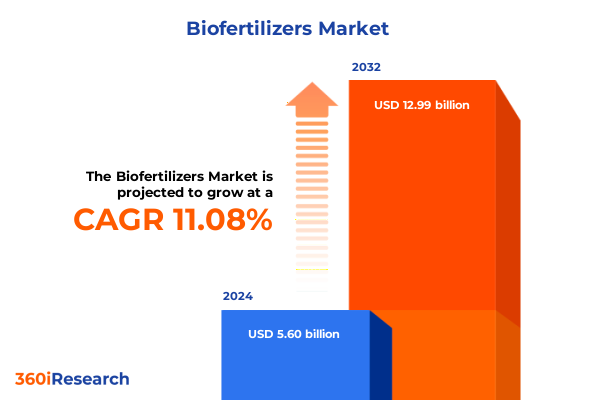

The Biofertilizers Market size was estimated at USD 6.23 billion in 2025 and expected to reach USD 6.94 billion in 2026, at a CAGR of 12.23% to reach USD 13.99 billion by 2032.

Embarking on a Revolutionary Era of Biofertilizers That Are Redefining Sustainable Agriculture and Elevating Crop Productivity Worldwide

Biofertilizers have emerged as a cornerstone in the pursuit of resilient and eco-conscious agriculture. Driven by a confluence of environmental imperatives and advancements in microbial technology, these biological inputs offer a promising alternative to conventional chemical fertilizers. Through symbiotic interactions with crops, biofertilizers unlock soil nutrients, bolster plant immunity, and reduce reliance on synthetic compounds, thereby fostering healthier ecosystems and sustainable yields.

The dawn of this bio-centric era reflects growing regulatory support for carbon reduction targets and soil health initiatives. Stakeholders across the value chain-from research institutions to agribusinesses-are channeling resources into next-generation microbial consortia. Concurrently, farmers are embracing precision agriculture and digital monitoring tools to optimize the deployment of beneficial organisms, ensuring crop-specific efficacy under diverse climatic conditions.

As we delve deeper into the transformative potential of biofertilizers, it becomes clear that these innovations not only address immediate agronomic challenges but also align with long-term goals for food security and environmental stewardship. The following analysis unpacks critical shifts, regulatory influences, market segmentation, and regional nuances that are shaping the trajectory of this dynamic sector.

Charting the Dramatic Transformation in Biofertilizer Innovation Fueled by Scientific Advances Regulatory Support and Integrated Nutrient Strategies

The landscape of biofertilizers is undergoing a profound metamorphosis propelled by groundbreaking scientific discoveries and evolving market dynamics. Recent years have witnessed a surge in high-throughput screening techniques that accelerate the identification of beneficial microbial strains. These innovations have enabled the development of multi-species formulations tailored to specific crop and soil conditions, thereby enhancing nutrient uptake and stress resilience.

Simultaneously, policy frameworks are shifting to recognize the importance of biological solutions. Governments across key markets have introduced incentives and streamlined registration processes for microbial products, reducing time-to-market and fostering competition. Private investments are flowing into biotechnology platforms, supporting the scale-up of production methods such as solid and liquid fermentation, which optimize product stability and shelf life.

Moreover, a transition toward integrated nutrient management strategies is becoming prevalent. Instead of viewing biofertilizers in isolation, farmers increasingly incorporate them into holistic programs that combine organic amendments, precision irrigation, and digital decision support systems. As a result, biofertilizers are no longer niche offerings but essential components of modern agronomic toolkits, marking a decisive shift in how sustainable agriculture is conceived and practiced.

Assessing the Far-Reaching Consequences of 2025 Tariff Policies on Biofertilizer Supply Chains Production Costs and Industry Resilience

The United States’ tariff regime in 2025 has created a challenging environment for biofertilizer producers and distributors who rely on imported raw materials and specialty equipment. In early February, additional tariffs of 10 percent on imports from China and 25 percent on steel and aluminum raised production costs across the agriculture inputs sector. Shortly thereafter, on March 4, 2025, the administration imposed a 25 percent tariff on fertilizers imported from Canada and Mexico and a further 10 percent on shipments from China, directly impacting key ingredients such as carrier substrates and nutrient salts. Reports indicated that a 25 percent tariff was placed on fertilizer imports from Canada, including potash, ammonium sulfate, and nitrogen, with some prices jumping by over $100 per ton as a consequence of these measures.

In addition to standard fertilizers, biofertilizer producers faced higher costs for packaging materials and equipment components sourced internationally. Shipping delays and customs complexities compounded these challenges, ultimately disrupting supply chain reliability. Notably, broad-based reciprocal tariffs announced on April 2, 2025 added complexity by extending higher duty rates to a wider array of agricultural inputs.

Despite these headwinds, certain carve-outs provided relief: potash and specific agrochemicals were exempted following advocacy by farm-state lawmakers and industry associations. Although these exemptions offered temporary reprieve, the cumulative effect of unpredictable tariff shifts has encouraged biofertilizer companies to diversify procurement strategies, localize production where feasible, and pursue tariff-resilient formulations to maintain competitive pricing and supply continuity.

Deep Dive into Biofertilizer Market Segmentation Revealing Diverse Types Forms Methods Crop Applications and Distribution Channels

The biofertilizer market encompasses a wide array of biological agents categorized by their type, form, application approach, crop compatibility, and distribution pathways. Actinomycetes, known for their soil-enhancing properties, coexist alongside algal biofertilizers, which are represented by Blue-Green Algae and Seaweed Extract variants that unlock micronutrients and phytohormones. Bacterial preparations such as Azospirillum, Azotobacter, and Rhizobium each contribute distinct nitrogen-fixation capabilities under varying soil conditions. Similarly, fungal options featuring Mycorrhizal inoculants and Trichoderma strains improve root architecture and suppress soil-borne pathogens.

These microbial types are formulated either as liquids-enabling precise dosing and rapid crop uptake-or in solid forms like granules and powders, which offer extended shelf stability and ease of handling. When applied, foliar sprays deliver beneficial organisms directly to leaf surfaces, seed treatments optimize germination and early vigor, and soil treatments establish resilient rhizosphere communities that support plants throughout their lifecycle.

Furthermore, biofertilizers address the needs of a diverse crop spectrum. For large-scale cereal and grain production, tailored grower programs enhance nutrient use efficiency. In horticultural systems involving fruits and vegetables, formulations are calibrated to maximize fruit set and quality. Oilseed and pulse crops receive microbial blends that boost nitrogen availability, while turf and ornamental applications focus on root strength and stress mitigation.

Finally, distribution spans offline channels where companies maintain dedicated brand websites and e-commerce platforms to engage agricultural stakeholders, as well as online marketplaces offering seamless order management and direct farm delivery. This multi-dimensional segmentation underscores the complexity and adaptability of biofertilizer strategies in meeting agronomic demands.

This comprehensive research report categorizes the Biofertilizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Crop Type

- Application Method

- Distribution Channel

Illuminating How Americas Europe Middle East Africa and Asia-Pacific Regions Are Uniquely Shaping the Biofertilizer Revolution

Regional dynamics are shaping the global biofertilizer arena in distinctive ways. In the Americas, particularly in the United States and Brazil, sustainability mandates coupled with large-scale agriculture have driven rapid adoption. Research collaborations between universities and biotechnology firms are pioneering next-generation microbial consortia tailored for extensive grain and oilseed systems. Ample government support, through grant programs and regulatory allowances, has further propelled market maturation.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasize reduced chemical inputs and soil health restoration. The European Union’s Farm to Fork initiative and the Africa Soil Health Consortium’s initiatives are fueling demand for biological solutions. In North African horticultural hubs and Middle Eastern controlled-environment agriculture projects, biofertilizers are leveraged to minimize water usage and enhance crop uniformity under challenging climatic conditions.

Within Asia-Pacific, rapid population growth and constrained arable land are intensifying the need for sustainable intensification. Nations such as India and Indonesia are scaling biofertilizer production through public-private partnerships, while Australia’s stringent biosecurity standards ensure high-purity microbial strains. Growing digital agriculture platforms in the region facilitate knowledge transfer and best practice adoption among smallholder farmers, extending the reach of biobased inputs into remote areas.

These regional variations underscore the necessity for tailored strategies that align product development, regulatory engagement, and distribution logistics with local agronomic, economic, and policy landscapes.

This comprehensive research report examines key regions that drive the evolution of the Biofertilizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Leading Companies Are Leveraging Biotech Expertise Strategic Alliances and Scalable Production to Dominate the Biofertilizer Arena

Market leadership in biofertilizers is driven by companies leveraging R&D excellence, strategic alliances, and scalable production capacities. Global agrochemical giants have expanded biological portfolios through targeted acquisitions of biotechnology startups, integrating expertise in microbial fermentation and formulation science. Meanwhile, specialized biofertilizer manufacturers have differentiated through proprietary strain libraries and advanced consortia design, enabling precision solutions for diverse crop systems.

Collaborative ventures between biocontrol experts and digital agronomy platforms have accelerated the commercialization of data-driven biofertilizer applications. By harnessing remote sensing, soil mapping, and predictive analytics, leading firms offer integrated services that optimize timing, dosage, and environmental compatibility. Strategic alliances with seed companies provide bundled offerings that combine improved genetics with microbial inoculants, thereby enhancing value propositions for growers.

On the production front, investments in modular fermentation facilities and drying technologies have allowed companies to localize manufacturing and mitigate cross-border tariff impacts. This shift not only reduces logistics costs but also enhances supply chain resilience. In parallel, marketing initiatives emphasize sustainability credentials and field-validated performance, reinforcing brand recognition among progressive farming communities.

Collectively, these competitive strategies reflect a convergence of biotechnology innovation, digital integration, and agile operations, positioning leading companies to capture growth opportunities in both established and emerging markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biofertilizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrinos AS

- Atlántica Agrícola

- Bayer AG

- Corteva Agriscience

- IPL Biologicals Limited

- Kiwa Bio-Tech Products Group Corporation

- Koppert Biological Systems

- Lallemand Inc.

- Novonesis)

- Rizobacter Argentina S.A.

- Syngenta

- The Mosaic Company

- UPL Limited

- Valent BioSciences Corporation

Driving Industry Leadership by Combining Genomics-Powered Discovery Localized Manufacturing and Digital Agronomy Integration

To thrive in this dynamic environment, industry leaders should prioritize the development of robust microbial portfolios that address region-specific agronomic challenges. Investing in genomics and phenotyping capabilities will accelerate the discovery of high-impact strains, while partnerships with local research institutions can facilitate field trials that validate performance under diverse conditions.

Given the volatility introduced by recent tariff policies, companies must also enhance supply chain flexibility by establishing localized production hubs and diversifying sourcing channels for key inputs. Embracing continuous process optimization in fermentation and formulation will reduce production costs and minimize exposure to duty fluctuations.

Furthermore, integrating biofertilizers into digital agronomy platforms can elevate value propositions. By coupling remote sensing data with predictive application algorithms, providers can offer tailored recommendations that maximize crop response and resource use efficiency. Collaborative pilot programs with progressive growers will showcase real-world benefits and drive broader adoption.

Finally, engaging proactively with policymakers to advocate for streamlined registration processes and targeted incentive programs will foster a supportive regulatory environment. By demonstrating the environmental and economic merits of biofertilizers, industry stakeholders can secure policy frameworks that accelerate market expansion and sustainability outcomes.

Unveiling Rigorous Primary Secondary and Triangulated Research Approaches Underpinning Insights into Biofertilizer Market Dynamics

This study integrates insights from comprehensive primary and secondary research methodologies. Primary data were gathered through in-depth interviews with key stakeholders, including agronomists, regulatory experts, biofertilizer producers, and distribution partners across major regions. These qualitative discussions were complemented by targeted surveys of commercial growers, capturing usage patterns, efficacy perceptions, and adoption barriers.

Secondary research encompassed the analysis of regulatory documents, scientific publications, and industry reports to map policy landscapes, technological advancements, and competitive dynamics. Trade statistics and customs data were examined to quantify the impact of tariff measures on input flows and pricing structures.

A triangulation approach was then employed to validate findings, cross-referencing market sentiments with empirical performance data from field trials and case studies. Advanced data analytics tools facilitated trend identification and segmentation mapping, ensuring that conclusions reflect real-world market behavior.

The combination of these research layers provides a holistic understanding of biofertilizer market drivers, constraints, and strategic opportunities, equipping decision-makers with actionable intelligence founded on rigorous evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biofertilizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biofertilizers Market, by Type

- Biofertilizers Market, by Form

- Biofertilizers Market, by Crop Type

- Biofertilizers Market, by Application Method

- Biofertilizers Market, by Distribution Channel

- Biofertilizers Market, by Region

- Biofertilizers Market, by Group

- Biofertilizers Market, by Country

- United States Biofertilizers Market

- China Biofertilizers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding that Adaptive Innovation and Strategic Collaboration Are Paving the Path for a Resilient and Sustainable Biofertilizer Future

The biofertilizer sector stands at the nexus of agricultural innovation and environmental stewardship. As microbial solutions gain traction across global food systems, they are poised to deliver tangible benefits ranging from improved nutrient efficiency to enhanced soil health and reduced carbon footprints. Despite recent trade policy headwinds, the industry’s adaptive strategies in strain development, production localization, and digital integration signal robust potential for sustained growth.

Key market segments-from algal extracts to fungal inoculants-continue to evolve through advanced formulation technologies, while diversified application methods enable tailored deployment across cereals, horticulture, pulses, and turf disciplines. Moreover, regional distinctions highlight the importance of customized approaches that align with local regulatory, economic, and climatic contexts.

Competitive landscapes are intensifying as established agrochemical players and nimble biotech specialists converge through partnerships, acquisitions, and platform innovations. Those leaders who harness genomics-driven discovery, forge strategic alliances, and refine supply chains will secure decisive advantages.

In sum, the biofertilizer revolution represents both an agronomic imperative and a strategic opportunity. With targeted investments and collaborative initiatives, stakeholders can shape a resilient, sustainable agriculture future while capitalizing on emerging market pathways.

Secure Strategic Advantage with Expert-Led Biofertilizer Market Intelligence to Elevate Growth and Drive Sustainable Agriculture Initiatives

I invite you to harness these insights and propel your organization to leadership in the fast-evolving biofertilizers market by securing the full research report today. For personalized guidance on leveraging these trends and deeply understanding regional, segmental, and competitive dynamics, please contact Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Access to this comprehensive study will equip you with the data-driven intelligence necessary to shape strategic initiatives, optimize investments, and drive sustainable growth. Reach out now to transform knowledge into action and stay ahead in the sustainable agriculture revolution

- How big is the Biofertilizers Market?

- What is the Biofertilizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?