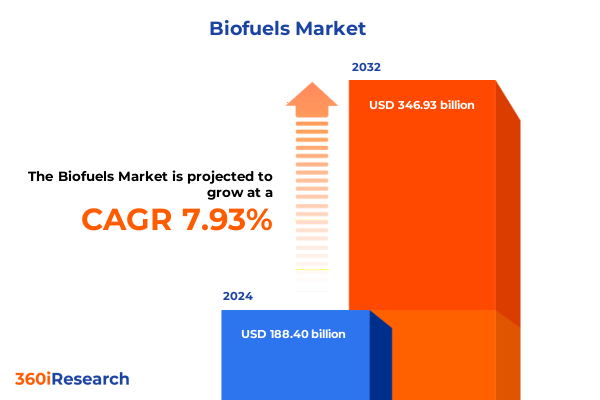

The Biofuels Market size was estimated at USD 148.83 billion in 2025 and expected to reach USD 160.11 billion in 2026, at a CAGR of 7.84% to reach USD 252.57 billion by 2032.

Unveiling the Dynamic Evolution of the Biofuels Industry and Its Pivotal Role in Advancing Global Sustainable Energy Markets and Ecosystems

Today’s energy paradigm increasingly recognizes biofuels as a cornerstone in the global trajectory toward lower carbon intensity transportation and industrial sectors. Emerging from early reliance on first-generation solutions like ethanol and biodiesel, the industry has matured into a diversified ecosystem that balances environmental stewardship with economic viability. Fueled by stringent emission reduction targets and mounting pressure on agribusiness value chains to adopt circular practices, biofuel producers are harnessing innovative feedstock strategies and optimized processing pathways to drive resilience and profitability.

Against this backdrop, the advent of advanced biofuels such as bio-Butanol and biohydrogen, coupled with evolving conversion techniques spanning fermentation, gasification, pyrolysis, and transesterification, underscores a pivotal shift toward next-generation sustainability benchmarks. Industry stakeholders are also exploring the promise of gaseous microbes, solid residues, and liquid intermediates to unlock further value within existing infrastructure. Meanwhile, the synergy between coarse grain, molasses, sugar crops, and emerging feedstocks like Jatropha reflects a deliberate push to reduce feedstock risk and improve supply chain agility.

This executive summary distills key trends, policy catalysts, and strategic imperatives that define the contemporary biofuels landscape. By examining the catalysts of transformation, the impact of trade dynamics, insights across critical segmentation frameworks, and actionable pathways for industry leadership, this document offers a coherent foundation for informed decision-making and long-term investment in sustainable energy markets.

Examining Key Macro and Technological Transformations Reshaping the Global Biofuels Landscape Toward Decarbonization and Energy Resilience

Global biofuels have entered an era defined by technology convergence and policy evolution. Legislative milestones such as the Inflation Reduction Act and updates to renewable fuel mandates have created a landscape that rewards lower carbon intensity production. At the same time, digitalization of supply chain management, real-time carbon tracking, and blockchain-enabled traceability are reshaping traditional value chains. Consequently, the industry is witnessing capital deployment in advanced refineries and decentralized bioprocessing hubs, forging a more distributed production footprint.

Technological breakthroughs in catalytic processes and genetic engineering are expanding the frontier of feedstock utilization. Innovations in enzyme optimization and pretreatment methods have reduced conversion costs for lignocellulosic materials, making cellulose-derived fuels increasingly competitive. Furthermore, the exploration of pyrolysis oils and syngas upgrading technologies is facilitating the emergence of biohydrogen as a viable low-carbon fuel, advancing both the industrial and transport sectors.

The integration of circular economy principles is also reshaping feedstock flows. Waste lipids, used cooking oil, and municipal solid waste streams are being repurposed to produce renewable diesel and biodiesel, advancing feedstock circularity while mitigating disposal challenges. These shifts are not merely incremental but transformative, as they broaden the scope of biofuel applications from residential heating to large-scale power generation and industrial processes. The cumulative effect of these macro and micro transitions underscores the sector’s capacity to pivot toward a more sustainable energy future.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Biofuel Supply Chains and Market Dynamics

On March 4, 2025, the United States implemented a 10% tariff on biofuel imports from Canada, marking the latest chapter in a series of trade measures aimed at bolstering domestic production. This levy has heightened feedstock costs for refineries relying on Canadian canola and biodiesel blends, exacerbating margin pressures throughout the value chain. In response, Canada has signaled potential retaliatory duties on U.S. biodiesel, heightening uncertainty for exporters on both sides of the border.

In parallel, analysis by Reuters indicates that unclear U.S. policy on green fuel subsidies and fears of expanding trade conflicts have contracted sector activity in North America. Producers in states such as Iowa and provinces in Canada have temporarily idled capacity amid pricing volatility and ambiguous subsidy frameworks.

However, a recent ruling by the U.S. Court of International Trade may recalibrate these dynamics. By striking down emergency tariffs enacted under economic emergency provisions, the court has opened the possibility for renewed imports of critical feedstocks such as used cooking oil and beef tallow that underpin renewable diesel processes. While the Trump administration has appealed this decision, the legal uncertainty underscores the volatility of trade policy as a focal point for industry planning and risk management.

Illuminating Critical Segment-Specific Opportunities Across Biofuel Types, Processes, Forms, Feedstocks, and Applications for Strategic Investment

In examining the diverse spectrum of biofuel types, it becomes evident that each category offers distinct pathways to carbon reduction. Traditional ethanol continues to command significant volumes, yet bio-Butanol has emerged as a high-energy alternative prized for compatibility with existing fuel infrastructure. Biodiesel, produced through the transesterification of lipids ranging from vegetable oil to animal fats, remains a mainstay, while biogas contributes to decarbonization efforts in power generation via anaerobic digestion. Meanwhile, the development of biohydrogen illustrates the sector’s push beyond liquid fuels into emerging clean energy vectors.

The spectrum of conversion technologies further delineates market opportunities. Fermentation platforms have matured for sugar and starch feedstocks, yet gasification and pyrolysis approaches are unlocking value from lignocellulosic biomass and municipal waste. Transesterification continues to optimize the transformation of triglyceride-rich inputs, but the integration of synergistic process configurations-combining catalytic upgrading with thermal depolymerization-has expanded the feasibility of multi-feedstock biorefineries. This technological plurality allows project developers to align processing routes with locally abundant resources.

Feedstock selection and product formulation underscore the intricate interplay between resource availability and end-use demands. From coarse grain inputs and sugar crops to emerging sources such as Jatropha and choice white grease, producers calibrate feedstock blends to balance cost and carbon performance. Gaseous and solid formulations support power plants and industrial heating, whereas liquid biofuels interface seamlessly with transportation and residential heating sectors. This confluence of feedstock versatility, form-factor differentiation, and application-specific targeting forms the backbone of strategic investment frameworks.

This comprehensive research report categorizes the Biofuels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Biofuel Type

- Feedstock Type

- Production Process

- Form

- Blend Level Type

- End-Use

- Distribution Channel

Revealing Strategic Regional Dynamics Shaping Biofuels Adoption and Infrastructure Development Across the Americas, EMEA, and Asia-Pacific

Across the Americas, the biofuels landscape is characterized by significant feedstock integration and policy support. The United States maintains robust capacity for biodiesel and renewable diesel production, leveraging domestic soybean oil, used cooking oil, and animal fats. Canada’s abundant canola resources have underpinned a growing renewable diesel cluster, while Brazil’s ethanol sector continues to benefit from sugarcane efficiencies and favorable land use dynamics. Together, these markets exemplify regional leadership in both first and second-generation biofuel deployment.

In Europe, Middle East & Africa, regulatory mandates such as the Renewable Energy Directive II have accelerated adoption of advanced biofuels, especially in the transport sector. European producers are increasingly sourcing feedstocks from waste and residue streams, while the Middle East explores biohydrogen ventures aligned with broader decarbonization goals tied to hydrogen economies. African initiatives, although nascent, are capitalizing on lignocellulosic biomass and Jatropha cultivation to address energy access challenges and rural development objectives.

The Asia-Pacific region is experiencing rapid growth driven by energy security imperatives and urbanization trends. Countries like China and India are scaling up bioethanol blending programs and incentivizing domestic biodiesel capacity through targeted subsidies. Southeast Asian nations leverage palm oil residues to produce renewable diesel, while Australia and New Zealand focus on waste-to-energy pathways. This region’s strategic emphasis on feedstock circularity and local processing capabilities signals a shift toward integrated biofuel ecosystems poised for expansion.

This comprehensive research report examines key regions that drive the evolution of the Biofuels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Biofuel Industry Players and Their Strategic Innovations Driving Competitive Advantage and Market Expansion

Leading producers in the biofuels sector are deploying differentiated strategies to capture value across the value chain. Neste, for instance, has solidified its position through investments in hydrotreated vegetable oil (HVO) production, expanding capacity in Europe and Asia-Pacific to meet rising renewable diesel demand. Renewable Energy Group (REG) operates a network of biorefineries in North America, leveraging proprietary technology to optimize feedstock flexibility and carbon intensity metrics.

Global agribusiness conglomerates also play a pivotal role; Archer Daniels Midland (ADM) and Valero are integrating biofuel operations into existing refining portfolios, enabling economies of scale and streamlined logistics. Meanwhile, innovators such as Enerkem and LanzaTech are pioneering gasification and microbial fermentation routes, respectively, advancing the commercial readiness of cellulosic ethanol and renewable chemicals. These emerging players are forging partnerships with traditional energy companies to accelerate deployment of advanced biofuels.

Strategic collaboration extends beyond production to feedstock sourcing and distribution. Companies like Wilmar and Cargill are enhancing traceability frameworks and investing in supply chain decarbonization, while joint ventures between oil majors and technology firms are focusing on biohydrogen and e-fuels. Collectively, these corporate initiatives underscore a dynamic ecosystem in which scale, technology differentiation, and value chain integration define competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biofuels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Neste Oyj

- Valero Energy Corporation

- Archer-Daniels-Midland Company

- Shell PLC

- TotalEnergies SE

- Verbio SE

- Cargill, Incorporated

- Green Plains Inc.

- Chevron Corporation

- BP PLC

- Exxon Mobil Corporation

- Gevo, Inc.

- Praj Industries Limited

- Borregaard AS

- Aemetis, Inc.

- Air Liquide S.A.

- Alto Ingredients, Inc.

- Bangchak Corporation Public Company Limited

- Cosan S.A.

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Enerkem Inc.

- FutureFuel Corp.

- GE Aerospace

- Indian Oil Corporation Limited

- Münzer Bioindustrie GmbH

- POET, LLC

- Shree Renuka Sugars Ltd.

- St1 Biokraft AB

- Sunoil Bio Fuels B.V.

- Swedish Biofuels AB

- Tidewater Renewables Ltd.

- Verde Clean Fuels, Inc.

- Woodland Biofuels Inc.

Formulating Targeted Action Plans to Enhance Biofuel Competitiveness, Build Resilience, and Navigate Policy and Market Uncertainties

Industry leaders should prioritize proactive engagement with policymakers to shape regulatory frameworks that incentivize low-carbon intensity production. Establishing clear guidance on subsidy mechanisms and sustainable feedstock criteria will reduce investment risk and facilitate capacity expansion. Engaging in multi-stakeholder forums and public–private partnerships can also foster alignment on carbon accounting standards and accelerate the implementation of credit systems tied to lifecycle emissions.

Operationally, adopting diversified feedstock sourcing strategies is essential to mitigate supply volatility and price fluctuations. Investing in advanced analytics for feedstock yield optimization and real-time market intelligence can enable companies to pivot between coarse grains, waste lipids, and energy crops based on regional availability. Furthermore, integrating digital supply chain tools enhances traceability and supports premium pricing for verified low-carbon products.

From a technological perspective, channeling resources into the scale-up of emerging pathways such as pyrolysis-derived bio-oils and microbial biohydrogen will unlock new revenue streams. Forming strategic alliances with technology pioneers and academic institutions can catalyze innovation while sharing development risks. Additionally, exploring cross-border joint ventures can spread geographic risk and tap into emerging markets, ensuring resilience in the face of evolving trade policies.

Detailing Rigorous Research Methodologies and Data Validation Techniques Underpinning the Biofuels Market Analysis Integrity and Reliability

The research underpinning this analysis integrates both primary and secondary sources to ensure robustness and validity. Secondary data was collected from publicly available industry reports, government policy releases, trade association publications, and peer-reviewed journals. These sources provided a comprehensive view of regulatory developments, feedstock trends, and technological advancements across key markets.

Primary research consisted of in-depth interviews with senior executives, technical leads, and policy advisors within the biofuels sector. These discussions offered nuanced perspectives on supply chain constraints, investment priorities, and emerging business models. Interviews were conducted across a representative sample of stakeholders, including producers, feedstock suppliers, end-users, and technology licensors, to capture diverse viewpoints.

Quantitative data underwent rigorous validation through triangulation methods, comparing trade flow statistics with survey findings and financial disclosures. Qualitative insights were cross-verified against independent expert commentary and case studies of pioneering biorefineries. This multi-dimensional methodology ensures that the conclusions and recommendations presented herein rest on a solid evidence base and reflect current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biofuels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biofuels Market, by Biofuel Type

- Biofuels Market, by Feedstock Type

- Biofuels Market, by Production Process

- Biofuels Market, by Form

- Biofuels Market, by Blend Level Type

- Biofuels Market, by End-Use

- Biofuels Market, by Distribution Channel

- Biofuels Market, by Region

- Biofuels Market, by Group

- Biofuels Market, by Country

- United States Biofuels Market

- China Biofuels Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Concluding Key Insights and Synthesizing Strategic Implications for Stakeholders to Propel the Biofuels Industry Toward Sustainable Growth

As the global pivot toward sustainable energy intensifies, biofuels stand out as a versatile solution capable of delivering decarbonization across multiple sectors. The confluence of policy support, technological innovation, and strategic corporate initiatives is catalyzing a new phase of industry maturation. Yet, stakeholders must remain vigilant to evolving trade policies and shifting feedstock dynamics that can quickly reshape economic viability.

By synthesizing insights across segmentation, regional dynamics, and corporate strategies, this summary offers a coherent view of both opportunities and challenges. It underscores the imperative for collaboration across the value chain-from farmers and feedstock aggregators to refinery operators and end users-to unlock the full potential of biofuels in advancing global climate objectives.

Ultimately, sustained growth in the biofuels market will hinge on the ability of industry players to adapt swiftly, invest judiciously, and forge partnerships that drive down carbon intensity while ensuring supply chain resilience.

Take the Next Step to Secure Your Comprehensive Biofuels Market Research Insights by Connecting with Ketan Rohom for Tailored Guidance

Empower your strategic vision with a comprehensive biofuels market research report tailored to today’s dynamic environment. To access in-depth analysis, proprietary insights, and customized guidance, connect with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through key findings and support your decision-making process to capitalize on emerging biofuel opportunities.

Reach out to Ketan Rohom to secure your copy of the full report and ensure your organization is positioned at the forefront of sustainable energy innovation.

- How big is the Biofuels Market?

- What is the Biofuels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?