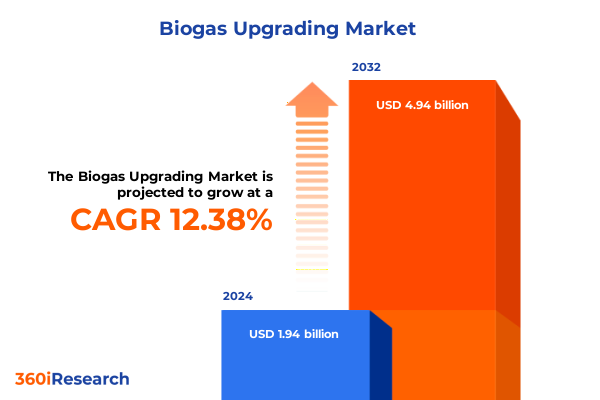

The Biogas Upgrading Market size was estimated at USD 3.36 billion in 2025 and expected to reach USD 3.74 billion in 2026, at a CAGR of 11.56% to reach USD 7.23 billion by 2032.

Charting the Path for a Sustainable Energy Future by Leveraging Cutting-Edge Biogas Upgrading and Renewable Natural Gas Solutions

Biogas upgrading has emerged as a pivotal driver in the global energy transition, transforming organic waste streams into high-purity methane that seamlessly integrates with existing gas networks. As countries pursue ambitious decarbonization targets, renewable natural gas has gained traction across sectors ranging from power generation to heavy-duty transportation. This shift leverages mature anaerobic digestion processes, where feedstocks such as agricultural residues, municipal waste, and animal manure are harnessed to produce biogas. By removing carbon dioxide and impurities, upgraded biogas achieves methane concentrations comparable to fossil natural gas, enabling direct deployment in conventional infrastructure and end-use appliances.

The strategic appeal of biogas upgrading extends beyond greenhouse gas reductions. It enhances energy security by localizing fuel production, mitigates waste disposal challenges, and supports rural economies through distributed generation. Moreover, the integration of upgrading technologies such as membrane separation, pressure swing adsorption, and chemical scrubbing aligns with broader circular economy principles. As renewable natural gas (RNG) adoption accelerates, stakeholders across the value chain-from feedstock suppliers to equipment manufacturers-are charting new collaborative models to scale capacity and optimize operations. This introduction sets the stage for a detailed exploration of the transformative market trends, policy dynamics, and technological advancements shaping the biogas upgrading landscape.

Unleashing the Transformative Effect of Policy Momentum, Technological Breakthroughs, and Digitalization in Biogas Upgrading

The biogas upgrading landscape has been reshaped by an unprecedented convergence of supportive policies, technological breakthroughs, and the digital revolution. Governments worldwide have introduced tailored incentives, carbon intensity standards, and grid-injection mandates to accelerate renewable natural gas deployment. Since 2020, over fifty distinct policies have been articulated, reinforcing the role of upgraded biogases as a low-emissions substitute for conventional gas. Concurrently, advancements in adsorbents, membranes, and cryogenic systems have driven down operational complexity and energy consumption, positioning modern upgrading plants as both efficient and cost-competitive alternatives.

In parallel, digitalization has emerged as a transformative catalyst. The deployment of IoT sensors, AI-driven process optimization, and remote monitoring platforms now enables real-time performance analytics, predictive maintenance, and dynamic control of gas separation parameters. These innovations not only maximize methane recovery but also ensure compliance with evolving environmental standards. Containerized, modular systems incorporating smart controls are unlocking new opportunities in decentralized settings, from rural agricultural sites to urban wastewater treatment centers. Altogether, these transformative shifts are converging to unlock scalable, resilient pathways for biogas upgrading, setting the stage for robust market expansion.

Evaluating the Cumulative Burden of 2025 U.S. Tariff Measures on Biogas Upgrading Equipment Costs and Project Viability

Throughout 2025, U.S. tariff policies have exerted substantial pressure on the biogas upgrading sector, increasing the cost of imported modules and key components. Average applied tariffs peaked at roughly 27% before moderating to 15.8% by mid-year, marking the highest levels in over a century. These elevated duties have particularly affected spiral-wound and hollow-fiber membranes, high-specification valves, and precision housing materials-critical inputs for membrane separation, cryogenic, and pressure swing adsorption systems.

Sector-specific exemptions and temporary relief have provided limited reprieve, but the net effect remains a significant uptick in capital expenditures for new projects. Equipment manufacturers and project developers face compressed margins as increased procurement costs are passed through or absorbed internally. Domestic production has gained momentum as a risk-mitigation strategy, yet challenges such as skilled labor shortages and higher compliance burdens persist. As a result, stakeholders are re-evaluating project timelines and financial models, while also seeking alternative supply chains and localization strategies to shield operations from future tariff volatility.

Unearthing Market Potential Through In-Depth Analyses of Capacity, Technology, Feedstock, and Application Segmentation

Insights derived from capacity segmentation reveal distinct investment dynamics across small-scale, medium-scale, and large-scale facilities. Small-scale systems, typically generating below one megawatt, are predominantly deployed in rural or off-grid contexts, offering rapid payback through reduced waste management costs. Medium-scale plants in the one to two megawatt range bridge community-level waste processing with local grid injection, balancing economies of scale against capital intensity. Conversely, large-scale facilities, spanning two to five megawatts and beyond five megawatts, harness bulk feedstock supplies to supply utility and industrial offtake agreements, benefitting from optimized energy yields and downstream integration opportunities.

Technology segmentation underscores the evolution of upgrading processes. Chemical scrubbing platforms, encompassing both amine and non-amine formulations, deliver precise CO₂ capture for high-purity outputs in applications such as vehicle fuel. Cryogenic separation and water scrubbing maintain relevance for large throughput projects, while pressure swing adsorption and advanced membrane modules-featuring inorganic and polymeric membranes-enable modular, energy-efficient solutions. Feedstock segmentation further highlights the importance of raw material diversity: agricultural residues, including crop residue and lignocellulosic biomass, complement animal waste streams like bovine, swine, and poultry manure, as well as municipal organics such as sewage sludge and landfill fractions. Application segmentation reveals differentiated end-use drivers, from industrial chemical and fertilizer production to distributed power generation, residential heating, and the burgeoning transport sector encompassing buses, trucks, and passenger vehicles.

This comprehensive research report categorizes the Biogas Upgrading market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Solutions

- Services

- Feedstock

- Plant Capacity

- End Use Application

Illuminating Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific Biogas Upgrading Markets

Regional insights illuminate how local policy frameworks, resource endowments, and infrastructure maturity shape biogas upgrading trajectories. In the Americas, particularly the United States and Canada, robust incentives under low-carbon fuel standards and extended tax credits have catalyzed a wave of renewable natural gas projects. This has spurred investment in modular upgrading units tailored for landfill gas and dairy waste applications, reinforcing North America’s leadership in distributed RNG production.

Europe, Middle East & Africa present a composite picture. Established markets such as Germany and Denmark leverage Guarantee of Origin schemes to drive biomethane trade, while emerging regions in EMEA grapple with nascent infrastructure and variable policy landscapes. The European Union’s RED II directives and methane management guidelines provide strategic clarity, yet national registries and cross-border trading arrangements remain in early stages of adoption.

In Asia-Pacific, rapid urbanization and growing energy demand underpin a surge in waste-to-energy initiatives. Countries like China, India, and South Korea are integrating biogas upgrading into broader renewable energy plans, often in tandem with wastewater treatment and agricultural modernization programs. Infrastructure constraints and feedstock logistics pose challenges, but scalable digital solutions and international collaborations are accelerating technology transfer and capacity building.

This comprehensive research report examines key regions that drive the evolution of the Biogas Upgrading market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Biogas Upgrading Providers and Their Strategies to Advance Renewable Natural Gas Deployment

Leading providers are deploying differentiated strategies to capture the expanding biogas upgrading opportunity. Greenlane Renewables and Xebec Adsorption continue to diversify their technology portfolios, blending pressure swing adsorption with membrane hybrids and digital controls to deliver energy-efficient, high-recovery solutions. Collectively, these companies have installed hundreds of upgrading units globally, achieving methane purities above 99.5% and demonstrating the scalability of modular platforms.

Established industrial gas majors, including Air Liquide, Linde, and Evonik, are leveraging cryogenic and advanced membrane technologies to pursue large-scale biomethane liquefaction and grid injection projects. Strategic partnerships with utilities, waste management firms, and technology start-ups are fostering integrated service models that encompass feedstock sourcing, upgrading, and downstream offtake. These collaborations underscore an evolving competitive dynamic, where lifecycle support, digital analytics, and sustainability credentials increasingly differentiate market leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biogas Upgrading market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Wärtsilä Corporation

- Pentair PLC

- EnviTec Biogas AG

- Vaisala Oyj

- Greenlane Renewables Inc.

- Ammongas A/S by European Energy A/S

- AB Holdings SpA

- Kanadevia Inova Group

- Morrow Renewables LLC

- PRODEVAL SAS

- Suomen Biovoima Oy

- CarboTech AC GmbH

- DMT Environmental Technology

- ETW Energietechnik GmbH

- Waga Energy SA

- MalmbergGruppen AB

- Clarke Energy by Kohler Co.

- Atmos Power Pvt. Ltd.

- QED Environmental Systems Ltd.

- Adicomp S.p.A

- Bright Renewables B.V.

- Condorchem Enviro Solutions by Eco-Techno Srl

- EcoVapor Recovery Systems by DNOW Company

- Ennox Biogas Technology GmbH

- Future Biogas Limited

- HAASE Environmental Technology GmbH

- Ivys Adsorption Inc.

- Mahler AGS GmbH

- NeoZeo AB

- PlanET Biogastechnik GmbH

Strategic Pathways and Proactive Measures to Accelerate Growth and Competitiveness in Biogas Upgrading Markets

Industry leaders should prioritize the integration of advanced digital platforms to optimize process performance and minimize operational downtime. Investing in IoT-enabled sensors and AI-driven analytics can unlock incremental gains in methane recovery while ensuring proactive maintenance across diverse upgrading installations.

Cultivating feedstock diversification strategies is essential to de-risk supply chains and enhance project resilience. By developing partnerships across agricultural cooperatives, municipal waste authorities, and livestock operations, firms can secure stable feedstock volumes and capitalize on waste management synergies.

Embracing strategic alliances and joint ventures with equipment manufacturers, utilities, and technology innovators will enable the pooling of capital and expertise. These collaborations can expedite project timelines, facilitate knowledge transfer, and unlock new market segments-particularly in emerging economies with high untapped potential.

Engaging proactively with policymakers and regulatory bodies to shape supportive frameworks will be critical. Advocating for transparent methane measurement protocols, incentive harmonization, and cross-border trade agreements can strengthen the economics of renewable natural gas and foster a stable investment climate.

Ensuring Robust Insights Through Comprehensive Research Methodology Combining Primary, Secondary, and Data Triangulation Approaches

This analysis is grounded in a robust research methodology combining primary and secondary data sources. Extensive secondary research included review of policy documents, technology white papers, and industry reports to map global trends in biogas upgrading processes and regulatory landscapes.

To validate and enrich findings, targeted primary interviews were conducted with equipment OEMs, project developers, feedstock suppliers, and end users. These discussions provided firsthand insights into operational challenges, technology adoption drivers, and investment considerations. Quantitative and qualitative data were triangulated to ensure comprehensive coverage and analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biogas Upgrading market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biogas Upgrading Market, by Technology

- Biogas Upgrading Market, by Solutions

- Biogas Upgrading Market, by Services

- Biogas Upgrading Market, by Feedstock

- Biogas Upgrading Market, by Plant Capacity

- Biogas Upgrading Market, by End Use Application

- Biogas Upgrading Market, by Region

- Biogas Upgrading Market, by Group

- Biogas Upgrading Market, by Country

- United States Biogas Upgrading Market

- China Biogas Upgrading Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Consolidating the Imperative for Biogas Upgrading as a Cornerstone of the Low-Carbon Energy Transition and Circular Economy

Biogas upgrading stands at the forefront of sustainable energy solutions, bridging waste management imperatives with decarbonization objectives. As technological advancements and policy frameworks converge, renewable natural gas is poised to play an increasingly prominent role in global energy portfolios, offering low-carbon alternatives for electricity, heat, and transport.

Realizing the full potential of biogas upgrading demands continued innovation, strategic partnerships, and conducive policy environments. Stakeholders who align operational excellence with feedstock security and digital optimization will be best positioned to capitalize on emerging market opportunities and drive the next wave of renewable gas deployment.

Secure Your Comprehensive Biogas Upgrading Market Research Report with Ketan Rohom to Empower Data-Driven Strategic Decisions

To acquire the comprehensive market research report, please connect with Ketan Rohom, Associate Director, Sales & Marketing, through our professional inquiry channels to ensure timely access to the strategic insights necessary for informed decision-making.

- How big is the Biogas Upgrading Market?

- What is the Biogas Upgrading Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?