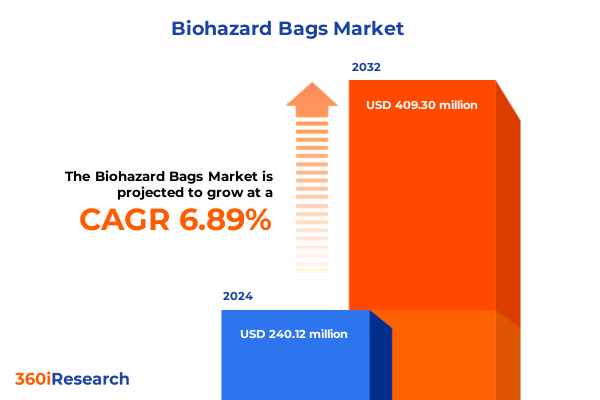

The Biohazard Bags Market size was estimated at USD 256.55 million in 2025 and expected to reach USD 279.08 million in 2026, at a CAGR of 6.90% to reach USD 409.30 million by 2032.

Establishing the Strategic Foundation for a Comprehensive Biohazard Bag Market Analysis Emphasizing Purpose, Scope, and Value-Driven Insights

The biohazard bag market sits at the intersection of healthcare safety, regulatory compliance, and environmental responsibility. As healthcare systems worldwide intensify efforts to prevent contamination and pathogen transmission, the demand for robust waste containment solutions has surged. The purpose of this analysis is to present a clear understanding of market drivers, challenges, and emerging opportunities that shape the strategic landscape for manufacturers, distributors, and end users. By establishing a solid foundation of purpose and scope, stakeholders can align their product development, investment, and go-to-market strategies with evolving industry requirements.

Drawing on a comprehensive review of industry developments, this report synthesizes key themes including transformative shifts in material technologies, the cumulative impact of recent United States tariff measures, and nuanced segmentation dynamics. Readers will gain holistic visibility into regional growth patterns, competitive intensity among leading suppliers, and actionable recommendations designed to bolster operational resilience. Ultimately, this introductory section sets the stage for a detailed exploration of how safety, sustainability, and strategic decision-making converge to define the trajectory of the biohazard bag market.

Unveiling the Critical Paradigm Shifts Reshaping the Global Biohazard Bag Landscape Through Technological Innovation, Sustainability, and Evolving Regulations

Over the past several years, the biohazard bag landscape has undergone pivotal shifts driven by the convergence of technological innovation and heightened environmental responsibility. Manufacturers are investing in novel polymer blends and bio-based alternatives that reduce reliance on traditional petrochemicals while maintaining or enhancing barrier performance. Concurrently, advances in closure mechanisms-from self-sealing options to reinforced drawstring designs-have improved ease of use and spill prevention. These product innovations are complemented by digital quality-control systems that enable real-time monitoring of manufacturing parameters, ensuring consistent compliance with stringent safety standards.

Moreover, regulatory bodies in North America, Europe, and Asia have introduced increasingly rigorous guidelines governing infectious waste containment, prompting suppliers to recalibrate their production and testing protocols. The legacy of the COVID-19 pandemic has also elevated awareness around personal protective equipment and waste management practices, leading to increased adoption of high-specification biohazard bags across hospitals and laboratories. As a result, the industry is witnessing a transition from commoditized low-cost offerings to premium product tiers that emphasize sustainability certifications, sterilization compatibility, and lifecycle traceability.

Assessing the Comprehensive Effects of 2025 United States Tariff Measures on Material Costs, Supply Chains, and Market Competitiveness in Biohazard Bags

In early 2025, the United States enacted a series of tariff adjustments targeting select plastic resins and finished polyethylene and polypropylene products. These measures have exerted upward pressure on raw material costs for film manufacturers, exacerbating margin compression for biohazard bag producers reliant on high density polyethylene and linear low density polyethylene. Consequently, several suppliers have initiated price adjustments in their finished goods or absorbed incremental expenses through lean manufacturing initiatives. These cost mitigations, however, have variable efficacy depending on scale and supply chain flexibility.

Furthermore, the tariff environment has accelerated strategic reconfiguration of supply networks. Some players have pursued nearshoring initiatives to secure duty-free access to North American resin supplies, while others are negotiating long-term agreements with domestic petrochemical producers to lock in favorable pricing. Concurrently, importers of closure components have also reassessed their sourcing footprints to circumvent duties, exploring regional distribution centers in Mexico and Canada to optimize inbound logistics. Collectively, these adaptations underscore the need for agile procurement strategies and diversified supplier ecosystems to navigate the evolving trade landscape.

Delivering In-Depth Segmentation Insights by Material, Closure Type, Thickness, and End User to Illuminate Biohazard Bag Market Dynamics

Diving into segmentation reveals unique performance expectations and purchasing behaviors across key submarkets. When analyzing product formulations, high density polyethylene exhibits robust puncture resistance favored by high-risk healthcare facilities, whereas linear low density polyethylene balances flexibility and tensile strength for laboratory use. Low density polyethylene serves cost-sensitive clinics that still require baseline containment, and polypropylene variants gain traction where higher chemical compatibility is paramount. These material distinctions directly influence price positioning, channel strategies, and end-user recommendations.

Similarly, closure preferences diverge across application environments: self-seal configurations deliver rapid single-hand operation in emergency care, while drawstring styles facilitate manual tying for bulky load disposal. Adhesive flap types remain prevalent for standard specimen transport and low-volume waste. Thickness criteria further stratify market opportunities, with the thinnest bags capturing demand among outpatient clinics and diagnostic laboratories, thicker films addressing heavy-use hospital wards, and above-4-mil constructions tailored for specialty hospitals and research institutes handling high-risk biohazards. End-user segmentation underscores this complexity, as general hospitals, specialty hospitals, diagnostic laboratories, research laboratories, pharmaceutical manufacturers, and institutes each impose distinct performance, compliance, and customization requirements.

This comprehensive research report categorizes the Biohazard Bags market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Closure Type

- Thickness

- End User

Exploring Regional Differentiators and Growth Drivers Across Americas, Europe, Middle East & Africa, and Asia Pacific Biohazard Bag Markets

Regional ecosystems exert significant influence on supply, demand, and regulatory stringency. In the Americas, mature markets in the United States and Canada demand adherence to FDA and EPA waste disposal guidelines, fostering a preference for certified single-use bags with traceability features. Latin American nations display emerging opportunities fueled by healthcare infrastructure investments and public-private partnerships aimed at modernizing waste management protocols.

Across Europe, Middle East & Africa, stringent EU directives around waste categorization and landfill diversion are driving adoption of recyclable and incineration-compatible biohazard bags. In the Gulf and North Africa, government initiatives in disease surveillance have translated into heightened containment requirements for infectious materials. Simultaneously, Asia Pacific stands out with the fastest expansion, propelled by large-scale pharmaceutical manufacturing in India, China, and Southeast Asia, alongside rigorous biosafety mandates in research hubs such as Japan and Australia. This region’s dynamic mix of cost competitiveness, regulatory evolution, and capacity expansion underscores its strategic importance for global suppliers.

This comprehensive research report examines key regions that drive the evolution of the Biohazard Bags market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Postures, Innovation Roadmaps, and Competitive Advantages Driving Leadership Among Global Biohazard Bag Manufacturers

Leading manufacturers are reinforcing their positions through targeted innovation and strategic partnerships. Major global suppliers leverage advanced polymer research to introduce antimicrobial-infused liners and integrated labeling systems that enhance chain-of-custody documentation. These product enhancements address end-user demand for traceable waste streams and facilitate compliance audits.

Moreover, forward-looking companies are expanding their footprint by securing capacity expansions in proximity to key healthcare clusters and pharmaceutical hubs. Joint ventures with resin producers and collaborations with sterilization service providers enable seamless integration across the supply chain. These alliances not only strengthen resilience against raw material volatility but also accelerate go-to-market timelines for differentiated offerings. Collectively, such strategic postures underscore the competitive advantages enjoyed by companies that marry innovation with operational agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biohazard Bags market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abdos Labtech Private Limited

- AdvaCare Pharma

- Bel-Art - SP Scienceware

- Certified Safety Manufacturing, INC.

- Champion Plastics

- Clean Harbors, Inc.

- Cole-Parmer Instrument Company, LLC

- Dana Poly, Inc.

- Dynalab Corp.

- Four Star Plastics

- Heathrow Scientific LLC

- International Plastics Inc.

- Lithey Inc.

- Mopec

- Petoskey Plastics

- Pride Pack

- Spartech Corporation

- Stericycle, Inc.

- Thermo Fisher Scientific, Inc.

- Thomas Scientific LLC

- Tilak Polypack Private Limited

- Transcendia, Inc.

- Universal Plastic Bags MFG Co. Inc.

- VWR International, LLC by Avantor, Inc.

Outlining Actionable Strategic Recommendations to Guide Industry Leaders in Enhancing Competitiveness, Sustainability, and Operational Resilience in Biohazard Bags

Industry leaders must embrace a multifaceted strategic agenda to thrive in an increasingly complex environment. Prioritizing sustainable polymer sourcing and bio-based material adoption will meet tightening environmental mandates while enhancing brand reputation among healthcare buyers. At the same time, digital quality assurance tools should be deployed to reduce defect rates and accelerate batch release times, ensuring that safety credentials remain beyond reproach.

Furthermore, executives should diversify supply networks to mitigate tariff and logistics risks, exploring nearshore production capabilities and dual-sourcing arrangements. Engagement with regulatory bodies through industry associations can yield early visibility into forthcoming compliance requirements, enabling proactive product adjustments. Lastly, investment in research and development must be balanced with targeted portfolio expansion for high-growth segments such as specialty hospitals and advanced research laboratories, thereby capturing premium pricing opportunities.

Detailing a Robust Research Methodology Combining Primary Insights, Secondary Data, and Rigorous Triangulation to Ensure Market Analysis Integrity

This research draws upon a rigorous mixed-methodology framework designed to ensure analytical integrity and relevance. Primary insights were obtained through in-depth interviews with senior executives, procurement specialists, and biosafety officers across healthcare institutions, labs, and waste management firms. These qualitative inputs were complemented by structured surveys and focus-group sessions to validate performance criteria and purchasing drivers across end-user segments.

Secondary research incorporated regulatory filings, standards documentation, and proprietary databases to benchmark material specifications, tariff classifications, and regional policy directives. Comprehensive data triangulation was conducted to reconcile supply chain cost models, product feature matrices, and adoption rates. The final dataset underwent peer review and quality control audits to confirm accuracy, consistency, and applicability to strategic planning scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biohazard Bags market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biohazard Bags Market, by Material

- Biohazard Bags Market, by Closure Type

- Biohazard Bags Market, by Thickness

- Biohazard Bags Market, by End User

- Biohazard Bags Market, by Region

- Biohazard Bags Market, by Group

- Biohazard Bags Market, by Country

- United States Biohazard Bags Market

- China Biohazard Bags Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders in the Evolving Biohazard Bag Market

The analysis underscores that biohazard bag market dynamics are shaped by intersecting technological, regulatory, and trade considerations. Material innovation and closure design enhancements respond directly to elevated safety expectations, while regional regulatory frameworks and tariff environments drive supply chain complexity. Segmentation analysis reveals differentiated needs across end users, highlighting opportunities for targeted product development and premium positioning.

Looking ahead, sustained growth will hinge on the ability of manufacturers to integrate sustainability imperatives with agile operational capabilities and strategic partnerships. By aligning innovation roadmaps with evolving compliance landscapes and end-user demands, stakeholders can capture value across diverse geographies and application domains. This synthesis of findings provides a strategic blueprint for navigating the challenges and opportunities that define the biohazard bag industry’s future trajectory.

Engage Directly with Our Associate Director of Sales & Marketing to Secure In-Depth Biohazard Bag Market Research for Strategic Decision-Making

To obtain comprehensive insights, detailed market data, and strategic analysis tailored to your organization’s growth objectives, please connect with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the report’s key deliverables, customization options, and licensing models, ensuring you have the actionable intelligence necessary to make informed decisions in the rapidly evolving biohazard bag industry. Reach out today to secure your copy and empower your team with the most current research and market expertise.

- How big is the Biohazard Bags Market?

- What is the Biohazard Bags Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?