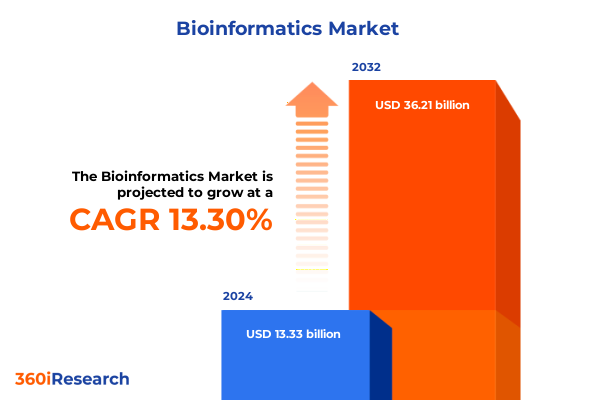

The Bioinformatics Market size was estimated at USD 15.00 billion in 2025 and expected to reach USD 16.92 billion in 2026, at a CAGR of 13.41% to reach USD 36.21 billion by 2032.

Pioneering the convergence of cutting-edge bioinformatics innovations and market dynamics shaping tomorrow’s life sciences breakthroughs

The bioinformatics landscape is propelled by an unprecedented convergence of technological advancements and shifting research paradigms, marking the dawn of a new era in life sciences discovery. At its core, this field integrates computational power with biological data to decode the complexities of genomics, proteomics, and systems biology, thereby accelerating breakthroughs from bench to bedside. As organizations seek to navigate vast repositories of sequence information and leverage structural analysis platforms, they encounter both unparalleled opportunities and emerging challenges that demand strategic foresight.

Amidst these dynamics, stakeholders from academic laboratories to pharmaceutical innovators are recalibrating their approaches to harness sequence alignment tools, advanced data management services, and knowledge platforms that facilitate cross-disciplinary collaboration. This introductory overview lays the foundation for a comprehensive examination of the transformative shifts altering the bioinformatics ecosystem, the ramifications of evolving trade policies on supply chains, and the segmentation frameworks that underpin market differentiation. By aligning on these pivotal themes, readers will gain a cohesive understanding of the critical forces shaping tomorrow’s life sciences breakthroughs and the strategic levers available to maintain competitive advantage.

Unraveling transformative shifts driving the evolution of bioinformatics ecosystems across research, diagnostics, and therapeutic development pipelines

The bioinformatics sector is undergoing a series of transformative shifts driven by the integration of machine learning into structural analysis workflows and the migration of core platforms to cloud-native architectures. These changes are amplifying data accessibility and enabling real-time insights, which in turn streamline sequence analysis pipelines and foster collaborative data sharing across institutional boundaries. As a result, pathbreaking modalities in functional genomics and comparative genomics are becoming increasingly feasible, shortening experimental lifecycles and reducing time-to-discovery.

Simultaneously, the proliferation of sequencing services and database management solutions has sparked a wave of consolidation among platform providers, challenging legacy vendors to innovate or risk obsolescence. Startups harnessing AI-driven target identification tools and computational frameworks for metabolomics are reshaping the competitive landscape, compelling established players to invest in interdisciplinary partnerships and open-source initiatives. These convergent trends underscore the imperative for research and business leaders to anticipate shifts in software licensing models, upscale bioinformatics services teams, and optimize workflows to extract maximum value from multi-omics datasets.

Exploring the cumulative effects of recent United States tariff adjustments on global bioinformatics supply chains and innovation collaboration models

The cumulative impact of recent United States tariff adjustments has reverberated throughout global life sciences supply chains, introducing cost pressures and logistical complexities for suppliers of reagents, instruments, and software platforms. Import duties on specialized sequencing reagents and high-precision analytical hardware have elevated operating expenses for laboratories, prompting procurement teams to explore near-shoring strategies and diversify supplier portfolios. These measures, while mitigating immediate cost spikes, have also lengthened lead times for critical consumables and necessitated more sophisticated inventory management practices.

Moreover, collaborative partnerships with international academic consortia and contract research organizations have faced additional layers of compliance requirements, compelling legal teams to reconcile shifting tariff classifications with existing trade agreements. In response, vendors are increasingly structuring multi-tiered pricing strategies and leveraging bonded warehousing solutions to stabilize supply and preserve research continuity. As stakeholders assess the long-term implications of these policy shifts, they must integrate tariff sensitivities into decision models and foster resilient ecosystems capable of weathering continued trade policy oscillations.

Delving into layered segmentation insights that illuminate product type, application scope, and end-user dynamics steering bioinformatics adoption

Segmenting the bioinformatics market by product type reveals a layered ecosystem comprising integrated platforms, specialized services, and comprehensive knowledge management solutions. Within platform offerings, sequence alignment capabilities coexist with advanced sequence analysis innovations, while emerging tools for structural and functional analysis drive deeper insights into molecular interactions. Concurrently, service providers deliver data analysis expertise alongside robust database management and high-throughput sequencing operations to streamline research workflows and extend institutional capabilities.

Shifting focus to application domains uncovers a spectrum of use cases spanning agricultural biotechnology to clinical diagnostics, each underpinned by distinct technology requirements. In agricultural biotechnology, next-generation breeding tools for genetically modified organism development are paired with comparative and functional genomics frameworks to accelerate crop improvement. In parallel, the pharmaceutical sector leverages computational target identification and drug screening methodologies to optimize therapeutic pipelines, while genomics and proteomics investigations propel personalized medicine and biomarker discovery.

Evaluating end-user segments highlights the nuanced needs of academic research institutes, which rely on both university core facilities and independent laboratories to validate hypotheses, versus healthcare providers that integrate diagnostic centers and hospitals into clinical decision support systems. Agricultural and environmental entities adopt predictive analytics to monitor crop resilience, whereas pharmaceutical and biotechnology organizations mobilize bioinformatics infrastructures to sustain drug development programs. These segmentation insights equip stakeholders to tailor value propositions and prioritize investment in the solutions that align with their strategic objectives.

This comprehensive research report categorizes the Bioinformatics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Types

- Applications

- End-User

Illuminating regional variances in bioinformatics advancements with a focus on the Americas, Europe, Middle East, Africa, and Asia-Pacific landscapes

Regional dynamics in bioinformatics are shaped by distinct regulatory frameworks, funding landscapes, and innovation ecosystems across the Americas, the combined territories of Europe, the Middle East and Africa, and the diverse markets of the Asia-Pacific region. In the Americas, a robust network of research universities and dedicated biotechnology clusters fosters rapid adoption of cutting-edge platforms, with service providers benefiting from streamlined regulatory pathways for diagnostics and therapeutics development. This environment supports agile collaborations, particularly between government agencies and private sector stakeholders.

By contrast, the Europe, Middle East and Africa region presents a multifaceted tapestry of policy regimes, ranging from the European Union’s rigorous data protection mandates to targeted research incentives in Gulf Cooperation Council nations. Cross-border consortia and pan-regional funding initiatives have catalyzed large-scale genomics projects, while service models are increasingly adapted to meet stringent clinical validation standards. Looking eastward, the Asia-Pacific arena blends innovation hubs in Japan, South Korea, and Singapore with rapidly expanding research infrastructures in China, India, and Australia. In these markets, competitive labor costs and aggressive government support for life sciences enable high-throughput sequencing ventures and large-scale proteomics programs.

These regional insights underscore the importance of customizing go-to-market strategies, regulatory engagement plans, and partnership frameworks to local nuances, as well as leveraging regional centers of excellence to optimize resource allocation across the global bioinformatics value chain.

This comprehensive research report examines key regions that drive the evolution of the Bioinformatics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic imperatives and competitive positioning of leading bioinformatics solution providers driving market differentiation and innovation

Leading bioinformatics entities are differentiating themselves through strategic alliances, proprietary technology roadmaps, and integrated service offerings that span the continuum from data acquisition to interpretive analytics. Pioneering platform providers invest heavily in artificial intelligence and machine learning modules to enhance sequence analysis speed and accuracy, while simultaneously expanding cloud-native deployments to meet escalating data security and scalability demands. Service specialists are forging partnerships with academic consortia to co-develop novel pipelines for structural and functional annotation.

In turn, instrument manufacturers are collaborating with software developers to embed analysis tools directly into sequencing hardware, creating unified ecosystems that minimize manual data transfers and accelerate decision-making. Knowledge management vendors are integrating semantic search and natural language processing capabilities into their repositories, enabling research teams to surface insights across disparate publications and experimental records. Collectively, these initiatives reflect a broader industry imperative to converge platforms, services, and data assets into cohesive workflows that drive higher throughput and reproducibility.

Market leaders are also prioritizing open science contributions and interoperability standards to foster community-driven innovation, while emerging challengers target niche segments such as metabolomics and single-cell analysis to capture high-value opportunities. This competitive mosaic highlights the need for organizations to continuously assess partnership strategies, intellectual property portfolios, and technology roadmaps to sustain momentum in a rapidly evolving landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioinformatics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Benchling, Inc.

- BGI Genomics Co., Ltd.

- Biomatters Ltd.

- Congenica Ltd.

- DNAnexus, Inc.

- DNASTAR, Inc.

- F. Hoffmann-La Roche Ltd.

- Fabric Genomics, Inc.

- Genestack Ltd.

- Genialis, Inc.

- Golden Helix, Inc.

- Illumina, Inc.

- Lifebit Biotech Ltd.

- Partek Incorporated

- PerkinElmer, Inc.

- Qiagen N.V.

- Seven Bridges Genomics, Inc.

- SoftGenetics, LLC

- Thermo Fisher Scientific Inc.

Advocating actionable strategic recommendations for industry leaders to navigate bioinformatics challenges and harness transformative opportunities successfully

To thrive amidst accelerating technological change and policy uncertainty, industry leaders must adopt a series of actionable strategies that align organizational capabilities with emerging market demands. First, prioritizing modular platform architectures and open application programming interfaces will facilitate seamless integration of third-party analytics and enable rapid deployment of novel algorithms. This architectural agility supports iterative development cycles and reduces total cost of ownership by allowing selective upgrades of core components.

Second, forging collaborative consortia with academic institutions and contract research organizations can expand access to specialized expertise in comparative genomics and proteomics, while also distributing risk across multiple stakeholders. These partnerships should be formalized through clear data governance frameworks and mutual intellectual property agreements to maintain trust and compliance. Third, establishing dual-sourcing strategies for critical consumables and instruments will mitigate the operational impact of tariff fluctuations and geopolitical disruptions. By diversifying supply bases across domestic and near-shore vendors, organizations can stabilize procurement lead times and negotiate more favorable contract terms.

Finally, cultivating internal talent through targeted training programs in bioinformatics services, database stewardship, and regulatory affairs will build organizational resilience. Empowering cross-functional teams to adopt agile methodologies, while investing in continuous learning platforms, ensures that the workforce remains proficient in sequence manipulation, structural analysis, and knowledge curation. These combined actions create a robust strategic foundation for navigating the complexity of the modern bioinformatics ecosystem.

Outlining a rigorous mixed-method research methodology combining primary insights and secondary data to underpin robust bioinformatics market analysis

The research underpinning this analysis was conducted through a rigorous mixed-method methodology combining primary and secondary data sources. Primary efforts included in-depth interviews with senior stakeholders from academic research institutes, healthcare providers, agricultural biotechnology firms, and pharmaceutical companies to capture firsthand perspectives on platform adoption, service efficacy, and regulatory considerations. These conversations were supplemented by surveys administered to laboratory directors and procurement managers to validate key themes and assess technology priorities.

Secondary research involved comprehensive reviews of peer-reviewed journals, industry white papers, and open-source databases to map trends in sequence analysis techniques, structural annotation workflows, and knowledge management innovations. Data triangulation techniques were employed to reconcile divergent viewpoints and ensure robustness, while thematic coding protocols were applied to interview transcripts to distill actionable insights. Throughout the study, an emphasis was placed on cross-regional comparability and the identification of segmentation-specific dynamics across product types, applications, and end-user categories.

Quality assurance measures included expert panel reviews and methodological audits to confirm the validity of data interpretations and the reproducibility of findings. This structured approach ensures that readers can rely on the integrity of the insights presented, with transparent linkage between evidence and strategic conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioinformatics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioinformatics Market, by Product Types

- Bioinformatics Market, by Applications

- Bioinformatics Market, by End-User

- Bioinformatics Market, by Region

- Bioinformatics Market, by Group

- Bioinformatics Market, by Country

- United States Bioinformatics Market

- China Bioinformatics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding reflections on the converging forces shaping bioinformatics and their enduring implications for research, clinical practice, and industry partnerships

In synthesizing these insights, it becomes clear that bioinformatics stands at a pivotal juncture where advanced computational tools, evolving regulatory landscapes, and dynamic trade policies converge. The multifaceted segmentation insights elucidate how platform vendors, service specialists, and knowledge management providers must tailor solutions to distinct application domains and end-user contexts. Regional variations further compound strategic considerations, necessitating localized engagement models and flexible operational frameworks.

For industry participants, mastering the implications of United States tariff adjustments and other geopolitical factors is essential to maintaining supply chain resilience and cost competitiveness. Meanwhile, the competitive imperatives identified among leading companies underscore the value of open architectures, collaborative ecosystems, and integrated technology roadmaps. By aligning on these strategic pillars and applying the actionable recommendations outlined, organizations can position themselves to capitalize on the next wave of bioinformatics-driven innovation.

Ultimately, this executive summary offers a cohesive framework for understanding the forces shaping the future of bioinformatics. It empowers stakeholders to make informed decisions, adapt to emerging trends, and collaborate across disciplines to unlock new frontiers in life sciences research, clinical diagnostics, and agricultural biotechnology.

Empowering decision-makers to secure comprehensive bioinformatics intelligence by engaging with Ketan Rohom for a tailored market research report acquisition

To harness the full spectrum of insights uncovered in this executive summary, we invite decision-makers and strategic planners to engage directly with Ketan Rohom, whose deep knowledge of the bioinformatics sector and sales and marketing acumen ensures a tailored experience. By initiating a dialogue with the Associate Director of Sales & Marketing, stakeholders can secure access to the complete market research dossier, enriched with granular analyses, proprietary expert interviews, and actionable strategic frameworks. This collaboration enables organizations to align their innovation roadmaps with emerging technological inflection points, address supply chain complexities amplified by recent trade policy shifts, and capitalize on segmentation nuances across platforms, services, and applications. Reach out to Ketan Rohom to acquire the definitive guide that will empower your team to anticipate competitive threats, optimize product portfolios, and position your enterprise at the forefront of bioinformatics evolution.

- How big is the Bioinformatics Market?

- What is the Bioinformatics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?