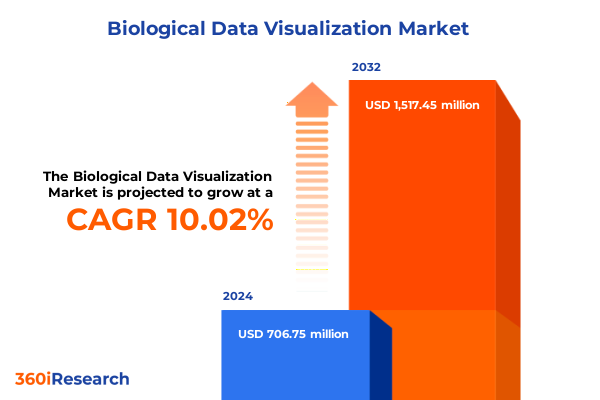

The Biological Data Visualization Market size was estimated at USD 772.62 million in 2025 and expected to reach USD 846.49 million in 2026, at a CAGR of 10.12% to reach USD 1,517.45 million by 2032.

Unlocking the Transformative Power of Biological Data Visualization for Illuminating Intricate Life Science Discoveries and Accelerating Breakthrough Research

The landscape of biological research has been transformed by an unprecedented surge in data complexity and volume, driven by advances in omics technologies and high-resolution imaging platforms. Researchers are no longer constrained by analytical throughput; instead, they face the challenge of interpreting intricate datasets that reveal multilayered insights into cellular function, disease mechanisms, and environmental interactions. In response to this challenge, biological data visualization has emerged as a critical discipline that bridges raw data and meaningful discovery, turning voluminous sequence reads, pixel-level images, and mass spectra into intuitive visual narratives.

By integrating these diverse data modalities through sophisticated software and algorithmic frameworks, scientific teams are able to explore patterns, correlations, and anomalies that would otherwise remain concealed. The evolution of visualization tools-from static charts to dynamic, interactive environments-has enabled real-time exploration of multi-omics profiles, three-dimensional tissue reconstructions, and cross-platform data alignment. As a result, decision-makers can rapidly hypothesize, validate findings, and communicate complex concepts to stakeholders across research, clinical, and industrial domains. Moving forward, the field is poised to harness emerging technologies such as augmented reality and AI-driven analytics to further elevate the clarity and impact of biological insights.

Navigating the Rapid Evolution of Biological Visualization Technologies That Are Reshaping Life Science Research and Redefining Data Interpretation Practices

Recent innovations in artificial intelligence have redefined how researchers convert multidimensional biological data into actionable knowledge. A notable example is the OmicsFootPrint platform developed by Mayo Clinic, which leverages AI algorithms to translate vast multi-omics datasets into intuitive circular visualizations. These two-dimensional OmicsFootPrints enable clinicians and scientists to discern disease-specific molecular signatures at a glance, highlighting up- or downregulated gene activity in visually coherent formats, thereby accelerating hypothesis generation and therapeutic exploration.

Building on the need for immersive data exploration, the 3D IntelliGenes application offers interactive three-dimensional scatter plots and feature-plotting modules for multi-omics integration and AI model evaluation. Researchers can manipulate these visualizations in real time, investigating patient clustering, classifier performance, and biomarker interdependencies. The extension of IntelliGenes to augmented and virtual reality environments promises deeper engagement with complex datasets, fostering collaborative analysis across disciplines and geographies.

Meanwhile, advances in computational data harmonization are empowering teams to merge disparate datasets into unified frameworks that reveal overarching biological mechanisms. AI-driven multi-analyte algorithms now analyze genomics, transcriptomics, proteomics, and metabolomics in concert, uncovering subtle interdependencies that single-modality approaches would miss. These integrative capabilities are critical for biomarker discovery, disease classification, and personalized therapeutic strategies, reflecting a shift toward predictive, data-centric research paradigms.

Exploring the Extensive Cumulative Impact of Recent United States Trade Tariffs on Biological Visualization Equipment and Research Operations in 2025

The United States government’s actions in early 2025 have introduced a complex array of trade measures that directly affect access to critical biological visualization hardware and supplies. The U.S. Commerce Department imposed stringent export controls on high-parameter flow cytometers and selected mass spectrometry equipment, citing national security concerns and restricting unlicensed shipments to China and other jurisdictions. Concurrently, tariffs scheduled to take effect in April 2025 levied 20 percent duties on imports from the European Union and more than 30 percent on goods originating in China, while imposing 25 percent tariffs on non-USMCA imports from Mexico and Canada as part of a broader strategy to address perceived trade imbalances.

Taken together, these measures have elevated the landed costs of sophisticated imaging systems, spectral analyzers, and associated consumables. Research laboratories are now navigating extended procurement timelines and reassessing supplier portfolios. In response, life science organizations are stockpiling essential components, negotiating long-term engagements with domestic vendors, and diversifying sourcing channels to mitigate the risk of supply interruptions. Discussions within multinational pharmaceutical research centers reveal a shift toward greater reliance on U.S.-based manufacturing and strategic inventory planning to guard against tariff escalations and regulatory uncertainties.

For teams specializing in biological data visualization, the cumulative impact is twofold: hardware acquisition costs have increased, and project timelines have been elongated by complex compliance requirements. As a result, many research groups are prioritizing software-centric solutions that can extract deeper insights from existing instrumentation. Adaptive visualization platforms, modular analytics toolsets, and cloud-enabled rendering services are gaining traction as flexible alternatives that help preserve research continuity despite hardware access constraints.

Revealing Key Market Segmentation Insights That Uncover How Technology Platforms Data Types and Applications Shape the Biological Visualization Landscape

An in-depth review of market segmentation provides clarity on the varied pathways through which biological visualization tools serve research objectives. When examining the field by technology, it becomes evident that methodologies ranging from high-throughput flow cytometry and mass spectrometry to advanced microscopy and X-ray crystallography each address distinct analytical needs, while magnetic resonance imaging and sequencing-based platforms unlock deeper layers of cellular and molecular architecture. Similarly, categorizing the landscape by data type highlights the unique challenges and opportunities associated with genomic sequences, metabolomic profiles, proteomic maps, and transcriptomic readouts, each demanding specialized visualization strategies to render complex results intelligible.

Platform type segmentation further refines the understanding of user preferences, with many organizations favoring integrated bioinformatics suites that offer end-to-end workflows over standalone visualization tools that excel in flexibility and customization. Equally important is the device type dimension, where researchers split their reliance between desktop and laptop applications for intensive data processing tasks and mobile or tablet interfaces for on-the-go inspections and collaborative reviews.

The mode of deployment sheds light on organizational priorities around security, scalability, and infrastructure investment: purely cloud-based systems deliver rapid access and seamless updates, on-premise solutions provide tight control over sensitive data, and hybrid arrangements allow teams to balance performance and compliance. Application-driven segmentation illuminates the specific contexts in which visualization tools operate, whether in agricultural and horticultural experiments, clinical and medical investigations, or environmental assessments of marine microbiomes and environmental DNA. Finally, end-user categorization underscores the dual pillars of demand, with pharmaceutical and biotechnology companies leveraging high-precision analytics for drug discovery and production, while academic laboratories and government research centers pursue fundamental scientific inquiries under distinct operational models.

This comprehensive research report categorizes the Biological Data Visualization market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Data Type

- Platform Type

- Device Type

- Deployment Mode

- Application

- End-User

Unpacking Critical Regional Dynamics to Understand How the Americas Europe Middle East Africa and Asia-Pacific Are Driving Biological Data Visualization Trends

Regional dynamics offer a nuanced portrait of how adoption and innovation vary across the globe. In the Americas, a combination of robust funding across government agencies and private sector investment has driven widespread uptake of advanced visualization software and high-resolution imaging systems, fostering a rich ecosystem of startups and established vendors. Transitioning to Europe, Middle East & Africa, stringent data privacy regulations under frameworks like GDPR have catalyzed the development of secure, compliant visualization platforms and catalyzed cross-border collaborations that emphasize interoperability and standards harmonization. Meanwhile, in the Asia-Pacific region, accelerating research pipelines in biotechnology hubs are fueling demand for cost-effective, scalable solutions, with local providers integrating cloud infrastructure and mobile interfaces to address diverse user requirements from academic centers to industrial R&D labs.

Despite these regional divergences, a common thread emerges: research organizations everywhere are seeking interoperability across data modalities and seamless integration with downstream analytics. This shared objective has sparked international consortiums focused on open data formats and platform-agnostic visualization standards. These collaborative efforts aim to democratize access to sophisticated tools and foster a global community of practice that drives continuous refinement of visualization methodologies.

This comprehensive research report examines key regions that drive the evolution of the Biological Data Visualization market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Company Dynamics and Competitive Positioning of Leading Hardware and Software Providers in the Biological Data Visualization Ecosystem

In the realm of biological data visualization, a diverse group of companies is advancing both hardware and software frontiers to meet evolving research requirements. Leading laboratory equipment manufacturers are integrating intelligent imaging modules with cloud connectivity, enabling remote monitoring and automated data capture workflows that feed directly into visualization pipelines. Parallel to this, specialized software vendors are enhancing their platforms with machine learning-driven annotation tools, customizable dashboards, and collaboration features that support cross-institutional projects and regulatory compliance.

Strategic partnerships between instrument providers and bioinformatics software firms are also reshaping the competitive landscape, yielding co-developed solutions that leverage best-in-class hardware alongside curated analytics environments. As established players invest in expanding their portfolios to include user-friendly visualization interfaces, a new wave of agile startups is carving out niches by focusing on niche applications, including marine microbiome mapping and single-cell spatial transcriptomics. Through targeted acquisitions and open-source community engagement, these companies are accelerating feature development and fostering ecosystems where plugins and extensions can be rapidly integrated.

Amid this dynamic environment, the vendors who excel are those demonstrating a clear vision for interoperability, ensuring their platforms can seamlessly ingest data from multiple instrument sources and deliver visually compelling insights without extensive IT overhead. This emphasis on user experience, coupled with scalable infrastructures, is distinguishing top providers and setting new benchmarks for speed, flexibility, and reliability in biological data visualization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biological Data Visualization market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- AnalyzeDirect

- Candelis Corporation

- Canon Medical Systems Corporation

- Carl Zeiss AG

- Clarivate

- Danaher Corporation

- Dotmatics

- Esaote S.p.A

- GE HealthCare Technologies Inc.

- Golden Helix

- Media Cybernetics, Inc. by Roper Industries, Inc

- MetaCell LLC, LTD.

- MR Solutions Ltd.

- Oxford Instruments PLC

- Pluto Bioinformatics

- QIAGEN GmbH

- Revvity, Inc.

- Salesforce, Inc.

- Scientific Volume Imaging B.V.

- Siemens Healthineers AG

- Tempus Labs, Inc.

- Thermo Fisher Scientific Inc.

- Waters Corporation

- ZONTAL INC.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Technological Shifts and Regulatory Challenges in Biological Data Visualization

Industry leaders must proactively embrace emerging technologies while navigating regulatory complexities and market pressures. First, adopting modular visualization architectures that decouple data ingestion, processing, and rendering layers will enable seamless integration of new data types and computational algorithms without disrupting existing workflows. By investing in open APIs and standardized data exchange protocols, organizations can future-proof their environments and foster collaborations with external tool providers.

Second, strengthening partnerships with cloud and cybersecurity specialists is essential to safeguard sensitive biological datasets and adhere to evolving data privacy regulations across regions. Integrating robust encryption, identity management, and audit-ready reporting within visualization platforms will build trust among research stakeholders and expedite technology adoption across highly regulated sectors such as clinical trials and genomics services.

Finally, cultivating in-house expertise through training programs and cross-functional teams will accelerate time to insight. By empowering scientists and data analysts to master advanced visualization techniques and AI-augmented analytics, companies can reduce reliance on external consultants and create internal centers of excellence that continuously refine best practices. These strategic initiatives will position organizations to harness the full potential of biological data visualization and drive impactful discoveries in an increasingly competitive landscape.

Illustrating the Comprehensive Research Methodology Employed to Ensure Rigorous Data Collection Analysis and Validation in This Biological Visualization Study

This study combines primary and secondary research methodologies to deliver a comprehensive analysis of the biological data visualization landscape. Primary insights were gathered through structured interviews and surveys with researchers, laboratory managers, and technology executives across academic, government, and commercial institutions. These engagements yielded qualitative perspectives on user requirements, adoption barriers, and emerging feature demands.

Complementing the primary research, secondary data was sourced from peer-reviewed journals, industry white papers, and reputable trade publications to map technology trajectories and regional market dynamics. Publicly available export control notices, tariff announcements, and regulatory filings provided factual grounding for the assessment of trade policy impacts on equipment access. Additionally, case studies of technology deployments illuminated best practices and implementation challenges across diverse research environments.

Data synthesis involved thematic analysis to identify cross-cutting trends, followed by iterative validation workshops with subject matter experts. This multi-phase approach ensured that research findings were triangulated, rigorously vetted, and reflective of current industry realities, delivering actionable insights for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biological Data Visualization market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biological Data Visualization Market, by Technology

- Biological Data Visualization Market, by Data Type

- Biological Data Visualization Market, by Platform Type

- Biological Data Visualization Market, by Device Type

- Biological Data Visualization Market, by Deployment Mode

- Biological Data Visualization Market, by Application

- Biological Data Visualization Market, by End-User

- Biological Data Visualization Market, by Region

- Biological Data Visualization Market, by Group

- Biological Data Visualization Market, by Country

- United States Biological Data Visualization Market

- China Biological Data Visualization Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Insights on the Future Trajectory of Biological Data Visualization Emphasizing Innovation Collaboration and Sustainable Growth Pathways

As biological research continues to generate increasingly complex datasets, the importance of sophisticated visualization tools cannot be overstated. From multi-omics profiling to high-resolution imaging, these platforms serve as the interpretive lens through which researchers transform raw data into scientific knowledge. The convergence of artificial intelligence, cloud computing, and interactive graphics is redefining the boundaries of what is possible, enabling faster hypothesis testing, more intuitive collaboration, and deeper insights into life’s molecular underpinnings.

Looking ahead, successful adoption will hinge on the ability to integrate diverse data modalities within cohesive visualization ecosystems, maintain robust data governance, and cultivate user expertise. Organizations that navigate these dimensions proactively will gain a strategic advantage, accelerating throughput and bolstering research quality. Collectively, the advancements in biological data visualization will continue to drive breakthroughs across drug discovery, clinical diagnostics, environmental science, and beyond, shaping a future where data-driven insights fuel innovation and improve outcomes globally.

Connect Directly with Ketan Rohom to Secure Your Definitive Biological Data Visualization Market Research Report and Unlock Strategic Competitive Advantages

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your authoritative and comprehensive biological data visualization market research report. Through this partnership, you will gain unparalleled insights and strategic guidance that will empower your organization to make data-driven decisions, optimize technology investments, and strengthen your competitive position. Ketan is ready to facilitate a tailored briefing, address your specific research needs, and ensure that you receive the actionable intelligence necessary to drive innovation and achieve your research goals. Contact him today to unlock the full potential of this definitive analysis and accelerate your path to scientific discovery and commercial success.

- How big is the Biological Data Visualization Market?

- What is the Biological Data Visualization Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?