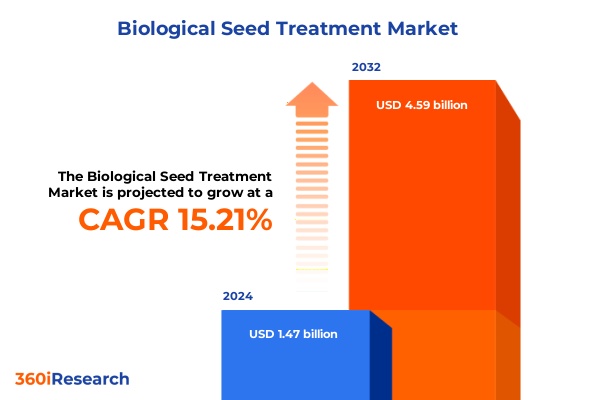

The Biological Seed Treatment Market size was estimated at USD 1.71 billion in 2025 and expected to reach USD 1.94 billion in 2026, at a CAGR of 15.17% to reach USD 4.59 billion by 2032.

Understanding the Foundation of Biological Seed Treatment and Its Role in Reinventing Global Crop Health Management Strategies

Biological seed treatment stands at the forefront of modern agricultural innovation, offering a compelling solution to the twin challenges of crop productivity and environmental stewardship. Drawing upon naturally occurring microorganisms, this approach enhances seedling vigor, supports root development, and delivers protection against soil-borne pathogens without the reliance on synthetic chemicals. As global demand for sustainable farming intensifies, biological seed treatments are emerging as a critical component in the diversification of crop protection strategies, prompting both established agribusinesses and agile startups to deepen their investment in research and development.

From the perspective of growers, biological seed treatments provide a pathway to healthier yields by harnessing symbiotic relationships between plants and beneficial microbes. This symbiosis fosters nutrient uptake efficiency and induces systemic resistance, which in turn reduces the need for conventional pesticides. Furthermore, the compatibility of biological agents with integrated pest management frameworks underscores their role in supporting long-term soil health, an attribute that resonates strongly with regulatory bodies committed to preserving agroecosystem resilience.

In parallel, technological advances in formulation and delivery have expanded the efficacy and shelf life of microbial products, allowing for greater consistency in field performance across diverse climatic and soil conditions. As a result, the adoption of biological seed treatments has shifted from niche application toward mainstream practice, laying the groundwork for an industry poised to redefine crop health management. By understanding this foundational landscape, stakeholders can appreciate both the immediate benefits and the broader implications for sustainable agricultural systems.

Exploring the Pivotal Transformative Shifts in Biological Seed Treatment Landscape Driven by Technological Breakthroughs and Sustainability Imperatives

Over the past decade, a series of transformative shifts has reshaped the landscape of biological seed treatment, driven by breakthroughs in microbial science and mounting sustainability imperatives. Advances in genomics and metagenomics have enabled researchers to identify and characterize microbial strains with unprecedented precision. This scientific progression has facilitated the development of consortia formulations that synergistically target multiple stress factors, including drought, salinity, and pathogen pressure, thereby elevating the reliability of biological interventions in the field.

Concurrently, the integration of digital agronomy platforms has revolutionized how seed treatments are prescribed and monitored. Remote sensing, machine learning algorithms, and precision application equipment now work in concert to match specific microbial profiles with soil microbiome data, optimizing efficacy at a granular level. As a result, companies are forging partnerships with technology providers to embed diagnostics and analytics tools into their product offerings, creating a new paradigm for evidence-based crop management.

Moreover, the growing emphasis on regulatory harmonization and environmental safety has catalyzed a shift toward more transparent approval processes for microbial products. This regulatory evolution has bolstered confidence among investors and accelerated the commercialization of novel bioformulations. In addition, strategic collaborations between multinationals and regional innovators have become instrumental in navigating local compliance landscapes, ensuring that product pipelines remain robust and globally scalable.

Taken together, these developments underscore a decisive movement away from single-microbe solutions toward integrated, data-driven ecosystems. Industry participants who embrace this shift are well positioned to harness the full potential of biological seed treatment in addressing both agronomic challenges and climate-smart agriculture goals.

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on the Biological Seed Treatment Supply Chain and Trade Dynamics

The introduction of new tariffs by the United States in early 2025 has exerted significant influence on the biological seed treatment supply chain and trade dynamics. Specifically, increased duties on imported microbial active ingredients and formulations have elevated input costs for producers relying on cross-border sourcing. This has prompted many organizations to reevaluate their supplier networks, with a growing number seeking to localize production capabilities or diversify procurement to include non-tariffed regions. In turn, these strategic adjustments are reshaping market entry strategies and competitive positioning.

Furthermore, tariff-related cost pressures have spurred innovation in formulation efficiency. Companies are now investing more heavily in research that reduces the required microbial load per seed unit, thereby offsetting the impacts of higher raw material expenses. Such R&D efforts have given rise to novel carrier media and encapsulation technologies that maintain efficacy while minimizing volumetric input requirements. As a consequence, stakeholders are gaining a heightened appreciation for formulation science as a lever to mitigate trade tensions.

In parallel, regulatory bodies and industry associations have intensified diplomatic engagement to resolve disputes and harmonize trade rules affecting biological inputs. These dialogues have yielded provisional trade exemptions for select microbial strains considered critical to food security objectives. However, uncertainty remains regarding the long-term stability of these exemptions, making continuous risk assessment and contingency planning essential for market participants.

Ultimately, while the cumulative impact of the 2025 tariffs has introduced complexity and cost volatility, it has also stimulated localized capacity building and formulation innovation. Companies that adapt through supply chain resilience measures and proactive regulatory advocacy are poised to weather tariff fluctuations more effectively than those relying on traditional import-dependent models.

Uncovering Key Segmentation Insights to Reveal How Microbial Types, Application Methods, Formulations, Crop Types, and Sales Channels Shape Market Dynamics

A nuanced understanding of market segmentation sheds light on the diverse forces shaping biological seed treatment adoption. Based on microbial type, market dynamics hinge on the distinct functionalities of bacteria versus fungi, with bacterial strains often leveraged for nitrogen fixation and root development enhancements, while fungal inoculants excel at forming protective mycorrhizal networks. This differentiation influences both product positioning and targeted R&D investments, as companies tailor their portfolios to specific crop stress profiles.

In terms of application method, the market divides among seed coating, seed dressing, and seed pelleting approaches. Seed coating technologies, encompassing both encrusting and film coating techniques, enable precise delivery of active ingredients directly to the seed surface, ensuring optimal microbial contact during germination. Seed dressing offers an alternative by blending biologics with stabilizing agents that adhere to the seed husk, whereas pelleting integrates the treatment into a uniform matrix, often favored for smaller seed sizes or irregular shapes. Each method entails trade-offs in terms of ease of application, cost, and field performance, driving strategic choices among farmers and service providers.

Formulation represents another critical axis of market segmentation, spanning granule, liquid, and powder formats. Liquid products, further classified into oil-based and water-based systems, are prized for their versatility in on-site mixing and compatibility with existing spray equipment. Granular formulations, by contrast, offer extended shelf life and ease of transport, while powders provide a cost-effective option for dry application. The interplay between formulation type and logistical considerations continues to influence distribution and inventory management strategies.

Lastly, segmentation by crop type-covering cereals, fruits and vegetables, and oilseeds and pulses-reveals differentiated adoption curves. Corn, rice, and wheat within cereals exhibit high receptivity to microbial enhancements, driven by large acreage and yield optimization imperatives. Fruits and vegetables benefit from tailored biofungicides that address post-emergence pathogen threats. Within oilseeds and pulses, rapeseed, soybean, and sunflower each present unique agronomic challenges, prompting customized product development. Ultimately, the sales channel axis, encompassing both offline and online pathways, shapes how end-users access these solutions, with digital platforms gaining traction among tech-savvy growers.

This comprehensive research report categorizes the Biological Seed Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Microbial Type

- Application Method

- Formulation

- Crop Type

- Sales Channel

Analyzing Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Highlight Opportunities and Adoption Trends in Biological Seed Treatments

Regional dynamics play a pivotal role in defining the uptake and evolution of biological seed treatments around the globe. Within the Americas, robust R&D ecosystems in North America coexist with rapidly expanding agricultural frontiers in South America. This diversity fuels cross-regional collaborations, with proprietary formulations developed in the United States often finding large-scale adoption in Brazil and Argentina, where high-value crops drive demand for sustainable yield enhancement solutions. Regulatory frameworks in both regions tend to align on safety thresholds, smoothing the path for product registration and market introduction.

Moving to Europe, the Middle East, and Africa, a mosaic of regulatory regimes and agronomic conditions shapes adoption trajectories. Western Europe leads in stringent environmental mandates, incentivizing biological alternatives to chemical seed treatments. In contrast, parts of the Middle East leverage biostimulant technologies to address soil salinity and water stress, while sub-Saharan Africa increasingly views microbial seed applications as a cost-effective tool for smallholder empowerment and yield stabilization. Emerging public-private partnerships are fostering technology transfer and local production capabilities, creating a more resilient supply chain that is sensitive to regional socioeconomic contexts.

In the Asia-Pacific region, high population densities and resource constraints have accelerated the search for sustainable intensification solutions. Countries like India and China prioritize cereals and oilseed crops, driving demand for robust microbial inoculants that can enhance nutrient use efficiency and mitigate pathogen outbreaks. Southeast Asian nations, balancing rice cultivation with vegetable production, are adopting integrated application methods to optimize labor inputs and reduce post-harvest losses. Across the region, both offline distribution networks and e-commerce platforms play vital roles, with digital marketplaces emerging as a significant channel for smallholder access to advanced seed treatment offerings.

Together, these regional insights underscore the critical importance of localized strategies. Market participants must navigate a patchwork of regulatory environments, agronomic needs, and distribution infrastructures to effectively deploy their biological seed treatment portfolios.

This comprehensive research report examines key regions that drive the evolution of the Biological Seed Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation and Strategic Partnerships to Shape the Competitive Landscape of Biological Seed Treatment Industry

A competitive landscape defined by innovation and strategic collaboration characterizes the biological seed treatment industry. Leading multinational players leverage extensive R&D pipelines to continually refine microbial strain libraries and advanced formulation platforms. At the same time, mid-sized specialized firms maintain an edge by rapidly translating cutting-edge microbial discoveries into niche solutions tailored for specific crop pathologies or environmental stressors. This dynamic interplay fosters an environment where both scale and agility confer distinctive advantages.

In recent years, strategic partnerships and mergers have emerged as primary drivers of market consolidation and technological diffusion. Partnerships between established agrochemical giants and biotech startups enable resource integration, combining deep market access with frontier science. Such alliances facilitate joint development agreements, accelerate field trials, and strengthen global distribution networks. Moreover, select collaborative ventures between research institutes and private firms have resulted in open-innovation platforms, democratizing access to genomic data and expediting next-generation bioinoculant discovery.

Investment trends further underscore the competitive momentum within the sector. Venture capital and corporate venture arms are directing capital toward synthetic biology firms and microbe-screening technology providers, seeking scalable solutions that can enhance product consistency and expedite regulatory clearance. Concurrently, publicly traded companies report increased R&D expenditure allocations for microbial research, signaling a strategic pivot from chemically based portfolios to biologically derived offerings.

Emerging startups focused on precision fermentation and bespoke strain engineering are also capturing attention, as they promise to deliver high-purity inoculants with reduced production footprints. These innovators, often supported by public grants and incubator programs, are challenging traditional production paradigms, pushing incumbents to reevaluate their manufacturing and supply chain models. In this environment, companies that harmonize scientific rigor with market foresight are best positioned to shape the future of biological seed treatment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Biological Seed Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrinos AS

- AMVAC Chemical Corporation

- BASF SE

- Bayer AG

- Bioworks Inc

- Certis USA LLC

- Corteva Agriscience

- East-West Seed

- FMC Corporation

- Germains Seed Technology

- Groupe Limagrain SA

- Incotec Group BV

- Italpollina SpA

- Koppert Biological Systems

- Marrone Bio Innovations Inc

- Novozymes A/S

- Nufarm Limited

- Plant Health Care plc

- Rizobacter Argentina S.A.

- SAKATA SEED CORPORATION

- Sumitomo Chemical Co Ltd

- Syngenta AG

- UPL Limited

- Valent BioSciences LLC

- Verdesian Life Sciences LLC

Delivering Actionable Recommendations for Industry Leaders to Navigate Regulatory Changes, Optimize Partnerships, and Accelerate Adoption of Biological Seed Solutions

Industry leaders seeking to excel in the biological seed treatment arena must adopt a multifaceted strategy that balances scientific innovation, regulatory engagement, and market responsiveness. First, prioritizing investment in advanced microbial screening platforms and genomics-enabled strain optimization will yield differentiated products capable of addressing complex agronomic challenges. By integrating high-throughput phenotyping and machine learning-driven analytics, organizations can streamline the discovery pipeline and accelerate time to market, thereby maintaining a competitive edge.

Second, proactive regulatory liaison is critical to ensuring uninterrupted product commercialization. Engaging with policymakers and standard-setting bodies early in the development process can facilitate clearer pathways for product approval and alignment on safety and efficacy benchmarks. This approach reduces the risk of unexpected compliance delays and establishes a track record of transparency that resonates with both regulators and end users.

Third, forging robust partnerships across the value chain-from seed producers to distribution networks and end-user cooperatives-will enhance route-to-market efficiency and bolster customer adoption rates. Collaborations that integrate digital agronomy solutions with on-farm service models can create feedback loops, enabling continuous product iteration based on real-world performance data. Such partnerships also strengthen brand equity and foster trust among growers, who value solutions tailored to their specific operational contexts.

Finally, embedding sustainability metrics into corporate strategy will be indispensable as environmental stewardship continues to influence purchasing decisions. Setting quantifiable targets for carbon footprint reduction, soil health improvement, and lifecycle assessments can distinguish leaders in the market and unlock opportunities with sustainability-focused funding sources. In sum, by marrying technical excellence with strategic collaboration and environmental responsibility, industry participants can unlock sustainable growth trajectories in the evolving biological seed treatment sector.

Detailing Comprehensive Research Methodology Combining Primary Interviews, Secondary Analysis, and Rigorous Validation to Ensure Data Integrity and Reliability

This research endeavor combined a rigorous methodology to ensure the accuracy and reliability of findings. The primary phase entailed in-depth interviews with a spectrum of stakeholders, including agronomists, regulatory experts, product developers, and commercial growers. These conversations provided qualitative insights into emerging needs, adoption barriers, and performance expectations, which informed the contextual framing of key themes.

Concurrently, an extensive secondary analysis was conducted, encompassing peer-reviewed scientific journals, patent filings, regulatory agency databases, and reputable agricultural publications. This phase validated the technological trends, market drivers, and policy developments identified during primary research. Emphasis was placed on cross-referencing data from multiple sources to identify convergent patterns and mitigate the risk of relying on isolated evidence.

Data triangulation further reinforced the robustness of the analysis. Quantitative metrics related to import-export volumes, formulation registration approvals, and R&D investment levels were gathered from public trade records, company financial statements, and industry association reports. These metrics were then mapped against qualitative insights to uncover correlations between regulatory shifts, supply chain dynamics, and innovation trajectories.

Quality assurance protocols were applied throughout the research process. All data points underwent peer review by subject matter experts, and methodological assumptions were transparently documented to facilitate reproducibility. While the scope of this study focused on tangible trends shaping the biological seed treatment market, recognized limitations-such as evolving tariff policies and variable data availability in certain regions-were explicitly acknowledged, ensuring that readers maintain appropriate context when interpreting the results.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Biological Seed Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Biological Seed Treatment Market, by Microbial Type

- Biological Seed Treatment Market, by Application Method

- Biological Seed Treatment Market, by Formulation

- Biological Seed Treatment Market, by Crop Type

- Biological Seed Treatment Market, by Sales Channel

- Biological Seed Treatment Market, by Region

- Biological Seed Treatment Market, by Group

- Biological Seed Treatment Market, by Country

- United States Biological Seed Treatment Market

- China Biological Seed Treatment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Conclusions That Reflect the Critical Role of Biological Seed Treatments in Enhancing Crop Productivity, Resilience, and Sustainable Farming Practices

The insights presented in this report underscore the transformative potential of biological seed treatments within the global agricultural ecosystem. From foundational advances in microbial genomics to strategic responses to 2025 tariff measures, the industry has demonstrated resilience and adaptability. The evolving segmentation landscape highlights how tailored application methods, formulation types, and crop-specific solutions converge to address diverse grower needs, while regional analyses reveal a rich tapestry of adoption drivers and regulatory influences.

Crucially, the competitive environment is characterized by dynamic partnerships, significant R&D investment, and the emergence of agile startups challenging established production models. These developments point toward a future where biological seed treatments become integral components of sustainable intensification strategies, supporting crop productivity and environmental stewardship in equal measure.

Looking ahead, stakeholders who invest in predictive analytics, deepen collaboration across the value chain, and engage proactively with regulatory frameworks will be best positioned to capture growth opportunities. As the agricultural sector grapples with climate volatility, resource constraints, and evolving consumer expectations, biological seed treatments offer a scientifically grounded pathway to resilient and sustainable crop systems. The collective insights herein lay the groundwork for strategic action and informed decision-making in this rapidly advancing field.

Empowering Stakeholders to Act Now by Engaging with Associate Director Ketan Rohom for In-Depth Strategic Insights and Market Research Acquisition

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, opens the door to tailored strategic insights and a comprehensive understanding of the biological seed treatment landscape. By partnering with him, stakeholders can secure immediate access to nuanced data analysis, competitive benchmarking, and expert guidance on navigating regulatory changes, supply chain complexities, and emerging technological trends. This personalized approach ensures that decision-makers possess the relevant intelligence needed to optimize product development pipelines, cultivate high-impact collaborations, and identify untapped market niches.

Initiating a conversation with Ketan Rohom accelerates your journey toward actionable market foresight. His expertise in synthesizing complex research into concise strategic roadmaps will empower your organization to capitalize on growth opportunities, mitigate risks associated with tariff fluctuations, and align your go-to-market strategies with evolving sustainability mandates. Reach out today to transform insights into impactful business outcomes and solidify your leadership in the rapidly changing realm of biological seed treatments.

- How big is the Biological Seed Treatment Market?

- What is the Biological Seed Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?