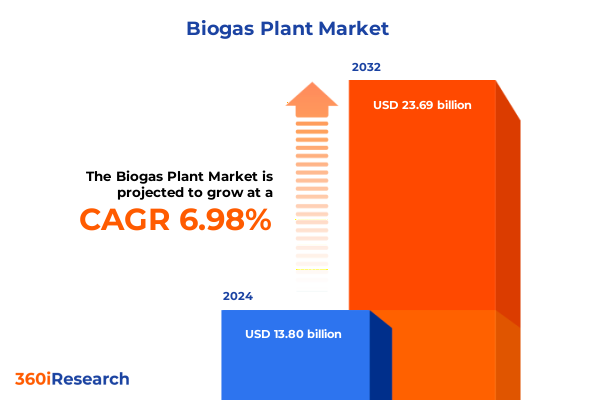

The Biogas Plant Market size was estimated at USD 14.71 billion in 2025 and expected to reach USD 15.69 billion in 2026, at a CAGR of 7.04% to reach USD 23.69 billion by 2032.

Unveiling the Dynamic Trajectory of the Global Biogas Plant Market Amid Energy Transition Imperatives and Sustainability Priorities

The biogas plant industry is at a pivotal moment as global energy priorities shift toward sustainability, circular economy principles, and decentralized power generation. Rising commitments to carbon neutrality, coupled with increasing governmental incentives for renewable energy, are propelling biogas technologies into the mainstream. This executive summary distills the critical market dynamics expected to shape project development, investment flows, and technological innovation across the value chain.

In this context, biogas emerges as a versatile solution capable of converting diverse organic residues into renewable fuel, fertilizer, and heat. As traditional energy sources face volatility and environmental scrutiny, biogas offers predictable feedstock availability derived from agricultural operations, industrial processes, and municipal waste streams. Consequently, stakeholders from equipment manufacturers to end-users are aligning their strategies to leverage biogas’s potential for on-site energy resilience and waste reduction.

This introduction sets the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, and competitive landscapes. By examining these facets, decision makers can navigate regulatory complexities, optimize capital allocation, and identify collaboration opportunities that will drive the next wave of biogas plant deployments worldwide.

Revolutionary Technological and Policy Shifts Reshaping Biogas Plant Development and Operational Paradigms Across the Value Chain

Recent years have witnessed a convergence of technological breakthroughs and policy reforms that are redefining how biogas plants are designed, operated, and integrated. Advanced membrane separation systems now enable higher methane yields and reduced energy consumption, while digital monitoring platforms facilitate predictive maintenance and real-time optimization. These innovations are not occurring in isolation but are being rapidly adopted through strategic partnerships between technology providers and waste management firms.

At the policy level, governments across Europe and Asia have introduced feed-in tariffs, carbon credit mechanisms, and circular economy regulations that incentivize the capture and utilization of organic waste. These regulations are stimulating projects focused on agricultural waste valorization and municipal solid waste treatment, effectively turning liabilities into revenue streams. Moreover, the integration of biogas with existing energy infrastructure-such as co-digestion facilities adjacent to wastewater treatment plants-exemplifies the shift toward holistic resource management.

Collectively, these technological and regulatory shifts are transforming biogas from a niche renewable resource into a core component of diversified energy portfolios. This section highlights how emerging digital tools, policy frameworks, and collaborative business models are converging to accelerate plant efficiency, reduce operational risk, and create new value propositions for investors and operators alike.

Analyzing the Cumulative Impact of United States 2025 Tariff Policies on Biogas Plant Supply Chains Costs and Investment Dynamics

The introduction of new United States tariffs in 2025 has created a complex landscape for biogas plant developers and equipment suppliers. Steel and specialized components imported from key manufacturing hubs now incur additional duties, directly influencing the capital expenditure profiles of new installations. As a result, project budgets must account for higher procurement costs and potential lead-time extensions, compelling stakeholders to reassess supply chain configurations.

Beyond immediate cost implications, the tariff environment is driving a reassessment of domestic manufacturing capabilities. Several equipment providers are exploring localized production partnerships to mitigate exposure to import surcharges. At the same time, project developers are evaluating alternative digester designs that rely on locally sourced materials and modular construction methodologies. These adaptive strategies aim to minimize tariff impact while preserving economic viability.

Furthermore, the uncertainty surrounding future tariff adjustments underscores the importance of proactive risk management. Forward procurement planning, diversified supplier portfolios, and contractual clauses that hedge against duty fluctuations have become critical components of project financing negotiations. Collectively, these measures are reshaping how investors and operators approach biogas plant supply chains, ensuring resilience amid a dynamically evolving trade policy landscape.

Uncovering Actionable Segmentation Insights to Navigate Feedstock Types Digester Technologies Capacities and Application Domains for Biogas Success

Understanding the biogas plant market requires a nuanced appreciation of how feedstock sources, digester technologies, capacity classes, and end-use applications interplay to define project viability and performance. Feedstock diversity spans agricultural waste, animal manure, energy crops, food and beverage waste, industrial waste, and municipal solid waste, with energy crops further segmented into maize, sugar beet, and wheat varieties that offer varying yields and nutrient profiles. Each feedstock category commands specific pretreatment needs and operational parameters, influencing digester configuration and gas output.

Digester technologies bifurcate into dry anaerobic digestion, optimized for high-solids substrates and minimal water usage, and wet anaerobic digestion, which accommodates slurries and high-moisture feedstocks. The choice between these approaches drives both CapEx intensity and operational complexity. Capacity segmentation distinguishes large scale facilities above 5 MW, medium scale operations ranging from 1 MW to 5 MW, and small scale units up to 1 MW, each tailored to distinct investment thresholds, grid interconnection requirements, and community energy demands.

Finally, end-use applications encompass agriculture, where digestate returns improve soil health; energy production, supporting on-site power and heat generation or pipeline injection; and waste & wastewater treatment, where biogas facilities reduce treatment costs and emissions. A comprehensive segmentation framework reveals critical pathways for project developers and policy makers to align technological choices with environmental objectives and revenue models.

This comprehensive research report categorizes the Biogas Plant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock

- Digester Type

- Capacity

- Plant Type

- Application

- End-User

Exploring Critical Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific Driving Biogas Plant Market Expansion and Collaboration

Regional dynamics exert a profound influence on the adoption and deployment of biogas plants, with each geography presenting distinct policy environments, resource endowments, and infrastructure maturity. In the Americas, supportive renewable portfolio standards and state-level incentives in North America are driving investment in agricultural waste digesters and landfill gas recovery projects. Latin American markets are witnessing the emergence of small-scale community digesters addressing rural energy access and organic waste management.

Across Europe, the Middle East and Africa, the European Union’s Green Deal and circular economy agenda are fueling large-scale projects that integrate industrial waste treatment with energy generation. Meanwhile, Middle Eastern countries are exploring biogas to diversify energy mixes away from hydrocarbons, focusing on food waste valorization. In parts of Africa, donor-funded biogas initiatives are advancing rural sanitation and greenhouse gas mitigation in agrarian communities.

The Asia-Pacific region remains the fastest-growing arena, propelled by substantial agricultural residues, rapidly urbanizing cities generating municipal solid waste, and policy mandates on renewable energy quotas. China and India lead capacity expansions through co-digestion facilities at wastewater treatment plants, while Southeast Asian nations emphasize decentralized systems to support off-grid rural electrification. Together, these regional insights illuminate tailored strategies for technology adoption, financing models, and stakeholder collaboration.

This comprehensive research report examines key regions that drive the evolution of the Biogas Plant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Shaping Innovation Partnerships and Competitive Strategies in the Global Biogas Plant Value Chain

The competitive landscape of the biogas plant sector is characterized by a spectrum of specialized equipment manufacturers, system integrators, technology innovators, and service providers. Leading digester OEMs are differentiating through modular designs, advanced mixing systems, and digital automation platforms that enhance performance predictability. At the same time, engineering consultancies are forging partnerships with waste management firms to deliver turnkey solutions encompassing feedstock logistics, plant construction, and O&M services.

Innovation is equally driven by research institutions collaborating with industry to develop next-generation microbial consortia and process intensification techniques that boost gas yields. Strategic alliances between energy companies and agricultural cooperatives are facilitating feedstock supply agreements, while utilities are engaging in joint ventures to leverage existing grid infrastructure and biomethane injection capabilities. Additionally, specialized EPC firms are capitalizing on regional policies by offering EPCM services that streamline project delivery across multiple geographies.

This dynamic ecosystem of companies underscores the importance of collaboration, intellectual property development, and customer-centric offerings. Organizations that excel in integrating technology proficiency with domain expertise are poised to capture premium value and establish long-term market leadership in the global biogas plant industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biogas Plant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Holding SpA

- Agrinz Technologies GmbH

- Air Liquide S.A.

- Ameresco Inc.

- BioConstruct GmbH

- Biofrigas Sweden AB

- Bosch Industriekessel GmbH

- Carbotech Gas Systems GmbH

- Engie S.A.

- EnviTec Biogas AG

- Future Biogas Ltd.

- Hitachi Zosen Inova AG

- Mitsui E&S Engineering Co., Ltd.

- PlanET Biogas Group GmbH

- Qingdao Green Land Environment Equipment Co., Ltd.

- Scandinavian Biogas

- Shandong Tianmu Environment Engineering Co., Ltd.

- Toyo Engineering Corporation

- Vaisala Group

- Veolia Environnement S.A.

- WELTEC BIOPOWER GmbH

- Wärtsilä Oyj Abp

Strategic Actionable Recommendations for Industry Leaders to Accelerate Deployment Optimize Operations and Secure Sustainable Growth in the Biogas Sector

Industry leaders can adopt a series of strategic actions to strengthen their market position and accelerate project deployment. First, forging cross-sector partnerships between feedstock suppliers, technology providers, and offtakers will ensure steady resource streams, optimized system design, and reliable revenue channels. Such collaborations reduce risk and enable joint value creation across the value chain. Second, investing in digitalization-through remote monitoring, predictive analytics, and process control solutions-will lower operational uncertainties, enhance uptime, and facilitate performance benchmarking.

Third, pursuing modular and standardized plant architectures can significantly compress delivery timelines and lower capital requirements, making biogas projects more accessible to smaller investors and community stakeholders. Fourth, active engagement with policy makers and industry associations will enable companies to influence incentive mechanisms, secure grant funding, and navigate regulatory approvals more efficiently. Fifth, prioritizing sustainability credentials-such as low-carbon certifications and circular economy certifications-will strengthen project bankability and align with corporate ESG commitments.

By executing these recommendations, industry leaders will not only optimize cost structures and operational resilience but also position themselves at the forefront of a rapidly evolving renewable energy landscape. These actionable measures provide a clear roadmap to translate emerging opportunities into tangible growth outcomes.

Transparency in Research Methodology Detailing Rigorous Data Collection Analytical Frameworks and Validation Processes Underpinning Market Insights

This research relied on a rigorous methodology combining primary interviews with executives, project developers, and technology providers alongside comprehensive secondary data analysis. Primary inputs were obtained through structured discussions with stakeholders spanning equipment OEMs, waste management firms, agribusinesses, and utilities to capture real-time perspectives on market drivers, technology adoption, and investment barriers. These insights were carefully triangulated with data extracted from government policy documents, industry association reports, and company filings.

Secondary research included a systematic review of academic publications, patent databases, and conference proceedings to identify technological advancements in anaerobic digestion processes. Global and regional policy frameworks were mapped to track incentive schemes, tariff structures, and environmental regulations. Quantitative data sets on feedstock availability, digester capacity installations, and energy pricing were sourced from public utility reports and international energy agencies, and were cross-validated for consistency.

The analytical framework integrated SWOT analysis to assess strengths, weaknesses, opportunities, and threats, and used scenario planning to model tariff impact sensitivity. Quality control was maintained through peer reviews and validation workshops with industry experts, ensuring the robustness and reliability of the findings. This multi-pronged approach underpins the credibility of the insights presented within this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biogas Plant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biogas Plant Market, by Feedstock

- Biogas Plant Market, by Digester Type

- Biogas Plant Market, by Capacity

- Biogas Plant Market, by Plant Type

- Biogas Plant Market, by Application

- Biogas Plant Market, by End-User

- Biogas Plant Market, by Region

- Biogas Plant Market, by Group

- Biogas Plant Market, by Country

- United States Biogas Plant Market

- China Biogas Plant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Path Forward for Biogas Plant Market Evolution and Sustainable Integration into Global Energy Ecosystems

As the global energy landscape shifts toward decarbonization and resource circularity, biogas plants are set to play a central role in transforming waste streams into renewable energy and value-added byproducts. The convergence of policy support, technological maturation, and collaborative business models will continue to propel capacity expansions across feedstock types and geographies. Looking ahead, the integration of biogas facilities with emerging hydrogen production, carbon capture, and grid balancing solutions will unlock additional revenue streams and environmental benefits.

Maintaining momentum requires a sustained focus on innovation, stakeholder engagement, and risk management. Organizations that invest in modular designs, digital solutions, and strategic alliances will be best positioned to navigate tariff uncertainties, feedstock variability, and regulatory shifts. Moreover, leveraging insights from regional pilot projects and scaling proven business models can accelerate deployment timelines and enhance project bankability.

Ultimately, the success of the biogas plant market will hinge on its ability to deliver competitive returns while contributing to sustainable development objectives. By embracing the actionable recommendations outlined in this report and continuously refining technology and policy strategies, stakeholders can chart a course toward a resilient, low-carbon energy future underpinned by biogas innovation.

Engage with Ketan Rohom Today to Unlock Exclusive Market Intelligence Propel Strategic Biogas Plant Investments and Secure a Competitive Edge

The market research report represents a comprehensive intelligence asset designed to guide strategic decision-making and drive sustainable growth in the biogas plant sector. To access the full insights encompassing detailed segmentation analysis, regional dynamics, tariff impact assessments, and competitive benchmarking, stakeholders are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will ensure you receive a tailored overview of how this research aligns with your investment objectives, operational priorities, and innovation roadmaps.

By connecting with Ketan Rohom, organizations will unlock an exclusive suite of insights that includes deep dives into feedstock trends, digester technology advancements, capacity utilization patterns, and application-specific opportunities. You will also gain clarity on navigating the 2025 United States tariff landscape as it pertains to equipment procurement and supply chain resilience. This dialogue will enable you to formulate data-driven strategies, identify partnership ecosystems, and accelerate project deployment.

Secure your copy of the market intelligence report today and gain the competitive edge necessary to capitalize on emerging opportunities within the global biogas plant market. Reach out to Ketan Rohom to arrange a personalized consultation and obtain licensing details, custom research briefs, and premium advisory support.

- How big is the Biogas Plant Market?

- What is the Biogas Plant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?