, partnerships, and targeted R&D investments are paramount.

As the bioethanol yeast market continues to mature, stakeholders who align their operational strategies with emerging technological inflection points and policy trajectories will be best positioned to capture growth. By synthesizing these insights, decision-makers can chart a path forward that balances innovation with resilience, paving the way for sustainable fuel production and broader bioeconomy development.

Take the Next Step to Gain Unparalleled Market Intelligence on Bioethanol Yeast Trends and Secure Your Competitive Advantage Today

To explore the full depth of market intelligence and leverage these insights for strategic advantage, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan combines deep domain expertise in biofuels with a consultative approach to help clients navigate complex market dynamics and pinpoint the most impactful growth levers. Engaging with Ketan will provide you with a personalized walkthrough of key findings, customized data extracts tailored to your business priorities, and guidance on translating research outcomes into actionable strategies. Secure your access to this comprehensive analysis today and position your organization at the forefront of bioethanol yeast innovation and commercialization.

- How big is the Bioethanol Yeast Market?

- What is the Bioethanol Yeast Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?