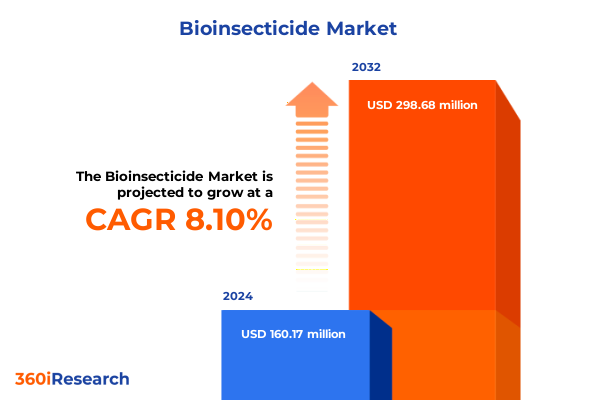

The Bioinsecticide Market size was estimated at USD 171.39 million in 2025 and expected to reach USD 187.13 million in 2026, at a CAGR of 8.25% to reach USD 298.68 million by 2032.

Growing Demand and Proactive Regulatory Momentum Propel Bioinsecticides to the Forefront of Sustainable Integrated Pest Management Solutions Worldwide

The global agricultural sector is undergoing a profound shift as growers, policymakers, and consumers demand sustainable pest management solutions that safeguard both crop yields and environmental health. In recent months, regulatory bodies have reinforced restrictions on synthetic pesticide use in response to mounting evidence of ecological and pollinator impacts. For example, the UK government’s refusal to authorize the emergency use of the neonicotinoid Cruiser SB underscores the growing commitment to protect pollinators and phase out high-risk chemicals in favor of safer alternatives that align with biodiversity goals. Concurrently, the U.S. Environmental Protection Agency has proposed a streamlined registration review process for low-risk biopesticides, reflecting an institutional push to expedite access to biologically based crop protection products by limiting unnecessary reevaluation under the latest scientific assessments.

Against this regulatory backdrop, industry innovation has accelerated as developers bring next-generation bioinsecticides to market with unprecedented speed and specificity. In early 2025, Vestaron secured EPA approval for BASIN®, its second novel active ingredient derived from modified spider venom, showcasing the debut of a new neuromuscular mode of action that minimizes non-target risk and bolsters resistance management for growers. Likewise, BioWorks obtained EPA registration for Principle WP, a Beauveria bassiana-based product targeting thrips, aphids, whiteflies, and other pests without the need for residue tolerances, illustrating the growing acceptance of microbial agents as frontline tools in integrated pest management. These milestones highlight a readiness among regulators and producers to embrace biological innovations that meet both performance and sustainability imperatives.

Emerging Technological Breakthroughs and Market Convergence Are Redefining the Bioinsecticide Landscape with Next-Generation Biological Pest Control Solutions

The bioinsecticide landscape is being transformed by unprecedented technological breakthroughs that are redefining efficacy, safety, and scalability for growers across diverse cropping systems. At the forefront, novel modes of action such as Vestaron’s BASIN®, built upon proprietary spider-venom peptides, deliver targeted insect control while preserving beneficial insects, illustrating how molecular insights can be harnessed for next-generation pest management. Beyond small-molecule innovations, advances in formulation science-ranging from nano-encapsulations to precision adjuvants-are enhancing product stability and delivery, enabling bioinsecticides to match or exceed the performance benchmarks set by conventional chemistries.

Simultaneously, biotechnological breakthroughs in RNA-based solutions and microbial proteins are reshaping the strategic roadmap for biological pest control. The U.S. EPA’s review docket for double-stranded RNA (dsRNA) products, alongside proposed registrations for Pepino mosaic virus-derived siRNAs, underscores a transition toward biologically tailored mechanisms that exploit insect gene silencing to achieve resistance-free mortality. These developments reflect a convergence of synthetic biology, genomics, and microbial ecology that is driving the emergence of highly specialized bioinsecticides, poised to deliver precision control with minimal ecological footprint.

Complex Trade Dynamics and Tariff Policies Are Reshaping Bioinsecticide Supply Chains and Cost Structures in the United States by 2025

In 2025, U.S. trade policy has imposed an additional 10 percent tariff on agricultural products imported from China, creating cost pressures across the crop protection value chain, particularly for active ingredients that originate abroad. The Ag Retailers Association has warned that many of these ingredients, including amino acids and botanical extracts used in pesticide formulations, could face price increases or supply constraints as tariffs compound existing import duties. Furthermore, Farmers Business Network’s Ag Chemical Price Transparency Report projects that restocking of depleted inventories under these tariff regimes may intensify cost volatility for pesticides sourced from China, given that a majority of certain conventional chemistries remain reliant on Chinese manufacturing.

Major agrochemical firms have proactively mitigated such trade disruptions by diversifying production footprints and securing localized manufacturing capabilities. Syngenta Group, for instance, anticipates only a minimal impact from U.S. tariffs in 2025 due to strategic measures implemented during earlier tariff cycles, including supply chain realignments and tariff-offset agreements established in previous administrations. While large players are equipped to absorb tariff-related cost increases, emerging bioinsecticide developers-often dependent on specialized botanical extracts or microbial raw materials-may experience moderate margin compression or logistical hurdles. To counteract these risks, firms are exploring domestic sourcing partnerships and forward-contract strategies to insulate their pipelines from future trade perturbations.

Diverse Product and Application Segmentation Insights Reveal Strategic Opportunities within Biochemical, Botanical, Microbial and Formulation Markets

The bioinsecticide market’s segmentation reveals nuanced patterns of innovation and adoption that inform strategic positioning. Products classified under biochemical types have expanded beyond traditional pheromones and growth regulators to include advanced plant extracts, while the botanical segment, historically dominated by neem and garlic formulations, is being augmented by proprietary phenolic blends and essential-oils technologies. Microbial agents, once limited to broadly active Bacillus and Beauveria strains, are diversifying into new bacterial and fungal species engineered for crop-specific compatibility and optimized environmental persistence.

Equally important are formulation preferences and application modalities that drive market uptake. Emulsifiable concentrates, granules, suspension concentrates, and wettable powders each offer distinct handling, mixing, and compatibility profiles, enabling tailored solutions for greenhouse, field, and post-harvest scenarios. The mode of application spans foliar spray, seed treatment, soil treatment, post-harvest treatment, and trunk injection, reflecting the need for both pre-emptive and curative interventions. Distribution channels further accentuate this diversity, with established direct-sales and retail-store networks coexisting alongside digital platforms, e-commerce marketplaces, and branded company websites. This multi-channel environment underscores the importance of omnichannel strategies to reach growers across varied geographies and operational scales.

This comprehensive research report categorizes the Bioinsecticide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Formulation

- Mode of Application

- Crop Type

- Distribution Channel

Regional Adoption Patterns and Regulatory Frameworks Drive Distinct Growth Trajectories for Bioinsecticides across the Americas, EMEA and Asia-Pacific

Regional dynamics play a critical role in shaping the adoption and growth trajectory of bioinsecticides. In the Americas, supportive policies such as the U.S. Biopesticide Registration Improvement Act and streamlined review processes have accelerated product approvals and stimulated investment in domestic manufacturing, fostering a robust landscape for both large agribusinesses and agile startups. Meanwhile, Latin American countries are embracing bio-based options to address environmental concerns and consumer demand, positioning the region as both a manufacturing hub and a burgeoning market for biological crop protection.

Europe, the Middle East, and Africa present a more complex regulatory tapestry, where stringent EU directives on pesticide residues and harmonized registration requirements coexist with fragmented national frameworks in the Middle East and Africa. This regulatory mosaic drives demand for harmonized datasets and strategic alliances, as companies navigate extended timelines and diverse safety assessments to secure market access. In contrast, the Asia-Pacific region exhibits rapid market expansion fueled by agricultural intensification, rising food security challenges, and government incentives promoting biopesticide adoption. Countries such as India and China are investing in local fermentation and botanical extraction facilities, while Australia and New Zealand champion integrated pest management programs that prioritize biological controls for high-value horticulture.

This comprehensive research report examines key regions that drive the evolution of the Bioinsecticide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Innovators and Strategic Collaborations Highlight the Competitive Bioinsecticide Market Dynamics and R&D Imperatives of Key Companies

Leading global agrochemical players have intensified their focus on biological innovations, forging partnerships with biotech firms and academic institutions to deepen their product pipelines. Companies such as Bayer and BASF are leveraging their formulation expertise and global distribution networks to expand microbial and botanical offerings alongside conventional chemistries. Syngenta’s acquisition strategy, targeting specialized startups in pheromone technologies and RNA-based solutions, underscores the trend toward integrated platforms that span multiple modes of action.

At the same time, pure-play biopesticide specialists such as Marrone Bio Innovations and BioWorks are capitalizing on niche expertise in microbial fermentation and entomopathogenic fungi to deliver high-performance products for specialty crops and greenhouse applications. These smaller organizations benefit from agile development cycles and targeted field trials, enabling rapid iteration of formulations to address emergent pest pressures. Collaborations between multinational conglomerates and indigenous biopesticide producers are also on the rise, reflecting a mutual interest in localizing supply chains and co-developing region-specific solutions that align with sustainability goals and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioinsecticide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADAMA Ltd.

- BASF SE

- Bayer AG

- BioWorks, Inc.

- Certis USA, LLC

- Corteva Agriscience, Inc.

- Isagro S.p.A.

- Koppert Biological Systems B.V.

- Marrone Bio Innovations

- Novozymes A/S

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta Group Co., Ltd.

- UPL Limited

- Valent Biosciences Corporation

Proactive Strategies and Collaborative Partnerships Empower Industry Leaders to Navigate Regulatory Complexity and Accelerate Bioinsecticide Adoption

To thrive amid evolving regulations and technological disruptions, industry leaders should prioritize investment in advanced research platforms that integrate omics-driven discovery with predictive formulation modeling. By building cross-functional teams that blend molecular biology, agronomy, and data science, companies can accelerate the pipeline for novel active ingredients while ensuring targeted efficacy and environmental safety.

Strategic alliances across the value chain-from raw material suppliers to distribution partners-are essential to mitigate supply chain risks and expand market reach. Engaging proactively with regulatory authorities to shape policy frameworks and co-design field-trial protocols can streamline approval timelines and reduce barriers to entry. Furthermore, adopting a customer-centric approach that leverages digital agronomy services and localized training programs will enhance grower adoption and support evidence-based decision-making in integrated pest management.

Robust Multi-Source Methodology Underpins Credible Bioinsecticide Analysis through Expert Interviews, Industry Data and Regulatory Review

This analysis is grounded in a comprehensive research approach that integrates primary and secondary data sources. Expert interviews with regulatory officials, product developers, and agronomy specialists provided firsthand perspectives on policy trends, technological breakthroughs, and market entry challenges. These qualitative insights were triangulated with publicly available regulatory filings, EPA docket summaries, and trade-press announcements to ensure accuracy and currency.

Secondary research encompassed a systematic review of scientific literature, patent filings, and industry publications to map evolving modes of action, formulation technologies, and regional regulatory frameworks. Field-trial data shared by manufacturers and independent testing agencies informed assessments of product performance across diverse environments. Throughout the process, findings were validated through iterative consultations with subject-matter experts, ensuring that the final deliverable reflects both strategic imperatives and practical realities for stakeholders in the bioinsecticide sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioinsecticide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioinsecticide Market, by Type

- Bioinsecticide Market, by Formulation

- Bioinsecticide Market, by Mode of Application

- Bioinsecticide Market, by Crop Type

- Bioinsecticide Market, by Distribution Channel

- Bioinsecticide Market, by Region

- Bioinsecticide Market, by Group

- Bioinsecticide Market, by Country

- United States Bioinsecticide Market

- China Bioinsecticide Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Integrating Insights on Market Evolution, Regulatory Trends and Technological Advances to Conclude the Future Pathways of Bioinsecticide Adoption

The bioinsecticide sector stands at a pivotal juncture where regulatory momentum, scientific innovation, and market demand converge to redefine pest control paradigms. Breakthroughs in novel modes of action-from venom-derived peptides to RNA-based biotechnologies-are unlocking high-precision tools that align with environmental sustainability goals. Concurrently, shifting trade policies and tariff structures underscore the importance of resilient supply chains and the strategic localization of raw material production.

By synthesizing segmentation insights across product types, formulations, modes of application, and distribution channels, this report illuminates the strategic pathways that companies can pursue to capture growth opportunities. Regional dynamics further highlight the need for adaptive market strategies that address varied regulatory landscapes and adoption drivers. Ultimately, this comprehensive analysis underscores the transformative potential of bioinsecticides to meet global crop protection challenges, positioning stakeholders to capitalize on burgeoning demand for eco-efficient solutions.

Connect with Our Associate Director of Sales & Marketing to Secure the Definitive Bioinsecticide Market Research Report and Empower Your Strategic Decisions

To explore the full depth of the bioinsecticide market and gain actionable insights tailored to your strategic priorities, connect with our Associate Director of Sales & Marketing, Ketan Rohom. Ketan offers personalized guidance on how this comprehensive research can inform product development, supply chain optimization, and market entry plans. By partnering with him, you’ll receive a customized consultation that highlights the key findings most relevant to your organization’s goals. Don’t miss this opportunity to leverage industry-leading expertise and stay ahead in an increasingly competitive landscape-reach out to Ketan Rohom today to secure your copy of the definitive report.

- How big is the Bioinsecticide Market?

- What is the Bioinsecticide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?