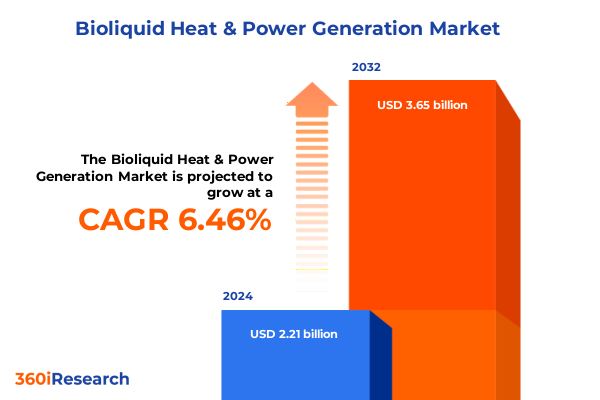

The Bioliquid Heat & Power Generation Market size was estimated at USD 2.35 billion in 2025 and expected to reach USD 2.50 billion in 2026, at a CAGR of 6.47% to reach USD 3.65 billion by 2032.

Unveiling the Strategic Importance and Rapid Evolution of Bioliquid Heat & Power Generation Amidst Global Decarbonization Efforts and Energy Security Imperatives

The global energy landscape is undergoing a transformative shift as decarbonization objectives, resource security concerns, and technological breakthroughs converge to elevate bioliquid heat and power generation as a strategic imperative. Fueled by an urgent need to reduce greenhouse gas emissions, governments and enterprises are increasingly viewing biomass-derived liquids-such as bio-oils from pyrolysis and gasification processes-as viable pathways to replace fossil fuels. This introductory overview establishes the context in which bioliquid heat and power solutions are gaining traction, emphasizing the nexus of environmental policy, climate targets, and energy diversification strategies.

Against a backdrop of ambitious net-zero pledges and tightening emissions regulations, the ability of bioliquid technologies to deliver dispatchable heat and power with low lifecycle carbon profiles has garnered attention across industrial, commercial, and utility sectors. Whereas earlier iterations of biomass utilization faced limitations related to feedstock variability and conversion efficiency, recent advances in reactor design, process integration, and digital controls have substantially improved performance metrics. As a result, bioliquid generation is increasingly viewed not merely as an ancillary sustainable practice but as a core component within comprehensive energy transition frameworks.

This section lays the groundwork for a deeper examination of market drivers, regulatory catalysts, technological innovations, and competitive forces. By unpacking the strategic importance and rapid evolution of bioliquid solutions, we set the stage for an exploration of transformative shifts, tariff impacts, segmentation nuances, regional dynamics, and strategic recommendations designed to guide decision-makers through a complex and rapidly maturing marketplace.

Exploring Key Transformative Shifts Driving Bioliquid Heat and Power Market Evolution Through Technological Innovation and Regulatory Support Mechanisms

The bioliquid heat and power sector has witnessed a series of transformative shifts propelled by breakthroughs in biomass conversion technologies, evolving regulatory frameworks, and growing investor interest in sustainable energy assets. Over the past two years, gasification platforms have progressed from pilot-scale demonstrations to modular commercial units capable of achieving higher syngas yields with lower tar formation. Concurrently, pyrolysis processes have benefitted from enhanced reactor geometries and catalyst formulations that enable the production of bio-oils with consistent calorific values and reduced oxygen content.

Regulatory support mechanisms have further accelerated these technological advances. Incentive structures-ranging from feed-in tariffs for bio-oil-derived power to tax credits linked to low-carbon heat supply-have de-risked capital investment and facilitated partnerships between technology developers and energy off-takers. In tandem, stricter emission ceilings for industrial boilers and steam generators have compelled facilities to explore bioliquid co-firing and dedicated combustion applications, driving a more rapid adoption trajectory than previously anticipated.

A third critical inflection point has been the convergence of digitalization and process analytics. The integration of real-time monitoring, predictive maintenance algorithms, and machine-learning-driven optimization tools has unlocked new levels of operational resilience and uptime. This digital layer not only enhances yield stability across co-firing and combustion applications but also supports remote asset management at distributed sites. Taken together, these shifts attest to a market that is not simply expanding in scale but evolving in sophistication and resilience to meet emerging demands.

Assessing the Cumulative Impact of 2025 United States Tariffs on Bioliquid Heat and Power Supply Chains and Market Competitiveness Dynamics

In 2025, a series of United States tariff adjustments targeting imported bio-oils, biomass pellets, and related equipment have introduced new complexities for international supply chains and domestic market competitiveness. Early in the year, anti-dumping duties were applied to certain categories of bio-oil feedstocks originating from key exporter regions, aimed at shielding local producers from below-cost imports and preserving domestic feedstock markets. These measures, ranging from five to twenty percent in applied tariffs, have had a pronounced effect on feedstock sourcing strategies and cost structures for project developers.

Consequently, many stakeholders have accelerated efforts to secure long-term feedstock contracts within North America or pivot toward alternative biomass streams, such as agricultural residues and industrial organic waste. While this shift has enhanced regional supply resilience, it has also introduced challenges related to feedstock quality consistency and logistics. In parallel, tariffs on imported power generation turbines and heat recovery systems have elevated capital expenditure profiles, incentivizing greater collaboration between original equipment manufacturers and local contractors to mitigate import duties through onshore assembly and service agreements.

Despite these headwinds, several market participants view the tariff environment as a catalyst for deeper vertical integration and strategic partnerships. By forging alliances with domestic forestry and agricultural cooperatives, bioliquid producers are securing more stable feedstock pipelines, even as they invest in in-house conversion capacity. This realignment underscores a broader industry trend: tariffs may temporarily inflate costs, but they are also redefining competitive dynamics and driving a shift toward resilient, regionally anchored value chains.

Unraveling Segmentation Insights Revealing How Technology, Capacity, Feedstock, Application, and End Use Shape Bioliquid Heat and Power Market Trajectories

A nuanced understanding of market segmentation offers critical insights into growth vectors and technology adoption patterns. From a technology standpoint, co-firing solutions retain appeal among existing power producers seeking incremental decarbonization without major infrastructure overhaul, while standalone combustion units are gaining favor in regions where heat demand outstrips electricity requirements. Gasification technology, with its capacity to yield syngas for downstream power generation or chemical feedstock, is carving a niche in industrial clusters focused on circular economy principles. Pyrolysis, meanwhile, is emerging as the method of choice for producing bio-oils with adjustable quality profiles suited to both power generation and heat-only applications.

Capacity range further stratifies the competitive landscape. Below one megawatt installations are favored in remote or off-grid scenarios, where modularity and rapid deployment are priorities. Projects in the one-to-five megawatt band dominate suburban commercial and small industrial installations, balancing economies of scale with manageable capital intensity. Above five megawatts, centralized plants are attracting major utility partnerships and institutional financing, reflecting their ability to integrate with existing district energy systems and industrial operations.

Feedstock diversity underscores another axis of differentiation. Agricultural residues, particularly corn stover and rice husks, are prized for their predictable supply cycles, whereas energy crops offer tailored calorific profiles at higher input costs. Industrial and municipal organic wastes provide a dual benefit of waste diversion and energy production, albeit requiring more advanced pretreatment. Wood pellets remain a cornerstone feedstock in regions with established forestry sectors, valued for their uniformity and ease of handling.

When considering applications, combined heat and power installations are leading adoption in markets with simultaneous thermal and electrical requirements, while heat-only plants address standalone heating demands in cold climates and process heat applications. Power-only units are selectively deployed where grid integration is seamless and regulatory incentives favor renewable electricity generation. End-use segmentation reveals commercial and industrial sectors as primary adopters, leveraging onsite generation to control energy costs and emissions. Residential and utility-scale implementations are less prevalent but are gaining traction in jurisdictions with supportive tariff structures and renewable heat mandates.

This comprehensive research report categorizes the Bioliquid Heat & Power Generation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Capacity Range

- Feedstock

- Application

- End Use

Distilling Key Regional Perspectives Highlighting Opportunities and Challenges Across Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics in the bioliquid heat and power market reflect divergent policy priorities, resource endowments, and infrastructure readiness across the Americas, Europe, Middle East & Africa, and Asia Pacific. In the Americas, strong government incentives for renewable energy and robust agricultural supply chains have positioned the United States, Canada, and select Latin American nations as early adopters. Focused investments in co-firing projects within the U.S. Midwest and large-scale combined heat and power facilities in Brazil illustrate an emphasis on both retrofitting existing assets and deploying greenfield capacity.

Conversely, Europe, Middle East & Africa presents a mosaic of regulatory environments. European Union directives on renewable energy and emissions reductions have spurred advanced markets in Germany and Scandinavia to integrate bioliquid solutions into district energy networks. In contrast, emerging economies in the Middle East and North Africa are exploring small-scale combustion and pyrolysis plants to address water desalination energy needs and circular economy ambitions, albeit constrained by funding and technology transfer hurdles.

In Asia Pacific, a dual narrative emerges. Mature markets such as Japan and South Korea are advancing gasification projects tied to chemical and fertilizer clusters, leveraging their industrial demand for high-purity syngas. Meanwhile, Southeast Asian nations and Australia are capitalizing on abundant agricultural residues and forestry by-products to pilot distributed heat-only and combined heat and power installations in rural and peri-urban areas. Cross-regional collaboration on feedstock standards and technology licensing is fostering knowledge exchange, while tailored financing mechanisms are helping to overcome project bankability challenges.

This comprehensive research report examines key regions that drive the evolution of the Bioliquid Heat & Power Generation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Providing In-Depth Analysis of Leading Industry Players and Strategic Partnerships Shaping the Competitive Landscape of Bioliquid Heat & Power Sector

Leading companies in the bioliquid heat and power sector are differentiating themselves through technological innovation, strategic partnerships, and expansion into adjacent value chains. Several established global firms have invested heavily in next-generation gasification platforms, securing intellectual property rights and forging alliances with engineering partners to accelerate commercial deployment. Simultaneously, a cohort of specialized technology providers is targeting niche applications-such as modular pyrolysis units for remote industrial sites-enabling them to capture early mover advantages in underserved segments.

Strategic collaborations between feedstock suppliers, conversion technology developers, and end users are reshaping traditional competitive boundaries. For example, forestry cooperatives in North America are partnering with turbine manufacturers to co-design combustion systems optimized for specific pellet characteristics. At the same time, industrial conglomerates in Europe are integrating gasification-derived syngas into existing chemical operations, thereby internalizing renewable energy supply and reducing exposure to carbon pricing.

Mergers and acquisitions have become a critical lever for market consolidation and technology access. In recent months, several large utilities have acquired minority stakes in bioliquid project developers to secure off-take rights and accelerate project pipelines. Meanwhile, venture capital and private equity interest continues to grow, funding startups that are exploring advanced catalyst development, feedstock pretreatment solutions, and digital twins for process modelling. This infusion of capital is fostering a vibrant ecosystem of innovation, ensuring that leading players are well-positioned to capture emerging opportunities as the market scales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bioliquid Heat & Power Generation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Argent Energy Holdings Ltd.

- BTG Bioliquids B.V.

- Bunge Limited

- Cargill, Incorporated

- Chevron Renewable Energy Group, Inc.

- Drax Group plc

- Enerkem Inc.

- Ensyn Fuels Inc.

- Green Plains Inc.

- MBP Group A/S

- Munzer Bioindustrie GmbH

- Neste Oyj

- Olleco Ltd.

- Valero Energy Corporation

Outlining Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Positioning in the Bioliquid Heat & Power Market

To navigate the evolving bioliquid heat and power market, leaders should adopt a proactive strategy that emphasizes feedstock security, technology diversification, and policy engagement. Cultivating long-term feedstock partnerships with agricultural cooperatives and municipal waste authorities will mitigate supply volatility and support cost-competitive operations. Concurrently, investing in modular conversion technologies across co-firing, gasification, and pyrolysis will enable rapid scaling and adaptability to shifting demand profiles.

Engagement with policymakers and regulatory bodies is equally critical. Industry leaders can accelerate favorable market conditions by collaborating on the design of renewable heat incentives, emissions trading schemes, and standards for sustainable feedstock sourcing. By contributing to policy frameworks, organizations not only secure supportive environments but also shape the guidelines that govern future deployment scenarios.

Finally, integrating digital optimization tools-such as predictive maintenance platforms and performance analytics-into existing operations will drive efficiency gains and reduce unplanned downtime. Combining these insights with scenario planning for tariff changes and tariff mitigation strategies will strengthen resilience against geopolitical and economic headwinds. Through these targeted actions, companies can position themselves at the forefront of a market that promises both environmental benefit and commercial growth.

Detailing Rigorous Research Methodology Incorporating Expert Interviews, Data Triangulation, and Comprehensive Secondary Research Approaches for Robust Insights

The research underpinning this analysis combined primary and secondary methodologies to ensure the robustness and reliability of insights. Expert interviews with technology developers, feedstock suppliers, policy influencers, and end users provided qualitative perspectives on market drivers, adoption challenges, and future expectations. These conversations were supplemented by secondary research encompassing academic journals, industry reports, policy white papers, and regulatory databases, which helped validate trends and benchmark technological performance.

Data triangulation played a pivotal role in reconciling divergent inputs and achieving a cohesive market narrative. Quantitative data-such as installation counts, project capacities, and tariff schedules-were cross-verified against proprietary datasets and public records. A dual bottom-up and top-down approach was employed to map installed capacity by region and segment, while scenario modelling assessed the sensitivity of tariff developments and feedstock availability to market dynamics.

Quality assurance processes included peer review by subject matter experts and iterative feedback cycles with industry stakeholders. This multi-layered methodology ensured that conclusions were grounded in factual evidence, unbiased by single-source dependencies, and reflective of both current realities and foreseeable trajectories. The result is a comprehensive, actionable body of knowledge designed to guide strategic decision-making in the bioliquid heat and power domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bioliquid Heat & Power Generation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bioliquid Heat & Power Generation Market, by Technology

- Bioliquid Heat & Power Generation Market, by Capacity Range

- Bioliquid Heat & Power Generation Market, by Feedstock

- Bioliquid Heat & Power Generation Market, by Application

- Bioliquid Heat & Power Generation Market, by End Use

- Bioliquid Heat & Power Generation Market, by Region

- Bioliquid Heat & Power Generation Market, by Group

- Bioliquid Heat & Power Generation Market, by Country

- United States Bioliquid Heat & Power Generation Market

- China Bioliquid Heat & Power Generation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Findings Reinforcing the Strategic Imperative for Bioliquid Heat & Power Adoption Within the Context of Evolving Energy and Environmental Policies

The synthesis of our findings underscores a clear strategic imperative: bioliquid heat and power generation is poised to transition from niche applications to mainstream energy solutions as decarbonization, technology maturity, and supportive policies align. Core adoption is coalescing around co-firing retrofits and combined heat and power installations, driven by their compelling environmental profiles and commercial viability. Equally notable is the acceleration of gasification and pyrolysis platforms that promise customizable output streams, catering to diverse industrial needs.

Tariff developments in 2025 have imparted short-term pressures on import-dependent supply chains but have also catalyzed a shift toward regional integration and feedstock diversification. Segmentation analysis reveals that opportunities are strongest in the one-to-five megawatt range, where balance-of-scale economics and deployment flexibility converge. Meanwhile, agricultural residues and municipal organic wastes are emerging as high-potential feedstocks in both mature and emerging markets.

Regional insights highlight a global patchwork of policy incentives and technology adoption rates. The Americas lead in co-firing and CHP deployment, Europe accelerates circular syngas integration, and Asia Pacific pioneers distributed heat-only solutions. Looking ahead, industry leaders who embrace strategic partnerships, advocate for enabling policy frameworks, and integrate digital process optimization will shape the next wave of bioliquid growth and contribute materially to energy transition goals.

Prompt Engagement to Secure Customized Bioliquid Heat and Power Market Research Insights by Contacting Ketan Rohom Associate Director Sales & Marketing Today

To gain unparalleled clarity on market dynamics and strategic opportunities within the bioliquid heat and power space, industry stakeholders are encouraged to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex energy market research into actionable growth roadmaps offers clients a competitive edge in a rapidly evolving energy landscape. By engaging Ketan, you will receive guidance tailored to your organization’s unique goals, whether you seek to optimize technology adoption, diversify feedstock portfolios, or navigate shifting tariff environments. Take the next step toward securing differentiated insights by reaching out today and unlocking bespoke market intelligence that empowers informed decision-making and drives sustainable growth.

- How big is the Bioliquid Heat & Power Generation Market?

- What is the Bioliquid Heat & Power Generation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?