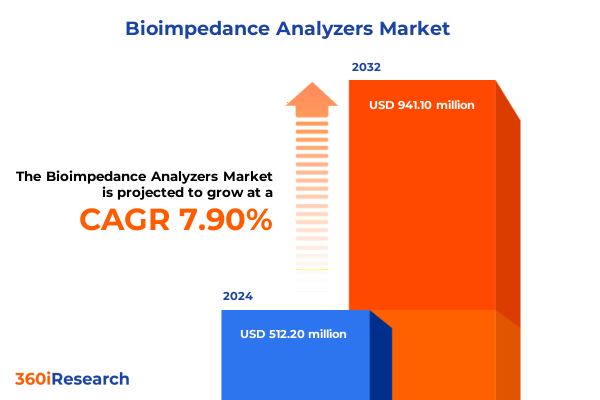

The Bioimpedance Analyzers Market size was estimated at USD 551.10 million in 2025 and expected to reach USD 598.71 million in 2026, at a CAGR of 7.94% to reach USD 941.10 million by 2032.

Setting the Stage for Transformation in Bioimpedance Analysis by Examining Current Trends Market Dynamics and Emerging Opportunities

Bioimpedance analyzers represent a pivotal convergence of physiology, electronics, and data analytics, offering noninvasive measurement of body composition and fluid status that have broad implications across clinical, wellness, and research domains. As healthcare systems strive for more personalized diagnostics and consumers demand greater insights into their fitness and wellness journeys, these devices are experiencing unprecedented interest. While early adopters focused on specialized research environments, a wave of technological miniaturization and cost efficiencies has made benchtop and portable instruments more accessible. Simultaneously, advances in signal processing and sensor materials have enhanced measurement precision, supporting applications from critical care monitoring to at-home wellness tracking.

This evolving backdrop is defined by several intersecting trends. An aging global population and the growing prevalence of chronic conditions such as heart failure, lymphedema, and malnutrition have driven clinical adoption, incentivizing diagnostic centers and hospitals to integrate bioimpedance analysis into routine assessments. Meanwhile, consumer-facing fitness and wellness platforms are embedding wearable variants to deliver actionable insights directly to individuals. The research community is also capitalizing on high-resolution impedance profiling to explore new biomarkers and refine therapeutic protocols. Together, these developments signal a transformative stage in which bioimpedance analyzers shift from niche laboratory instruments to versatile tools underpinning personalized health strategies and data-driven care pathways.

Revealing the Major Technological Advances and Market Realignments Reshaping Bioimpedance Analyzer Landscape Today with Emerging Use Cases

In the current landscape, breakthroughs in multi-frequency bioelectric impedance spectroscopy have enabled practitioners to differentiate intracellular and extracellular fluid compartments with finer resolution than ever before. This leap has not only elevated the accuracy of clinical diagnostics but also unlocked new avenues in nutrition assessment and fluid management for chronic disease patients. Parallel progress in bioelectric impedance vector analysis has delivered robust composite metrics that enhance risk stratification, allowing clinicians to detect subtle physiological changes before they manifest as overt symptoms. As a result, diagnostic centers and hospitals are reconfiguring care pathways to incorporate impedance-based monitoring at multiple touchpoints, from admission to discharge.

Emerging use cases are further extending the market’s horizons. Integrating bioimpedance sensors with mobile health platforms and cloud-based analytics has created remote monitoring solutions that support telemedicine initiatives and decentralized clinical trials. Wearable form factors, powered by low-energy wireless communication, now deliver continuous tracking of hydration status and body composition during athletic performance and rehabilitation. Strategic collaborations between device manufacturers, software developers, and healthcare networks are accelerating go-to-market timelines and broadening the value proposition of analyzer portfolios. Consequently, the sector is witnessing a shift from standalone hardware offerings to comprehensive ecosystems encompassing devices, data services, and clinical decision support tools.

Evaluating the Layered Effects of 2025 United States Tariffs on Bioimpedance Analyzer Imports Manufacturing and Pricing Ecosystem

The imposition of new tariff layers in 2025 on imported electronic components and finished medical devices has introduced a complex overlay of cost pressures and supply chain recalibrations for bioimpedance analyzer manufacturers. Components sourced globally-such as precision resistors, embedded sensors, and specialized microcontrollers-have become subject to variable duty rates, depending on origin and end-use classification. These additional levies have elevated the landed cost of multiple product categories, prompting device producers to reexamine sourcing strategies. In response, some manufacturers have shifted towards regional supply bases in North America, aiming to mitigate tariff exposure and enhance logistical resilience.

While domestic assembly can partially offset import duties on critical subassemblies, the transition demands upfront investment in local production infrastructure, workforce training, and quality control protocols. Furthermore, downstream stakeholders face trade-off decisions between absorbing higher costs and passing them on to end users. Diagnostic centers and homecare providers have reported tightening budgets, leading to extended equipment replacement cycles and increased negotiation on service agreements. Yet, this environment has also spurred innovation in cost-efficient device design, encouraging the adoption of modular architectures that allow for component standardization. Over time, companies that successfully balance nearshoring with agile manufacturing practices are poised to safeguard profitability and maintain competitive pricing in the face of tariff-induced headwinds.

Uncovering Critical Market Segmentation Insights That Define Bioimpedance Analyzer Adoption Across Applications Users Product Types Technologies and Frequencies

Segmenting the bioimpedance analyzer market reveals distinct patterns of adoption and growth potential across various application domains, user groups, product types, technologies, and frequency modalities. Analysis of the clinical diagnosis segment indicates sustained demand from care settings focused on edema management, nutritional status monitoring, and cardiovascular risk assessment, while fitness and wellness applications continue to thrive in gyms and consumer health programs. Research institutions, leveraging high-resolution impedance data, are exploring biomarker discovery and physiological modeling to enhance understanding of disease progression and therapeutic efficacy.

End-user segmentation further underscores the differentiated requirements of diagnostic centers, homecare centers, hospitals, research laboratories, and sports clinics. Diagnostic centers prioritize throughput and automation, driving interest in benchtop platforms with integrated software workflows. Homecare environments demand compact, portable analyzers that facilitate remote patient monitoring, whereas hospitals require versatile devices capable of supporting both inpatient and outpatient protocols. Research laboratories focus on advanced analytics capabilities and raw data access, and sports clinics are increasingly deploying wearable units to track hydration and body composition in elite athlete cohorts.

Product-level segmentation illustrates the interplay between benchtop, portable, and wearable analyzers. Benchtop units remain essential for high-volume clinical workflows, while portable instruments deliver a balance of accuracy and mobility for field and home settings. Wearable devices, though nascent, are gaining traction for continuous monitoring and integration with consumer health platforms. On the technology front, bioelectric impedance spectroscopy offers multi-frequency profiling for granular fluid analysis, bioelectric impedance vector analysis provides composite bioimpedance illustrations for clinical decision support, and single frequency analysis continues to serve cost-sensitive applications with simplified impedance readings. Finally, choices between multiple frequency and single frequency operation reflect trade-offs between measurement depth and device complexity, guiding manufacturers as they tailor solutions to specific market niches.

This comprehensive research report categorizes the Bioimpedance Analyzers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Frequency

- Application

- End User

Highlighting Distinct Regional Dynamics Influencing Bioimpedance Analyzer Market Trajectories in the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on the trajectory of bioimpedance analyzer adoption due to varying healthcare infrastructures, regulatory pathways, and economic drivers. In the Americas, robust reimbursement frameworks in the United States and Canada have accelerated integration of impedance analysis into clinical workflows, while growing telehealth initiatives in Latin America are stimulating demand for portable and user-friendly devices. Regional research collaborations, particularly across academic medical centers, are further cultivating an ecosystem that values interoperability and data integration.

Within Europe, the Middle East, and Africa, heterogeneous regulatory landscapes shape market accessibility, with Europe’s CE-mark framework fostering rapid product registration and Middle Eastern investment in sports medicine propelling uptake in specialized clinics. In sub-Saharan Africa, mobile health programs and NGO-led screening initiatives are beginning to explore bioimpedance for nutritional surveillance and disease management. Across these territories, partnerships with local distributors and contract research organizations play a pivotal role in aligning product portfolios with region-specific clinical practices and resource constraints.

The Asia-Pacific region stands out for its combination of high consumer health awareness and rapidly evolving medical device sectors. China’s focus on indigenous innovation is driving development of domestic analyzer brands, whereas Japan and South Korea continue to emphasize precision instrumentation and regulatory rigor. Southeast Asian markets are embracing cost-effective portable platforms to support expanding primary care networks. As healthcare digitization accelerates, cloud-enabled bioimpedance solutions are emerging as enablers of population health management and remote diagnostic services throughout the region.

This comprehensive research report examines key regions that drive the evolution of the Bioimpedance Analyzers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategies Partnerships and Technological Innovations from Leading Companies Shaping the Bioimpedance Analyzer Ecosystem Globally

Leading companies in the bioimpedance analyzer arena are differentiating themselves through strategic investments in next-generation sensor technology, advanced analytics platforms, and ecosystem partnerships. Some manufacturers have unveiled modular systems that integrate with electronic health record platforms, enabling seamless data exchange and facilitating interoperability with hospital information systems. Others have prioritized the development of wearable analyzers with proprietary electrode materials and adaptive signal processing algorithms to deliver real-time fluid status monitoring for athletes and chronic disease patients.

Collaboration between device developers and cloud-based software providers is further expanding service offerings, as predictive algorithms and machine learning models are embedded into analytics suites. These alliances are delivering actionable insights on patient hydration trends, nutritional interventions, and rehospitalization risk, thereby strengthening engagement with care teams and payers. In parallel, mergers and acquisitions are consolidating the market, as incumbents seek to augment their portfolios with complementary technologies and global distribution networks. Smaller, agile entrants continue to spur innovation in niche segments, prompting established organizations to pursue open innovation and co-development agreements to remain at the forefront of performance and reliability enhancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioimpedance Analyzers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akern S.r.l.

- Analog Devices, Inc.

- Bodystat Ltd.

- ImpediMed

- ImpediMed Limited

- InBody Co., Ltd.

- Jawon Medical Co., Ltd.

- Maltron International Ltd.

- Omron Healthcare Co., Ltd.

- RJL Systems, Inc.

- SECA GmbH & Co. KG

- TANITA Corporation

- Zimed Healthcare LLC

Prescriptive Strategies for Industry Leaders to Accelerate Bioimpedance Analyzer Market Growth Enhance Competitive Position and Drive Innovation Adoption

Industry leaders aiming to capitalize on the momentum within the bioimpedance analyzer market should adopt a multifaceted strategic approach that encompasses product innovation, supply chain agility, and stakeholder engagement. Prioritizing research and development efforts toward miniaturized sensor arrays and energy-efficient electronics can unlock new use cases in wearable health monitoring and point-of-care diagnostics. Concurrently, cultivating strategic alliances with software developers will ensure that advanced analytics and decision support functionalities are embedded into hardware offerings, augmenting value for clinicians and end users.

To navigate tariff-related cost pressures, organizations should explore diversification of manufacturing footprints, balancing local assembly operations with regional component sourcing to optimize landed costs. Strengthening relationships with distributors and establishing training programs for end users can foster confidence in device performance and drive adoption across diagnostic centers, homecare environments, and sports clinics. Finally, proactively engaging with regulatory authorities to streamline product registrations and to define performance standards will reduce time to market and enhance credibility. By aligning product roadmaps with evolving healthcare paradigms-such as remote patient monitoring, personalized nutrition, and digital therapeutics-leaders can secure a differentiated competitive position and foster sustainable growth.

Demonstrating the Rigorous Research Framework Data Collection and Analytical Techniques Underpinning High Reliability of Bioimpedance Analyzer Market Insights

This market research study employed a rigorous multi-stage methodology to ensure comprehensive coverage and analytical integrity. The primary research phase involved structured interviews with key opinion leaders, including clinicians, biomedical engineers, and device manufacturers, to capture qualitative insights on technology adoption drivers, end-user requirements, and regional market conditions. These conversations were complemented by surveys of diagnostic centers, homecare providers, research laboratories, and sports clinics to quantify deployment trends and identify feature prioritization.

Secondary research encompassed a thorough review of peer-reviewed journals, regulatory filings, patent databases, and company literature to map technological evolution and competitive landscapes. Data triangulation techniques were applied to reconcile discrepancies between secondary sources and primary feedback, reinforcing the reliability of the findings. Analytical modeling focused on mapping supply chain structures, tariff implications, and product segmentation dynamics, while internal validation workshops with domain experts ensured methodological transparency and accuracy. This disciplined framework underpins the credibility of the insights presented, delivering a robust foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioimpedance Analyzers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioimpedance Analyzers Market, by Product Type

- Bioimpedance Analyzers Market, by Technology

- Bioimpedance Analyzers Market, by Frequency

- Bioimpedance Analyzers Market, by Application

- Bioimpedance Analyzers Market, by End User

- Bioimpedance Analyzers Market, by Region

- Bioimpedance Analyzers Market, by Group

- Bioimpedance Analyzers Market, by Country

- United States Bioimpedance Analyzers Market

- China Bioimpedance Analyzers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Integrating Key Findings Implications and Forward Looking Perspectives to Summarize the Bioimpedance Analyzer Market Executive Summary with Strategic Clarity

The convergence of advanced impedance measurement technologies, evolving user requirements, and shifting regulatory landscapes underlines the strategic significance of bioimpedance analyzers in modern healthcare and wellness ecosystems. As multi-frequency spectroscopy and vector analysis continue to refine diagnostic precision, the balance between benchtop robustness and wearable convenience is reshaping market dynamics and enabling novel care pathways. Tariff-driven supply chain adjustments have introduced both challenges and opportunities, prompting manufacturers to adopt agile sourcing and localization strategies that fortify resilience.

Segmentation insights clarify that clinical diagnosis, fitness and wellness, and research applications each present unique value propositions, while diverse end users-from diagnostic centers through sports clinics-demand tailored form factors and functionality. Regionally, distinct healthcare infrastructures and regulatory frameworks in the Americas, Europe Middle East Africa, and Asia Pacific imbue the market with complexity, yet also offer areas of untapped growth. By analyzing the strategies of leading companies and synthesizing actionable recommendations, stakeholders are equipped to navigate the current landscape with confidence and to align innovations with emerging care models.

Unlock Immediate Access to the Definitive Bioimpedance Analyzer Market Report and Speak Directly with Ketan Rohom Associate Director of Sales & Marketing

Seizing the moment to leverage cutting-edge insights can transform strategic decision making and catalyze growth in the dynamic field of bioimpedance analysis. Engaging directly with Ketan Rohom, whose extensive experience as Associate Director of Sales & Marketing bridges market intelligence with client needs, ensures tailored guidance aligned with organizational priorities. By establishing a dialogue, prospective stakeholders can uncover bespoke perspectives on technology adoption, regulatory navigation, and competitive positioning that elevate operational readiness. Ketan’s deep understanding of end users’ evolving requirements-from diagnostic centers to sports clinics-and his visibility into regional subtleties will inform tailored deployment strategies and partnership opportunities.

Act now to secure your copy of the definitive market research report, an indispensable resource that distills complex market forces into pragmatic insights. This report encompasses nuanced analysis of application trends, segmentation intelligence, and tariff impacts without disclosing proprietary forecasts, providing a clear roadmap for growth. To access the full breadth of this strategic research and to discuss how these insights apply directly to your objectives, reach out to Ketan Rohom, Associate Director, Sales & Marketing, and unlock the next phase of your market leadership.

- How big is the Bioimpedance Analyzers Market?

- What is the Bioimpedance Analyzers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?