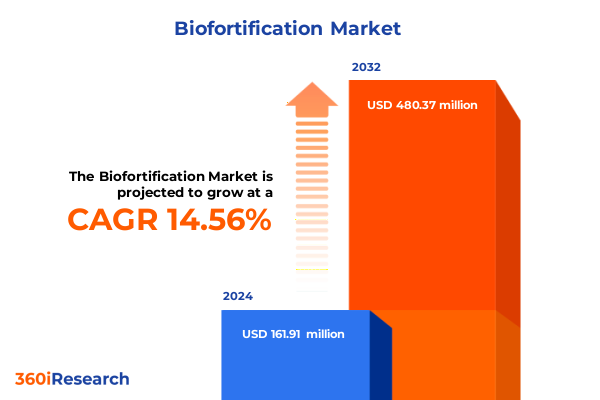

The Biofortification Market size was estimated at USD 186.00 million in 2025 and expected to reach USD 210.82 million in 2026, at a CAGR of 14.51% to reach USD 480.37 million by 2032.

Pioneering Nutritional Uplift: Understanding the Critical Role of Biofortification in Addressing Global Micronutrient Deficiencies and Food Security Challenges

Biofortification has emerged as a pivotal solution for addressing global micronutrient deficiencies and strengthening food security across diverse populations. By inherently enriching staple crops with essential vitamins and minerals, biofortification transcends traditional fortification approaches, embedding nutritional value directly within the agricultural value chain. This proactive enhancement of crop varieties not only caters to the nutritional needs of consumers but also integrates seamlessly into existing farming practices, presenting a sustainable pathway toward long-term nutritional improvements.

During the past decade, the convergence of scientific breakthroughs, policy support, and heightened consumer awareness has elevated biofortification from a niche research concept to a mainstream agricultural intervention. Advancements in conventional breeding and genetic engineering have expanded the toolbox available to plant scientists, enabling the development of robust, nutrient-dense cultivars. Simultaneously, progressive governmental frameworks and global health initiatives have underscored the importance of addressing hidden hunger, catalyzing investment and public–private partnerships that propel biofortification forward.

As stakeholders across the supply chain recognize the dual benefits of enhanced nutritional outcomes and resilience against climatic stressors, the role of biofortification has evolved into a cornerstone of integrated food system strategies. By bridging the divide between agricultural productivity and public health imperatives, the introduction of biofortified crops signals a transformative shift toward more equitable, nutritious, and sustainable food systems worldwide.

Unveiling Paradigm Shifts: Exploring Technological, Consumer, and Policy Drivers Revolutionizing the Biofortification Landscape for Sustainable Nutrition Security

The biofortification landscape is undergoing transformative shifts driven by an interplay of technological innovation, shifting consumer preferences, and progressive policy initiatives. Scientific tools such as genome editing and advanced phenotyping are redefining the pace at which nutrient-rich cultivars enter the market, thereby accelerating adoption curves and expanding the range of biofortified staples available to producers and consumers alike.

In parallel, evolving consumer demand for nutrient-dense, natural food solutions is reshaping value chain priorities. Health-conscious buyers increasingly seek products that deliver tangible nutritional benefits without altering dietary habits, reinforcing the strategic importance of biofortified options in mainstream retail channels. This consumer momentum is complemented by digital platforms that facilitate transparent communication about health attributes and traceability, thereby fostering trust and elevating the perceived value of biofortified offerings.

Furthermore, the policy environment has become more conducive to biofortification as regulators and funding bodies recognize its cost-effectiveness relative to conventional supplementation programs. Strategic alliances between governments, multilateral agencies, and private sector investors are channeling resources toward large-scale field trials, capacity building, and awareness campaigns. These multi-stakeholder collaborations are vital for overcoming regulatory hurdles and ensuring streamlined pathways from laboratory research to field deployment.

Consequently, the landscape has shifted from isolated research projects to integrated ecosystems where innovation, policy, and market dynamics collectively drive the sustainable expansion of biofortification as a key pillar in global nutritional strategies.

Navigating the Ripple Effects: Assessing the Cumulative Impact of United States 2025 Tariffs on Biofortified Agrifood Supply Chains, Input Costs, and Trade Dynamics

As of 2025, recent tariff adjustments by the United States have exerted significant pressure on the cost structure and supply chain dynamics of the biofortification sector. Changes in import duties on specialized seeds, agrochemicals, and advanced genetic tools have created both challenges and strategic inflection points for stakeholders operating within North American markets.

The heightened tariffs on advanced agronomic inputs have led to upward cost pressures for farmers and seed developers alike. In response, companies are reassessing sourcing strategies by exploring regional production hubs or engaging in joint ventures to internalize key components of the value chain. Although these efforts have demonstrated resilience in mitigating immediate cost escalations, they have also introduced complexities in logistics and inventory planning, requiring a more agile approach to procurement and distribution.

Simultaneously, tariff-induced shifts in trade flows have redirected certain biofortified seed imports toward alternative markets in regions with more favorable trade agreements. This reorientation underscores the importance of diversified sourcing networks and informed trade policy engagement. Furthermore, industry associations have amplified advocacy efforts to secure tariff exemptions for critical biotechnological inputs, emphasizing the broader public health and economic benefits of expanded biofortification programs.

Ultimately, while the 2025 tariff landscape has introduced short-term cost headwinds, it has also catalyzed strategic realignments that reinforce supply chain resilience, drive closer regional collaboration, and highlight the necessity of proactive policy dialogue to sustain the momentum of biofortification initiatives across the United States and beyond.

Deep Dive into Market Segmentation: Insightful Exploration of Crop Types Methods Applications Channels and End Users Shaping the Biofortification Ecosystem

A nuanced understanding of market segmentation is essential to unlocking the full potential of biofortification across diverse agricultural and nutritional contexts. By examining the market through the lens of crop types, it becomes evident that cereals and grains-particularly maize, rice, and wheat-represent foundational platforms for nutrient enhancement programs due to their widespread consumption and established cultivation infrastructure. At the same time, fruits and vegetables, notably carrots and tomatoes, offer targeted avenues for vitamin enrichment, while pulses such as beans, chickpeas, and lentils provide valuable protein- and mineral-dense alternatives. Roots and tubers, especially cassava and sweet potato, further expand the scope of biofortification by addressing nutrition gaps in regions where these staples are predominant.

Exploring biofortification methods reveals distinct trajectories for implementation. Agronomic practices, encompassing fertilizer application, foliar spray, and soil amendment, deliver rapid albeit incremental enhancements, making them suitable for immediate impact programs. Conventional breeding techniques-hybridization, mass selection, and recurrent selection-offer sustainable, long-term genetic improvements that integrate seamlessly into existing crop management systems. Meanwhile, genetic engineering approaches, including cisgenic, genome editing, and transgenic interventions, herald the next frontier of precision nutrition, enabling direct manipulation of metabolic pathways to amplify specific micronutrient profiles.

From an application standpoint, the spectrum of end uses spans animal feed, dietary supplements, and the food industry. Within animal feed, aquaculture, livestock, and poultry segments benefit from tailored nutrient fortification that improves growth performance and animal health. Dietary supplements in the form of capsules, powders, and tablets capitalize on concentrated nutrient delivery, catering to niche markets seeking convenience and dosage precision. The food industry leverages biofortified inputs in bakery, confectionery, dairy, and snack formulations, responding to retailer and consumer demands for functional food innovations.

Channel dynamics play a pivotal role in market reach, with online retail, specialty stores, and supermarkets and hypermarkets each offering unique advantages in consumer engagement and distribution efficiency. Lastly, end users such as feed manufacturers covering aquafeed, cattle feed, and poultry feed; food and beverage manufacturers encompassing bakery, confectionery, dairy, and snack product lines; and research institutes pioneering next-generation solutions collectively shape the trajectory of biofortification adoption and refinement.

This comprehensive research report categorizes the Biofortification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Crop Type

- Biofortification Method

- Application

- Distribution Channel

- End User

Regional Dynamics Illuminated: Key Environmental Policy Infrastructure and Consumer Behavior Trends Driving Biofortification Adoption across Major Global Markets

Regional dynamics exert profound influence on the evolution and uptake of biofortification strategies around the world. In the Americas, robust agricultural research institutions and well-established regulatory frameworks have facilitated the rapid introduction of biofortified varieties. Government incentive programs and nutrition-focused public health campaigns in the United States and Canada have set the stage for collaborative pilot projects, while Latin American nations with staple-dependent diets are increasingly integrating nutrient-enriched cultivars to combat persistent micronutrient deficiencies.

Meanwhile, the Europe, Middle East & Africa region presents a mosaic of regulatory environments and nutritional imperatives. Within Europe, stringent safety standards accompany robust funding mechanisms for agricultural biotechnology research, which together foster a cautious yet progressive approach to biofortified crops. In contrast, Middle Eastern markets show growing interest in fortification solutions as governments seek to diversify food systems, whereas African nations face both urgent nutritional challenges and logistical hurdles. Capacity-building initiatives, public–private alliances, and community outreach programs are critical to overcoming infrastructure constraints and enhancing local breeding programs.

Across the Asia-Pacific region, burgeoning population populations and evolving consumer health priorities have accelerated demand for biofortified staples. Countries such as India and China, with extensive rice and wheat consumption, are prioritizing nutrient enhancement to address widespread vitamin and mineral deficiencies. Southeast Asian nations, meanwhile, are exploring both agronomic and genetic approaches to fortify root and tuber crops critical to regional diets. Policy frameworks that align agricultural innovation with public health objectives are emerging as key enablers of biofortification success, supported by increased investment in local research and development hubs.

Through these varied landscapes, the interplay of regulatory bodies, funding agencies, and consumer behavior continues to define the pace and scale at which biofortification initiatives take root, highlighting the importance of region-specific strategies for sustainable adoption and impact.

This comprehensive research report examines key regions that drive the evolution of the Biofortification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Landscape of Leading Innovators: Evaluating Collaboration Strategies Portfolio Diversification and Competitive Positioning among Key Biofortification Companies

A diverse ecosystem of industry players is driving innovation and competitive positioning within the biofortification sector. Leading agricultural biotechnology firms are leveraging advanced breeding platforms and gene-editing technologies to develop next-generation nutrient-dense cultivars. These organizations often engage in strategic collaborations with public research institutes and non-governmental organizations to validate efficacy, conduct field trials, and streamline regulatory approval processes.

Meanwhile, specialized seed companies are reinforcing their portfolios by incorporating biofortification traits into high-yielding, climate-resilient varieties. By integrating digital agronomy tools such as remote sensing and predictive analytics, these entities enhance precision in variety selection and performance monitoring, thereby increasing the success rate of biofortification adoption among growers.

Contract research organizations and feed producers also play integral roles by facilitating product development and bridging the gap between research breakthroughs and commercial application. These stakeholders support scale-up efforts, design formulation processes for animal feed and food products, and advise on best practices for nutrient retention through processing and storage.

Lastly, emerging agritech start-ups are introducing disruptive models that combine blockchain-based traceability with consumer engagement platforms, ensuring transparency across the supply chain and heightening consumer trust. Through targeted investments, mergers, and acquisitions, established players are integrating these novel technologies into their value chains, creating a dynamic landscape where collaboration and competition coexist to advance the frontiers of biofortification.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biofortification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgroBio Institute

- Arcadia Biosciences Inc.

- BASF SE

- Bayer CropScience AG

- Brightseed Bio Inc.

- Bunge Limited

- Cargill Incorporated

- Corteva Agriscience

- DSM-Firmenich AG

- FutureCeuticals Inc.

- General Mills Inc.

- Groupe Limagrain

- HarvestPlus

- Kellogg Company

- Maharashtra Hybrid Seeds Company Limited

- Nestlé S.A.

- NutriPosh

- PepsiCo Inc.

- Syngenta AG

- Unilever PLC

Actionable Strategic Imperatives: Guiding Industry Leaders to Strengthen Partnerships Optimize Processes and Foster Innovation for Accelerated Biofortification Impact

Industry leaders can capitalize on burgeoning opportunities by adopting a series of strategic imperatives that drive sustainable growth and impact. First, forging cross-sector partnerships that unite agricultural researchers, policy makers, and private sector innovators is essential to accelerate variety development and regulatory navigation. These alliances can pool resources, share risk, and disseminate best practices across geographies.

Second, organizations should invest in integrated digital tools for data collection and supply chain management to ensure real-time visibility of biofortified product performance. By harnessing precision agriculture technologies and blockchain traceability, stakeholders can optimize input use, reduce waste, and build consumer confidence through transparent labeling of nutritional attributes.

Third, maintaining robust stakeholder engagement through community outreach and capacity-building initiatives bolsters adoption at the farmer level. Providing training on agronomic practices, conducting nutrition education workshops, and establishing demonstration plots can significantly enhance farmer buy-in and accelerate dissemination of biofortified cultivars.

Finally, proactive policy engagement and advocacy are critical to securing favorable regulatory frameworks and trade agreements. By articulating the socioeconomic benefits of biofortification-such as reduced healthcare costs and enhanced workforce productivity-industry leaders can influence decision-makers to implement supportive tariff structures, subsidy programs, and public procurement policies that amplify the reach of nutrient-rich crops.

Rigorous Multidimensional Research Framework: Leveraging Primary Engagement Secondary Validation and Data Triangulation to Ensure High Quality Biofortification Insights

This market analysis integrates a rigorous research methodology that combines primary and secondary approaches to ensure comprehensive and accurate insights into the biofortification sector. Primary research involved in-depth interviews with a cross-section of stakeholders, including crop scientists, regulatory authorities, agronomists, feed producers, and policy specialists. These consultations provided nuanced perspectives on technological advancements, regulatory landscapes, and adoption challenges, contributing to the contextual richness of the findings.

Supplementing direct stakeholder engagement, secondary research encompassed a thorough review of academic literature, patent filings, government reports, and industry white papers. Such documentary sources offered historical context, validated emerging trends, and highlighted best-practice case studies in biofortification programs. Data triangulation across these diverse channels ensured consistency and reliability throughout the analysis.

Quantitative elements of the methodology included supply chain mapping, cost-component analysis, and benchmarking against traditional fortification and supplementation models. Although the focus remained on qualitative insights, these quantitative frameworks provided critical context for interpreting the economic and operational implications of various biofortification strategies.

Quality assurance protocols were embedded across all stages of research, involving cross-functional review sessions, data validation checks, and expert panel deliberations to minimize bias and enhance the reproducibility of key conclusions. This structured approach underpins the report’s credibility and equips stakeholders with a well-substantiated foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biofortification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biofortification Market, by Crop Type

- Biofortification Market, by Biofortification Method

- Biofortification Market, by Application

- Biofortification Market, by Distribution Channel

- Biofortification Market, by End User

- Biofortification Market, by Region

- Biofortification Market, by Group

- Biofortification Market, by Country

- United States Biofortification Market

- China Biofortification Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesis of Critical Insights: Reinforcing the Imperative for Collaborative Innovation and Policy Alignment to Advance Biofortification as a Cornerstone of Nutritional Security

Biofortification stands at the nexus of agricultural innovation and public health, offering a sustainable pathway to alleviate hidden hunger while bolstering food system resilience. Throughout this analysis, critical trends have emerged-ranging from technological leaps in genome editing to evolving policy landscapes and shifting consumer expectations. These developments underscore the sector’s potential to deliver scalable nutritional solutions without imposing significant changes on existing dietary patterns.

Key insights reveal that strategic alignment across research institutions, private enterprises, and policy makers is paramount for overcoming cost barriers, regulatory complexities, and infrastructural challenges. Market segmentation analysis highlights the importance of tailoring approaches for different crop types, methods, applications, distribution channels, and end users, ensuring that biofortification efforts resonate with diverse stakeholder groups.

Regional snapshots further demonstrate that the success of nutrient enrichment programs depends on localized strategies that reflect regulatory norms, agronomic conditions, and cultural contexts. Moreover, the cumulative impact of recent United States tariff revisions has illuminated the resilience of supply chains, prompting a shift toward regional collaboration and proactive policy advocacy.

Collectively, these multifaceted insights affirm that biofortification has matured into a robust intervention capable of driving meaningful, long-term improvements in global nutrition. By embracing collaborative innovation, adaptive strategies, and evidence-based advocacy, stakeholders can amplify the impact of biofortification and secure a healthier future for populations worldwide.

Empower Your Strategic Decisions Today: Secure Exclusive Biofortification Market Intelligence and Personalized Consultation with Associate Director of Sales and Marketing

To access comprehensive market data along with tailored strategic insights on biofortification, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By connecting with him, you can secure an in-depth market research report that empowers your organization with evidence-based decision-making, customized growth strategies, and actionable recommendations. Engage directly with an expert dedicated to helping you navigate emerging opportunities, stay ahead of policy shifts, and capitalize on transformative industry trends. Don’t wait to elevate your competitive advantage-contact Ketan today to unlock exclusive access to the definitive analysis that will shape your next strategic move in the biofortification arena.

- How big is the Biofortification Market?

- What is the Biofortification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?